Fabrice Cabaud

Introduction

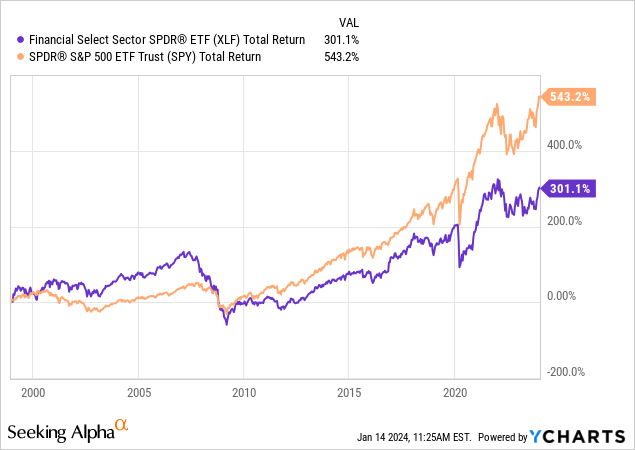

I like financial stocks. However, it’s important to be picky, as I believe that a lot of financial stocks have an unfavorable long-term risk/reward.

The Financial Select Sector ETF (XLF), which holds more than $34 billion in assets, has returned 300% since its inception in December 1998. During this period, the S&P 500 returned more than 540%.

One of the main reasons why financials tend to underperform on a long-term basis (they also have periods of outperformance) is steep sell-offs during recessions.

A quarter of the XLF ETF consists of banks. While the U.S. is home to some of the best banks in the world, they tend to do very poorly during recessions. On top of that, a lot of financial companies have no moats, as both the banking and financial services industries are competitive and prone to disruptors.

While this is by no means a call to not invest in banks, it is an explanation of why I focus on highly differentiated financial companies, including operators of stock exchanges.

My largest financial position is in CME Group (CME), which owns various exchanges, including COMEX, NYMEX, and others.

Another stock I like but do not own is Intercontinental Exchange (NYSE:ICE), the star of this article and one of the best financial compounders on the market.

- Since it went public in 2005, the ICE ticker has returned 17% per year, including dividends!

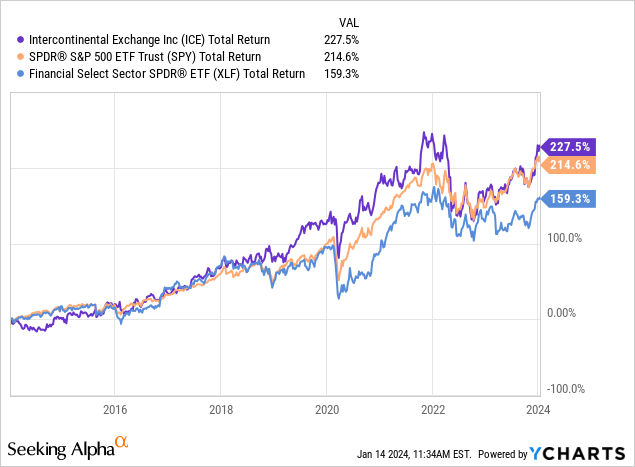

- Over the past ten years, ICE has returned 228%, beating the market by roughly 13 points.

My most recent article on the company was published on July 15, when I called the stock One Of The Best Compounders In Finance.”

In this article, it’s time to update my call, as the stock has risen 35% off its 52-week lows. It also closed the Black Knight acquisition and continues to report fantastic numbers and new partnerships.

I believe the stock is a great long-term buy, especially if the market offers us a correction opportunity soon.

So, let’s dive into the details!

A Financial Services Compounder

Intercontinental Exchange is a giant with a $73 billion market cap.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Exchanges |

5,878 | 64.1 % | 6,415 | 66.6 % |

|

Fixed Income and Data Services |

1,883 | 20.5 % | 2,092 | 21.7 % |

|

Mortgage Technology |

1,407 | 15.3 % | 1,129 |

11.7 % |

Going into 2023, the company operated three main segments, with its Exchanges segment generating two-thirds of its total revenue.

The Black Knight acquisition is not reflected in the numbers above.

Here’s what I wrote in my prior article.

- Exchanges Segment ICE operates regulated marketplaces for trading and clearing various derivatives contracts and financial securities. Its trading venues include 13 regulated exchanges and six clearing houses strategically located in major market centers worldwide. These include the New York Stock Exchange.

