JHVEPhoto/iStock Editorial via Getty Images

Growing up as a World Wrestling Entertainment (TKO) fan (WWF back in those days), I’ve long known about Mattel, Inc. (NASDAQ:MAT) as the company that produces iconic action figures of wrestling superstars. Some may recall Mattel for Barbie or Uno. Irrespective of which toy or game you associate with Mattel, it is irrefutable that Mattel is an iconic name that has been around for almost 80 years.

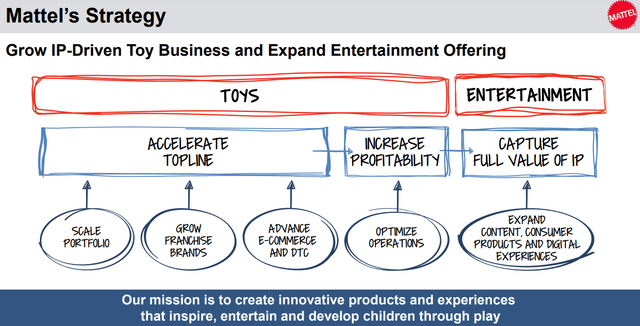

Mattel makes money primarily from two segments: toys and entertainment. Its toys (games and puzzles) are sold internationally through its e-commerce platform and a few physical stores. The company has also been successful in generating licensing and royalty fees for its proprietary products like the iconic Barbie when these characters are used in movies, TV shows, and video games. In summary, at the core of the company’s strategy is its IP-driven toy business, which the company then leverages by allowing third-party manufacturers and retailers to “limited-use” for a fee.

MAT Strategy (investors.mattel.com)

An iconic brand does not make its stock an automatic investment. I am sketching out a few reasons below why I believe Mattel is not a buy at present. Let us get into the details.

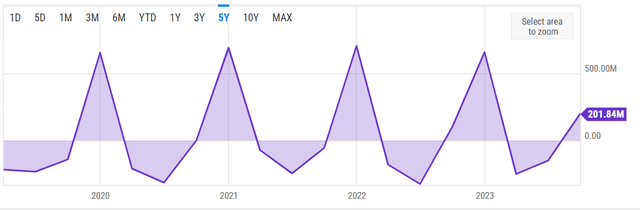

Extremely Seasonal Free Cash Flow

Yes, I get it. A consumer discretionary company, especially one into leisure products is not going to be the epitome of consistency. But the Free Cash Flow [FCF] chart shown below is extreme in my view even for seasonable products, with a heavy (positive) tilt towards December.

MAT FCF (YCharts.com)

Keeping the seasonality aside, the 5-year average quarterly FCF is just $32 million. However, over the last year (trailing twelve months), Mattel’s FCF appears healthier with an average of $115 million. Even the healthier TTM FCF gives Mattel stock a high price-to-FCF ratio of nearly 15. Finally, despite Q4 generally being the strongest quarter, Mattel and peers went onto slash prices by as high as 35% during the holiday season, confirming earlier worries that the holiday quarter may be lackluster. Obviously, slashing prices may have helped the volume but whether it was enough to offset the margin impact remains to be seen when the company reports on February 7th.

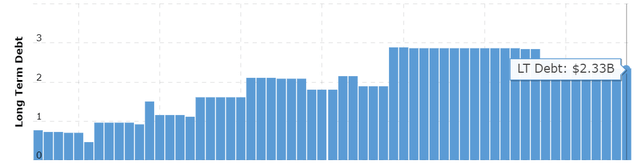

Debt and Resulting Interest Expense

Mattel carries $2.33 billion debt on its balance sheet, which isn’t terrible when you consider that the market capitalization is about thrice that and the debt level has remained steady over the last couple of years. There seems to be a lack of urgency in reducing debt level as the company has paid between $30 and $34 million per quarter in interest expense, which is not reflected in the FCF figures above. In other words, if we go by the 5-year average quarterly FCF, Mattel has nothing left in hand when you factor in the interest expense.

MAT Long Term Debt (Macrotrends.net)

Macro and Technical Weakness

Operating in the consumer discretionary sector, Mattel is highly susceptible to consumer spending habits and confidence. Inflation, although likely peaked, is adding to the company’s woes in the form of higher shipping costs. While we may have avoided a recession in 2023, according to Congressional Research Service [CRC], we may still have one in 2024.

“Recession looks to have been avoided in 2023, and many indicators have shown promising signs in recent months. Nevertheless, it is still possible that the economy could end up in a recession in 2024 through a few different scenarios.”

