SOPA Images/LightRocket via Getty Images

My last article on LendingClub (NYSE:LC) was back in April 2023 in the wake of the regional banking crisis where I discussed the impact of the adverse macro environment on its marketplace business as well as seeing some green shoots as rates appeared to decline. It has certainly been a volatile ride since then, however, the stock is still up ~12% since then.

To recap, the LendingClub business model has been adversely impacted in 2022 and 2023 by rapidly rising interest rates as well as the regional banking crisis.

The key impact was a material slowdown in LC’s marketplace revenues as investors (banking partners and asset managers) were largely sitting on the sidelines. The banks, as a consequence of the regional banking crisis and higher rates, were forced to deleverage and the increased supply of personal loans in the market also meant that margins were further compressed.

In short, it is hard to imagine more challenging circumstances for LC’s marketplace model. Importantly, LC found itself with a limited amount of excess capital and thus it could not grow by warehousing loans on its balance sheet like peers with excess capital (e.g. SoFi Technologies (SOFI)) have done. As such, LC resorted to two rounds of cost cuts to preserve GAAP profitability, and as of recent quarters has modified its business model to offer “structured certificates” to its investor base (but more on that later).

In this article, I will discuss the potential impact as LC’s capital requirements are expected to change effective from February 2024 and how this impacts its business model as well as its capacity to execute share buybacks.

The Regulatory Capital Position

Many investors do not realize that LC is subject to a more restrictive regulatory capital regime than most other banks. This was part of a conditional approval provided by regulators in respect of the Radius acquisition and enabling LC to become a chartered bank. Interestingly, the agreement for higher capital ratios is expiring in February 2024. The below is extracted from the most recent 10-K:

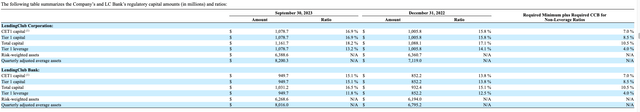

In addition to these guidelines, the regulators assess any particular institution’s capital adequacy based on numerous factors and may require a particular banking organization to maintain capital at levels higher than the generally applicable minimums prescribed under the U.S. Basel III capital framework. In this regard, and unless otherwise directed by the FRB and the OCC, we have made commitments for the Company and LC Bank (until February 2024) to maintain a CET1 risk-based capital ratio of 11.0%, a Tier 1 risk-based capital ratio above 11.0%, a total risk-based capital ratio above 13.0%, and a Tier 1 leverage ratio of 11.0%.

So LC has committed, for 3 years, to maintain much higher capital ratios than what is required from other banks. Next, consider LC’s published capital ratios:

As you can deduct from the above, LC operates at much higher ratios than the minimum and above 11% for most of its capital ratios. The exception is the Tier 1 Leverage Ratio where LC Bank is at 11.8%, just above the required 11% ratio. This is the binding capital constraint on LC and the reason why it does not capacity (from a capital perspective) to warehouse more loans on the balance sheet. You will also notice that the minimum requirement (for most banks) is only 4%. So assuming that the agreement expires in February 2024, then LC defaults to the minimum required ratios and thus instantaneously has plenty of capacity, from a regulatory capital perspective, to strongly grow the balance sheet. I believe this could potentially have a profound impact on LC’s business model which I will explain in the following section.

Structured Certificates

Given the challenging conditions concerning its marketplace and capital constraints, LC had to innovate. The Structured Certificates program (“SC”) is essentially private two-tier securitizations of packaged personal loans sold to investors (primarily asset managers) where LC takes the senior tranche and investors hold the junior tranche. From LC’s perspective, it is a risk-remote security (as first losses are taken by investors) and thus is attributed only 20% risk-weighting.

Why do asset managers like this product?

Asset managers get to generate equity-like returns and the embedded leverage in the security is at a lower cost of funds compared to warehouse lines financing such investors would typically deploy.

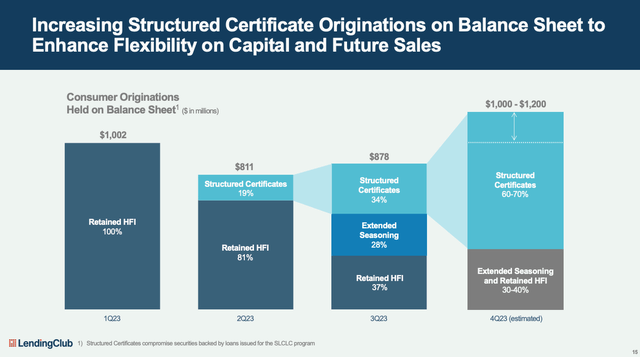

As of the end of Q3, LC has already managed to close ~$2 billion of such securities. Given the decline in the yield of the U.S. 2-year treasury bill in Q4, I expect a much stronger appetite for this product in Q4 and beyond. As it is, LC is planning to increase the percentage of originations of the SC:

