Donny DBM/iStock via Getty Images

All data as of December 31, 2023

|

Fund Characteristics |

|

|

P/V Ratio |

Mid-60s% |

|

Cash |

14.6% |

|

# of Holdings |

18 |

|

Annualized Total Return |

||||||

|

4Q (%) |

1 Year (%) |

3 Year (%) |

5 Year (%) |

10 Year (%) |

Since Inception (2/21/1989) (%) |

|

|

Small-Cap Fund |

10.85 |

20.15 |

2.55 |

6.08 |

5.71 |

9.75 |

|

Russell 2000 |

14.03 |

16.93 |

2.22 |

9.97 |

7.15 |

9.15 |

|

Russell 2000 Value |

15.26 |

14.65 |

7.94 |

9.99 |

6.75 |

9.96 |

|

Returns reflect reinvested capital gains and dividends but not the deduction of taxes an investor would pay on distributions or share redemptions. Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting southeasternasset.com. The prospectus expense ratio before waivers is 1.01%. Southeastern has contractually committed to limit operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) to 0.95% of average net assets per year. This agreement is in effect through at least April 30, 2024 and may not be terminated before that date without Board approval. |

||||||

Longleaf Partners Small-Cap Fund had a good year. We materially outperformed our market benchmark indices, the Russell 2000 (RTY) and Russell 2000 Value, and our absolute return goal of inflation plus 10%. We were pleased with the progress made at our portfolio companies. Our management partners took steps to realize value per share via discounted share buybacks and other intelligent actions. Strong stock performance across most of our portfolio holdings drove solid double-digit returns in a year when value investing faced headwinds relative to growth strategies and the US Small-Cap Index underperformed the Large-Cap Index, driven by a small handful of mega-cap stocks that are, in our view, now dangerously overvalued.

Our research team was busy in 2023. At the start of the year when everyone was still predicting an imminent recession, we saw opportunity as contrarians and improved our portfolio with weighting changes and compelling new investments, many of which have already contributed to the portfolio. In the fourth quarter, we have seen a growing consensus about a soft landing. This consensus view concerns us for the same reasons we were excited to be buying earlier in the year when everyone was fearful. However, we are confident in our ability to keep delivering double-digit returns with our portfolio of competitively advantaged, financially strong businesses with management teams that can take self-help measures in any environment. 2023 showed us that our investment approach can add meaningful value, even in a challenging period for bottom-up active equity managers.

In previous letters, we talked about the return of normal nominal interest rates making this a stock pickers’ market again.[1] When discounted cash flows (DCFs) matter more, bottom-up research matters more. Southeastern has thrived in environments like this before and believe the 2020s will be another great decade for us like most of the ’70s, ’80s and ’00s.

The Future of Public Equity Value Investing

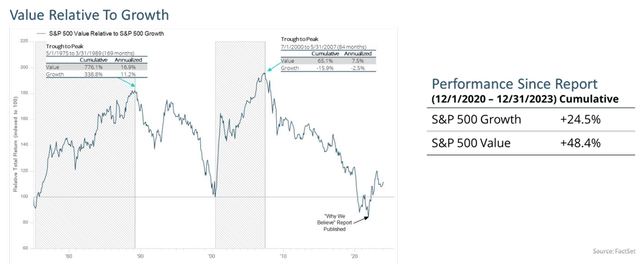

Three years ago, we wrote a paper on why we believe value was primed to work again, and we believe we are still well positioned for the return of value. Since we published the paper, Value has outperformed Growth over the subsequent three years, though it has been a rocky path.

However, we have continued to see the “Value” universe split into extremes of what we would call “Quality at a Higher Price” vs. “Value ETF” (or Low Quality at Low Multiples).