Personally, I expect at least a soft landing for a variety of reasons, including but not limited to a decline in small business hiring and soaring credit card delinquencies. Discretionary expenses, least of all leisure products like toys, may be the first ones to feel the purse tighten further in such circumstances.

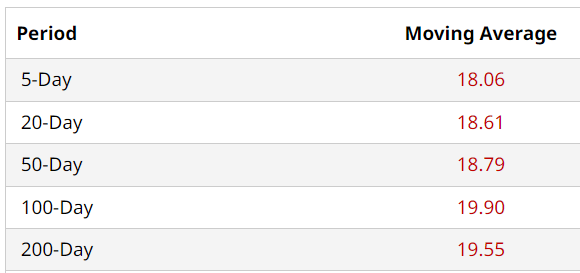

Technically, Mattel’s stock is looking extremely weak as the stock is trading below all the commonly used moving averages, with the 200-Day moving average 12% higher than the current market price of $17.41. This clearly suggests the stock has not found a bottom yet.

MAT Moving Avg (Barchart.com)

But, It’s Not All Gloom

I don’t mean to dump on Mattel’s stock as the company and stock do have some positive attributes that I am highlighting below.

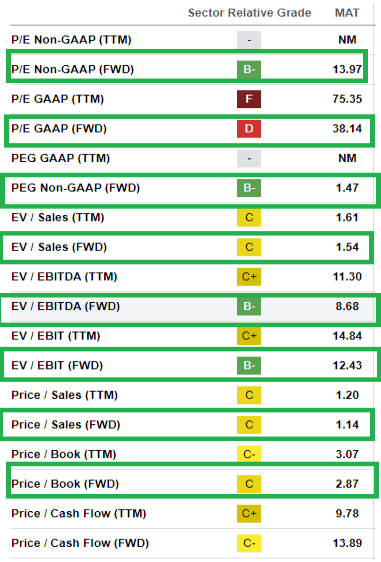

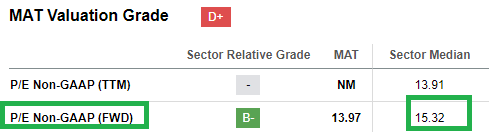

- On the valuation front, MAT stock gets a “D+” rating on Seeking Alpha. However, when you get deeper, you will find that almost all the forward ratings are looking much healthier than the trailing ratings as highlighted in the image below. As cliche as it sounds, investing is all about the future and most of the forward multiples appear reasonable to me. Especially, the 1.47 forward Price-Earnings/Growth [PEG] suggests that the stock is not excessively overvalued.

MAT Valuation Ratings (Seekingalpha.com)

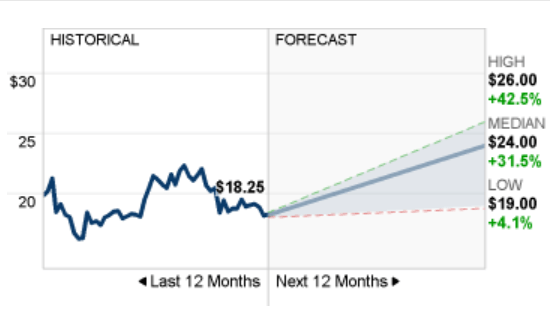

- The 12 analysts covering Mattel have a median price target of $24, suggesting 38% upside from here. The lowest price target of $19 suggests the margin of safety for someone buying here in the $17 range is fairly high.

MAT Price Target markets.money.cnn.com)

- The biggest thing in favor of the bulls here is the company’s history. Mattel has been operating as a public company since 1960. And that means, the company has been through

- 13 different presidents (including the incumbent)

- the ages of computer to internet to mobile phones to smartphones to tablets to AI at present (and many of these inventions have been seen as toys themselves)

- many market crashes and recoveries

In short, Mattel has shown it can operate in any environment, not always thriving but at least surviving.

Forward Looking Thoughts And Conclusion

What do all these mean for the stock at present? At the crux of it, Mattel is a discretionary, cyclical company, dependent on continuous hit products and the holiday season. Hence, its stock should be viewed as a trade and not an investment. The company does not pay a dividend and hence, downturns could be extremely brutal. I rate the stock a Hold now and suggest waiting for a pullback to the mid-teens at least, which cannot be ruled out given the break below the 100- and 200-Day moving averages. At around $14, the stock would get interesting to me personally, as it would be trading at a forward non-GAAP multiple of 10, a 50% discount to the sector median multiple.

Sector Median FWD PE (Seekingalpha.com)

Overall, I expect Mattel to continue having its cyclical highs and lows and look forward to revisiting this stock in a quarter or two to see how my thesis panned out.