Ralf Hahn

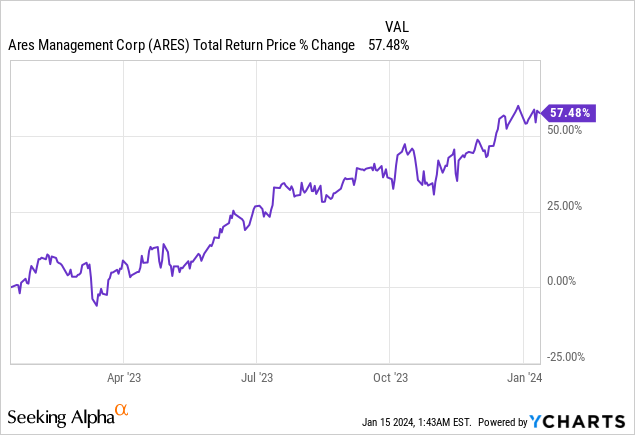

Ares Management Corporation (NYSE:ARES) has outperformed most listed alternative asset managers in the past year with a one-year total return of about 57%. This was mainly attributable to its outsized emphasis on private credit, a hot buzzword in alternative investing. Direct lending was ~45% of ARES’ AUM in 3Q23, whereas real estate was only ~12% of AUM, helping it navigate away from a tough sector in 2023.

Robust 3Q earnings amidst high interest rates

ARES has had a notable 3Q23 with fundraising reaching $21.9B, (record second-best quarter), bringing new investments for the year to $53.4B. This was helped by a strong performance across their funds, with approximately three-quarters outperforming their respective public indices benchmarks.

Management fees and related earnings grew by more than 20% y/y for the first nine months (3Q23 vs 3Q22: management fees up by 17% y/y, fee-related earnings (FRE) up by 18% y/y). The US direct lending business raised $11.6B, contributing to a strategy AUM nearing $118B, while their sixth European direct lending fund reached €9.9 billion, on track to surpass €11 billion by year-end. ARES’ alternative credit Pathfinder II fund closed at its hard cap of $6.6B, nearly double its predecessor’s size.

Private credit expansion is still in its early innings

Looking at the entire industry, private credit AUM (including dry powder/capital commitment not yet drawn) increased at a CAGR of 14.8% in the last ten years. This was in line with private equity AUM CAGR of 14.7% during the same period. Both were the top categories for AUM growth among relevant asset classes, however, private credit is still considered under-allocated by institutional investors by 8% on average compared to private equity, according to data from Preqin and other market sources.

Looking towards the future, private credit AUM is projected to increase at 11% per year to 2028, ahead of private equity AUM at 10%, and real estate and infrastructure at 7%. This puts private credit as one of the strongest asset classes to receive inflows.

Based on our conversations with investors, institutional investors generally feel there’s more room to allocate to private credit while retail investors including HNW individuals are even less exposed to this asset class. Higher yield in direct lending is attractive and has a lower duration.

We believe private credit has a large global TAM, with more maturity in developed economies like the U.S., and lesser so in Europe, but almost completely undeveloped in Asia, Latin America, Africa, etc. The company is also looking towards expanding internationally as well.

Overweight in credit strategies, especially direct lending

As of 3Q23, ~45% of the company’s AUM is derived from direct lending (US/European mix: ~30%/~15%). In the past five years, direct lending AUM grew at a CAGR of 24.4% which is likely much faster than the industry’s estimated ~15%. This is mainly due to the firm’s strength in this asset class, leading to stickiness among its investors.

Credit funds (68% of total AUM) contributed to 56% of its total management fees. We can deduce the average management fee per annum was ~0.76% in the last twelve months (excludes not yet drawn capital commitments). Direct lending, alternative credit, liquid credit, and Asian credit were about 67%/12%/17%/4% of credit AUM.

Valuation

ARES has had a robust operating history in the past five years. It was able to grow its management fees income, fees-related earnings, and realized income by an average annual rate of 25%, 35%, and 29%, respectively. Hence, it increased its dividend per share by 27% over the past year or at an average rate of 23% in the past five years. It currently trades at forward dividend yield of 3% and 27 times forward earnings which is likely justified due to its estimated earnings growth of about 30% in FY24E, putting its PEG ratio at about 0.9.

Against its asset manager peers, ARES commands a 25% premium in P/E ratio but has a significantly stronger growth profile with at least a 10% in earnings growth spread.

Compared with direct lending itself, the average yield-to-worst for investment grade and high-yield loans is about 7% and 9% respectively, but they tend to have lower duration due to shorter tenors. As the Fed likely embarks on a rate-cutting cycle this year, yields will gradually fall as floating notes get repriced. This may reduce the yield earned by investors but does not necessarily reduce the fees earned on private credit assets managed by ARES because of a growing AUM.