We do not belong to either of these tribes. Our continued focus is on “Business, People, Price.” We demand high-quality businesses, defined as competitively advantaged companies that will produce more free cash flow (‘FCF’) in the near future and earn above average returns – i.e., not “cigar butts.” However, we will not pay the high prices commanded by the traditionally defined “Quality” that can be overvalued as it is easy to see. We look for hidden quality with management teams that will take steps to get that quality recognized by the market over the medium to long term. As a result, our portfolios look meaningfully different than the index and our value peers, with on average ~50% of our portfolios not found in the index. We believe this is a considerable advantage that should allow us to produce strong, differentiated future returns versus a narrowly defined index and peer set. After a brief period of “Value ETF” outperforming in 2022, the “Quality at a Higher Price” (‘QHP’) strategy outperformed again in 2023. However, we saw a lot of positive signs in 2023 that our approach is well positioned for 2024 and beyond.

In the large-cap world, many investors in both the Value and Growth camps have crowded into the same “quality” stocks. There are, by contrast, more options in smallcap world, meaning portfolios are less homogenous. While many other portfolios struggle to define quality if there is less of a crowd to follow, our deep research allows us to find unique companies that have both great assets and great partners. Many small cap companies that might at times seem higher quality can in fact have questionable terminal values if they are too exposed to a single operational risk factor and/or do not have owners on the case. These companies fall into what Warren Buffett described as his “too hard box” where a multiple on next year’s revenue or earnings might be deceiving.

It seems harder to argue that we have more upside than “Value ETFs” trading at an earnings multiple of 11.8 (as measured by the Russell 2000 Value) when our next twelve months multiple is higher (although it’s debatable on how these multiples should be adjusted). However, our year 2 and 3 multiples look much more compelling than the market as companies with temporarily lower margins like Oscar, Anywhere Real Estate, Boston Beer and Westrock have hockey-stick improvements in their earnings power coming while other more asset-based companies like Atlanta Braves and White Mountains are not best judged by an earnings multiple.

Furthermore, when we dig into what the value index owns, we feel much better about the relative quality of our portfolio. There are three primary buckets that comprise 51% of the value index and have lurking dangers within their lower-than-market headline multiples:

- Financials (27%) – While we are happy to own Financials (the Fund is currently overweight relative to the Index), we have historically had difficulty qualifying banks using our Business, People, Price discipline. However, in the wake of the crisis that rocked the bank industry in the first quarter, we have spent more time on banks (which comprise 18% of the Index) over the last one year than we have in the previous 10 years. Even with steep headline price declines, we have had trouble qualifying these generally opaque, highly levered businesses. While the stated next twelve-month (NTM) price to earnings multiple of the average bank is certainly lower than the market’s, we question the growth and stability of that earnings per share (EPS) – let alone FCF for an industry like this. We suspect there are still potential bombs lurking in many loan books. American Banker recently summarized a study detailing how 40%+ of office real estate loans are underwater, and there are problems in other places as well. Our values for high-quality, small-cap real estate companies that are the best proxies for some of these loans are more conservative than the numbers many loans need to avoid write downs. Many market prices for publicly traded real estate equities are below our values, even after a strong end to the year. Many loans on real estate are attached to lower quality assets than are owned by these public real estate companies. That’s not a good chain of facts for many publicly traded banks. At times over the last year, the valid fear over this dynamic was much more priced in than it is now.

- Information Technology + Health Care (15%) – We have typically had limited exposure to IT and Health Care in our portfolios, which has been a notable relative drag on performance over the last decade+. Both of these industries share many characteristics that can put them into the aforementioned “too hard box.” We are extra wary of low multiples in this part of the market for two main reasons: 1) cyclical peaks in volatile industries are dangerous (e.g. it’s generally been better to pay a “high” NTM multiple for a semiconductor company than a low one); 2) multiples can be low for good reasons if the dreaded “disruption” is real, which it is for a higher percentage of companies in these industries than in others (e.g. if a healthcare company will have its key product go off patent protection in 5-10 years, its “low” multiple on NTM earnings might still be too high).

