Andrzej Rostek/iStock via Getty Images

Investment thesis

Our current investment thesis is:

- If Plus500 can maintain its current trajectory, its cash-distributable potential is significant. The company has limited overheads and no real capex requirements, allowing for substantial cash generation. The route to growth is clear and currently being executed, although even if this does not materialize, its existing position and single-digit growth will still allow a yield in excess of 10%.

- Underpinning this is a genuinely talented management team and a good suite of products. The company’s competitive position is unlikely to be materially overcome quickly, allowing it to protect its market share. With its entry into the US and broader global expansion on the cards, we do believe Plus500 represents an attractive takeover target from a downside perspective.

Company description

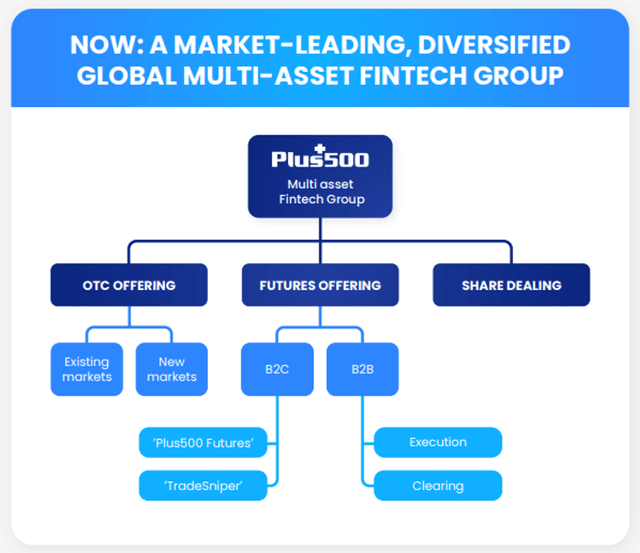

Plus500 Ltd. (OTCPK:PLSQF) is a fintech company that operates technology-based trading platforms globally. It offers an online and mobile trading platform that allows its international customers to trade CFDs on various financial instruments such as shares, indices, commodities, options, ETFs, foreign exchange, and cryptocurrencies.

The company also operates Plus500 Invest, a share dealing platform, and TradeSniper, an intuitive futures trading platform for the US retail trading market.

The company is primarily known for its CFDs and other financial instruments rather than traditional share dealings. CFDs are, as they are far more popular in Europe (and the UK especially) than in North America. A contract for differences is “an arrangement made in financial derivatives trading where the differences in the settlement between the open and closing trade prices are cash-settled“. Essentially, CFDs work similarly to opinions in that you are making a bet on directional movements, however, you have no right to the underlying asset.

Share price

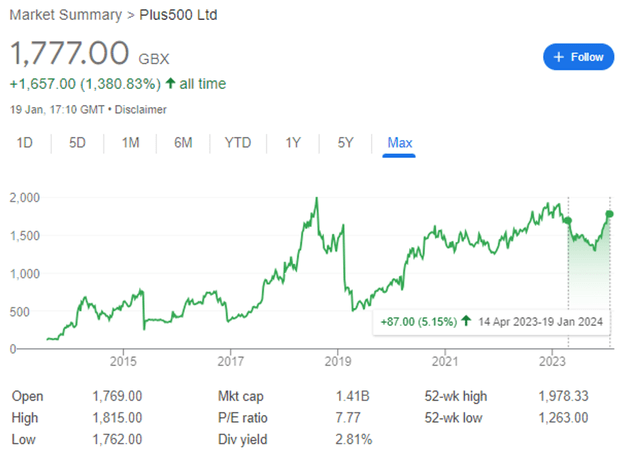

Plus500’s share price (Google)

We last covered Plus500 in Apr23, rating the stock a buy. Since then, its share price performance has been modest, gaining +5% following a considerable decline in late 2023. For a detailed analysis of the company’s business model, see this paper.

Although markets performed better in 2023, it is worth highlighting that this was overly weighted to a handful of stocks, creating a disingenuous perception.

Commercial analysis

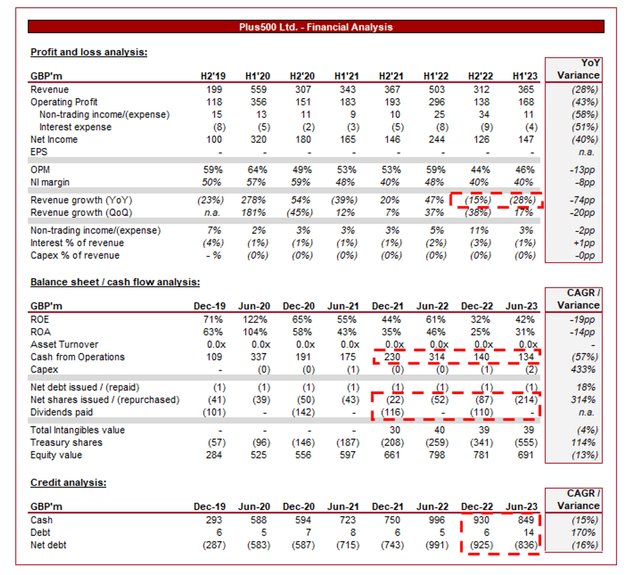

Presented above are Plus500’s financial results on a half-year basis, as is reporting customs in the UK.

