ThamKC/iStock via Getty Images

I am bullish on Granite Construction Incorporated (NYSE:GVA) because its strategic plan is delivering higher margins and because of significant tailwinds from lower interest rates and the Infrastructure Act.

About Granite

The company operates through two segments, according to its 10-K for 2022:

- Construction: “focuses on construction and rehabilitation of roads, pavement preservation, bridges, rail lines, airports, marine ports, dams, reservoirs, aqueducts, infrastructure, and site development for use by the general public and water-related construction for municipal agencies, commercial water suppliers, industrial facilities and energy companies. It also provides construction of various complex projects including infrastructure/site development, mining, public safety, tunnel, solar, battery storage, and other power-related projects.”

- Materials: “focuses on production of aggregates and asphalt production for internal use and for sale to third parties.”

In 2022, it brought in total revenue of $3.30 billion, with a Construction contribution of $2.80 billion and a Materials contribution of $497.32 million.

It was founded in 1922 and began trading publicly in 1990; also, in 1990, it began paying a quarterly dividend. At the close of trading on January 12, 2024, it traded at $46.99 and had a market cap of $2.06 billion.

It pays an annual dividend of $0.52, which amounts to a yield of 1.11%, which is below the S&P 500 average of 1.47%. It has a payout ratio of 18.12%

Competitors

We would expect intense competition in an industry with low barriers to entry and multiple competitors. Granite noted in its 10-K that it faces competition from larger regional, national, and international companies, as well as small local companies.

Competitive advantages: the company argues in the 10-K that it possesses multiple competitive advantages:

Local market knowledge, relationships, and project management expertise, supported by the financial strength of a publicly traded company with a strong balance sheet provide a sustainable competitive advantage. By diversifying our revenue channels across geographies and clients, and by taking measured risks within our construction capabilities, we simultaneously grow our business and mitigate risk. Supported by proven operating processes, functional support systems and financial governance processes, our growing network of regional businesses focus on local market conditions, client relationships, employee development, workforce capabilities and investment opportunities to drive growth and efficiency within their home markets.”

Conflicting fundamentals

In assessing Granite’s fortunes over the past couple of years, a few things stand out. First, its revenue plunged as COVID-19 took hold in the first half of 2020.

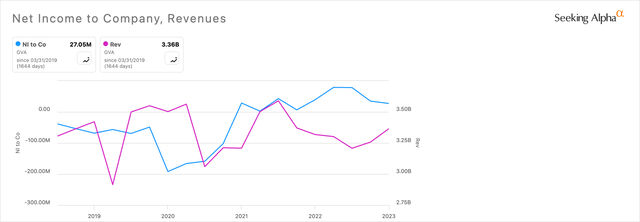

As the following five-year chart shows, revenue and net income have rarely been aligned over the past five years:

GVA-RevenueNetIncome chart (SeekingAlpha)

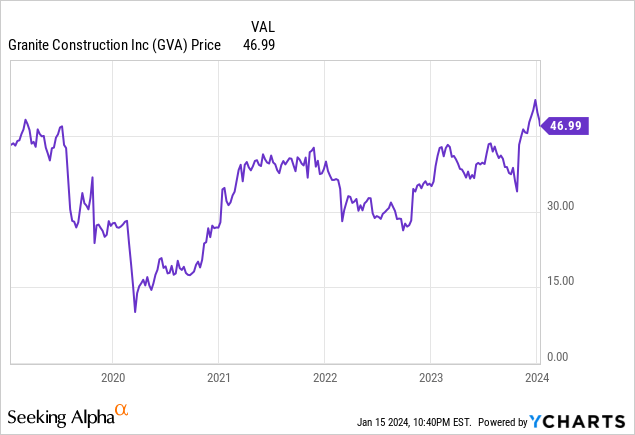

Shareholders, who already had been pushing the Granite share price down, really hammered it in the early days of the pandemic. The price dropped to a low of $10.10 on March 17, 2020, and hit a high of $52.08 on December 27, 2023, before pulling back again:

Given recent tailwinds that should support revenue, margin, and earnings, I consider Granite to be a growth stock that could reward investors over the next five years.

Growth

In what GEP Market Intelligence calls “A boon for the U.S. construction industry”, the Infrastructure Investment and Jobs Act was passed on November 15, 2021.

The additional $1.2 trillion in spending should keep the construction industry, and particularly the infrastructure component of it, busy for several years.

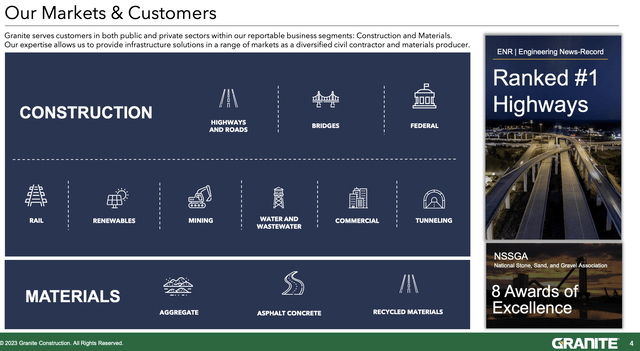

The act seems almost custom-made for Granite, as shown in this slide from its December 2023 investor presentation:

GVA Markets and Customers (Investor Presentation)

These new incentives come on top of regular construction and infrastructure projects. As a result, we should expect Granite’s revenues and margins to both increase. More demand should strengthen prices for both construction work and its materials.

The company also pointed to several other positive developments in its investor presentation:

- State transportation budgets support its growth expectations.

- Margins have normalized after lows caused by high energy prices in 2022.

- It intends, and can afford, to remain selective in its project bidding, which will strengthen margins.

