guvendemir

Introduction

The iShares US Aerospace & Defense ETF (BATS:ITA) is a passive index fund composed of the largest manufacturers of arms and military-grade equipment in the US (and the world, for that matter, but it is restricted to US stocks). Included in the index’s top holdings are names like Raytheon, now RTX Corp (RTX); Boeing (BA), and Lockheed Martin (LMT).

In this column, I’m going to discuss why the defense industry is ripe for buying. I will break my thesis down into two major parts:

- Warfare has changed in the modern era. Surrogate warfare is the “new normal” for modern armies. This has created room for deeper military-industrial integration that sovereign powers are eager to utilize.

- This is voiced by both the US and UK governments and their respective defense administrations.

- The US is continuing its “Arsenal of Democracy” doctrine with military aid being given to Ukraine, Israel, Taiwan, and other key allies indefinitely, providing a catalyst for future growth of the military-industrial complex.

- Increased levels of insurgency, armed conflict, and territorial disputes in recent years have prompted increased military spending.

Brief Overview

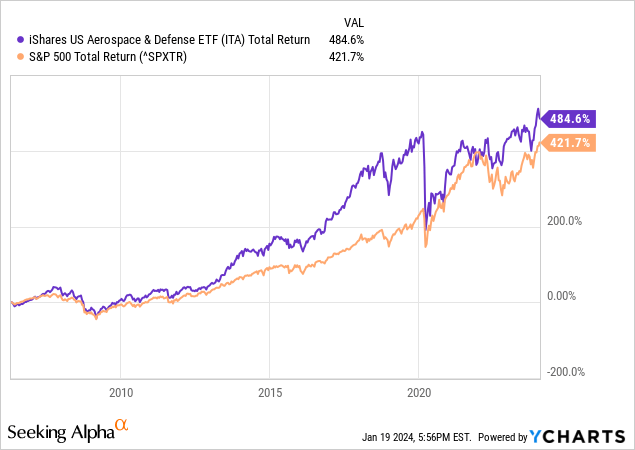

ITA’s portfolio is made up of US companies that produce military equipment and aircraft, for commercial, private, or governmental use. It holds thirty-five stocks, has an expense ratio of 0.40% (only beat by XAR’s 0.35% among all of its peers), and has a dividend yield of 1.45%. Since inception, it has bested the S&P 500. Note the severity of the drop in March 2020 compared to the S&P. This was due to ITA’s exposure to aerospace companies, many of whom had demand for parts and components drop to virtually zero overnight as there were mass flight cancellations around the world.

Before I cover my macro thesis on the defense industry, I need to elaborate on why I’m using ITA as the primary ticker for this column over others I’ve listed as secondaries. I chose ITA for my exposure to defense over other ETFs like Global X’s SHLD or SPDR’s XAR.

Primarily, my choice of passive indices fell to ITA, XAR, and PPA. In line with my desire for a passive index over stock picking (my thesis is macro, not micro), ITA is the least restrictive in its methodology. The largest difference is that ITA’s caps far exceed the market weight of its top holdings, with its cap on holdings being up to 35%. XAR has a cap of 4.5%, and PPA has a dynamic cap designed to reflect a “pure play” on defense.

Because of these caps, these funds do not hold their components at their respective market weights. ITA does, which is what makes it attractive to me. I want to hold the industry at its natural market weight, which could mean overweighting stocks with a lot of momentum. This should result in increased gains over XAR or PPA in a “winner takes all” environment.

