utah778

Dear Baron Real Estate Income Fund Shareholder:

Performance

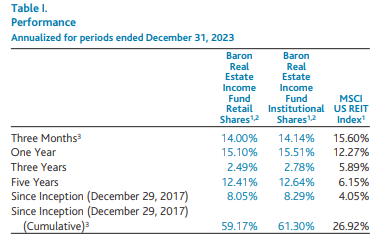

Baron Real Estate Income Fund® (MUTF:BRIFX, MUTF:BRIIX, MUTF:BRIUX) (the Fund) generated strong performance in 2023, gaining 15.51% (Institutional Shares) for the year ended December 31, 2023.

The Fund’s 15.51% gain in 2023 exceeded the performance of the MSCI US REIT Index (the REIT Index), which rose 12.27%.

For the most recent three-month period ended December 31, 2023, the Fund increased 14.14%, underperforming the REIT Index which gained 15.60%.

Since inception on December 29, 2017, through December 31, 2023, the Fund’s cumulative return of 61.30% was more than double that of the REIT Index, which increased 26.92%.

We are pleased to report that as of December 31, 2023, the Fund has received high rankings from Morningstar for its performance:

- Top 9% real estate fund ranking for its 1-year performance period

- #5 ranked real estate fund for its 5-year performance period

- #4 ranked real estate fund ranking since the Fund’s inception on December 29, 2017

We will address the following topics in this letter:

- Big picture thoughts regarding 2023 and 2024

- The prospects for real estate in the public markets (preview: we remain bullish)

- Portfolio composition and key investment themes

- Top contributors and detractors to performance

- Recent activity

- Concluding thoughts on the prospects for real estate and the Fund

|

As of 12/31/2023, the Morningstar Real Estate Category consisted of 251, 235, 215, and 225 share classes for the 1-, 3-, 5-year, and since inception (12/29/2017) periods. Morningstar ranked Baron Real Estate Income Fund Institutional Share Class in the 9th, 87th, 3rd, and 2nd percentiles for the 1-, 3-, 5-year, and since inception periods, respectively. On an absolute basis, Morningstar ranked Baron Real Estate Income Fund Institutional Share Class as the 28th, 215th, 5th, and 4th best performing share class in its Category, for the 1-, 3-, 5-year, and since inception periods, respectively. Morningstar calculates the Morningstar Real Estate Category Average performance and rankings using its Fractional Weighting methodology. Morningstar rankings are based on total returns and do not include sales charges. Total returns do account for management, administrative, and 12b-1 fees and other costs automatically deducted from fund assets. Since inception, rankings include all share classes of funds in the Morningstar Real Estate Category. Performance for all share classes dates back to the inception date of the oldest share class of each fund based on Morningstar’s performance calculation methodology. © 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted, or distributed; (3) is not warranted to be accurate, complete, or timely; and (4) does not constitute advice of any kind, whether investment, tax, legal or otherwise. User is solely responsible for ensuring that any use of this information complies with all laws, regulations, and restrictions applicable to it. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. MORNINGSTAR IS NOT RESPONSIBLE FOR ANY DELETION, DAMAGE, LOSS, OR FAILURE TO STORE ANY PRODUCT OUTPUT, COMPANY CONTENT, OR OTHER CONTENT. |

|

Performance listed in the above table is net of annual operating expenses. The gross annual expense ratio for the Retail Shares and Institutional Shares as of December 31, 2022, was 1.32% and 0.96%, respectively, but the net annual expense ratio was 1.05% and 0.80% (net of the Adviser’s fee waivers), respectively. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visit baronfunds.com or call 1-800-99-BARON. 1 The MSCI US REIT Index Net (USD) is a free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks, and copyrights related to the MSCI Indexes. The index and the Fund include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The index is unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. 2 The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. 3 Not annualized. |

Big Picture Thoughts Regarding 2023 and 2024

One year ago, in our year-end 2022 shareholder letter, we stated that we believed 2023 would ultimately emerge as a mirror image of 2022 in that many of the headwinds of 2022 (multi-decade high inflation, a hawkish Federal Reserve policy and corresponding spike in interest rates, and elevated corporate and economic growth) would reverse course and become tailwinds in 2023. We stated that we were optimistic about the full-year prospects for the stock market, public real estate securities, and the Fund. Though there were fits and starts along the way, our expectations for 2023 largely materialized.

As we peer into 2024, we remain optimistic.