- Energy (9%) – We have proven we are open to this industry and remain willing to own companies in it that qualify on a bottom-up basis if we have competitively advantaged assets and great management partners. Another factor that determines returns is the starting spot commodity price and futures strip. We no longer have the free shot at upside we did before inflation and the Ukraine war, but we also are down from the highs post-Ukraine. That suggests to us an industry that is neither dear nor cheap in total. If you buy the market-cap weighted index, you will likely get more capital allocation pain from larger companies overpaying for smaller ones, which we saw happening more as the year went on and expect to continue if animal spirits run wilder.

Our future absolute returns will be driven by what we own. As discussed above, our portfolio looks meaningfully different than the Russell 2000, the Value Index and our average value peers. We believe our differentiated portfolio will lead to significant alpha via a differentiated return stream.

The Future of Our Portfolios

This time last year, we wrote about three portfolio management process improvements we made in the second half of 2022. After an extended period of relative underperformance, capped off by a particularly challenging absolute and relative year in 2022, we undertook extensive analysis that helped inform tweaks to our long-term discipline. We believe this evolution of our process has helped us be a better version of ourselves for the present and future. The analysis showed that we have demonstrated long-term skill as bottom-up stock pickers, with a historic batting average of wins to losses of 60%+. However, the data led us to conclude we could improve in three primary areas by 1) limiting large overweight positions in the portfolio, 2) building in additional conservatism into our appraisals for holding companies (and therefore demanding a higher discount) and 3) focusing on price-to-enterprise value (P/EV) rather than pure price-to-value (P/V) in leveraged businesses where net debt to EBITDA exceeds 3x (again, resulting in a higher discount for such businesses).

The rules have improved how we analyze existing holdings and influenced the price at which we will buy a new holding and/or trim or add to an existing one. This has resulted in a higher level of resizing positions in the portfolio and exiting some long-term holdings this year. A good example in the portfolio today is Westrock Coffee (WEST), a company that we bought at a solid price in 2022. While our initial cost was $10/share, we sold shares over the last year at an average price of $12.26/share after the company exceeded our 6.5% position limit. After reassessing the case as the year went on with some ups and downs as detailed below, we ended up purchasing more shares at an average price of $8.81/share, which nicely improved our average cost.

These three filters also help us make better decisions about what NOT to own, leading to fewer mistakes. In 2023, 26% of our investments delivered negative returns from the start of the year to the end of the year or from our average cost during the year if they were new investments in 2023. Of course, this was an up-market year, but our 26% down compares to the index, where 46% were negative this year.

Performance across all strategies meaningfully improved since we implemented the new rules, and we believe these process improvements will help drive a higher batting average and strong future returns.

