Michael M. Santiago

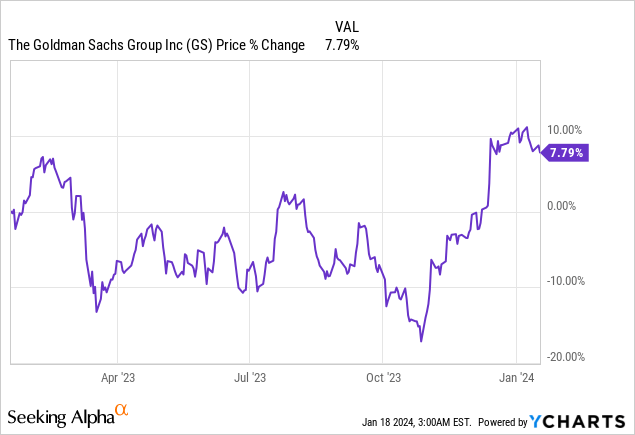

Two days ago, Goldman Sachs Group (NYSE:GS) submitted better-than-expected results for the fourth quarter in terms of both revenues and earnings. The investment bank saw a more than 50% jump in net earnings in the fourth-quarter, largely due to a strong performance of its asset and wealth management business which has delivered consistently solid results over the last several years. Goldman Sachs also managed to raise a ton of capital for its investment funds, against the backdrop of a confidence-shaking regional banking crisis in early FY 2023. Although I acknowledge that Goldman Sachs’ earnings are driven chiefly by capital market conditions, I believe the investment bank provides attractive long-term value for investors as it grows its more durable revenue streams!

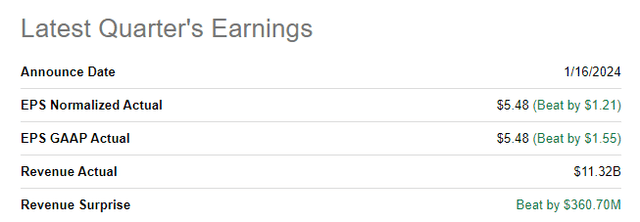

Goldman Sachs beats top and bottom line expectations

The investment bank reported strong results for Q4’23 that surpassed the consensus prediction on both the top and the bottom line. Goldman Sachs reported earnings per-share of $5.48, which beat expectations by $1.21 per-share, and revenues of $11.32B. The average top line prediction ahead of Q4’23 earnings was $10.95B.

A strong quarter despite extraordinary charges

Goldman Sachs is a top global investment bank: it provides investment advice to corporations and wealthy individuals, help companies raise equity and debt in the capital markets and has a huge asset management business. According to the Financial Times, Goldman Sachs, was the second-most successful investment bank in FY 2023, after JPMorgan Chase and it is this fee-generating power that makes Goldman Sachs a long term buy, in my opinion.

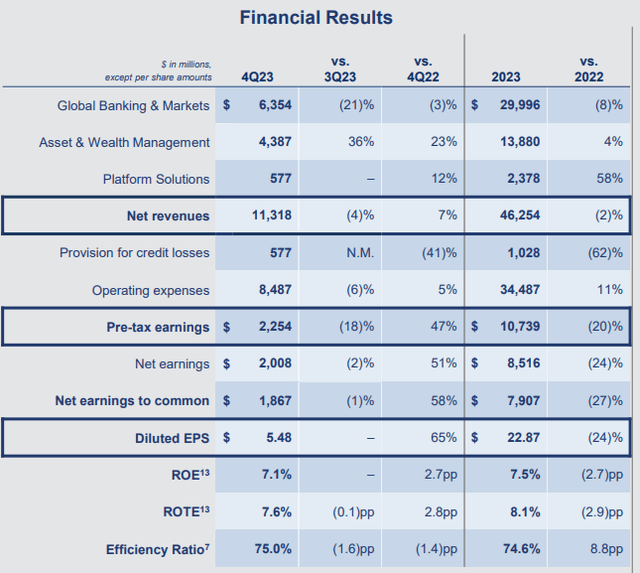

The bank also just reported very solid results for its Q4’23. Despite special charges in the fourth-quarter related to the regional banking crisis last year, Goldman Sachs had a pretty decent quarter: the investment bank generated 7% year over year top line growth, chiefly because of a strong performance of the asset and wealth management business. Goldman Sachs’ net earnings soared 51% year over year in Q4’23 while its diluted EPS shot up by 65% year over year to $5.48. Besides strength in asset and wealth management, Goldman Sachs stands out in terms of its ability to raise capital from investors.