Though we are aware that our bullish view appears to be the consensus view and are mindful of possible market headwinds such as an escalation in geopolitical tensions, a reversal in the disinflationary process, and the lag effect of interest rate increases resulting in a sharp slowdown in growth, we are sanguine about the prospects for the stock market for the following reasons:

1. We believe a severe economic slowdown is unlikely to materialize, in part due to still relatively healthy consumer spending and wage growth:

– The U.S. unemployment rate remains at only 3.7%

– The demand for labor is strong as there are 1.4 jobs available for every unemployed worker

– Consumers have purchasing power as wage growth of approximately 4% exceeds inflation for the first time since early 2021

2. We expect ongoing disinflation.

3. We anticipate that the global pivot in monetary policy will result in interest rate cuts and welcome relief for consumers and corporations.

4. We see the potential for an improvement in company valuations (e.g., P/E expansion, capitalization rate compression) driven by an easing in financial conditions and better-than-feared economic and corporate growth.

We believe prospective two- to three-year returns for the stock market, public real estate securities, and the Fund could be strong should a sharp economic slowdown be avoided and 2025 emerge as a rebound year for economic and corporate profit growth.

The Prospects for Real Estate in the Public Markets

We see a strong backdrop for real estate securities – REITs and non-REIT real estate-related companies – in 2024:

– Several public real estate companies have underperformed the S&P 500 Index since 2019, in part due to the lingering impacts from COVID-19, the aggressive Federal Reserve interest rate tightening cycle, and more recently, the overhang of the commercial real estate crisis narrative which we continue to believe is unlikely to materialize.

– The global pivot in monetary policy – from restrictive to accommodative – has historically been bullish for real estate.

– We expect a decline in interest rates and tighter credit spreads, which would support real estate valuations, reduce the weight of debt refinancings, and reignite the transaction market.

– We see attractive demand versus supply prospects. Vacancies are low, rents and home prices continue to increase albeit at a slower rate, and competitive new construction is muted for most commercial and residential sectors and geographic markets over the next several years.

– Most balance sheets are in strong shape.

– Several public real estate companies are cheap relative to historical averages and relative to private real estate alternatives.

– Substantial private capital is in pursuit of public real estate because private funds can buy quality public real estate at a discount relative to private real estate.

– Generalist investors who have been underweight real estate may increase allocations and real estate fund flows may turn positive given the aforementioned considerations.

We continue to believe the long-term case for real estate remains compelling as real estate tends to provide:

– Partial inflation protection

– Diversification and low correlation to equities/bonds

– Strong historical long-term returns relative to most investment alternatives

Portfolio Composition and Key Investment Themes

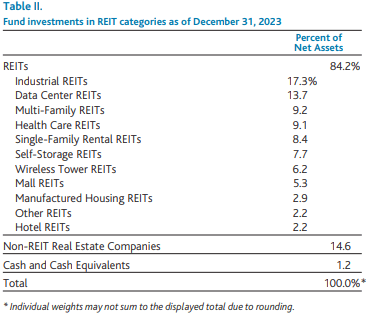

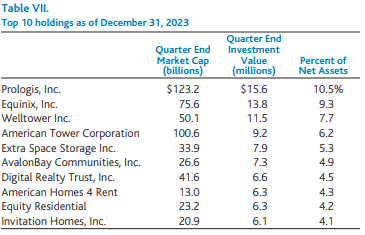

As of December 31, 2023, we invested the Fund’s net assets as follows: REITs (84.2%), non-REIT real estate companies (14.6%), and cash (1.2%). We currently have investments in 11 REIT categories. Our exposure to REIT and non-REIT real estate categories is based on our research and assessment of opportunities in each category on a bottom-up basis (See Table II below).

REITs

Business fundamentals and prospects for many REITs remain solid, although, in most cases, growth is slowing due to debt refinancing headwinds, a moderation in organic growth (occupancy, rent, and/or expense pressures), reduced investment activity (acquisitions and development), and, in a few select instances, the impacts from transitory oversupplied conditions. Most REITs enjoy occupancy levels of more than 90%, with modest new competitive supply forecasted in the next few years due to elevated construction costs and contracting credit availability for new construction. Balance sheets are in good shape. Several REITs have inflation-protection characteristics. Many REITs have contracted cash flows that provide a high degree of visibility into near-term earnings growth and dividends. Dividend yields are generally well covered by cash flows and are growing.