Contribution To Return

| 4Q Top Five | |||

|

Company Name |

Total Return (%) |

Contribution to Return (%) |

Portfolio Weight (%) (12/31/23) |

|

Oscar |

65 |

3.34 |

6.1 |

|

Park Hotels |

39 |

1.52 |

4.4 |

|

Knife River |

37 |

1.38 |

2.5 |

|

Anywhere Real Estate |

26 |

1.21 |

5.4 |

|

Empire State Realty |

21 |

1.09 |

4.7 |

|

4Q Bottom Five |

|||

|

Company Name |

Total Return (%) |

Contribution to Return (%) |

Portfolio Weight (%) (12/31/23) |

|

Mattel |

-14 |

-1.05 |

5.6 |

|

CNX Resources |

-11 |

-0.71 |

5.0 |

|

Boston Beer Company |

-11 |

-0.62 |

4.3 |

|

Lumen |

-31 |

-0.41 |

0.0 |

|

Masonite |

-9 |

-0.30 |

1.4 |

|

2023 Top Five |

|||

|

Company Name |

Total Return (%) |

Contribution to Return (%) |

Portfolio Weight (%) (12/31/23) |

|

Oscar |

275 |

7.99 |

6.1 |

|

Knife River |

79 |

2.53 |

2.5 |

|

GRUMA |

39 |

2.38 |

5.7 |

|

Empire State Realty |

45 |

2.12 |

4.7 |

|

Hyatt |

45 |

1.99 |

3.5 |

|

2023 Bottom Five |

||||

|

Company Name |

Total Return (%) |

Contribution to Return (%) |

Portfolio Weight (%) (12/31/23) |

|

|

Lumen |

-81 |

-4.54 |

0.0 |

|

|

Westrock Coffee |

-24 |

-1.64 |

6.3 |

|

|

Lanxess |

-23 |

-0.80 |

0.0 |

|

|

Lazard |

-13 |

-0.44 |

0.0 |

|

|

MSG Sports |

-5 |

-0.10 |

0.0 |

|

- Oscar (OSCR) – Health insurance and software platform Oscar Health was the top contributor in the fourth quarter and for the year, after the stock price appreciated over 270% in 2023. Oscar was a top detractor in 2022 and highlights the importance of pragmatically revisiting the case for our decliners and not panic selling or adding too early on price declines. It is also a good reminder that game changing value creation can come in unexpected ways, as it did with Mark Bertolini joining as CEO at Oscar this year. We couldn’t have modeled this as a driver, but we did recognize the stock price had become unduly punished alongside most tech related businesses in 2022 and had confidence the business would rebound strongly. We remained engaged with management and the board to encourage proactive steps to close the extreme value gap. Oscar did benefit from a general rally in tech businesses coming out of 2022 weakness, but the positive price movement was primarily a direct reflection on the management upgrade and operational execution. Mark Bertolini brings significant operational expertise, as well as a strong endorsement value to the business, given his long-term track record as CEO of Aetna, which he sold to CVS for a great outcome for Aetna shareholders. Bertolini’s compensation package aligns his interests with shareholders, and he only really starts getting paid when the stock trades at $11 (vs the still discounted ~$9 level where the stock ended the year). In his first year, he has in quick order improved cost control and operational efficiency that drove EBITDA strength. Oscar reported another great quarter in November, beating expectations across most metrics and increasing 2024 guidance. The original venture investor holders beyond Thrive remain an overhang on the share price, and Oscar still offers significant upside from here.

- Knife River (KNF) – Construction materials and contracting company Knife River was a top contributor for the year and for the quarter. We initiated the position this year after it was spun out of MDU Resources Group, a utility holding company in North Dakota. We were familiar with the business from previous work done on MDU. Knife River was the business that originally attracted us to MDU, and the spin gave us the opportunity to buy the best business as a standalone stock at a discount when utility shareholders focused on a steady dividend dumped it. The business had not been optimized for a long time under MDU but still delivered solid mid-single digit revenue growth over the prior decade. We believe CEO Brian Gray and his plan to improve cash flow represents an improvement over the previous path. Knife River reported strong results in its first two quarters, beating expectations and company guidance.

- GRUMA (OTCPK:GPAGF) – Corn flour and tortilla manufacturing company GRUMA was again a top performer for the year, following on its 2022 strength. GRUMA consistently reported solid results with positive growth ahead of 2023 full year company guidance. 3Q23 saw FCF turning positive, and the company used the cash to pay down debt before likely turning back to share repurchase, as it has done before. This strong performance came despite headwinds such as foreign exchange and geopolitical concerns not specific to GRUMA.

- ESRT – New York commercial real estate and tourism company Empire State Realty Trust (ESRT) was a top contributor in the fourth quarter and for the year, bouncing back from a challenging real estate environment that made it a top detractor last year. After a slow start in 1Q23, ESRT resolved the significant overhang of losing Signature Bank as a flagship tenant, announcing that Flagstar Bank took over the entire 300,000+ square foot lease at 1400 Broadway at a comparable rate. The company reported a solid 2Q and 3Q23, with good operating results for the NYC office business and raising 2023 full year guidance. ESRT outperformed its peer group by 4000bps, highlighting the importance of our great partners. We trimmed our position in the quarter on the back of price strength but think the company provides attractive upside from still depressed levels today.