- Fixed Income and Data Services Segment ICE’s Fixed Income and Data Services segment offers fixed income pricing, reference data, indices, analytics, execution services, global credit default swaps (“CDS”) clearing, and multi-asset class data delivery solutions.

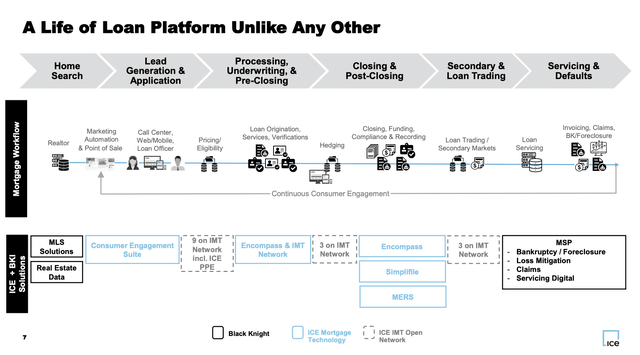

- Mortgage Technology Segment ICE’s Mortgage Technology segment aims to address inefficiencies in the US residential mortgage market. It provides a technology platform that offers advanced digital workflow tools from application through closing and the secondary market.

During the December Goldman Sachs Financial Services Conference, the company made clear that one pivotal aspect of its growth strategy lies in its evolution from an energy platform (it owns ICE Brent oil products) to a diversified entity with three distinct business segments.

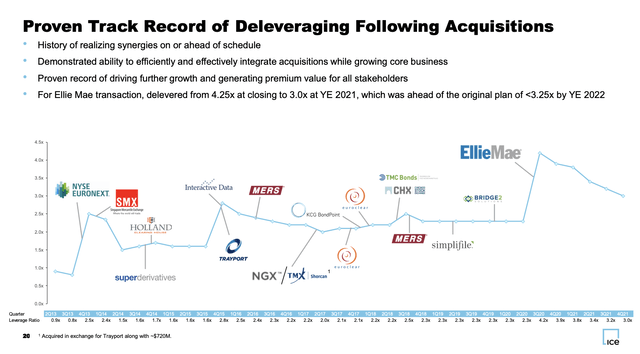

A significant contributor to ICE’s growth story is buying new capabilities.

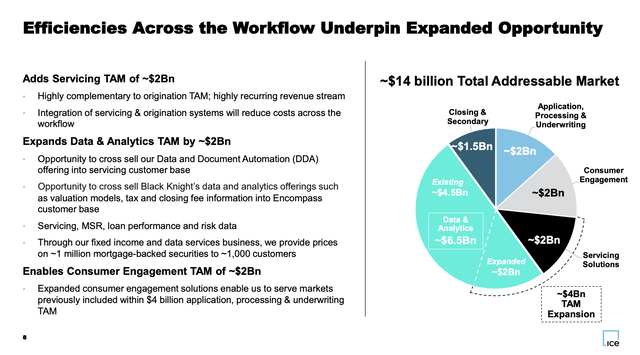

For example, ICE successfully closed the Black Knight acquisition in September, a move that further expanded its footprint in the mortgage space.

The acquisition aligns with ICE’s broader strategy to diversify its business segments, with a particular focus on mortgage-related solutions.

This strategic pivot positions ICE to capitalize on the opportunities coming from a very complex and large mortgage market, including the growing significance of data-driven insights and artificial intelligence.

Furthermore, a key driver behind the Black Knight acquisition is its significant presence in the artificial intelligence (“AI”) and data analytics space.

In light of the AI-driven data revolution, Black Knight’s capabilities enhance ICE’s ability to leverage data for informed decision-making.

Essentially, the integration of Black Knight’s AI models into ICE’s operations provides a foundation for innovative solutions, particularly in the mortgage sector, where data-driven insights are increasingly crucial.

The integration of Black Knight not only strengthens ICE’s existing capabilities but also opens doors for modernizing mortgage trading in capital markets.

With that said, even without acquired growth, the company has the capability to expand its existing services.

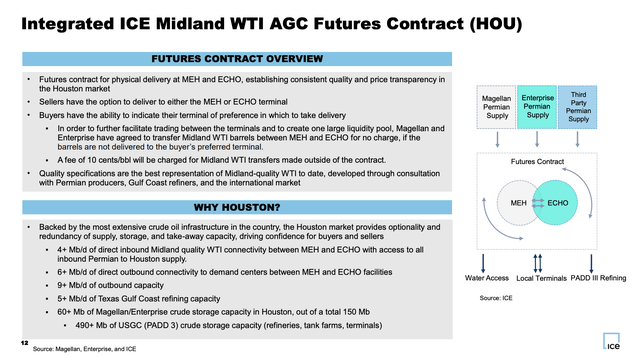

For example, ICE has witnessed significant growth opportunities within its energy trading business, particularly in the oil sector.