REIT valuations are attractive on an absolute basis relative to history and relative to private market valuations, but not relative to fixed income alternatives. If economic growth contracts and evolves into no worse than a mild recession and the path of interest rates peaks at levels not much higher than current rates, we believe the shares of certain REITs may begin to perform relatively well. Should long-term interest rates begin to decline and credit spreads compress, REIT return prospects may also benefit from an improvement in valuations as valuation multiples expand (e.g., capitalization rates compress).

We continue to prioritize secular growth REITs and short-lease duration REITs with pricing power:

- Secular growth REITs: Our long-term focus remains on real estate companies that benefit from secular tailwinds, where cash-flow growth tends to be durable and less sensitive to a slowdown in the economy. Examples include our investments in industrial logistics, data center, wireless tower, and life science REITs. As of December 31, 2023, secular growth REITs represented 39.4% of the Fund’s net assets.

- Short-lease duration REITs with pricing power: We have continued to emphasize REITs that are able to raise rents on a regular basis to combat inflation’s impact on their businesses. Examples include our investments in single-family rental, multi-family, self-storage, manufactured housing, and hotel REITs. As of December 31, 2023, short-lease duration real estate companies represented approximately 30.4% of the Fund’s net assets.

Secular growth REITs (39.5% of the Fund’s net assets)

Industrial REITs (17.3%): Though we are a bit cautious near term due to expectations that demand will continue to normalize to pre-pandemic levels (elongated corporate decision-making), anticipated elevated supply deliveries in the first half of 2024, and expectations of moderating rent growth in certain geographic markets, we remain optimistic about the long-term prospects for industrial REITs.

With industrial vacancies at less than 4%; moderating new supply in the second half of 2024; rents on in-place leases more than 50% below market; and multi-faceted secular demand drivers including the ongoing growth in e-commerce, companies seeking to improve inventory supply chain resiliency by carrying more inventory (shift from just in time to just in case inventory), and on-shoring, we believe our investments in industrial warehouse REITs Prologis, Inc. (PLD), Rexford Industrial Realty, Inc. (REXR), First Industrial Realty Trust, Inc. (FR), EastGroup Properties, Inc. (EGP), and Terreno Realty Corporation (TRNO) have compelling multi-year cash-flow growth runways.

Data Center REITs (13.7%): Following strong share price performance in the first three quarters of 2023, we trimmed our large exposure in data centers from 19.2% to 13.7%. We continue to believe the multi-year prospects for real estate data centers are compelling. Data center landlords such as Equinix, Inc. (EQIX) and Digital Realty Trust, Inc. (DLR) are benefiting from record low vacancy, demand outpacing supply, and rising rental rates. Regarding the demand outlook, several secular demand vectors are contributing to robust demand for data center space globally. They include outsourcing of information technology, increased cloud computing adoption, ongoing growth in mobile data and internet traffic, and artificial intelligence (AI) as a new wave of data center demand.

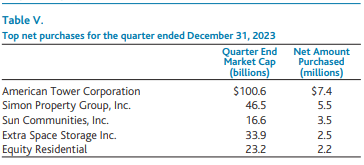

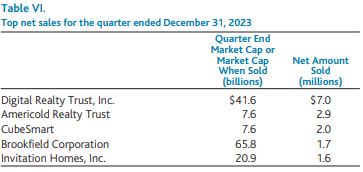

Wireless Tower REITs (6.2%): Following a sharp decline in wireless tower REITs in the first nine months of 2023, we reacquired shares of American Tower Corporation (AMT) during the fourth quarter. For our more complete thoughts on American Tower, please see “Top net purchases for the quarter ended December 31, 2023.” We remain optimistic about the long-term growth prospects for tower REITs given strong secular growth expectations for mobile data usage, 5G spectrum deployment and network investment, edge computing (possible requirement of mini data centers next to a tower presents an additional revenue opportunity), and connected homes and cars, which will require increased wireless bandwidth and increased spending by the mobile carriers.

Life Science REITs (2.2%): Alexandria Real Estate Equities, Inc. (ARE) is the life science industry leader and sole publicly traded life science pure-play REIT. At its current discounted valuation, we believe concerns about competitive supply and distress for some of the company’s biotechnology and health care tenants are overblown and sufficiently discounted in the company’s valuation. We believe the management team has assembled a desirable real estate portfolio, enjoys a leading market share position in its geographic markets, and has solid expectations for long-term demand-driven growth.

