grandriver

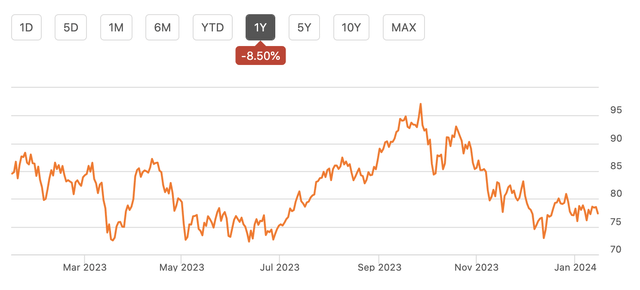

Shares of Permian Resources (NYSE:PR) have been a strong performer over the past year, rising 40% as it has quickly built up scale, helping it to reduce costs and generate solid free cash flow. While it has core acreage in the attractive Permian Basin, shares now appear fully valued within the current energy price environment, and there are better go-forward investment opportunities.

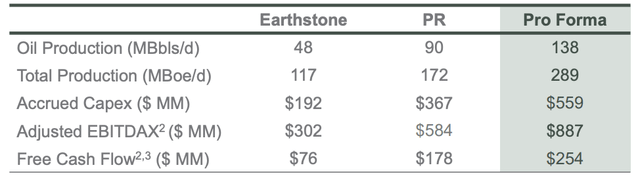

In the company’s third quarter, Permian Resources earned $0.13 on a GAAP basis, which was $0.25 below consensus due to M&A costs. On November 1, it completed its all-stock $4.5 billion purchase of Earthstone Energy, bringing production to a pro forma 289mboe/d in Q3 whereas PR’s stand-alone production was 172mboe/d. This production was up 87% from 2022 due to M&A activity.

Annual growth is flattered by the closing of the merger between Centennial and Colgate in September 2022, creating the renamed Permian Resources. With its acquisition of Earthstone, PR now has a 15-year reserve life and scaled activity in the Delaware Basin in the Permian. With this achieved, I expect its M&A activity to slow considerably as it instead focuses on developing its asset base and generating free cash flow. With its $15 billion enterprise value, PR is now a major player in the Permian Basin.

We have seen a wave of energy consolidation with Exxon Mobil (XOM), Chevron (CVX), and Occidental (OXY) all making purchases. While PR’s Delaware activity could be attractive to suitors, I do not see it as a likely target.

On December 19th, major shareholders NGP, Riverstone, and EnCap sold 39.4 million shares; as of 9/29/23, Riverstone had a 55 million share position for perspective. As part of this transaction, PR repurchased 2.24 million shares. This followed a $334 million share sale in early November. These major energy investors would likely have pushed for a sale at a premium if there were conversations, active or informal, with larger firms. Their decision to sell shares publicly speaks to their view on the likelihood of near-term M&A. Additionally with three of the largest energy producers having done deals, the window for M&A may have narrowed until these companies complete and fully integrate their acquisitions.

With M&A not the central case, Permian’s own financial performance is likely to be the primary driver of shares. On a stand-alone basis, Q3 production was 172mboe/d with 52% of production oil. Because oil is more lucrative on a barrel equivalent basis than natural gas, oil accounted for 87% of revenue. I view PR’s oil centricity positively, which is discussed further below on my commodity price outlook.

Adjusted EBITDAX was $584 million while cap-ex spending was $380 million, which resulted in $165 million in free cash flow. Excluding working capital, this was $111 million, down from $273 million last year, due to lower commodity prices. Management targets paying a base dividend and then 50% of free cash flow after its base dividend goes to variable dividends and shares repurchases. As such, in Q3, it paid a $0.07 special dividend and did $28 million in repurchases, returning $96 million to shareholders.

Importantly, as PR has built scale, it has brought down costs and improved efficiencies. Production rose by 6% sequentially while operating costs fell by 2% to $7.92/boe. Its cap-ex spending amounts to about $23.4/boe, and there was a sequential 14% improvement in drilled feet per day while cycle times were 17% better. PR is getting better at getting more oil out of the ground more quickly, helping to drive breakeven down towards $50/boe.

