tum3123

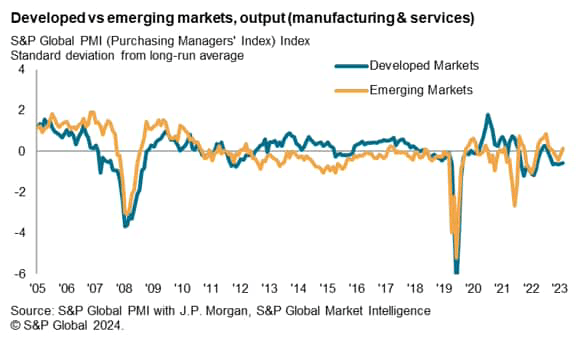

The divergence between emerging and developed markets continued into the end of 2023, with faster economic expansions among emerging economies contrasting with a sustained fall in developed world output.

Underpinning the divergence in performance into the end of the year remained a divergence in demand conditions, with the degree of price inflation likewise varying between regions to in part drive the growth trend disparity.

While the outlook for the year ahead improved across both developed and emerging markets at the end of 2023 amid expectations for lower interest rates in 2024, the picture is becoming more complicated for developed markets as escalating tensions along key supply lines threaten to drive up costs once again. Emerging markets will also be looking closely at economic conditions in mainland China, which will be a key determinant of broader emerging market growth in 2024.

Pace of emerging market expansion accelerates again in December

The expansion of emerging markets continued into the final month of 2023, according to PMI data, extending the sequence of growth that had commenced at the very start of the year. Moreover, the pace of growth accelerated for a second straight month to the fastest since June, reflecting the robustness of emerging market growth at the end of the year.

In contrast, developed markets remained in contraction for a fifth successive month in December. Although the pace of decline eased again in the latest survey period, and has been only marginal through the past five consecutive months of contraction, a comparison with long-run averages helped to underscore the difference in performance through 2023. Broadly, emerging markets have outperformed developed economies through the whole of 2023, with the divergence having further widened at the end of the year.

Incoming new business rises across emerging markets

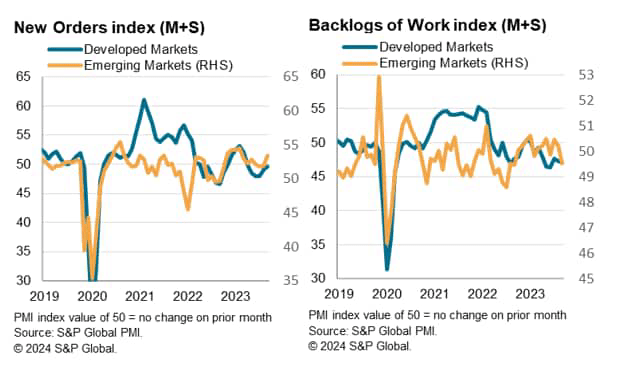

A key reason for diverging emerging and developed market performance was the marked variation in demand conditions. On one hand, emerging markets saw incoming new business expand at a quicker pace in December, reporting the fastest rise since May. On the other hand, developed economy firms’ new orders fell for a sixth straight month on aggregate. The difference in performance was also apparent for export orders, albeit with both regions registering fewer overseas new orders in December.

To some extent, the downturn in new orders has eased into the end of the year for developed markets. However, forward-looking indicators such as the PMI backlogs of work index recorded a sharper fall in December, indicating that we may continue to see developed market output remain under pressure in the near-term.

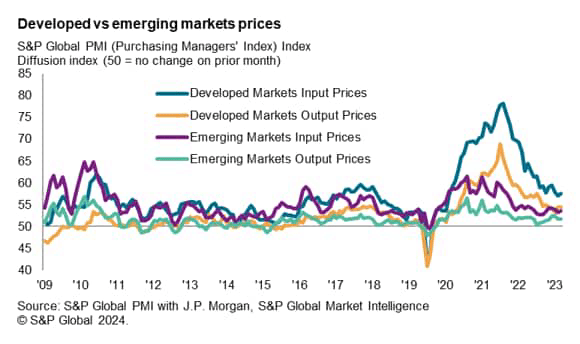

Price pressure differences

One of the key reasons for the variation in demand conditions was the difference in price pressures across developed and emerging markets. The PMI output price indices, while having eased from the heights in 2022, averaged 55.4 across developed markets and just 51.6 for emerging markets in 2023. Furthermore, while emerging markets saw price pressures moderate into the end of the year, the opposite was true for developed markets.

These price gauges point to the cost-of-living crisis still affecting developed economies to a greater extent than their emerging counterparts at the end of year.

With much of the developed world replying on the Panama Canal and the Suez Canal/Red Sea as key supply routes, recent issues surrounding these areas have started to translate to increased mentions of higher shipping costs as a source of goods inflation and will need to be monitored closely moving into the new year. This is especially with sentiment having only recently recovered for developed markets to the most optimistic since June as looser financial conditions are to be expected in 2024, based on expectations of the Fed and other central banks lowering rates.

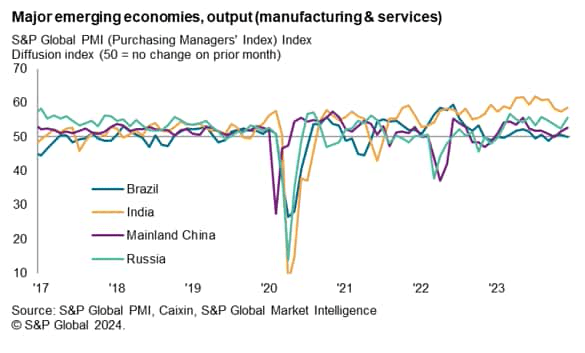

Similarly, a lower interest rates environment, coupled with falling inflation and still resilient emerging market growth, is expected to bode well for emerging market performance going into 2024. That being said, the fate of emerging markets growth is largely tied to that of mainland China’s economic performance. Ahead of the fourth GDP release, the Caixin PMI, which tracks the official data, showed encouraging signals with mainland China’s growth accelerating into the end of year. New orders have also picked up at the end of year for mainland China as with the only sentiment-based indicator, the Future Output Index.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.