The expansion is not solely tied to the well-known Brent crude but has diversified to include other grades, such as Murban crude from the Middle East and HOU representing WTI on ships leaving the Gulf.

With these changes, the company is on top of energy developments, including the importance of U.S. shale. It also launched Northwest Europe Liquid Natural Gas futures when the energy crisis in Europe started to heat up.

To be honest, this is the stuff that lets my heart beat faster, as I really like the importance of these new financial products in the current market environment.

Furthermore, within the fixed-income market, the company has strategically positioned itself to tap into growth opportunities.

According to the company, its entry into fixed-income trading, particularly in niche areas like municipal bonds, has proven successful, as the move has allowed it to cater to a specific market segment that was not the primary focus of some competitors.

Even better, the company is implementing a shift towards subscription-based revenue models, as it is recognizing the long-term benefits of locking in customers on extended contracts.

This transition is not only a response to market dynamics but also reflects an effort to make the business more resilient and valuable for shareholders.

After all, recurring revenues make future revenues more predictable and less volatile.

Impressive Shareholder Value

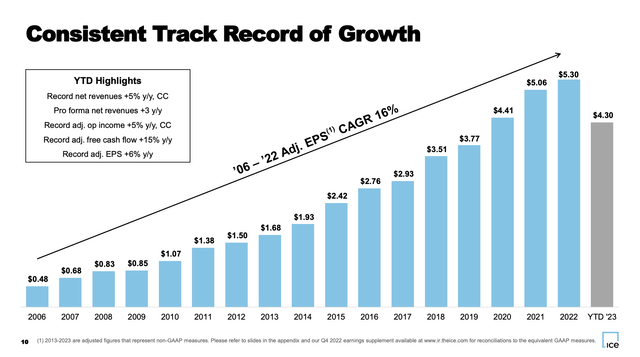

Thanks to its impressive business model consisting of both recurring revenues and volume-dependent operations, like its exchanges, the company has grown its adjusted EPS by 16% per year in the 2006-2022 period.

This year, growth continued as adjusted earnings per share reached a record high of $1.46 thanks to an impressive 11% increase year-over-year.

Net revenues also hit a new high at $2 billion, showing a 4% increase on a pro forma basis. Growth was primarily propelled by a substantial 22% increase in the Futures platform within the Exchange segment.

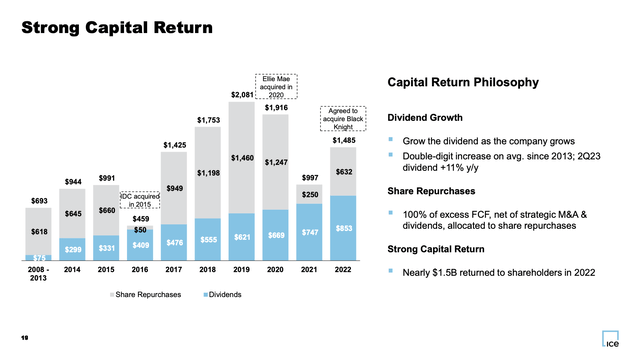

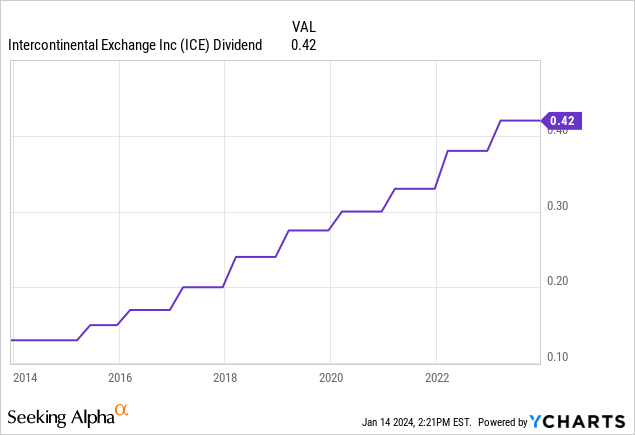

Thanks to strong historical growth, ICE has a fantastic history of dividend growth and buybacks.

