Justin Sullivan

I’ve written a ton about SoFi (NASDAQ:SOFI). I don’t know if I have ever been more confident that they will beat quarterly and annual expectations than I am right now. One week from today on January 29 they will report Q4 earnings and give full year 2024 guidance. Let’s look at Q4 and FY 2024 analyst projections on revenue and EPS and I’ll show why I think they are going to handily beat all expectations.

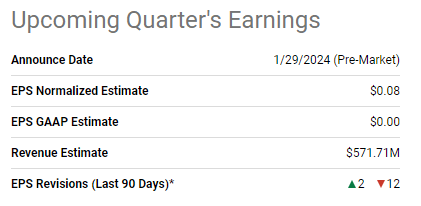

Q4 Earnings

SoFi 4Q23 Earnings estimates (Seeking Alpha)

Analysts expect $571M in revenue and $0.00 in EPS for 4Q23. SoFi, in its history as a public company (which only goes back to 2Q21, but that’s 9 quarters reported now), has never missed on its revenue guidance. The midpoint of their guidance calls for $575M in revenue. SoFi is still growing its balance sheet, its net interest margin on its loans is still expanding, deposits are growing, and student loan payments restarted this quarter to give student loan refinance a tailwind. They are going to beat on revenue.

As for EPS, between earnings calls and conferences, management has made 25 separate statements this year that they will be profitable in this quarter (here are the references if you want to count them yourself). The most recent of these quotes came from their shareholder Q&A that took place on December 4, over two-thirds of the way through the quarter. CFO Chris Lapointe said, “As we’ve stated previously, we’re still on track to achieve GAAP profitability this quarter.” He also said, “In terms of some of the specific areas of optimism that we see, first, we’re on track to reach GAAP profitability in this quarter.” CEO Anthony Noto also stated, “Our goal of achieving positive GAAP net income in the fourth quarter is one that we remain very confident in.” This is an absolute make-or-break metric that they’ve focused all their efforts on this entire year. They are not going to miss.

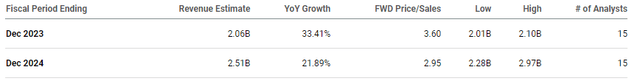

2024 Revenue

SoFi 2024 revenue estimates (Seeking Alpha)

Analysts are expecting 2.51B in revenue in 2024. CFO Chris Lapointe said, “In 2024, we expect 50% of our revenue to be from tech platform and financial services and then the remaining 50% from lending” at the Stephens Annual Investment Conference on November 15. When I heard that, I thought he was talking about the revenue split by the end of 2024. I recently verified with Chris Lapointe that he was, in fact, talking about the revenue split for the full year 2024. Let’s use some conservative assumptions and figure out what this means for the company’s revenue. At that same conference, he gave some context for the guidance that would lead to this revenue split.

So back to your question on the growth outlook for student loans and personal loans. What I would say there is there’s a lot of macro uncertainty out there right now. We’re really optimistic about everything we’ve been able to achieve, but we also have to be mindful of what’s happening around us. […] We may be in an environment that’s uncertain, and we may be in an environment where interest rates stay higher and more volatile for a longer period of time. We do think that demand for our products and our ability to capture that demand will remain extremely robust, but we need to be mindful of the turmoil that’s happening around us.

In that type of environment, we’re going to take a more cautious and conservative approach to our lending. In that environment, our personal loans could be flat to slightly up. Our student loan business could grow just modestly, but we’re going to be mindful of everything that’s happening around us.