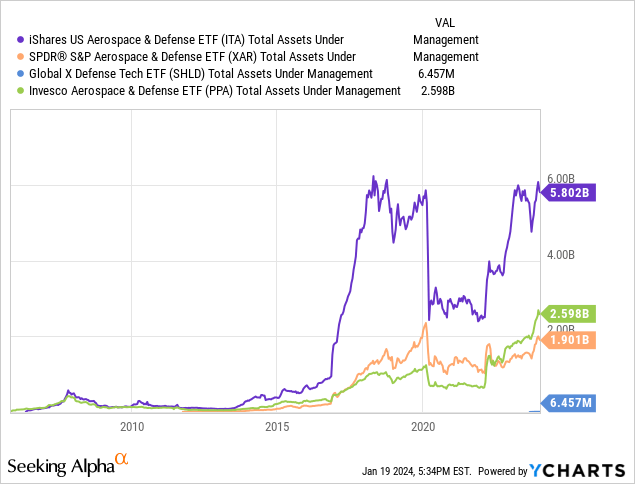

Secondarily, my choice of ITA was made simpler due to liquidity. There is a very large difference between the AUM of defense ETFs, which may matter to a lot of investors (and has been a common comment left on my articles in the past). ITA has more than double the assets of the next largest passive defense & aerospace index fund, PPA.

Private Military Contractors

Surrogate Warfare

Increasingly, as war rages on around the globe, we are seeing surrogate warfare tactics dominate battlefields. Dr. Rickli of the Geneva Center for Security policy defines these kinds of tactics in a 2021 report:

The surrogate is an actor or a technological tool that absorbs the patron’s political, operational, or financial burden of conflict. The surrogate, thereby, can be a state or non-state actor, a commercial military company, a band of mercenaries or a criminal organization, a terrorist organization, or an insurgency group. Increasingly though, because of the potential power unleashed by the military applications of emerging technologies, surrogates are also cyber trolls and bots as well as increasingly autonomous technological platforms such as drones or robots.

This kind of warfare is not waged by infantry and tank battalions. Primarily, operations are conducted by private military companies and their personnel, equipment is purchased from contractors instead of being manufactured in-house, and even some intelligence is outsourced to companies like Booz Allen Hamilton (BAH) as was the case with the NSA.

The move to surrogate warfare tactics is a move toward private military contractors.

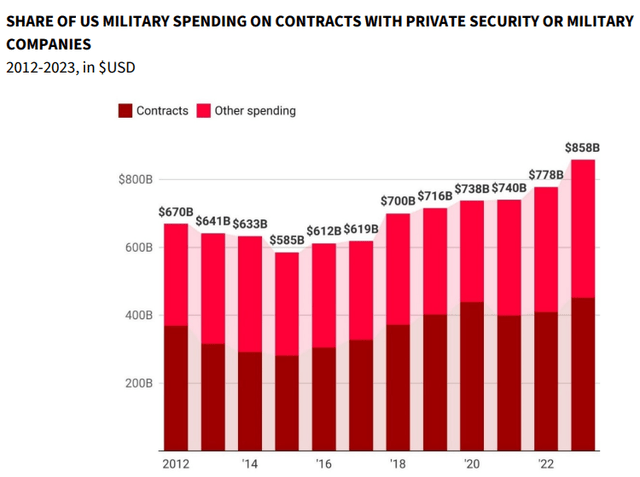

Private contractors that provide services, manufacturing capabilities, equipment, munitions, or personnel to the US government; such as those companies included in ITA, accounted for more than half of the US defense budget last year.

Figure 1 (Council of the European Union)

US spending on private contractors has only increased in the last decade, increasing year-over-year since 2016. They are becoming a larger and larger part of routine military operations every year, which gives these companies predictable revenues and sets expectations, but leaves them at the mercy of the changing whims of government.

Integrating with Contractors

The United States, in its FY 2024 defense budget request, states one of its objectives as furthering cooperation with manufacturers of munitions using multi-year procurement plans (“MYPs”).

[The DoD] is executing an unprecedented number of MYP contracts for critical munitions. The Department is pursuing five of the systems for MYP plans in 2023 and 2024. The execution of MYP contracts focuses on several objectives:

1. Providing a strong demand signal by the DoD and Congress to procure more munitions to meet current and future needs;

2. Helping to expand the production capacity for critical munitions;

3. Helping the industrial base shift from peacetime production to an improved surge capability;

4. Improving the defense industrial base by permitting the more efficient use of a contractor’s resources (e.g. industrial facilities, production efficiencies, design stability); and

5. Providing defense contractors a longer and more stable time horizon for planning and investing in production (e.g. attracts subcontractors, vendors, and suppliers).

The current sentiment from the Department of Defense is that furthering the integration of the military-industrial complex to allow for the faster and more efficient roll-out of new weapons systems is the only way to keep up with modern warfare.

