For hundreds of people once associated with Zulily, their time at the Seattle-based online retailer was meaningful and formidable — which is why many are bemoaning the tech company’s recent evaporation.

“It’s incredibly sad,” said Kiran Akkineni, an early analytics leader at the company. “It was a life-changing experience for me, and for a lot of folks. And so, it will be missed.”

Zulily’s downfall is a story of a brand that lost its identity and struggled to maintain a competitive moat, years after the company attracted millions of customers with an innovative e-commerce model aimed at moms.

It’s also raised questions about Regent, the little-known Los Angeles private equity firm that acquired Zulily in May and said it planned to grow the retailer in new markets — but then put the company in liquidation last month.

Zulily was struggling and unprofitable in recent years under ownership of QVC parent Qurate Retail Group.

But the business was generating cash — more than $300 million through the first five months of 2023, according to Qurate financial reports.

The rapid deterioration under Regent’s ownership came as a shock to more than 800 employees across three states who lost their jobs and vendors around the country who said they weren’t getting paid.

Regent has acquired more than 30 companies over the past decade, including Escada, Intermix, and more recently Cheddar Media. It has not responded to multiple emails from GeekWire over the past several months.

Former employees at Regent said the firm follows a playbook: buy distressed companies for little-to-nothing and try to extract value.

“They can do deals,” said one former employee who requested anonymity. “But they’re not having any success from an operational perspective in actually turning these things into cash-flowing assets.”

But Zulily’s collapse began long before Regent got involved.

A spike, a slowdown, and a sale

In its early days, Zulily had a problem — a good problem.

“The company almost had too many customers and not enough product. It was crazy,” said Kevin Saliba, a longtime marketing exec who joined in 2012.

Zulily’s target market — moms, and their kids — proved to be a lucrative e-commerce niche. Its limited number of daily deals and flash sales turned shopping into entertainment, co-founder Mark Vadon told GeekWire last month.

Some people set alarms in the morning just so they could access new products. Sales launched at 6 a.m. and products were sold out by lunchtime.

“That feeling of getting a great deal on a really differentiated product, it created massive customer retention,” Akkineni said. “They couldn’t get enough.”

The startup found a way to allow smaller vendors to surface their products for a large audience, giving Zulily an edge as it competed with retail giants such as fellow Seattle companies Amazon and Nordstrom.

The company also used an unusual fulfillment strategy by selling merchandise on its site before ordering products from vendors. This “inventory-light” strategy enabled more control over supply chain and fulfillment.

On the technology side, Zulily designed software that would hyper-personalize each customer’s experience based on their clicks and purchases. And it had a robust content arm thanks to photoshoots at its headquarters that helped make the site feel like a cohesive catalog.

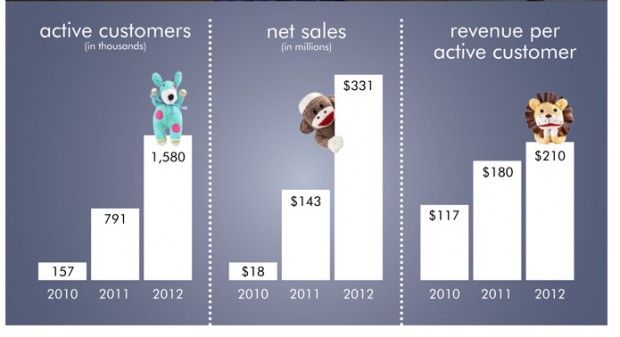

Revenue skyrocketed from $143 million in 2011 to $331 million the next year. Active customers nearly doubled year-over-year to 1.58 million in 2012. The business was humming. It was one of the fastest-growing Seattle tech companies ever, at the time.

Zulily raised more than $130 million from investors including Andreessen Horowitz and Maveron before a big IPO in 2013 that pumped its valuation past $4 billion — just four years after it launched.

But analysts soon began questioning its long-term strategy, even as the company topped $1 billion in annual revenue and grew its warehouse footprint. Customers complained about how long it took to receive orders as Amazon set the standard for fast shipping.

Zulily missed earnings expectations and its stock price began falling toward the latter half of 2014.

In 2015, Liberty Interactive’s QVC Group (later renamed to Qurate) paid $2.4 billion to acquire Zulily — a 49% premium, but well below the retailer’s stock price after its IPO.

When the deal was announced, executives talked about synergies and complimentary customer segments between Zulily and QVC.

“I think our cultures will fit incredibly well,” co-founder and former CEO Darrell Cavens told Fortune at the time.

A mismatch, and a culture clash

Zulily and QVC both targeted women who loved to shop.

But Zulily was focused on younger moms scrolling on their smartphone. QVC catered to an older customer shopping on TV.

They each also used unique merchandising models, which made cross-selling between the two businesses more difficult.

In hindsight, it was a “mismatch,” according to a former Qurate exec who requested anonymity.

Leaders also had competing views on how to manage Zulily’s business.

“We were sort of operating in a different way,” said Saliba. “There was less of a growth mindset from Qurate.”

