MihailDechev/iStock via Getty Images

Introduction

Dorian LPG (NYSE:LPG) is one of the leading LPG shipping companies. It operates 25 vessels, 4 of which are chartered-in. Besides that, it participates in the Helios LPG pool along with MOL Energia. Being part of the pool, LPG operates 27 additional vessels. The company`s vessels are, on average, eight years old, well below the global average for LPG carries at 10.3 years old. Fifteen of the company’s ships are scrubber-equipped. LPG has 25 VLGCs, including one dual-fuel VLGC and 19 ECO-design vessels.

Financially, LPG is sound, having $192 million cash, $578 long-term debt, and $838 million total debt. Profit margins and returns are strong due to scrubber-equipped vessels and economy of scale. However, those qualities are priced in. LPG trades at 100% P/NAV and the highest EV/Sales and P/TBV in the sample group. To pick the right stock is not enough to win the investing game. The other two ingredients are price and timing. LPG is expensive for my taste, and I missed the right moment. I find value at reasonable prices in other shipping segments. My verdict is a hold rating.

LPG market highlights

The Red Sea crisis profoundly affected container shipping and tankers. LPG and LNG carriers had to alter their navigation course to South Africa. As per Vortexa, 32 gas carriers were diverted to Cape of Good Hope. Additional pressure puts the Panama Canal in drought. The chart below shows LPG carrier’s transit via the Panama Canal since January 2023.

Vortexa

The Panama Canal issues pushed LPG operators to change the routes, choosing between South Africa and the Red Sea. For now, only the former remains a viable option due to the escalation in the Red Sea. The number of LPG vessel transits via South Africa is expected to increase by 140% MoM. In the meantime, Suez Canal traffic is projected to decline by 60%.

The US started strikes on Yemen on 12 January. Most LNG and LPG companies stop transitioning via the Red Sea, observing the situation. Most ships were diverted via South Africa, while some remained around Bab el Mandeb.

The direction of the transits has changed, as shown in both graphs below.

Vortexa

Ballast voyages to the Middle East and the US are increasing. Adding to the Panama Canal drought, the length of the voyages increased considerably. From Gulf Mexico to Japan via Panama is 30 days, via Suez is 45 days, and via Cape of Good Hope is 55 days. The first two choke points are already constrained, pushing LPG companies to increase the duration of their voyages by at least 50%. Eventually, ton per mile demand will keep rising.

Crude and product tanker order books reside in the single-digit percentage. VLGC market, however, is not in such a precarious situation. The chart below shows the quarterly delivery schedule for 2022, 2023, and 2024.

Freightwaves

In contrast, the VLGC book is 22%. 45 VLGC were delivered in 2023, and 144 vessels are to be delivered in 2024. A constrained supply side is a long-term driver for the deficit. I prefer to focus on shipping segments with order books below 10%, such as tankers (crude and product), bulkers, and offshore supply vessels.

3Q23 overview

The table below presents LPG revenues realized in 3Q23 and 3Q22. The image is from the company`s last quarter filling.

LPG 3Q23 filling

LPG realized $144.7 million in revenue in 3Q23, 90.5% higher YoY. The prime reasons were higher TCE rates and improved vessel utilization. The latter grew from 90.7% to 96.5%, resulting in more available days. The average TCE increased from $40,632 3Q22 to $65,128 in 3Q23. The Baltic LPG index doubled YoY from $66.7 in 3Q22 to $121 in 3Q23. Another revenue booster was lower VLSFO costs per ton. The price fell from $840/ton in 3Q22 to $628/ton in 3Q23.

Conversely, operating expenses were $10,158 per vessel or 19.5% higher YoY. This resulted in $21.0 million OPEX in 3Q23 compared to $17.6 million in 3Q22. March 2023 LPG received VLGC Captain Marcos, adding more calendar days and increasing the company`s OPEX. In 3Q22, the OPEX per vessel was $9,541. The difference is due to increased spare parts and maintenance costs.