This is especially true of munitions manufacturers, where their production is needed not just for US use but also for distribution to key allies globally. Further on in the DoD budget request, they elaborate on the need for consistent, predictable production of these weapons.

A constant emphasis on innovation and modernization within the munitions portfolio is essential to addressing advanced and persistent threats around the world…

Ensuring the Department is prepared to deter in a dynamic threat landscape is paramount. Forecasting munitions requirements remains a considerable challenge given the domains spectrum (ground, sea, and air) the Department covers, coupled with the range of combat effects demanded by different operational theaters. The parallel obligation to support coalition partner munitions needs and integrating them with Department actions is similarly essential in ensuring cooperative combat operations can be conducted successfully.

In a 97-page report presented to the UK Parliament, the UK Ministry of Defense wrote about their own similar plan to shorten MYPs and adapt to the new normal in warfare.

…the pace of innovation across the battlespace is accelerating and cannot credibly be met through conventional – often decades-long – acquisition programmes and platform upgrades. As a rule, we must buy simpler platforms more quickly and design into them the capacity to upgrade at speed – and not just with the original prime contractor. Secondly, we must partner with industry, exploring together advances in technology and what they mean for UK defence capability…

As western governments clamor to spend more and integrate more deeply with contractors, we should expect to see a few things happen with these businesses:

- Revenues will steadily increase as new MYPs progress and old weapons systems are replaced.

- Contractors who primarily gain their revenue from defense spending stand the most to gain. These include some of the top holdings in ITA like RTX, BA, LMT, and NOC.

The Arsenal of Democracy

This phrase was used to describe the role of the US during the first part of the second world war by President Franklin D. Roosevelt. During a “fireside chat” radio broadcast to the nation, FDR was quoted as saying that he would do everything in our power to arm those defending democracy around the globe.

Since then, we have not wavered far from this doctrine. It is still central to US foreign policy, as we routinely arm factions and armies around the world.

The Russo-Ukraine War that began in February ’22 has been one of the largest military aid missions to a European country since WW2. Prior to 2022, we had provided various levels of non-lethal and lethal support, according to the Congressional Research Service. This changed when full-scale war broke out.

[US aid to Ukraine] prior to FY2022 provided sniper rifles, rocket-propelled grenade launchers, counter-artillery radars, Mark VI patrol boats, electronic warfare detection and secure communications, satellite imagery and analysis capability, counter-unmanned aerial systems (UAS), air surveillance systems, night vision devices, and equipment to support military medical treatment and combat evacuation procedures…According to DoD, U.S. security assistance committed to Ukraine since the start of Russia’s full-scale invasion through December 27, 2023, has included the following:

• 39 High Mobility Artillery Rocket Systems (HIMARS);

• 12 National Advanced Surface-to-Air Missile Systems (NASAMS); 1 Patriot air defense battery; other air defense systems; and 21 air surveillance radars;

•31 Abrams tanks, 45 T-72B tanks and 186 Bradley infantry fighting vehicles; • 300 M113 and 189 Stryker Armored Personnel Carriers; • 2,000+ Stinger anti-aircraft missiles;

• 10,000+ Javelin and 90,000+ other anti-armor systems;

• Phoenix Ghost, Switchblade, and other UAS;

• 198 155 mm and 72 105 mm Howitzers and artillery;

• 227 mortar systems;

• Remote Anti-Armor Mine (RAAM) Systems;

• 9,000+ Tube-Launched, Optically-Tracked, WireGuided (TOW) missiles;

• High-speed anti-radiation missiles (HARMs) and laserguided rocket systems;

• 35,000+ grenade launchers and small arms;

• communications, radar, and intelligence equipment; and

• training, maintenance, and sustainment.

The cost of these systems adds up, and provides a dynamic stream of revenue to private military contractors, who are largely the manufacturers of the equipment listed above.

The top-line item sent to Ukraine was the HIMARS rocket system, manufactured by Lockheed Martin (LMT). Each system costs approximately $3.5M.