Short-lease duration REITs (30.3% of the Fund’s net assets)

Multi-Family REITs (9.2%): In the fourth quarter, we modestly increased our exposure to apartment REITs Equity Residential (EQR) and AvalonBay Communities, Inc. (AVB) from 7.9% to 9.2% of the Fund’s net assets as public valuations were highly discounted relative to the private market.

In the months ahead, we are cognizant that multi-family REITs may face moderating demand and rent growth, in part due to the possibility of accelerating job losses in certain geographic markets. Further, reports of elevated multi-family supply and select private market distress may weigh on multi-family shares, though a portion of these headwinds are, in our opinion, already reflected in share prices.

We remain long-term bullish on multi-family REITs and may look for an opportunity to increase the Fund’s exposure at some point in 2024 or 2025. Rental apartments continue to benefit from the current homeownership affordability challenges. Multi-family REITs provide partial inflation protection to offset rising costs due to leases that can be reset at higher rents, in some cases, annually. We believe the supply outlook is likely to be attractive in 2025 to 2027. Balance sheets are well capitalized with low leverage thereby positioning certain multi-family REITs to take advantage of M&A opportunities should they arise.

Single-Family Rental REITs (8.4%): Following a strong performance in the first three quarters of 2023, we modestly decreased our investments in single-family rental REITs Invitation Homes, Inc. (INVH) and American Homes 4 Rent (AMH).

Demand conditions for rental homes are attractive due to the sharp decline in home affordability; the propensity to rent in order to avoid mortgage down payments, avoid higher monthly mortgage costs, and maintain flexibility; and the stronger demand for home rentals in suburbs rather than apartment rentals in cities. Rising construction costs are limiting the supply of single-family rental homes in the U.S. housing market. This limited inventory combined with strong demand is leading to robust rent growth.

Both Invitation Homes and American Homes 4 Rent have an opportunity to partially offset the impact of inflation given that their in-place annual leases are significantly below market rents. Valuations are compelling at mid-5% capitalization rates, and we believe the shares are currently valued at a discount to our assessment of net asset value.

We remain mindful that expense headwinds and slower top-line growth could weigh on growth in 2024. We will continue to closely monitor business developments and will adjust our exposures accordingly.

Self-Storage REITs (7.7%): Following share price underperformance in the first three quarters of 2023, largely due to moderating new customer demand that weighed on occupancy and rents, we increased our exposure to self-storage REITs – Extra Space Storage Inc. (EXR) and Public Storage (PSA) – in the fourth quarter because we believed that valuations had become attractive and business fundamentals would likely improve in the next year to two years.

Long term, we believe there is a lot to like about self-storage businesses. Existing customers continue to perform well with strong high-single-digit to double-digit existing customer rate increases. Monthly leases provide an opportunity for landlords to increase rents and combat inflation. Self-storage facilities do not tend to require significant ongoing capital expenditures. Elevated construction costs are constraining new construction. Should economic growth continue to decelerate and perhaps lead to a recession, self-storage business fundamentals have historically held up well during economic downturns.

Manufactured Housing REITs (2.9%): After suffering a more than 35% decline between early February and late October, we re-acquired shares in Sun Communities, Inc. (SUI) when the stock was trading near lows for the year. For our more complete thoughts on Sun Communities, please see “Top net purchases for the quarter ended December 31, 2023.”

Manufactured housing REITs (Sun Communities and Equity Lifestyle Properties, Inc.) are a niche real estate category that we expect to benefit from favorable long-term demand/supply dynamics. The companies are beneficiaries of strong demand from budget-conscious home buyers such as retirees and millennials, and negligible new inventory due to high development barriers. Sun Communities and Equity Lifestyle Properties have solid long-term cash flow growth prospects and lower capital expenditure requirements than a number of other REIT categories.

Hotel REITs (2.2%): We are long-term bullish about the prospects for hotel REITs and other travel-related real estate companies. Several factors are likely to contribute to multi-year tailwinds, including a favorable shift in consumer preferences, a growing middle class, and other encouraging demographic trends. Even though travel-related business conditions may moderate in the year ahead, which would negatively impact leisure spending and business travel, we maintain an allocation to select travel-related real estate because we believe the long-term investment case for travel is compelling.

