BrasilNut1

Following our Bullish long-term story on Ryanair Holdings released in early January, today we analyze easyJet (OTCQX:EJTTF, OTCQX:ESYJY). Since our last update, the company’s stock price is up by almost 35%, and moving into 2024, it is an excellent moment to review our long-term thesis and update easyJet’s yearly financial forecast. As a reminder, our supportive buy target was backed by 1) consumers’ resiliency on travel expenses, 2) a return on dividend payments supported by a solid balance sheet, and 3) investment in new aircraft with a double benefit to reduce fuel consumption & increase passengers volume to gain margin expansion.

Mare Evidence Lab’s past analysis

Why are we still positive?

Despite a stock price change of +35%, we believe there is still room for the stock price to grow. This is based on the following forward-thinking estimates:

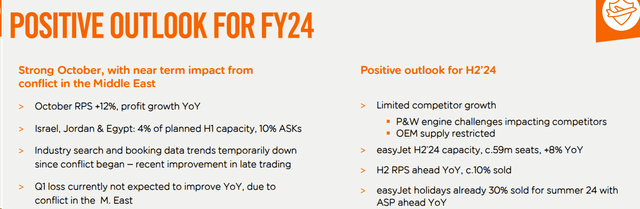

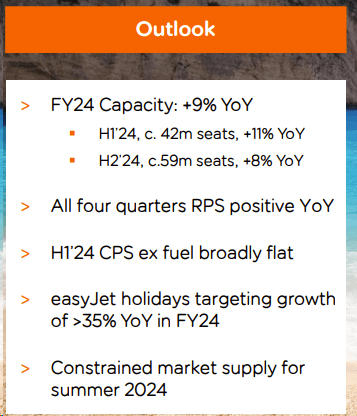

- (Wins from capacity constraints). We believe easyJet will benefit from aircraft capacity constraints in Europe. In our calculation, we are increasing the company’s 2024 load factor by 1 basis point, but in Q1, our team forecasted a Q1 load factor reduction to 87% from 87.5%. This is due to the limited impact of the Middle East conflict. In number, Israel, Jordan, and Egypt represent 4% of the planned H1 capacity. That said, the summer season has not been affected, and the company already reported that 30% of capacity is sold (Fig 2);

- (Positive holiday intake). Supported by a positive view on Winter Is Coming, we estimate higher holiday contributions. Higher passenger numbers will support this expected growth. easyJet targets a plus 35% (Fig 1), while we were at +30%. This will contribute to increase margins and provide cash flow generation. According to our estimates, the Holidays season is likely to represent almost 33% of the total profit in 2024;

- (Fuel savings). Here at the Lab, we are also lowering ex-fuel cost unit costs. We refresh our fuel calculation with the latest oil spot rates, leading to a 1% and 2% saving in easyJet P&L for 2024 and 2025, respectively. Since we last updated, our September 2024 fuel costs have been forecasted at £2.23 billion. As a reminder, the company targets unit costs ex-fuel as ‘broadly flat‘ in H1 2024, but we were anticipating higher ex-fuel costs on a yearly basis. In our previous guidance, we expected higher unit costs in H2 2024. That said, thanks to lower oil prices, this is now offset, and we expect flattish costs;

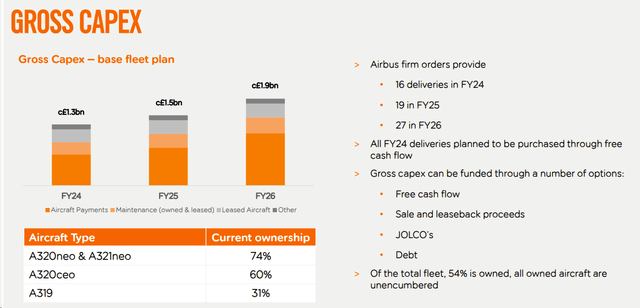

- (Supportive capital structure and better allocation). In our estimates, we take a positive view on the reinstated dividend. In our numbers, there is space for dividend growth. With a 4.5p payment this year and a 1% dividend yield, we forecast 11.5p in 2024 and 17p in 2025. Therefore, we see the potential for a DPS increase in the coming years. Despite fleet CAPEX, this is supported by a solid balance sheet with a net debt/EBITDA, which remains at 0.2x. Based on the company’s investment plan (Fig 3), we project CAPEX due to new deliveries of £1.3 billion and £1.5 billion in 2024 and 2025, respectively.

With the above consideration, we updated our Q1 and FY model. Our 2024 EBITDAR increased from £1.24 billion to £1.36 billion, moving our 2024(E) EPS from 56p to 60p. Regarding the Q1, we now see a profit before tax at -£140 million compared to last year at -€133 million. Our September 2024 increase is backed by lower fuel costs and higher passenger volumes (now more aligned with the company’s target).

Wins from capacity constraints

Source: easyJet Fiscal Year 2023 Presentation – Fig 1

Fig 2

Fig 3

Conclusion and Valuation

Benefits from EU capacity constraints, a 30% volume sold in the next holiday season, and stable costs supported by lower fuel costs make easyJet a buy. Our P/E (unchanged) is set at 10x, and we increased our target price from 560p to 600p. In addition, easyJet’s leverage and earnings have improved after the pandemic, but we do not apply a higher multiple. The shares trade below their historical average, which we think is unjustified. Downside industry risks include lower consumer demand and FX links to fuel costs; in particular, a higher $ may hurt profitability, wage inflation, and higher for longer interest rates and CAPEX delays. On easyJet-specific risk, we see market share loss in primary airports, lower cost control, weaker yield than anticipated, a miss in earnings, and weakness in passenger growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.