Pekic/E+ via Getty Images

Investment Thesis

Last year in June, I covered Flywire Corporation (NASDAQ:FLYW) where I discussed the company’s growth prospects and laid out my investment thesis. Today, I will discuss FLYW’s future prospects and review the results from last quarter. The company’s advanced platform is capable of addressing intricate cross-border and local payment challenges, bolstered by a proprietary network, as well as specialized software tailored to specific industries operating within large niche markets poised for digital transformation. I believe that the company’s business segments are relatively macro-insulated and FLYW can post sustained growth in the near term. I remain optimistic about the company and re-iterate my buy rating on the stock.

Q3 Review and Outlook

FLYW’s 3Q revenue came in below the mid-point of guidance, different than customarily coming in at the high-end or above, largely due to adverse FX, some implementation delays (no cancellations), and to a lesser degree some adverse trends in India relative to expectations. The company reported revenue of $117 million, slightly below Street’s estimate of $120 million, and an adjusted EBITDA of $27.5 million, slightly exceeding Street’s estimate of $26.8 million. Despite a record signing of over 185 new clients, the decelerating growth in transactional total payment volume by 36% and platform TPV by 4% couldn’t be fully offset. The main reasons for this underperformance (excluding FX) were due to delayed deployments and weaker performance in India. There is also a concern that the ramp-up in the Healthcare sector might be more challenging than initially anticipated, leading management to shift its focus toward exploring greater opportunities in the Travel sector.

This quarter marked a change in trend for FLYW, ending the company’s uninterrupted streak of beats and raises. The company attributed incremental weakness to a handful of implementation delays, split evenly across its Healthcare and Education verticals, and some adverse business mix trends in India. The Education delays were likely the primary culprit of the soft sales beyond FX given the heightened 3Q seasonality in the Education business. FLYW still showed strength in Travel, adding more clients than ever and more than doubling revenue from Q3 22.

Exposure to Macro-Insulated Segments is Beneficial

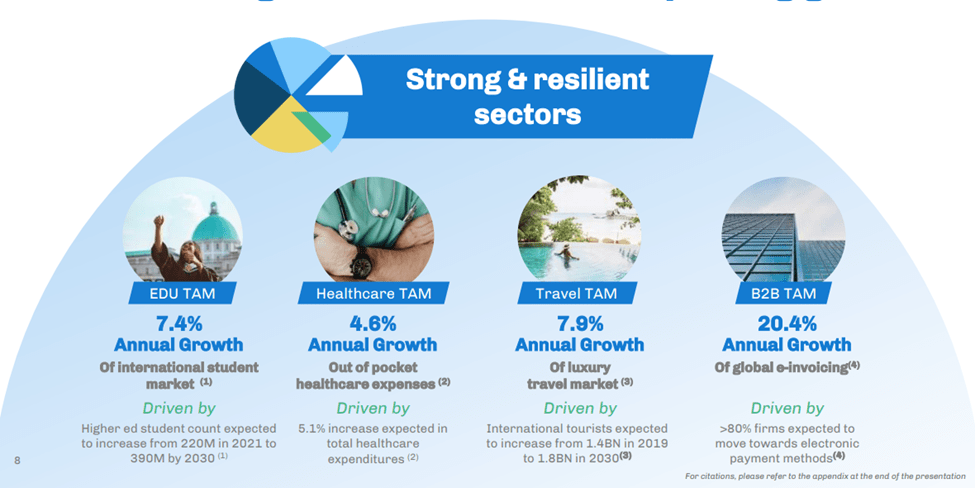

Each of FLYW’s verticals boasts some recession resilience. Tuition bills rarely go down, regardless of the economic outlook, and in many cases, people retool with advanced degrees during recessions. Demand for healthcare does not materially change with the economic outlook, healthcare costs show no sign of moderating, and increases in late or unpaid bills should only generate demand for FLYW’s payment solutions among incremental potential healthcare clients. Some areas of B2B volume may decline in a recession, but FLYW helps with collections and efficiencies, which should help. The areas of travel in which FLYW focuses are luxury-oriented and more resilient than general travel spending.