We modestly increased our position in DiamondRock Hospitality Company (DRH) during the fourth quarter. DiamondRock owns high-quality hotel assets skewed towards resort and leisure. We believe the value of the company’s irreplaceable leisure-focused portfolio, which the company has curated over the past 20 years, will ultimately be realized either in the public or private markets. There is a significant amount of undeployed private equity capital on the sidelines, geared toward the exact types of assets that DiamondRock owns. Shares remained attractively valued both on a relative and absolute basis, with the company being conservatively capitalized relative to its peers and with no near-term debt maturities.

Other REIT and non-REIT real estate investments (29.0% of the Fund’s net assets)

Health Care REITs (9.1%): We remain optimistic about our health care REIT investments in Welltower Inc. (WELL) and Ventas, Inc. (VTR) largely due to our favorable view of the multi-year prospects for senior housing. We believe senior housing real estate is likely to benefit from favorable cyclical and secular growth opportunities in the next few years. Fundamentals are improving (rent increases and occupancy gains) against a backdrop of muted supply growth due to increasing financing and construction costs and supply chain challenges. The long-term demand outlook is favorable, driven in part by an aging population (baby boomers and the growth of the 80-plus population), which is expected to accelerate in the years ahead. Expense pressures (labor shortages/other costs) are abating, and we believe highly accretive acquisition opportunities may surface, particularly for Welltower given its cost of capital advantage.

Mall REITs (5.3%): In the most recent quarter, we acquired shares in Simon Property Group, Inc. (SPG). We believe the shares are attractively valued and Simon and certain other mall landlords are benefiting from strong tenant demand for space, positive rent growth, and limited store closures and bankruptcies. For our more complete thoughts on Simon, please see “Top net purchases for the quarter ended December 31, 2023.”

Tanger, Inc. (SKT), an owner and operator of the second-largest outlet center portfolio in the U.S., was an excellent performer in 2023. Its shares increased 43.2% during the period held. We have maintained a position in the company as Tanger is the only mall REIT that focuses exclusively on outlets and, as a result, there is less risk of department store closures. Tenant demand and rents remain healthy, and we believe the shares remain attractively valued.

Non-REIT Real Estate Companies (14.6%): We emphasize REITs but have the flexibility to invest in non-REIT real estate companies. We tend to limit these to no more than 20% to 25% of the Fund’s net assets. At times, some of our non-REIT holdings may present superior growth, dividend, valuation, and share price appreciation potential than some REITs.

We are bullish about the prospects for the Fund’s non-REIT real estate investments, which include: Toll Brothers, Inc. (TOL), Wynn Resorts, Limited (WYNN), Brookfield Asset Management Ltd. (BAM, BAM:CA), Brookfield Infrastructure Corporation (BIPC, BIPC:CA), Brookfield Corporation (BN), Marriot Vacations Worldwide Corporation (VAC), and Lowe’s Companies, Inc. (LOW).

Top Contributors and Detractors to Performance

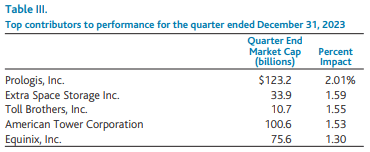

The shares of Prologis, Inc., the world’s largest industrial REIT, increased 19.5% in the fourth quarter of 2023 due to strong business results, an encouraging investor day update, and a favorable backdrop for most REITs in part due to the fourth quarter decline in interest rates.

We are big fans of CEO Hamid Moghadam and Prologis’ management team, and we remain optimistic about the company’s long-term growth outlook. Encouragingly, management believes it has strong visibility into annual earnings growth of approximately 10% for each of 2024, 2025, and 2026.

Prologis owns a high-quality real estate portfolio that is concentrated in major global trade markets and large population centers across the Americas, Europe, and Asia. It has an unmatched global platform, strong competitive advantages (scale, data, and technology), and attractive embedded growth prospects. The company is the only industrial REIT with an A credit rating.

We continue to believe the appreciation potential for Prologis’ shares remains compelling given that the company’s rents on its in-place leases are more than 50% below current market rents, thus providing a strong runway for growth in the next three to five years.

Following a more than 50% decline in its shares since the beginning of 2022, in the fourth quarter, we acquired additional shares of Extra Space Storage Inc., a best-in-class self-storage REIT. The shares rebounded strongly in the last few months of 2023, gaining 29.2%, as the company’s valuation had become compelling, and management delivered better-than-expected third quarter business results.