It has reiterated its guidance for 2024, of revenue between $3.6 billion and adjusted EBITDA margin between 9% and 11%.

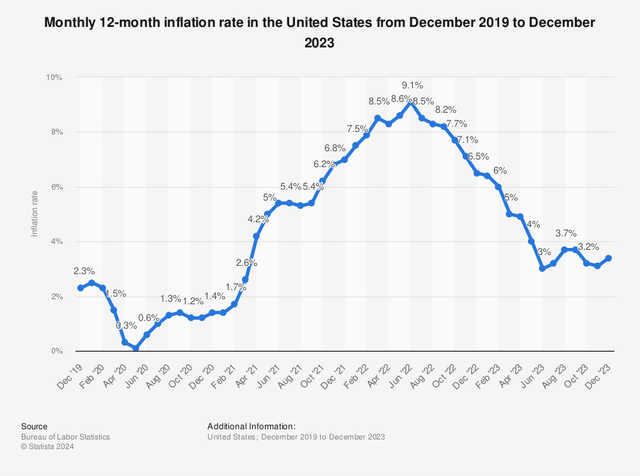

Growth also should be aided by ongoing reductions in the inflation rate. This five-year chart from Statista shows how dramatically it moved:

U.S. historical inflation rate (Statista)

For the industry as a whole, Mordor Intelligence reported that the United States Transportation Infrastructure Construction Market should see growth increase from $371.25 billion in 2024 to $471.13 billion in 2029, a compounded annual growth rate of 4.88%.

Margins

Through the first three quarters of 2023, that adjusted EBITDA margin varied between 7.5% and 9.0%. For 2022, it was 6.4%, and that was an improvement over the 6.0% of 2021.

What’s behind the improvement over the past two years? President and CEO Kyle Larkin told Rock Products magazine:

In the first quarter of 2022, we introduced our 2024 strategic plan, the roadmap for the transformation of Granite and the path we intend to follow to achieve sustainable growth and increased profit margins. During 2022, we were singularly focused on implementing our plan by, among other things, focusing on higher margin, less risky work in our home markets. I am delighted to report that this has enabled us to achieve improved adjusted EBITDA margin in 2022 and the highest quality CAP portfolio in recent history. We expect to continue improving our adjusted EBITDA margin in line with our 2024 target.”

If the company hits its margin targets for 2024, they will be at least 50% higher than in 2021, and more than 80% higher if they hit 11%.

Management and strategy

Kyle Larkin joined Granite in 1996, as an estimator. Since then, he has served in several management roles, becoming President in 2020 and CEO in 2021. He has a BS in construction management and an MBA.

Lisa Curtis joined the firm through an acquisition in 2018. She has a bachelor’s degree in accounting and finance and is a certified public accountant.

In its 10-K, Granite laid out what it called the key objectives in its strategic plan:

- Selective bidding: to focus its resources on bidding jobs that meet its criteria, including human resources, project procurement methodology, and expected profitability.

- Risk-Balanced Growth: growing by strategically adding clients within its current geographic markets and expanding into new territories organically and with acquisitions.

- Vertical integration: using its own aggregate reserves and processing plants.

- Diversification: it aims to mitigate construction risks by pursuing profits in the public and private sectors, a range of end markets, and other initiatives.

- Performance-based incentives: aligning compensation plans with key objectives in the strategic plan.

- Code of conduct and core values.

Valuation

Granite gets generally good marks for valuation:

- P/E Non-GAAP forward: 17.70, making it slightly less expensive than the Industrials sector median of 18.91. However, the GAAP forward ratio is significantly higher than the sector median: 40.28 versus 21.54.

- The PEG GAAP forward ratio is 1.18, versus 1.75 for the sector median; a ratio of 1.18 is squarely in fair-value territory.

- EV/EBITDA forward clocks in at 7.48, 35.03% lower than the sector.

- Price/Sales forward sees Granite at 0.60, almost 57% less than the sector median of 1.40.

Earnings for next year, based on the forecasts of five analysts, are expected to shoot up this year, no doubt thanks in part to higher margins. Earnings per share are expected to hit $2.66 for 2023 and $4.46 this year, a 67.67% increase. If that target shows up in the quarterly results, it should drive the current share price significantly higher.

The four Wall Street analysts who follow Granite have an average price target of $56.00, compared with the January 12 closing price of $46.99, a 19.17% increase. That seems a conservative target, given the company’s growing margins and earnings, as well as the stimulus from tailwinds.

Quants currently rate it as a Buy, the other Seeking Alpha analyst who posted in the past 90 days rated it a Hold while I will rate it a Buy. The four Wall Street analysts posted three Strong Buys and one Sell.

Risks

While Granite’s plan involves derisking by becoming less sensitive to economic conditions that influence construction activity, it’s possible a strong economic contraction could pull down its revenue.

Similarly, it has taken up selective bidding to improve its margins, but a significant slowdown could force it back into projects with slimmer margins.

It receives a significant amount of its revenue from various levels of government, and a change in its relationship with it or a severe decline in government spending could harm revenue and earnings.

Design-build projects, one of its mainstays, expose the firm to design errors and potentially heavy costs.

Many of its projects have penalties for late completion, which can lead to costs resulting from delays.

It is exposed to significant price fluctuations in some of the commodity products it uses. For example, it uses large volumes of petroleum-based products such as fuels, lubricants, and liquid asphalt.

Conclusion

I think that Granite Construction’s strategic plan formulated in 2022 is working and delivering several benefits, including higher margins. That, in turn, means higher earnings even if revenues don’t increase.

Combine this internal improvement with several economic tailwinds, such as lower interest rates and the Infrastructure Act, and I see a company with good prospects through at least the remainder of the year, and likely beyond. Therefore, I am giving it a Buy rating.