- Hyatt (H) – Global hotel operator Hyatt was another strong contributor in the fourth quarter and for the year, outperforming expectations that the post-COVID travel rebound would ease in 2023. Hyatt consistently reported strong results in the year and guided mid-to-high single-digits of revenue per available room (RevPAR) growth in the back half of the year, driven by a continued recovery in Asia Pacific and ongoing improvements in group and business demand. Hyatt announced the value additive purchase of UK booking company Mr & Mrs Smith and bought back discounted shares at a steady pace.

- Lumen (LUMN) – Global fiber company Lumen was the top detractor for the year, and we sold our equity position in the first half, when it became clearer the new management team under CEO Kate Johnson would not pursue a strategic path to monetizing Lumen’s consumer business. At that time, we felt the depressed bonds provided a unique opportunity to own the bonds backed by hard assets with a better risk-reward profile. However, our confidence in the business case further deteriorated and we exited the bonds in the second half. Lumen represented a permanent capital loss for the Fund, a significant opportunity cost for the portfolio and a disappointing long-term mistake. Lumen has reinforced the importance of limiting overweight positions in the portfolio, being cautious of leverage and value declines, and fully re-underwriting a case – and being willing to move on – when the people and/or underlying facts change.

- Westrock Coffee (WEST) – Westrock Coffee, which is the “brand behind the brand” producing and distributing coffee, tea and extracts for larger entities, was another top detractor for the year. Westrock faced a challenging summer with inflation, heat waves making hot coffee less popular and high gas prices negatively impacting traffic at convenience stores and rest stops. 3Q23 also had disappointing results driven by traditional roasted coffee volumes declining materially due to a variety of factors that should not continue, although flavors, ingredients and single serve were strong. The company lowered guidance for the full year and indicated that the expected capacity from its new Conway, Arkansas facility will be delayed, only coming online towards the end of 2024 / early 2025. The company reiterated its expectations for long-term earnings power remain intact, but our appraisal value is down slightly. We think the management and board have learned good lessons this year and still have strong long-term records.

- Mattel (MAT) – Global toy and media company Mattel was the top detractor in the quarter, though its strong 2Q performance on the back of the success of the Barbie movie made it a positive year to date contributor. Mattel reported positive 3Q23 results, with earnings and revenues beating guidance. However, negative sentiment weighed on the entire toy industry, with the challenging macro environment driving holiday season weakness. Mattel benefitted in the year from the strength of the Barbie movie, which underscores Ynon Kreiz’s plan to monetize the strong intellectual property that the company owns. The company bought back discounted shares in the quarter.

Portfolio Activity

2023 was a busy and productive year for our research team. We initiated five new positions spanning multiple sectors: Ingles Markets (IMKTA), Park Hotels and Resorts (PK), Boston Beer Company (SAM), Knife River and Douglas Emmett (DEI). These additions were funded by selling five positions and trimming an additional 11 in the year. We exited Vimeo (VMEO), Lanxess (OTCPK:LNXSF), Madison Square Garden Sports Corp (MSGS) and Lazard (LAZ) as our investment cases changed and we felt we could allocate our capital more effectively in other opportunities with a more compelling margin of safety and potential upside. As discussed in more detail above as well as in our 2Q letter, we sold our long-term position in Lumen – both the stock and the briefly-held bonds – at a loss. While it is always disappointing to have a permanent capital loss, taking these losses puts the Fund in a very tax advantageous position, meaning we could realize significant future capital gains without incurring a capital gain distribution.