We see 2023 as a transition year for Extra Space. Growth has been retracing to a more sustainable run-rate and the management team is preparing to incorporate its 2023 $12 billion acquisition of Life Storage. As a result, we remain optimistic about the long-term prospects for the company.

We believe Extra Space’s management team is excellent. Over the last decade, management has delivered strong occupancy gains, rent growth, and expense control that has led to a cost-of-capital advantage relative to its peers. Management has capitalized on this advantage by more than tripling its owned self-storage count since 2010. The company maintains a well-capitalized and liquid balance sheet. We believe Extra Space’s management team will continue to create tremendous value for shareholders and believe the long-term growth opportunity for the company remains strong.

The share price of our investment in homebuilder company, Toll Brothers, Inc., gained 39.2% in the most recent quarter, in part due to the continuation of strong quarterly business results, management optimism about 2024 prospects, and a more than 100 basis point decline in 30-year mortgage rates during the quarter.

2023 was an excellent year for Toll Brothers. Housing fundamentals were resilient despite the affordability challenges of elevated mortgage rates and home prices. Several years of pent-up demand, fears that mortgage rates could move higher, a dearth of inventory in the existing home market, and an overall housing supply shortage drove home buyers off the sidelines to stretch their wallets, in part due to fears that they could miss out on the opportunity to buy a home. Toll Brothers share price increased 80.4% during the period held in 2023.

Though we anticipate more modest gains for Toll Brothers in 2024, we remain optimistic about the long-term prospects for the company. Further, we continue to believe there is a compelling case for homebuilder valuations to re-rate higher over time. For our more detailed thoughts on the long-term opportunity for Toll Brothers and other U.S. homebuilders, please see our December 31, 2023, Baron Real Estate Fund shareholder letter.

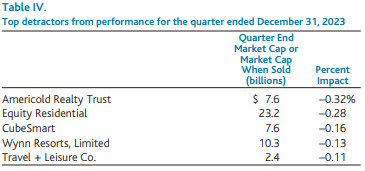

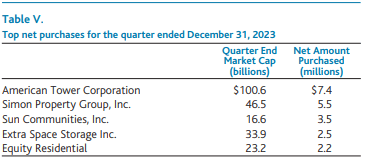

The shares of Americold Realty Trust (COLD), the second-largest owner-operator of cold storage facilities in the U.S. and globally, underperformed in the most recent quarter due to disappointing quarterly results. We exited the Fund’s investment because we believe growth expectations and the company’s valuation are currently not compelling relative to several other REIT and non-REIT companies.

In the most recent quarter, the shares of Equity Residential, the largest U.S. multi-family REIT, trailed the performance of most other REITs because of concerns that near-term business fundamentals (occupancy, rent, and growth) may moderate in 2024. Though we are aware that business conditions may be somewhat challenged in 2024, we believe a portion of these concerns are already reflected in the company’s attractively valued shares.

Management has assembled an excellent portfolio of Class A apartment buildings located in high barrier-to-entry coastal markets with favorable long-term demographic trends and muted overall supply growth. We believe the company is also well positioned to benefit from the affordability advantages of renting versus owning homes, annual leases that provide the potential for partial inflation protection, and its low levered balance sheet, which positions the company to take advantage of acquisition opportunities.

In our opinion, Equity Residential’s shares are attractively valued relative to private market values and the company owns and operates excellent and relevant real estate that should perform well, long term.

Shares of CubeSmart (CUBE) were down in the period before we chose to sell our position and reallocate the capital to other REITs that we believe offer superior return potential over the next few years. The company is the third largest self-storage REIT. It owns and operates a high-quality portfolio of approximately 1,274 self-storage properties. Management maintains a conservative balance sheet. We may revisit CubeSmart at a later date.

Recent Activity

The shares of Americold Realty Trust, the second-largest owner-operator of cold storage facilities in the U.S. and globally, underperformed in the most recent quarter due to disappointing quarterly results. We exited the Fund’s investment because we believe growth expectations and the company’s valuation are currently not compelling relative to several other REIT and non-REIT companies.

In the most recent quarter, the shares of Equity Residential, the largest U.S. multi-family REIT, trailed the performance of most other REITs because of concerns that near-term business fundamentals (occupancy, rent, and growth) may moderate in 2024. Though we are aware that business conditions may be somewhat challenged in 2024, we believe a portion of these concerns are already reflected in the company’s attractively valued shares.