Stepping back, it appears that LC is remixing the balance sheet to lower risk loan assets. The question investors may ask though whether that ultimately leads to lower returns as measured by ROE. Well, LC provided the following disclosures in the Q3 earnings release:

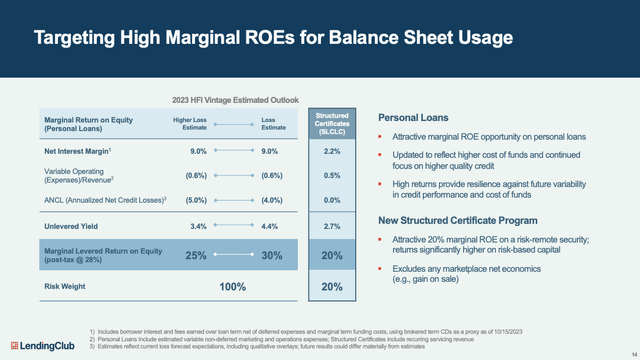

As you can see, the SC program is delivering a lower marginal ROE of 20% compared with the HFI vintages ranging between 25% and 30%. However, this is not the complete picture when you consider this in the context of the earlier discussion in this article on capital requirements.

The above calculation is based on the Tier 1 leverage ratio. If you apply a risk-based capital ratio (e.g. Common Equity Tier 1 (“CET1”), then the ROE is much greater (my estimate is ~80% given the 20% risk-weight of these SC assets).

Assuming the higher capital agreement expires in February 2024, then the Tier 1 Leverage ratio may not be the binding constraint any longer. Some of the comments by the CFO in the Q3 earnings call appear to support my assertion:

Drew LaBenne

Just as a reminder I think it’s — I would say just as a reminder, I think it’s probably clear from the presentation, but we have a 20% risk weighting on those securities right now. So as we’re going into next year and we’re thinking about our capital levels, that potentially gives us some more latitude to think about where our targets should be from a leverage and a risk-based capital ratio.

The above suggests to me that the CFO is indicating that the Tier 1 Leverage ratio target will be set at a lower percentage than the current 11% (maybe 6% to 8%). Remember the minimum requirement is 4%. Also important to note, is that the SC assets consume a higher amount of Leverage capital and a low amount of risk-based capital ratio or CET1. As such emphasizing the SC program would only make sense if the Leverage ratio is no longer consequential.

Buybacks

My analysis above concludes that LC is likely to be operating with material excess capital to all of its leverage and risk-based capital ratios. It also trades at a significant discount to its tangible book value (my estimate is ~ 0.7x net assets value) which is comprised of highly-liquid and short-duration assets.

Share buybacks are an attractive option and the equivalent of buying 70 cents in the dollar in the current circumstances. The CFO noted the following in the Q3 earnings call:

Artem Nalivayko

Great, thank you. And here’s a second question. So with the shares trading at such a steep discount to tangible book value. Is there a reason the company is not buying back shares?

Drew LaBenne

Yes, well, I think it’s probably worth just a reminder to everyone, we’re in the third year of our operating agreement that we entered into as part of the Radius acquisition. And some of the restrictions around that operating agreement make it difficult for us to execute any type of share buyback at this point.

Post February 2024, these restrictions are likely to be removed, and thus in my view, share buybacks become a compelling action for management and the board.

Final Thoughts

LC is remixing its balance sheet from riskier personal loans to lower-risk Structured Certificates. Given their respective capital treatment, the only conclusion I can draw is that the Tier 1 Leverage ratio is unlikely to be the going-forward binding constraint for LC. This has a profound and positive impact on the business model going forward and I heard no one discussing this important topic in the investment community. I believe this has a profoundly positive impact on the investment thesis in LC. Reading the tea leaves, I also expect management to engage in share buybacks, possibly as early as Q2 2024.

The key items to watch in the Q4 earnings is whether there are any signs that the marketplace is going to show some recovery as well as growth rates in its SC program.

The main risk to my thesis is if regulators, for whatever reason, decide to continue and apply higher capital requirements when it comes to LC. I see this risk as somewhat unlikely as it would be discriminatory compared to the treatment of peers. Additionally, LC has not been subject to any consent orders, known regulatory scrutiny, or any other known breaches that would warrant such a restriction. As such, there is no longer a sensible rationale to apply higher capital requirements on LC and I expect the agreement to fully phase out in February 2024.