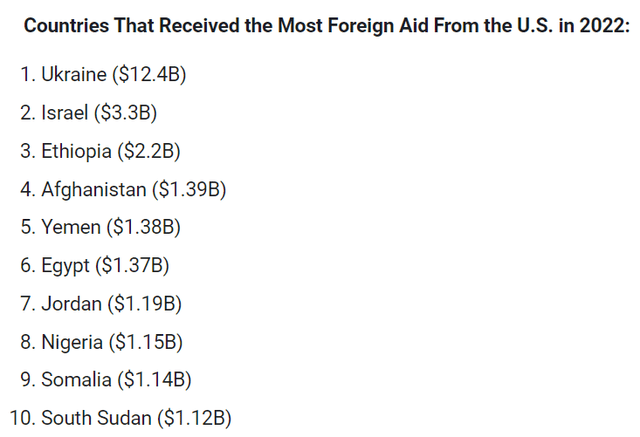

While Ukraine is receiving the lion’s share of aid, we still spent an enormous amount on other allies in 2022.

Figure 2 (US News)

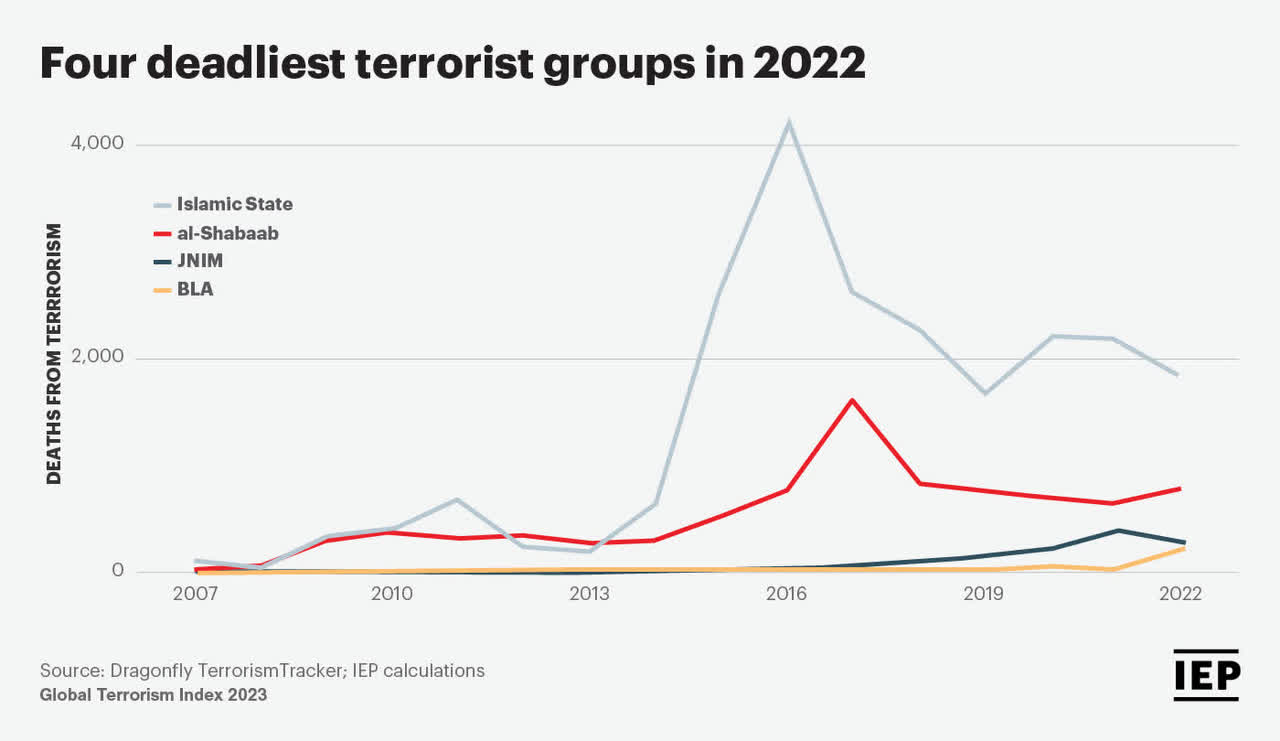

Most of the countries on this list are fighting asymmetrical wars against insurgencies, which have spiked in recent years, especially now with the Islamic State coming back into popular memory with its attack in Iran recently.