Management has assembled an excellent portfolio of Class A apartment buildings located in high barrier-to-entry coastal markets with favorable long-term demographic trends and muted overall supply growth. We believe the company is also well positioned to benefit from the affordability advantages of renting versus owning homes, annual leases that provide the potential for partial inflation protection, and its low levered balance sheet, which positions the company to take advantage of acquisition opportunities.

In our opinion, Equity Residential’s shares are attractively valued relative to private market values and the company owns and operates excellent and relevant real estate that should perform well, long term.

Shares of CubeSmart were down in the period before we chose to sell our position and reallocate the capital to other REITs that we believe offer superior return potential over the next few years. The company is the third-largest self-storage REIT. It owns and operates a high-quality portfolio of approximately 1,274 self-storage properties. Management maintains a conservative balance sheet. We may revisit CubeSmart at a later date.

Recent Activity

Late in 2022, we concluded that 2023 growth expectations were too high for American Tower Corporation, a global operator of over 200,000 wireless towers, given forthcoming headwinds from significantly higher financing costs (20%-plus exposure to floating rate debt), upcoming debt maturities, continued payment shortfalls from a key tenant in India, foreign exchange headwinds, and a reduction in mobile carrier capital expenditures.

Following a sharp decline in its shares in the first nine months of 2023, we re-acquired additional shares of American Tower in the fourth quarter because we believed that its shares had become more attractively valued, growth headwinds were better understood, and the potential monetization event of its India business would ultimately be value accretive to its business. We believed that 2023 would mark a trough in earnings growth for American Tower and growth would likely reaccelerate in the next few years.

We hold American Tower’s management team in high regard and are long-term bullish about the company’s prospects due to: i) accelerating growth expectations; ii) cash flow stability underpinned by core developed markets; iii) secular demand drivers such as strong mobile data usage, 5G spectrum deployment and network investment, edge computing (possible requirement of mini data centers next to a tower presents an additional revenue opportunity), and connected homes and cars, which will require increased wireless bandwidth and increased spending by the mobile carriers; and iv) optionality regarding its acquisition of a network-dense data center company (CoreSite) as future network needs and architecture evolve.

In the most recent quarter, we re-acquired shares in Simon Property Group, Inc., the largest U.S. mall and outlet REIT, because we felt the shares were attractively valued and business prospects remained strong.

The company has assembled a well-located portfolio of retail malls, outlets, and community centers. Simon’s size and access to capital are distinct advantages in the retail real estate industry. Led by CEO David Simon, its management team has a long track record of solid capital allocation decisions while managing its portfolio especially well. Over time, we believe the company will continue to acquire Class A malls.

We think Simon has opportunities to increase occupancy and rents and acquire new properties and assets at attractive prices relative to the company’s cost of capital while growing the company’s attractive 5.4% dividend.

We believe Simon’s valuation is compelling at less than 13 times earnings (AFFO) versus a long-term average of 15 times earnings.

In the fourth quarter of 2023, we re-acquired shares in Sun Communities, Inc., a REIT that owns a portfolio of manufactured housing properties, recreational vehicle parks, and marinas.

Following a near 50% decline in its share price since the beginning of 2022, we believed the company’s valuation had sufficiently reflected concerns about the company’s investments in the U.K., which have weighed on growth. Further, demand for Sun Communities’ core business (manufactured housing, RVs, and marinas) remains strong. We have a favorable view of CEO Gary Shiffman whose interests are aligned given his significant investment in the company.

Over the next few years, we expect the company to benefit from favorable long-term demand/supply dynamics. The company should continue to be a beneficiary of strong demand from budget-conscious home buyers such as retirees and millennials and negligible new inventory due to high development barriers. The company has superior long-term cash-flow growth prospects and lower capital expenditure needs than several other REIT categories.

Following strong share performance, we trimmed our large investment in data center REIT Digital Realty Trust, Inc. We remain optimistic about the long-term potential for the company.

Data center landlords such as Digital Realty (and Equinix, Inc.) are benefiting from record low vacancy, demand outpacing supply, more constrained power availability, and rising rental rates. Several secular demand vectors, which are currently broadening, are contributing to robust fundamentals for data center space globally. They include the outsourcing of information technology infrastructure, increased cloud computing adoption, the ongoing growth in mobile data and internet traffic, and AI as a new wave of data center demand.