LPG has four chartered vessels. Charter hire expenses grew from $5.4 million in 3Q22 to $12.1 million in 3Q23. The increased number of chartered days (from 184 in 3Q22 to 416 in 3Q23) mainly contributed to the rising hire expense.

LPG 3Q23 fillings

Higher TCE and improved fleet utilization positively impacted the company`s bottom line. 3Q23 EBITDA reached $104 million, compared to $46 million in 3Q22. 6M23 EBITDA grew at the same rate from $93 million in 3Q22 to $179 million in 3Q23. The most impactful variable was the steep increase (62.5% YoY) in TCE rates, while operating expenses increased at a lower rate (12% YoY).

Balance Sheet

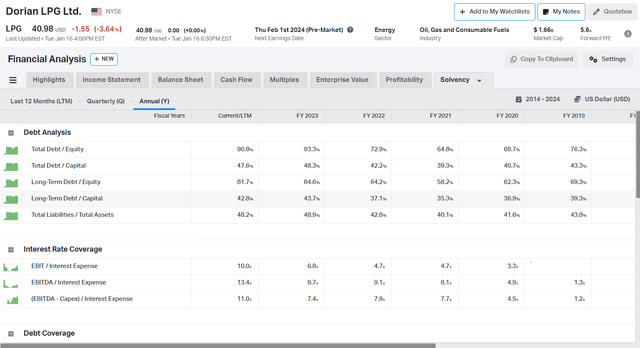

LPG has a healthy balance sheet with $192 million cash, $578 long-term debt, and $838 million total debt. The table below shows LPG capital structure and interest coverage.

Koyfin

The shipping market is defined by volatility, reflected in the company’s balance sheets. LPG management has done a great job keeping the company`s leverage low regardless of the shipping cycle. Total liabilities to total assets have been below 50% for the last five years. Total debt to equity is below 100%, too.

LPG maintains strong liquidity given its cash, net interest expenses, and cash flows. The company delivered $277 million operating income LTM and $304 million operating cash flow, while net interest expenses were $21 million. Those figures are better than those of its prime competitors, Navigator Holdings (NVGS) and Avance Gas Holdings (OTCPK:AVACF). NVGS and AVACF have higher net interest expenses as a percentage of their operating cash flow and operating income.

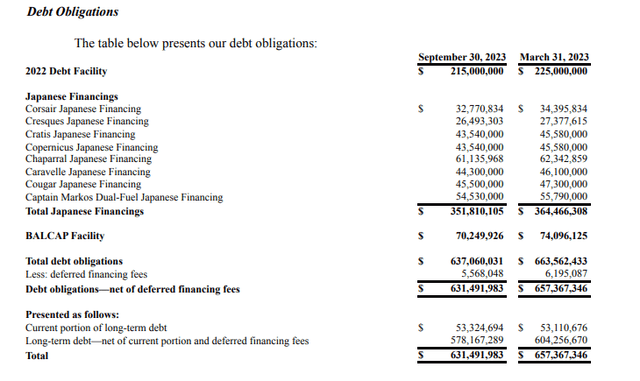

LPG 3Q23 filling

LPG uses multiple sources for financing. In July 2022, LPG took $260 million in debt financing from Credit Agricole, ING Bank, SEB Bank, and BNP Paribas. BALCAP facility is $83.4 million with Banc of America. All bank financing is with an interest rate based on SOFR plus premium. The latter falls in the range of 6.0%-6.79%.

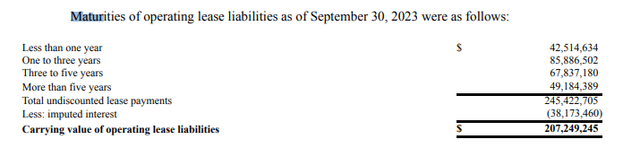

LPG has $207 million in lease obligations. The table below shows their maturity.

LPG 3Q23 filling

LPG has to cover $85 million in lease obligations in the next three years. As discussed above, the company has an ample liquid position. I do not expect any complications in debt servicing.