Plus500’s top-line performance looks slightly concerning on paper. The company has seen revenue decline in 2 consecutive half-years, falling by (15)% and (28)%, respectively. Prior to this, revenue was also volatile, with both double-digit gains and losses.

Before diving into the details, it is worth highlighting that Plus500 is still of the size that it will experience volatility in financial performance. The company is heavily reliant on trading volume, which swings more greatly than share purchases, broadly, owing to the short-term mindset.

Plus500 experienced an impressive H1’23, driven primarily due to the ramp-up of its services globally, particularly in the EEA (”European Economic Area”) and its RoW (”Rest of the World”) segment.

Following this, the company has experienced a noticeable decline in revenue in 2023. Importantly, its continued expansion efforts, particularly in the US, have offset much of this decline has certain markets have experience a fall of over 40%.

We do not believe this is a threat to Plus500’s competitive position, but is wholly attributable to market conditions. With rates continuing to rise in H1, alongside growing fears of a recession, the B2C segment has struggled as consumers’ funds are allocated elsewhere. Additionally, leverage is now far more expensive, as is the risk-free rate, dissuading market activity, particularly in favor of passive investment.

This has contributed to market volatility softened in H1’23 compared to 2022, reducing Plus500’s scope for revenue generation. The company is “the house” and so is not concerned by directional movements but does require volatility (and the volume that comes with this) to win.

It is worth contextualizing that Plus500 is still generating ~£340m per half-year, which broadly matches its performance during the bull-run post-pandemic. This implies that if market conditions improve, driven by the B2C segment and increased lending, the company has the capacity to consistently generate ~£500m.

Furthermore, during recent periods, the company’s margins have declined. This is primarily due to a combination of wage inflation and increased advertising. The company is heavily focused on expanding globally, particularly into the US Futures market, contributing to an increase in reinvestment. Management believes ~70% of its cost base is variable, which implies the “taps can be turned off” if/when it develops a healthy market position, allowing margins to rise at a higher scale.

The company has released flash trading for Q3’23, which suggests more of the same. Plus500 experienced growth of +5%, while EBITDA increased +5%. This is below its HoH growth rate, implying a continued slowdown. This again is a reflection of market conditions that continue into early 2024.

Importantly, however, its average deposit per active customer increased by 18%. This is attributable to its expansion into lucrative markets such as the UAE. This primes the company well from an uptick in activity.

Overall, we are content with the company’s recent performance. Declining revenue and margins are never good but the story behind this is positive we feel. The company is inherently tied to market conditions, which we know have been unfavorable in 2023. Further, the company is executing an aggressive global expansion strategy, which involves entering lucrative markets such as the US, UAE, and Japan. We are already seeing early signs of this as average deposits increase, with it reasonable to expect ARPC (”Average revenue per customer”) to increase proportionately as these locations ramp up. We are currently in the execution phase for Plus500, with the fruits of this likely to be seen in the coming ~5 years.

Economic & External Consideration

Economic conditions globally are a mixed bag. In the West, the US continues to march ahead of its European peers, many of which are facing their own internal and external struggles. The expectation is for rates to decline across most key nations in 2024, representing potential tailwinds for Plus500 as market activity grows in attractiveness relative to other investing strategies.

Offsetting this, partially, is the growing fear of a recession. The US recession probability indicator has exceeded 50% for the first time, and this is while the US outperforms its European counterparts. A recession would contribute to near-term volatility, although the impact on consumer wallets and investing appetite will likely be negative.

We see the company year as a risk to Plus500, although the inherent volatility that comes with this should limit the downside.