In the last few months, we have also spent time with CEO Andy Power of Digital Realty. Over the last few years, Andy and Digital Realty’s management team have been undergoing a business transformation, which accelerated after its acquisition of Interxion in March 2020, a pure-play European network-dense data center operator. The company has been shedding non-core slower-growth assets, investing and expanding in Europe, growing its retail colocation business, improving its balance sheet, and adding operational expertise by supplementing new management leadership. We have spent a significant amount of time with Andy over the years and believe the investments the company has made are on the cusp of bearing fruit and will pay dividends for years to come. In addition, we believe the fundamentals in its core business are at an inflection point, with robust demand/bookings, pricing power, hyperscale cloud players outsourcing a higher percentage of their digital infrastructure needs and limited competitive capacity. We believe these factors will lead to growth in the core business in the next few years and are optimistic about the long-term prospects for the company.

As noted early in this letter, we exited the Fund’s investments in Americold Realty Trust and CubeSmart in the most recent quarter and may revisit both companies at a later date.

Concluding Thoughts on the Prospects for Real Estate and the Fund

The last few years have been unusually challenging for real estate. Much of real estate has had to absorb a hurricane of headwinds, including COVID-19, the most aggressive Federal Reserve interest rate tightening campaign in decades, a spike in mortgage rates from 3% to 8%, fears of a commercial real estate crisis, a tightening of credit availability, multi-decade high inflation, and supply-chain challenges.

We believe many of the challenges of the last few years are subsiding. Though we expect market volatility at various points in the year ahead, we believe brighter prospects for real estate are on the horizon. We are optimistic.

We continue to believe the narrative about a commercial real estate crisis is hyperbole and unlikely to materialize. Public real estate generally enjoys favorable demand versus supply prospects, maintains conservatively capitalized balance sheets, and has access to credit.

We believe we have assembled a portfolio of best-in-class competitively advantaged REITs and non-REIT real estate companies with compelling long-term growth and share price appreciation potential. We have structured the Fund to capitalize on high-conviction investment themes. Valuations and return prospects are attractive.

We believe our approach to investing in REITs and non-REIT real estate companies will shine even brighter in the years ahead, in part due to the rapidly changing real estate landscape, which, in our opinion, requires more discerning analysis.

For these reasons, we remain positive on the outlook for the Baron Real Estate Income Fund.

I would like to thank my assistant portfolio manager, David Kirshenbaum, who is an outstanding partner. David’s contribution to our real estate business is exemplary. I would also like to thank the other members of our core real estate team – George Taras and David Baron – for their excellent work and dedication. 2023 was, once again, a challenging year to navigate, and David, George, and David continue to impress. I would also like to welcome the newest member of our real estate team, David Berk. We are thrilled to have David join our team.

I and our team remain fully committed to doing our best to deliver outstanding long-term results, and I proudly continue as a major shareholder alongside you.

Sincerely,

Jeffrey Kolitch

Portfolio Manager

|

Investors should consider the investment objectives, risks, charges, and expenses of the investment carefully before investing. The prospectus and summary prospectus contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99-BARON or visiting baronfunds.com. Please read them carefully before investing. Risks: In addition to general market conditions, the value of the Fund will be affected by the strength of the real estate markets as well as by interest rate fluctuations, credit risk, environmental issues, and economic conditions. The Fund invests in debt securities, which are affected by changes in prevailing interest rates and the perceived credit quality of the issuer. The Fund invests in companies of all sizes, including small and medium-sized companies whose securities may be thinly traded and more difficult to sell during market downturns. The Fund may not achieve its objectives. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk. Discussions of the companies herein are not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this report reflect those of the respective portfolio managers only through the end of the period stated in this report. The portfolio manager’s views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time based on market and other conditions, and Baron has no obligation to update them. This report does not constitute an offer to sell or a solicitation of any offer to buy securities of Baron Real Estate Income Fund by anyone in any jurisdiction where it would be unlawful under the laws of that jurisdiction to make such an offer or solicitation. The portfolio manager defines “Best-in-class” as well-managed, competitively advantaged, faster-growing companies with higher margins and returns on invested capital and lower leverage that are leaders in their respective markets. Note that this statement represents the manager’s opinion and is not based on a third-party ranking. Price/Earnings Ratio (next 12 months): is a valuation ratio of a company’s current share price compared to its mean forecasted 4 quarter sum earnings per share over the next twelve months. If a company’s EPS estimate is negative, it is excluded from the portfolio-level calculation. BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and a member of the Financial Industry Regulatory Authority, Inc. (FINRA). |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.