After plunging in 2022, Bitcoin (BTC -0.70%) got its mojo back, more than doubling in 2023. The end of the crypto winter came in large part because of anticipation that the Securities and Exchange Commission (SEC) might finally grant approval to exchange-traded funds (ETFs) seeking to own Bitcoin directly.

Indeed, that optimistic scenario came to pass earlier this month. The SEC approved 11 different spot Bitcoin ETFs on Jan. 10, opening the door to a flood of new interest from investors who were wary about investing directly in the cryptocurrency themselves.

That was particularly important for the Grayscale Bitcoin Trust ETF (GBTC -0.67%). The Grayscale Bitcoin investment vehicle had been in place for years as an unregistered fund for accredited and institutional investors through private placements.

With the SEC’s move, Grayscale Bitcoin Trust became a true ETF. And as it happens, what is now the world’s largest Bitcoin ETF has scored an even bigger win simply by virtue of its having retained its leadership status amid a flood of new rivals. Here’s why.

The advantages and disadvantages of Grayscale Bitcoin Trust

Prior to becoming an ETF, Grayscale Bitcoin Trust had operated for more than a decade. Its shares were listed on the over-the-counter market, and it had offered shares directly to those investors who were eligible to make purchases without Grayscale having to register its shares as securities with the SEC. After a holding period, initial purchasers could turn around and sell their shares over the counter to whoever wanted to buy them.

There were a couple of problems with Grayscale Bitcoin Trust, however. First, it carried a high expense ratio of 2% per year. Even worse, Grayscale didn’t offer any redemption rights, so unlike with an ETF, even large institutional shareholders had no ability to exchange shares for the Bitcoin that the trust held.

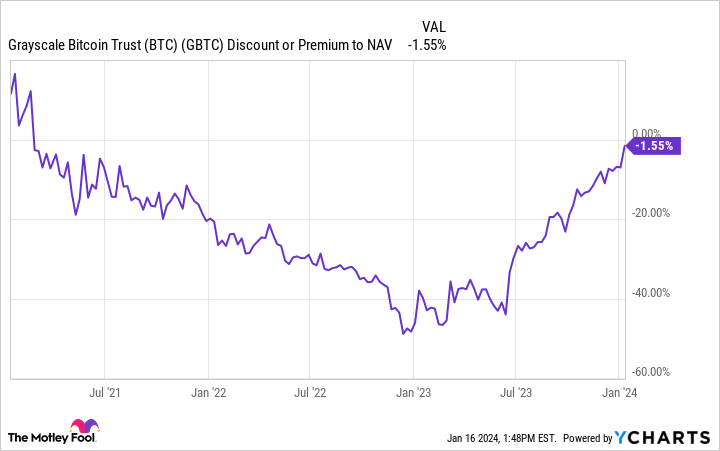

As a consequence, shares of Grayscale Bitcoin Trust plunged far below the value of the underlying Bitcoin that the fund owned. Lacking a redemption mechanism, there was no way for arbitrage-minded investors to capitalize on the disparity in the short run.

GBTC discount or premium to NAV data by YCharts. NAV = net asset value.

Indeed, when Grayscale Bitcoin Trust’s discounts to net asset value were at their highest, many investors believed that the crypto investment vehicle could suffer significant outflows if the SEC approved its ETF conversion.

Moreover, with alternatives offering Bitcoin exposure at much lower expense ratios — despite a post-conversion cut from 2% to 1.5% — it seemed that Grayscale might lose its crypto dominance. Instead, the discount disappeared, giving extra returns to those who invested in the Grayscale vehicle when discounts were at their highest.

Grayscale is holding its own

As a result, at least in its early days, no exodus from Grayscale Bitcoin Trust ETF has happened. The ETF reported 690 million shares outstanding as of Jan. 12, with a total value of $26.9 billion and each share representing roughly 0.000894 underlying Bitcoin. That’s consistent with where asset levels were prior to the SEC approval.

Deeper analysis suggests relatively small movements of actual Bitcoin from the Grayscale ETF. One report from Arkham Intelligence noted a movement of nearly 900 Bitcoin on Jan. 12, worth roughly $41 million. Even if that represented redemptions, though, it was inconsequential compared to the size of the fund.

Will Grayscale lose its leadership?

For cost-conscious investors, Grayscale has a disadvantage. Every single one of its 10 competitors offers a lower expense ratio. Early favorite iShares Bitcoin Trust (IBIT -1.00%) charges just 0.25% per year in fees.

That could eventually spur investors to move their assets away from Grayscale. Yet for those who have invested in Bitcoin long enough to have sizable gains, the capital-gains tax liability that would come from switching from Grayscale to a rival Bitcoin ETF would be a deterrent.

At least in the opening days, Grayscale has done well to hold on to its assets. But investors shouldn’t be surprised if that story changes in the months to come — particularly as other Bitcoin ETFs show their ability to track the value of the cryptocurrency.

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.