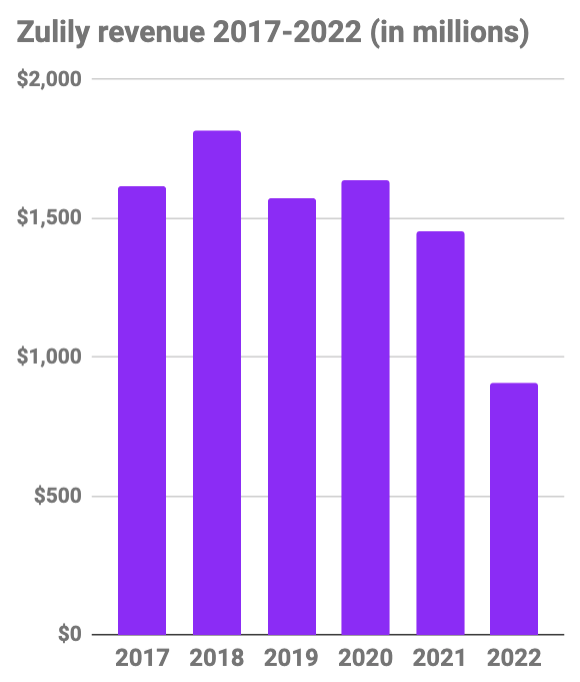

Zulily’s revenue and active customer count stayed flat in the two years following the acquisition. The company saw some momentum in 2018 but it was short-lived.

Zulily tried to spur sales by rolling out a “Best Price Promise,” encouraging customers to get a discount by purchasing multiple products.

“While shoppers perceive that Amazon and Walmart have the lowest prices, we are confident that we provide shoppers the best deal,” Jeff Yurcisin, who took over for Cavens in 2018 as CEO, said in a statement at the time.

But year-over-year sales decreased throughout 2019. Qurate — which also operated Home Shopping Network (HSN) — said its second quarter gains that year “were partially offset by deterioration at Zulily.”

Meanwhile, Zulily was dealing with product quality issues as it sourced more directly from China, according to Saliba. “That didn’t resonate well with customers,” he said.

Zulily was no longer just targeting moms. It expanded its product catalog to “women or men, with or without kids,” as Saliba described to GeekWire in early 2019, when the company inked a flashy sports sponsorship deal with the Seattle Sounders.

That was a stark change from the company’s early focus on a specific vertical — and it may have backfired.

“This is trying to be an endless aisle of everything, which is kind of going head-to-head with Amazon,” Alex Applico, CEO of tech platform consultancy firm Applico, said in 2020. “I don’t know how you win at that game.”

‘We lost an identity’

Like many other e-commerce companies, Zulily saw a big boost in revenue at the outset of the pandemic. Qurate entertained spinoff offers, but ultimately did not ink a deal. And the pandemic-fueled growth didn’t last.

Then in 2021, Apple made a significant privacy change that impacted the effectiveness of Facebook ads, which Zulily was using heavily for marketing.

“The new iOS privacy changes have created challenges for all marketers, but Zulily’s high concentration of marketing spend with Facebook resulted in a meaningful increase in the cost of customer acquisition and corresponding pressures on sales,” Mike George, CEO of Qurate at the time, told analysts in August 2021.

George, who retired later in 2021, declined to comment for this story. He was replaced by former NielsenIQ and Grainger exec David Rawlinson.

Revenue in 2021 fell 11% year-over-year, then fell 38% in 2022 as losses grew.

Zulily’s headcount dropped by more than 1,000 employees from Q3 2021 to Q3 2022.

Jeffrey Shulman, professor of marketing at the University of Washington, said the company didn’t do a good enough job demonstrating its value proposition to customers and vendors as it tried to expand and scale beyond its initial focus on moms.

“It wasn’t clear what was going to draw somebody outside that target market,” he said. “They didn’t pin their brand to that very cleanly.”

Akkineni, who returned to the company as chief marketing officer in 2020, put it simply: “We lost an identity.”

Zulily also faced increasing competition from Chinese e-commerce companies such as Shien and Temu that gained momentum in the U.S.

Amazon, meanwhile, continues to dominate the U.S. e-commerce market, buoyed by its Prime membership program and a growing third-party seller business.

In a surprising move amid its shutdown, Zulily filed a lawsuit against Amazon last month, alleging price-fixing and supplier coercion. The lawsuit is based in part on allegations in the Federal Trade Commission’s separate antitrust lawsuit against Amazon.

Regardless of the outcome of that suit, Zulily’s downfall likely wasn’t the result of one competitor or one acquisition, but rather a series of missteps.

The collapse “serves as a cautionary tale for brands and retailers, emphasizing the importance of agility, operational efficiency, innovation and a deep understanding of market dynamics and consumer demands,” Coresight Research wrote in a recent report. Some draw parallels to Jane.com, the online women-focused marketplace that also shut down abruptly late last year.

Former Zulily employees shared sadness and disappointment in recent months. But many also reminisced about the good times they had at the company and the impact on their careers. Several have gone on to launch startups or take leadership roles at companies in Seattle and beyond.

“Zulily wasn’t the perfect company. It had its ups and downs,” Jacob Tally, a former marketing leader, wrote on LinkedIn. “But most people have no idea how hard it is to actually build something. Zulily showed me and many others how rewarding that could be, and it inspired many of us to be better, even if was as a result of learning from mistakes.”