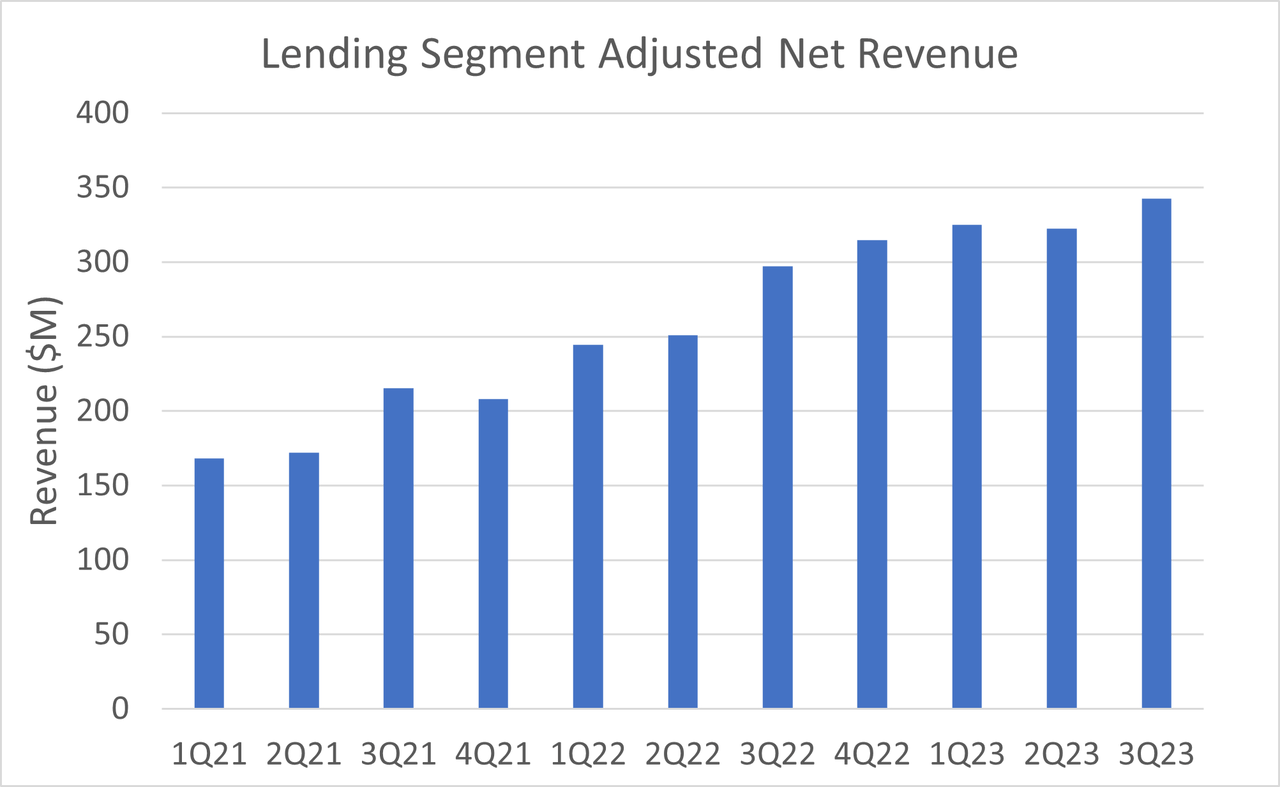

So, let’s be conservative and say that lending revenue is going to be completely flat from 3Q23 levels. That means six quarters of flat revenue growth from 3Q23 all the way through 4Q24. I am virtually certain this will not be the case since they are still growing the loan book, that lower rates will mean increased loan sales in 2024, and that they’ll be growing their tangible book value by $300M – $500M in 2024, which will allow them to further grow their loan book. This analysis should therefore be a lower bound for revenue for 2024.

In 3Q23, SoFi did $342M in adjusted net revenue in the lending segment. That is an annualized run rate of $1.37B. If that makes up 50% of their entire 2024 revenue, that means they would do $2.74B in revenue in 2024. Unless management is flat-out lying about their expectations for 2024, even with flat lending revenue from 3Q23 levels, they would handily beat analyst expectations of 2.51B of revenue in 2024. $2.74B in revenue would be around 33% revenue growth in 2024 compared to analyst estimates of 21.89%. This is a management team that has always guided conservatively (more on this below), but analysts are not even taking them at face value.

SoFi Lending Segment Revenue (Author)

I do not expect lending to be flat next year at all. When you look at the lending segment historically and look at the financial landscape for 2024, it is hard to imagine a full year without any growth here. Flat to slightly up revenue assumed a higher for longer scenario. This guidance was given in November before the dovish comments by Powell in November. If several rate cuts happen in 2024, there is significant room to the upside above that $2.74B number I calculated above.

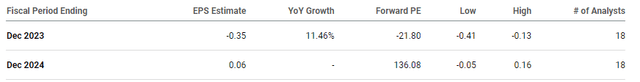

2024 EPS

SoFi 2024 EPS estimates (Seeking Alpha)

Analysts are expecting a grand total of $0.06 in EPS for 2024. Once again, I’d like to point out that SoFi’s management guides very conservatively in what they say publicly and that they have never once missed their guidance. Analyst expectations are significantly less than what SoFi is guiding for themselves internally. This is CEO Anthony Noto from the 3Q23 Earnings Call.

Obviously, in the fourth quarter, we’re expecting the profitability to increase since we go from not generating positive GAAP earnings to generate positive GAAP earnings for the first time. We’re committed to generating GAAP — positive GAAP earnings for all of 2024. We will — we’re still in investment mode, but we have to balance growth versus investment. I would think about the — what we talked about earlier this year from an investment standpoint, that will focus on 30% incremental EBITDA margins and 20% incremental GAAP net income margins as a guiding factor and how much will adopt to the bottom line versus reinvest in the business.

SoFi’s revenue in 2023 will be around $2.06B. As established above, in 2024, it should be $2.74B+. That is an annual increase of $680M. The quote above says that they expect their incremental GAAP net income margin to be 20%. That means that for each $100 of revenue growth, they expect $20 to drop to the bottom line earnings. They are starting somewhere around breakeven to start the year since they are expecting GAAP profitability in 4Q23. If they do in fact grow revenue by $680M in 2024, that corresponds to $136M in GAAP earnings for 2024. They will probably have around 980M shares outstanding next year, meaning that $136M in GAAP net income corresponds to $0.14 in EPS for 2024. This is more than double analyst expectations, and it stems from very conservative revenue assumptions.