Thanks to stronger efficiencies, management achieved its goal of increasing oil production by 10% from Q4 2022 levels a quarter ahead of schedule in Q3. In February, it will lay out its 2024 capital plans. Management is targeting “free cash flow maximization” with over 90% of capital spending allocated to the Delaware Basin. In a weaker commodity market, management has suggested it will aim for minimal production growth while it could seek up to 10% growth in high-priced markets.

Given where commodity prices are, I would expect the company to target mid-single-digit production growth in 2024, enabling it to reduce the cap-ex intensity of its business.

Now, given the incremental acreage from the Earthstone acquisition, cap-ex spending will of course rise in dollar terms. As you can see below, the entity generated $254 million (or ~$201 million excluding PR working capital movement) in Q4. Management anticipates $175 million of synergies from this purchase.

Due to this acquisition, PR will be increasing its base dividend by 20% to $0.06, which still leaves shares with a sub-2% yield. As this was an all-stock purchase, PR’s balance sheet will be strong with $3.8 billion in debt and roughly 1x debt/EBITDA pro forma. That is at the upper end of its 0.5-1x target, but strong on an absolute basis. This leaves PR well positioned to continue its 50% of free cash flow after its base dividend commitment as there is no urgent need for debt reduction.

At $4.5 billion, Earthstone accounts for about 1/3 of PR’s enterprise value even as it generates about 40% of its production. This discount is driven by the fact that its production is much more gas-centric, at 41% oil vs 52% for PR. Accordingly, the consolidated entity is just below 50% oil, though I expect that share to rise with cap-ex being focused on oil-rich Delaware acreage. This is one modest drawback of the deal.

In the third quarter, oil realizations were $79.92 while natural gas was $1.93. Oil prices have traded lower over the past year but are down just 9%. They are also supported by a truly global market, a cartel (OPEC+), which seeks to keep prices elevated, and the potential for supply disruptions in Middle East tensions get worse. Plus, the US government is now also a source of demand, refilling the Strategic Petroleum Reserve.

With a soft economic landing appearing more likely, constrained cap-ex spending, and modest demand growth, this leaves me feeling comfortable with oil prices. Commodity prices are inherently uncertain, but I expect oil prices to be in the $70-85 range, well above PR’s cost base.

On the other hand, natural gas has lost over 60% of its value over the past 18 months, even aided recently by extremely cold weather in the US. With Russian gas exports to Europe stopping, there was hope for a more sustained increase in natural gas prices. However, that proved short-lived with Europe able to secure enough supplies. Additionally, given limited LNG export capacity, regional differentials in natural gas remain persistently wide, and with US production so strong, it is very difficult for natural gas to move out of the $2.25-$3.25 range. There is also no cartel acting to limit supply and support prices.

These factors leave me preferring oil exposure to gas exposure. Additionally, I would note that PR has just over 20% of 2024 production hedged with 18% at $76 and the remainder with $60 floors as of 9/30. When Q4 results are announced, I would expect more to be hedged, which helps to reduce cash flow volatility.

At a $75 oil/$2.50 natural environment, PR can generate $600-650 million in free cash flow, assuming it targets about 5% production growth, or about $0.80/share. That leaves shares with a 6% free cash flow yield, which is relatively expensive in the energy sector, and likely a reason we have seen its major investors sell via secondary offerings. Based on its framework, PR will pay $0.24 in dividends, leaving $0.56 in free cash flow, of which $0.28 will go to dividends and buybacks, for a capital return yield of 4%. For comparison, Diamondback Energy (FANG) offers an over 8% free cash flow yield. Given 5% production growth, I would seek at least a 5% capital return yield or about $10.50/share to provide greater certainty of double-digit long-term investment returns. Given its pristine acreage, I expect shares likely to trade at some premium to this, but at a 25% premium, shares are now clearly expensive, barring an increase in oil prices toward $90.

PR has turned itself into a meaningful Permian producer, and in the process, it has generated great returns for investors. However, with M&A likely, its valuation is now stretched, and I recommend following its major investors and taking profits, given its relative valuation.