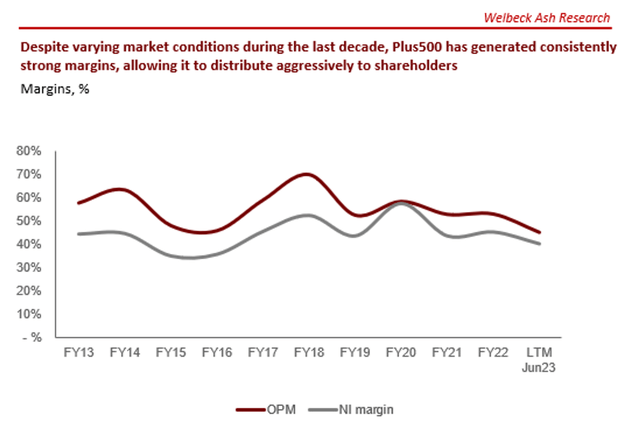

Margins

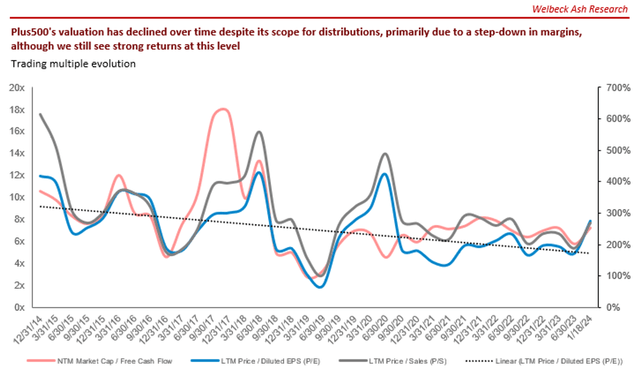

Plus500’s margin erosion should be contextualized over a larger period of time. Since FY13, its average NIM was 45% while its average OPM was 56%. Plus500 is not significantly below these levels, whilst clearly being in a reinvestment phase.

We do think it could struggle to return to its heights due to the impact of inflation on its cost base and the inherent nature of competition, but a reversion toward its average is reasonable to expect over ~5 years.

Balance sheet & Cash Flows

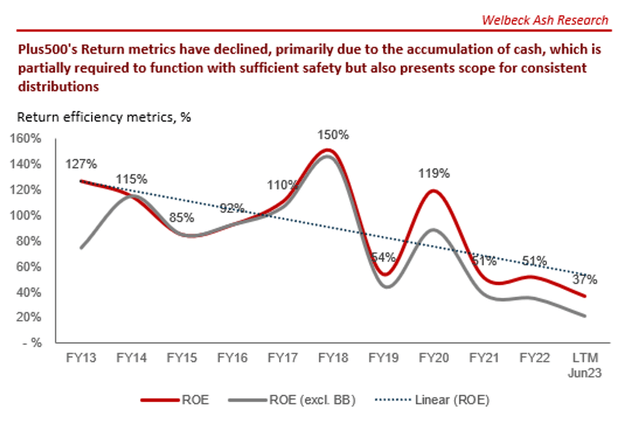

Plus500 is conservatively financed. The company remains debt-free, with its balance sheet primarily comprised of cash. ~£550m of this is required for regulatory reasons and risk, meaning ~£300m is available for shareholders or reinvestment.

This has contributed to the erosion of its ROE, although Management is increasingly repurchasing shares to offset this.

Valuation

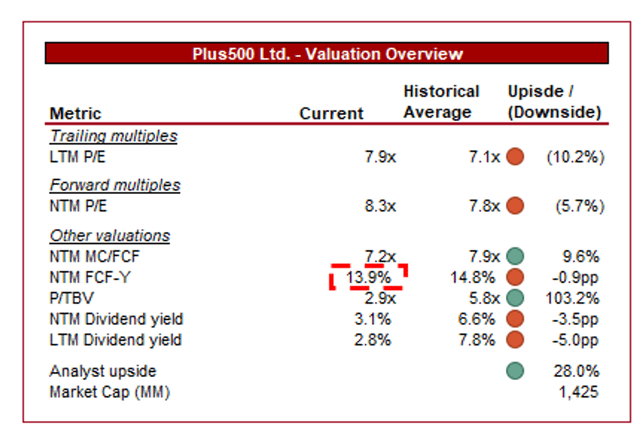

Plus500 is currently trading at 8x LTM P/E and 8x NTM P/E. This is a small premium to its historical average.

A premium to its decade average is warranted in our view. The company is significantly larger and diversified relative to its historical position, with a broader suite of products and greater global presence. This is far more important for its long-term trajectory, relative to the small margin erosion, as it increases the company’s growth potential and competitive advances.

Plus500 is currently trading at a FCF yield of ~14%, alongside a dividend yield of ~3% (and LTM buybacks at a yield of ~20%). Although a ~20% distribution yield appears unsustainable, we do believe Plus500 can consistently return ~£225-£275m a year to shareholders (at a market cap of ~1.4b). In its last 5 years, Plus500’s average FCF was £380m.

For this reason, the company appears completely mispriced. It has already returned more to shareholders than its entire market cap (£1.5b) and is primed to continue to do so.

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- The financial services industry is highly regulated and subject to ongoing changes in regulations. CFD operations are an area of social criticism due to the high level of losses (~70% of customers lose money).

- Decline in market conditions restricting volatility.

- FX risk for investors as Plus500 is UK-listed. In the last year, the USD has depreciated ~2% against the Sterling.

Final thoughts

Plus500 is a high-quality business in our view. Management is clearly razor-focused on growing the company’s capabilities and market reach, showing a proactive approach to broadening its revenue generation potential. Given its strong position in core markets, this is commendable.

Its recent performance has been weak, although we believe it is masking strong progress and the scope for outperformance in the coming years. With market conditions as they are, it’s very unlikely Plus500 can outperform and so we see this as a “wait and see” period.

At a substantial cash yield, we continue to rate the stock a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.