Figure 3 (Global Terrorism Index)

With no signs of these conflicts slowing down, it is clear to military leadership the need to continue shipments of military aid to our allies. This is a catalyst for continued revenue from defense contractors, who are the primary benefactors of this spending.

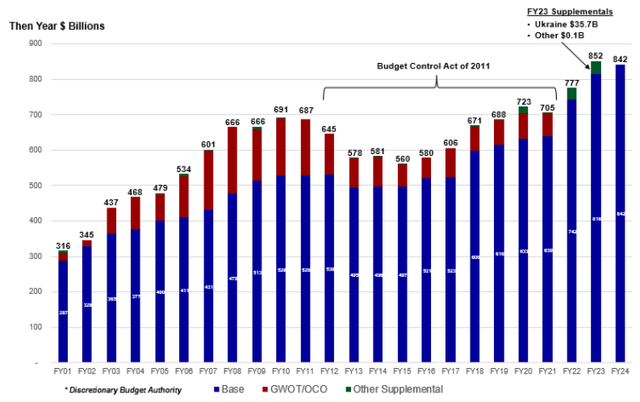

With the exception of the decade the Budget Control Act limited defense spending, spending has only increased and continues to do so now that the act has lapsed.

Figure 4 (US Department of Defense)

Risks

The primary risk to my thesis is the idiosyncratic nature of the stocks held by ITA. While there is little that can be done to untangle the military-industrial complex, its existence does not guarantee the success of the companies that service it.

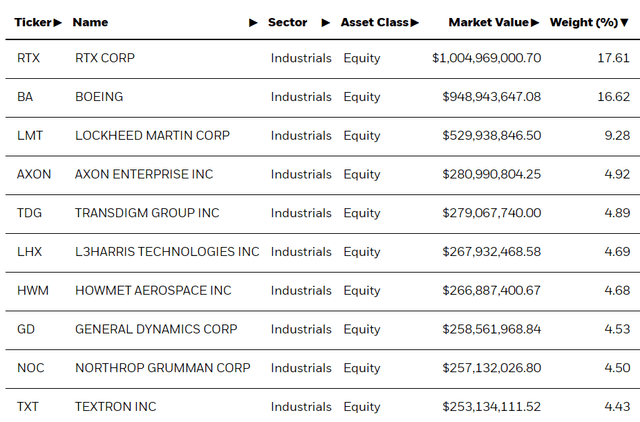

The index is relatively small, at 29 holdings, and the largest holding, RTX Corp (RTX), constitutes over 17% of the fund’s NAV. Boeing (BA) is also over 16%.

Figure 5 (iShares)

Because my thesis is primarily backed by political and economic trends, it means that there is great risk for the larger components of the index to fail for their own fundamental or managerial reasons.

It is important to keep an eye on these larger holdings, and investors should consider them carefully if they are considering an investment in the index. Normally, indices come with a great level of diversity, but ITA is an exception in that it still boasts some concentration risk.

The only way to combat this is to keep your allocation to ITA small.

As with every sector I overweight in my equity portfolio, I keep them at sub-5% and all individual stocks at 2% or less. I encourage others to do the same, in line with their own personal risk tolerance.

Conclusion

The US DoD and its allies are demanding more and more integration from defense contractors, further blurring the lines of the military-industrial complex. This, compounded by increased overall budgets and an uptick in global armed conflict, means that the US government is giving us the buy signal on the defense and aerospace industry.

The government intends to continue its doctrine of arming nations in conflict against second world powers like the Russia or China. Military aid to Ukraine has shown the US’ willingness to indefinitely provide this kind of assistance as needed.

We could expect the US to follow this doctrine is war breaks out in the South China Sea, the Middle East, or the Russo-Ukraine War in Eastern Europe expands to include other belligerents like Belarus.

Without discussing individual stocks within the index, I believe it is safe to say that the US government has given us the buy signal for defense contractors for the coming years.

We can accuse the US government of many things, but underspending on defense is not one of them.

Thanks for reading.