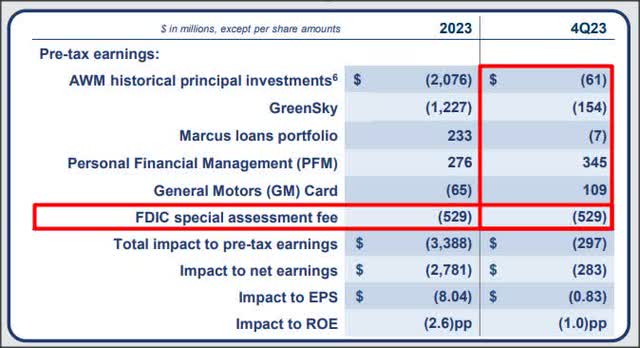

Goldman Sachs took a number of extraordinary charges in Q4’23 that were detrimental to earnings, but whose overall effect was quite limited. The largest charge, the FDIC special assessment fee related to the regional banking crisis in the first quarter of FY 2023, amounted to $529M.

The special assessment fee is meant to top up the FDIC’s rescue fund which bled money last year as a number of banks went out of business, especially Silicon Valley Bank. Despite these extraordinary charges in the fourth-quarter, Goldman Sachs’ EPS was only impacted by and the FDIC fee is likely not recurring.

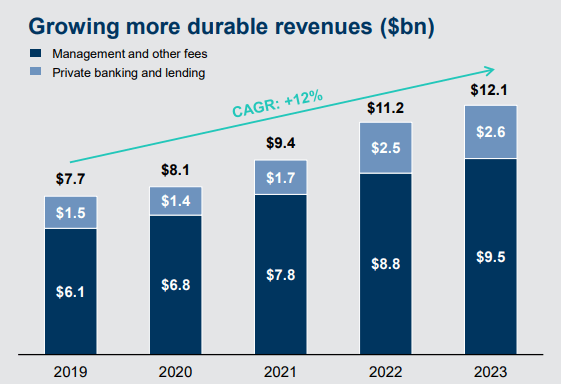

Asset and wealth management segment results, expectations for FY 2024

The key driver of Goldman Sachs’ growth in revenues and profitability was the asset and wealth management business which is one of the world’s largest. Goldman Sachs’ management and other fees in this segment increased 8% year over year to $9.5B while its private banking revenues grew 5% year over year to $2.6B. The asset and wealth management business plays an important role in Goldman Sachs’ long term strategy to reduce the volatility of its earnings profile and grow more resilient revenue streams. Since FY 2019, asset and wealth management revenues have trended up 12% annually and Goldman Sachs’ ability to raise money in difficult markets is a key strength for the investment bank.

Goldman Sachs

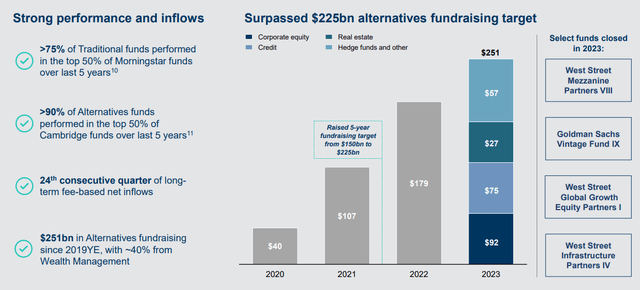

Goldman Sachs has been extremely successful in raising capital from investors in FY 2023. Last year was obviously very challenging given the regional banking crisis that unfolded after Silicon Valley Bank collapsed and had to be rescued by the Federal Deposit Insurance Corporation (SVB was later acquired by JPMorgan Chase).