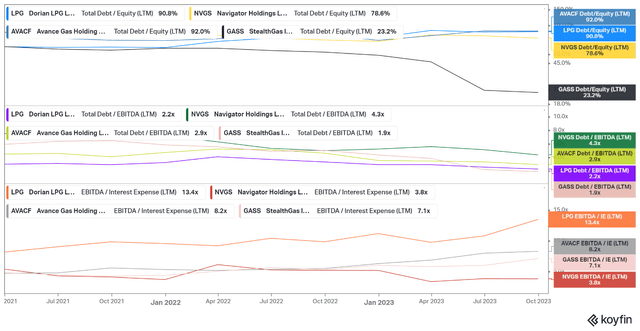

The chart below compares LPG, NVGS, AVACF, and GASS based on total debt to equity, total debt to EBITDA, and EBITDA to interest expenses.

Koyfin

All four companies have excellent balance sheets. GASS has the best capital structure, with 23% debt to equity and 1.9 total debt to EBITDA. LPG excels on liquidity metrics, as mentioned earlier. The company scores the highest EBITDA/Interest expenses.

Profitability and dividends

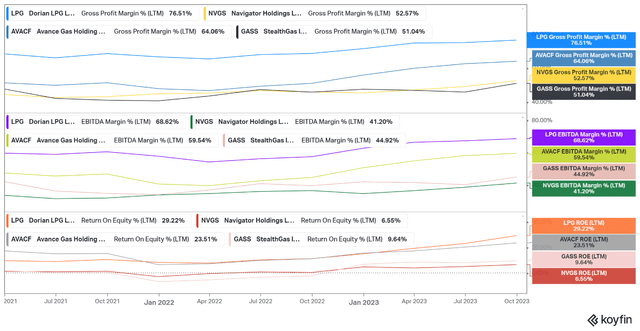

LPG delivers the best margins and returns in its peer group. The table below compares LPG, NVGS, StealthGas (GASS), and AVACF on gross margin, EBITDA margin, and ROE.

Koyfin

LPG scores significantly higher: 76% profit margin, 68% EBITDA margin, and 29% ROE. LPG operates the second largest fleet in the group, with 25 vessels and 27 managed as part of the Helios pool. NVGS owns 56 ships, while AVACF has 14 VLGCs and 4 MGCs.

LPG operates primarily VLGCs with scrubbers. NVGS has 25 vessels on dual fuel, but none with scrubbers. GASS is focused on smaller and medium-sized gas carriers. Larger ships equipped with scrubbers are generally more profitable due to the economy of scale and higher TCE for scrubber-equipped vessels than ECO and dual-fuel ships.

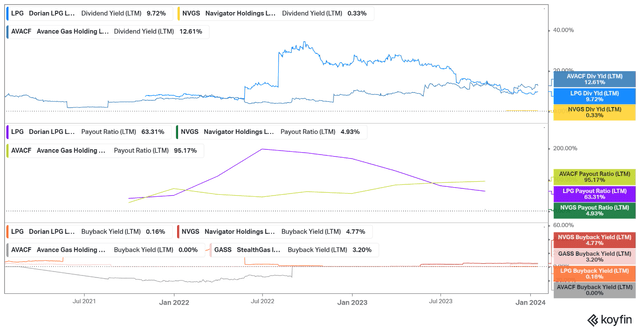

LPG pays dividends with an attractive yield of 9.76%, although it is not the best in the group.

Koyfin

AVAC distributes dividends with a 12.6% yield but at a 95% payout ratio. The latter is too high for my taste. LPG`s payout ratio is 63.3%. GASS does not pay dividends, though it repurchases its shares, delivering a 3.2% buyback yield.

In 3Q23, PLG announced a $1.00 dividend per share. A total of $40.1 million will be returned to the company`s shareholders via dividends. On February 2, 2022, LPG announced its $100 million share repurchase program. In 3Q23, LPG repurchased 50,0000 shares for $0.7 million.