Outlook

While our cash ended the year at a higher than usual level of 14%, our on-deck list remains healthy, if not as strong as it was at other points over the last two years. The high level of new idea generation this year means we have multiple partial positions that we would love to fill out. Adding to these partial positions, plus one new company from our on-deck list, could quickly reduce cash to a more normal level in the mid-single digits or lower. We think it likely that 2024 will give us some volatility to put our cash to work and continue to improve our portfolio. We can’t tell you exactly where that volatility will come from or when it will hit. We did like how The Economist quantified 2024 as globally “the biggest election year in history.” And it might not be anecdotal that the market and humanity seemingly have a shorter fuse than in the past. One quantification comes from how unruly airline passengers remain elevated at ~2x pre-covid levels. Volatility won’t just help us improve our portfolios, it will help our existing investees grow their own value per share in ways that are unexpected and don’t fit into a spreadsheet, again highlighting the importance of high-quality people who are on offense. We thank our long-time clients for their partnership. It was good to deliver better results in 2023. We believe we have the pieces in place to continue to deliver future results more like our first 30+ years.

|

Footnotes [1] Discussed in our 4Q21 Partners Fund Commentary See following page for important disclosures. Before investing in any Longleaf Partners Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. For a current Prospectus and Summary Prospectus, which contain this and other important information, visit Longleaf Partners Small Cap Fund. Please read the Prospectus and Summary Prospectus carefully before investing. RISKS The Longleaf Small-Cap Fund is subject to stock market risk, meaning stocks in the Fund may fluctuate in response to developments at individual companies or due to general market and economic conditions. Also, because the Fund generally invests in 15 to 25 companies, share value could fluctuate more than if a greater number of securities were held. Smaller company stocks may be more volatile with less financial resources than those of larger companies. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. The Russell 2000 Value index is drawn from the constituents of the Russell 2000 based on book-to-price (B/P) ratio. An index cannot be invested in directly. The S&P 500 Index is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. S&P 500 Value Index constituents are drawn from the S&P 500 and are based on three factors: the ratios of book value, earnings, and sales to price. An index cannot be invested in directly. S&P 500 Growth Index constituents are drawn from the S&P 500 and are based on three factors: sales growth, the ratio of earnings change to price, and momentum. Discounted cash flow (DCF) is a valuation method used to estimate the attractiveness of an investment opportunity. DCF analysis uses future free cash flow projections and discounts them to arrive at a present value estimate, which is used to evaluate the potential for investment. EBITDA is a company’s earnings before interest, taxes, depreciation, and amortization. Free Cash Flow (FCF) is a measure of a company’s ability to generate the cash flow necessary to maintain operations. Generally, it is calculated as operating cash flow minus capital expenditures. Earnings per share (EPS) is the portion of a company’s net income allocated to each share of common stock. Price / Earnings (P/E) is the ratio of a company’s share price compared to its earnings per share. “Margin of Safety” is a reference to the difference between a stock’s market price and Southeastern’s calculated appraisal value. It is not a guarantee of investment performance or returns. Enterprise value (EV) is a company’s market capitalization plus debt, minority interest and preferred shares, and less total cash and cash equivalents. P/V (“price to value”) is a calculation that compares the prices of the stocks in a portfolio to Southeastern’s appraisal of their intrinsic values. The ratio represents a single data point about a Fund and should not be construed as something more. P/V does not guarantee future results, and we caution investors not to give this calculation undue weight. As of December 31, 2023, the top ten holdings for the Longleaf Partners Small-Cap Fund: Eastman Kodak, 9.0%; Westrock Coffee, 6.3%; Oscar, 6.1%; GRUMA, 5.7%; Mattel, 5.6%; Graham Holdings, 5.5%; Anywhere Real Estate, 5.4%; CNX Resources, 4.9%; White Mountains, 4.9% and Empire State Realty, 4.7%. Fund holdings are subject to change and holdings discussions are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Funds distributed by ALPS Distributors, Inc. LLP001492 Expires 4/30/2024 |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.