Company Presentation

Healthcare Business Can Provide Growth

FLYW’s differentiated software gives it the credibility to go after large healthcare providers, which often have significant breath in the industry with many hospitals and patients under ‘one roof’. Healthcare business, while primarily contributing to platform revenue, offers greater gross margins than other parts of its business, which should provide meaningful benefits to the overall business even at lower growth rates. In the next couple of years, I see further opportunities to expand Healthcare outside of the US, through strategic investments and hiring in regions of the world that are expected to increase their overall spending on healthcare, creating another layer of growth for the unit and increasing the segment’s proportion of revenue. It’s worth mentioning that the company has already announced two new customer deployments and a substantial expansion during the third quarter of 2023. In the long run, the healthcare segment could become a pivotal component of Flywire’s counter-cyclical verticals, offering highly favorable economic prospects.

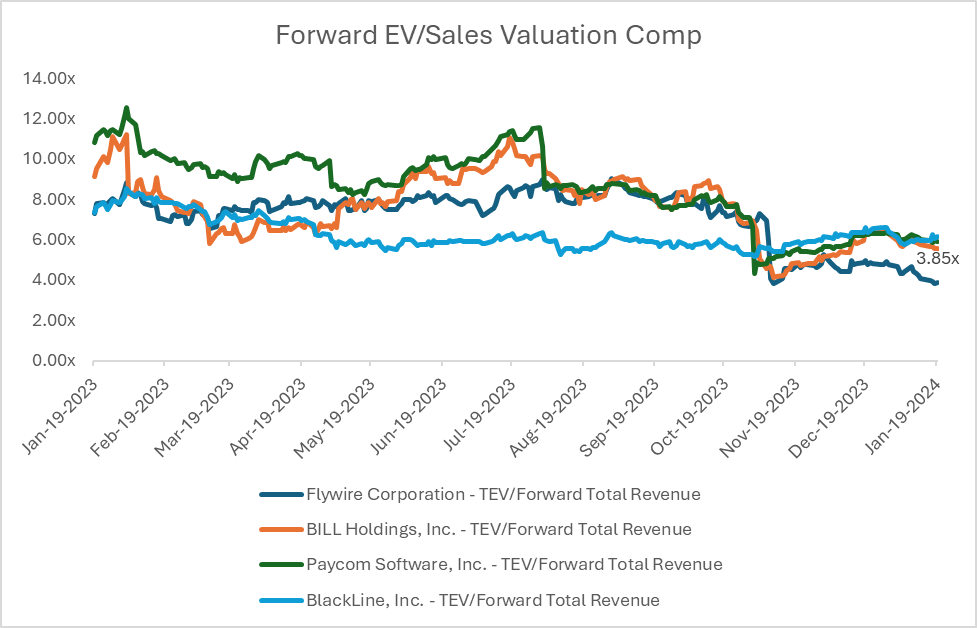

Valuation

Shares of FLYW have underperformed in the market despite the company maintaining its track record of strong net revenue retention on the back of increasing travel and education trends. FLYW currently trades at about 4x forward EV/sales, below its peers in the industry. Over the years FLYW has built a strong foundation on its vertical-specific software solutions and proprietary global payment network that has benefited from the secular digitization trends across its verticals. The company now serves over 3.5K clients with significant volumes still available to capture through its ‘land-and-expand’ strategy. FLYW’s advantage should continue to drive a healthy combination of top-line growth through strong NRR and client adds, along with greater profitability as the company scales its offerings. The company also provides a unique level of downside protection to investors due to its less cyclical end markets (Healthcare/Education) with attractive TAMs. I believe FLYW will continue to benefit from secular tailwinds in its resilient verticals with multiple avenues of growth in the coming years, and reiterate my buy rating on the stock.

Capital IQ

Investment Risks

Flywire has not yet demonstrated an ability to produce sustainable positive free cash flow and operating margins. It is investing heavily coming out of the pandemic, doubling its operating expenses to capture a bigger share of wallet in the markets it serves. It is unclear if these investments will pay off longer term, and if further investments will be required to enter new markets should management choose to do so. Such decisions could delay profitability and potentially raise concerns about the earning power of the company. Moreover, historically, about half of Flywire’s revenue growth has come from new sales, so replenishing its backlog and timely implementations will be key to returning to, and sustaining, pre-pandemic growth. Putting the right resources into new sales and integrations will be important to monitor against other initiatives.

Conclusion

FLYW is one of the highest-quality growth stories in FinTech with multiple avenues to revenue upside in resilient verticals, led by a management team that has proven its financial and strategic mettle. I believe FLYW will continue to benefit from secular tailwinds in its resilient verticals with multiple avenues of growth in the coming years, hence I re-iterate my buy rating on the stock.