The company currently pays $0.42 per share per quarter. This translates to a 1.3% yield. On February 2, 2023, the company hiked its dividend by 10.5%.

The five-year dividend CAGR is 11.8%.

The dividend is protected by a load of free cash flow.

In 2024, the company is expected to generate $3.7 billion in free cash flow. This translates to 5.1% of the company’s $73 billion market cap and a 25% payout ratio.

This year, the company is expected to lower net debt to $10.2 billion. This would translate to 3.3x EBITDA. In 2025, that number could be 2.7x EBITDA.

In other words, if everything goes according to plan, the company is, once again, rapidly de-leveraging after a major M&A deal.

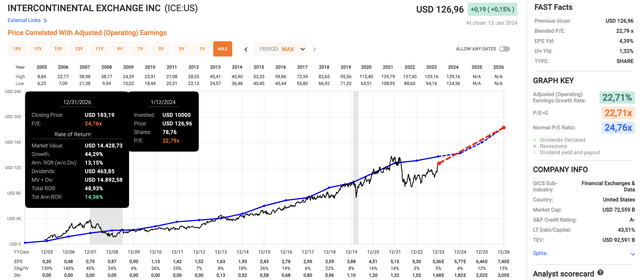

Furthermore, after its recent rally, the stock is still attractively valued.

Using the data in the chart below:

- ICE trades at a blended P/E ratio of 22.8x.

- Its normalized valuation (going back to its IPO) is 24.8x, which I believe still fits its growth profile.

- After 5% expected EPS growth in 2023, 2024 is expected to see 5% growth.

- In 2025, growth is expected to accelerate to 12%, followed by a potential increase to 15%.

- While these numbers are obviously subject to adjustments, I agree with analysts that prolonged double-digit EPS growth is likely.

Although I already own CME Group, I want to own ICE as well. I believe it is a fantastic financial compounder that would suit my portfolio of supply chain critical stocks very well.

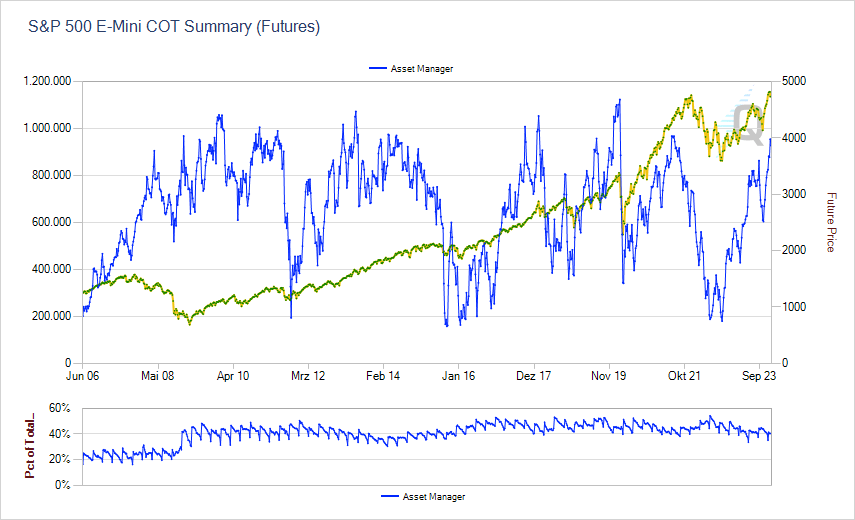

However, my view is that the market is a bit overbought (asset managers haven’t been this long S&P 500 futures in years!), which is why I am not buying ICE just yet.

I hope to buy it if the market offers a correction opportunity in the months ahead. That’s why I hold an above-average cash position.

CME Group (Asset Manager Net Positions)

Regardless of my personal view, I will stick to a Buy rating due to the company’s long-term potential.

Takeaway

In the ever-evolving financial landscape, my focus on distinct financial companies leads me to Intercontinental Exchange.

As a giant with a $73 billion market cap, ICE’s diversified segments, including Exchanges, Fixed Income, and Mortgage Technology, position it for sustained growth.

The recent Black Knight acquisition aligns with its strategic pivot, leveraging AI and data analytics in the mortgage sector.

Meanwhile, ICE’s impressive financials, marked by a 16% yearly growth in adjusted EPS since 2006, demonstrate its shareholder value commitment.

With a robust dividend history and attractive valuations, ICE stands as a compelling long-term buy.