Should You Trust Management?

A lot of this analysis relies on what SoFi management has told us. The reason I feel confident in their word is because they have proven extremely trustworthy. Here is their revenue guidance compared with their results for every single quarter since 2021. The guidance is presented at the midpoint.

| Revenue Guidance ($M) | Total Revenue ($M) | |

| 1Q21 | 192.5 | 216.0 |

| 2Q21 | 217.5 | 237.2 |

| 3Q21 | 250 | 277.2 |

| 4Q21 | 277 | 279.9 |

| 1Q22 | 282.5 | 321.7 |

| 2Q22 | 335 | 356.1 |

| 3Q22 | 401 | 419.3 |

| 4Q22 | 422.5 | 443.4 |

| 1Q23 | 435 | 460.2 |

| 2Q23 | 475 | 488.8 |

| 3Q23 | 500 | 530.7 |

SoFi has never missed its guidance and on average it beats the midpoint of its guidance by $22M/qtr. They predictably overperform their revenue guidance, so how about their profitability guidance? They don’t guide for GAAP net income, but they do guide for adjusted EBITDA. Here is its guidance compared to its performance.

| EBITDA Guidance ($M) | EBITDA Actual ($M) | |

| 1Q21 | -$2,000 | $4,132 |

| 2Q21 | -$3,000 | $11,240 |

| 3Q21 | -$2,000 | $10,256 |

| 4Q21 | $3,500 | $4,593 |

| 1Q22 | $2,500 | $8,684 |

| 2Q22 | $10,000 | $20,304 |

| 3Q22 | $30,000 | $44,298 |

| 4Q22 | $44,214 | $70,060 |

| 1Q23 | $42,500 | $75,689 |

| 2Q23 | $55,000 | $76,819 |

| 3Q23 | $78,000 | $98,025 |

Again, the outperformance here is stellar. They’ve never missed on EBITDA either and beat the midpoint of their guidance by an average of $15M. The pattern here is obvious. SoFi guides conservatively and outperforms. Yet somehow, after three years of this, many analysts and bears still think that SoFi management cannot reliably predict their future revenues and profits.

It also isn’t like they are constantly decreasing guidance so they can get over an easier hurdle either. In every single quarter they’ve ever had, they have raised that year’s full-year revenue and EBITDA guidance. The only exception to this was when the student loan moratorium was extended in 2Q22 and they had to take student loans out of their guidance. Other than that one circumstance that was completely outside their control, they beat their established guidance, raised their guidance for the next quarter and year, and then beat that number again the next quarter. That has happened over and over for three straight years.

Risks

It’s possible that management is wrong, that for the first time in three years, they have overreached and their execution did not match what they’d done previously. It’s also possible that in the last 27 days of the quarter, since they said they were on track for profitability, that something meaningfully changed. Given that spending during the holidays exceeded expectations, which seems unlikely.

SoFi does have significant balance sheet risk if there is a hard landing in 2024. They recognize losses and charge-offs on their loans as they occur, so a seriously deteriorating macro environment would almost certainly result in downside risk. Their unsecured personal loans that go into default would directly reduce revenue and profits. In that environment, lending revenue would not be flat as I outlined above, it would almost certainly decline, making what I considered conservative assumptions to be false. SoFi guided for a shallow recession in 2023 but has not specified the assumptions for 2024 yet. If their assumptions end up being rosier than actual 2024 conditions, then their track record of outperforming their guidance would probably end. One of the key reasons for their outperformance is that they tend to take a very negative stance on the macro that makes it improbable that actual conditions end up being worse. They should spell out those assumptions on the earnings call at the end of the month, so we should get more clarity here soon.

Conclusion

The only assumption I made in the above analysis is that management can reliably predict revenues and profits. With that single assumption, SoFi will easily outperform analyst expectations. If the past is any indicator, the numbers I outlined above, which take management comments at face value, are almost certainly underestimating the results that SoFi will achieve in the next 12 months.

As long as that assumption is true, SoFi will continue to beat analyst estimates. They would beat them on January 29 at their 4Q23 earnings and they would show profitability for the first time. Their full-year 2024 guidance should be above analyst estimates of 2.51B in revenue and $0.06 EPS. If their past track record holds true, they would then systematically beat those estimates and slowly raise them throughout the year. At some point in the future, there will be a time when they will miss their guidance. It happens to every company and SoFi will not be an exception forever. However, this is the quarter and year that they have been absolutely laser-focused on and that they have been building towards since they came public. Management has earned my trust and I fully expect to be rewarded as a shareholder as their superior execution continues to result in the stronger business in the long term.