Valuation and price action

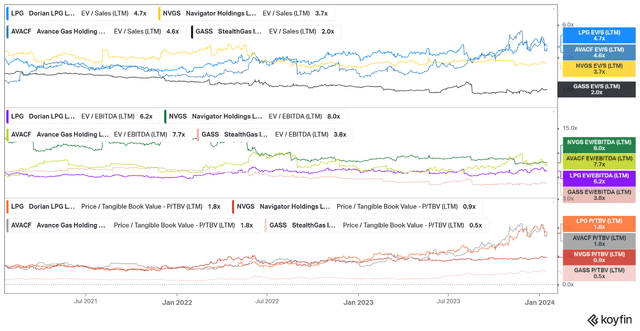

LPG is expensive at the current price levels. The chart below compares LPG, AVACF, GASS, and NVGS multiples.

Koyfin

LPG trades at 4.7 EV/Sales, 6.2 EV/EBITDA, and 1.8 P/TBV. The market reflects the company’s qualities. GASS trades at the lowest multiples in the group.

LPG P/NAV is 100% using Fernley`s data to estimate the company`s fleet value and NAV. The quoted prices are for five- and ten-year-old vessels. Given LPG`s average fleet age of eight years, I use 5% annual depreciation to estimate the price discounting the price of a five-year-old ship.

An important note: the prices are quoted for VLCCs. VLGC and VLCC prices deviate, although in narrow margins. Knowing roughly the value is good enough for me. Seeking precision in places dominated by uncertainty, such as stock markets, is a futile exercise.

The inputs for the NAV equation are as follows:

- VLCC (VLGC) 8Y old $90.7 million

- Current Assets: $277 million

- Total Liabilities: $860 million

- LPG share price: $40.98

LPG NAV = $1,667 million

P/NAV = 100%

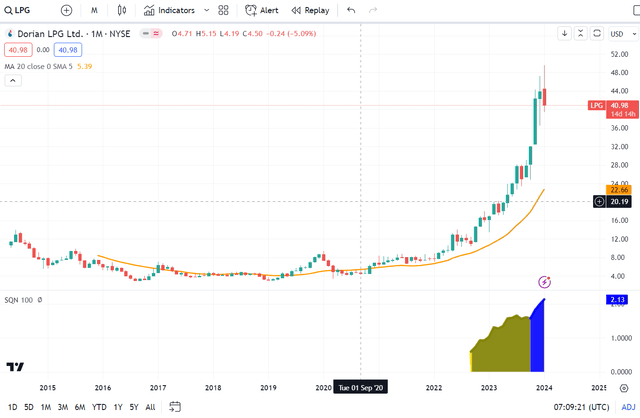

The market dearly values LPG. The price action confirms that.

Trading View

The price is far from the 20-month moving average (MMA). The SQN has been in a bull, volatile regime for the last three months. I am not keen on entering a long position at such extended price moves. The same is valid for shorts, though. The macro tailwinds are supportive for LPG carriers. However, the higher prices skew the risk-reward against me. I prefer to buy stocks at P/NAV below 100% when the price is on the verge of a breakout. Of course, I make exceptions, but not today. I like LPG, but I find more value in other shipping segments.

Final thoughts

LPG is an excellent company. Over the last two years, it has delivered exceptional returns for its investors. I confess I missed the party. I think the trends have the potential to move further north. However, the risk-reward is not in my favor. I find more opportunities in tankers (crude and product), bulkers, and containers. In those segments, I still find companies trading below their NAV. Tanking for LPG carriers, GASS offers a lot more than LPG. The former has smaller vessels directly exposed to Panama Canal issues, generates solid cash flows, and trades at bottom valuation multiples.

Financially, the company is sound, with cash flow to cover its debt obligations. Profit margins and returns are strong due to scrubber-equipped vessels and economy of scale. However, those qualities are priced in. LPG trades at 100% P/NAV and the highest EV/Sales and P/TBV in the sample group. I give LPG a hold rating.