Despite this challenging backdrop, Goldman Sachs has had a record year in terms of raising capital for its multitude of investment funds. Goldman Sachs raised a massive $251B in investment capital which has been feed into a multitude of credit, equity, real estate and hedge funds. The ability to raise capital even during extremely fragile markets attests to the strength of Goldman Sachs’ asset and wealth management franchise and is a key quality that I value about the investment bank.

In the longer term, I expect Goldman Sachs to aggressively grow its asset management, wealth management and private banking segments which provide more stable revenue and fee streams than capital market-dependent segments, like IPOs or bond sales. This may even help Goldman Sachs to achieve a higher valuation multiple in the long run if its earnings become less volatile and less reliant on the state of the stock market.

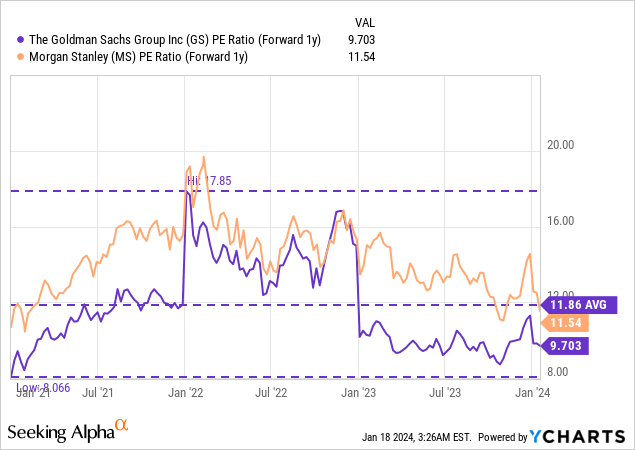

Goldman Sachs’ valuation

Goldman Sachs is an investment bank at its heart, so the most comparable rival in the industry is likely Morgan Stanley (MS). Both companies provide mergers and acquisition advice to their corporate clients, help companies raise debt and equity capital, and have sizable asset management businesses.

Goldman Sachs is currently trading at 9.7X forward earnings, implying an earnings yield of 10.3% while Morgan Stanley is trading at a slightly higher valuation ratio of 11.5X forward earnings. The average P/E ratio for Goldman Sachs was 11.9X in the last year and since asset and wealth management trends look very favorable, I do believe that Goldman Sachs is a premier investment bank that I can revalue higher.

Goldman Sachs has an estimated FY 2025 EPS figure of $38.89, implying 14% growth year over year. A 9.7X P/E ratio currently implies an earnings yield of 10.3% which makes it attractive to own shares of Goldman Sachs. I think that Goldman Sachs, given its growth in revenues, strength in its asset management business and double-digit forecasted EPS growth could revalue to its 1-year average P/E ratio. I see a fair value for GS at $460, based off of a 11.8X P/E ratio (the bank’s average) under the condition that capital markets don’t crash, the asset management delivers growth and a U.S. recession doesn’t occur.

How I monitor the thesis

Goldman Sachs is seeing solid momentum in the asset management part of its business and growth in this segment is crucial for the investment thesis. A slowdown in asset management-related revenue growth would be something I would consider to negatively affect my outlook for Goldman Sachs and its shares. Other factors that are worth monitoring are the bank’s EPS revisions.

Other risks with Goldman Sachs

Goldman Sachs relies on volatile investment banking-related revenues to drive its earnings. These earnings tend to be cyclical which introduces a degree of unpredictability into the equation and which is something investors have to be aware of when buying an investment bank. Goldman Sachs’ asset and wealth management business, however, is seeing a robust uptrend in assets and revenues which is creating a more durable earnings profile. A recession and a downturn in capital markets would likely negatively affect Goldman Sachs’ earnings and may result in a sharp revaluation of the bank’s shares to the downside.

Final thoughts

Despite extraordinary charges that Goldman Sachs took in the fourth quarter, the investment bank had a very successful and profitable Q4’23, especially in the asset and wealth management business. Goldman Sachs saw a more than 50% profit jump year over year and even the FDIC special assessment fee related to the banking crisis in Q1’23 did not impair the earnings picture by much. I believe Goldman Sachs provides solid value for investors as it grow its asset and wealth management practice. Shares are currently valued at 9.7X earnings, implying an impressive 10%+ earnings yield for investors!