fotostorm

Investment action

I recommended a hold rating for AppLovin (NASDAQ:APP) when I wrote about it the last time, as I was worried about a potential pullback after a strong rally as the market seemed to have elevated expectations for the stock. Based on my current outlook and analysis on APP, I recommend a hold rating for the near term until the 4Q23 earnings, where management should give more insights into FY24. Suppose management guidance or expectation is that the industry slowdown or flattish growth is not a major headwind to APP and that its growth momentum continues (with the AXON 2.0 platform gaining more share), then I think switching to a buy rating makes sense as the consensus FY24 estimate is plausible.

Review

I believe the way the APP stock price has reacted to its recent 3Q23 performance and how its valuation (forward PE) has trended recently are signs that the market is expecting a lot more from APP. I think buying the stock today would require confidence in how FY24 is going to turn out, and my view is to wait for management to talk about FY24 guidance and expectations on February 15 (4Q23 earnings) before making an investment decision.

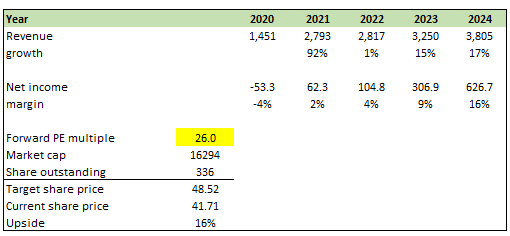

Starting with the strong 3Q23, APP did really well. In fact, it was one of the best-performing quarters in recent history, where APP revenue grew 21% to $864 million, beating consensus expectations of $796 million. The same was true for EBITDA, where APP reported $419 million, strongly beating consensus estimate of $355 million. Management even raised their 4Q23 expectations, now expecting 4Q23 revenue of $910 to $930 million and an EBITDA range of $420 to $440 million, implying a FY23 revenue of $3.25 billion at the midpoint (full year growth of 15%) and an EBITDA of $1.18 billion at the midpoint.

I believe the success that APP is seeing in its software segment is going to help it meet the 4Q23 guidance. In 3Q23, APP Software revenue came in at $504 million, representing an increase of 65% y/y, and adjusted EBITDA came in at $364 million, representing an increase of 91% and a margin of 72%. This was a spectacular performance, which speaks very well of the AXON 2.0 platform. The underlying operating metrics also point to strong momentum, which suggests 4Q23 will see strong performance as well. Among the AppDiscovery DSP, revenue per install grew 40%, with install volumes also growing by 29%. What was even more notable was that both price and volume were growth drivers, clearly suggesting that the AXON 2.0 differentiation in targeting audiences is working. The growth implication here is that AXON 2.0 has the entire ecosystem more valuable as each of those incremental installs increases the efficacy and efficiency of advertisers’ marketing dollars, which means advertisers are likely to invest more in marketing, which will drive growth for APP due to the revenue sharing agreement. On the other hand, remember that weak app revenue performance in previous quarters? Even that quarter has now turned around, growing sequentially for the first time after 7 long quarters, driven by APP increasing its marketing investment in AXON 2.0 for its own channel. This, again, showed that AXON 2.0 is working.

With such a strong performance, one would imagine that the stock price would react very positively. However, that is not the case. APP’s share price has been pretty much flattish at $39 (my last post was at $39 as well). I believe this is in line with what I mentioned previously: that the stock valuation, at ~32x previously, has a lot of expectations baked in already. If I were to summarize the share price performance so far into an equation, it would be: very high expectations (high valuation) + strong results = flat share price movement. My worry with the stock is that FY24 is going to be an uncertain year, and if APP were to deliver one weak quarter, the stock might see the sell-off that I was expecting previously. Remember that a lot of investors are sitting on good profits, so any signs of weakness could force them to lock in profits.

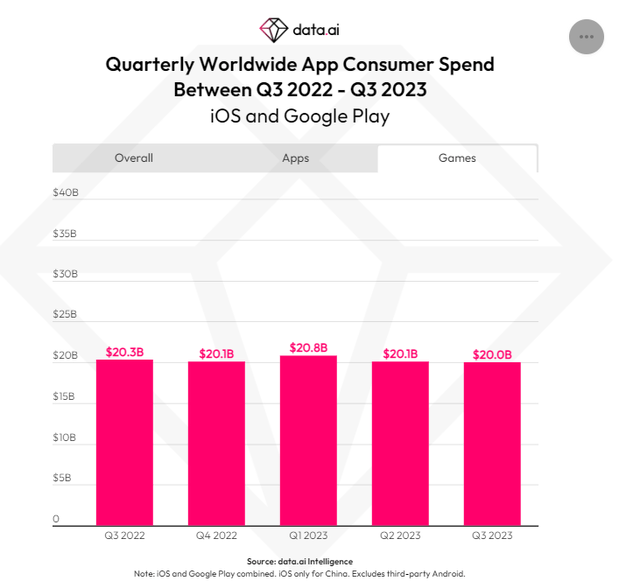

The first uncertain factor is the pace of the mobile gaming market’s recovery. According to data from data.ai, there is little to no growth in consumer spending on mobile games in 2023. In fact, on a sequential basis, spending has been in decline, which suggests no signs of growth at the industry level. Remember that 2023 was supposed to experience an easy comp given that 2022 was a weak gaming year? I believe this is strong evidence that the weak macroeconomy has impacted consumers’ spending on mobile gaming and that this weakness is likely to persist for longer than expected until the macroeconomy recovers. The implication here is that how much can the in-game advertising market grow if the overall consumer spending for mobile games is basically flat? My view is that it is not going to be a lot, and this dynamic will impact APP’s ability to grow as well.

The bullish argument is that APP can tap into other growth initiatives to reduce reliance on mobile gaming. Management has mentioned new growth initiatives, such as entering the connected television market through the Wurl acquisition and acquiring the Array OEM business. However, these products are still in the early stages of development, in my opinion. Although these initiatives may prove to be significant in the long run, I fail to see how they can impact the stock’s trajectory in the near future, particularly given that the narrative surrounding the company is still heavily focused on mobile gaming. In fact, if management were to invest heavily, it would impact near-term earnings growth as profit margin gets depressed, which may further hurt the stock’s sentiment.

Valuation

Author’s work

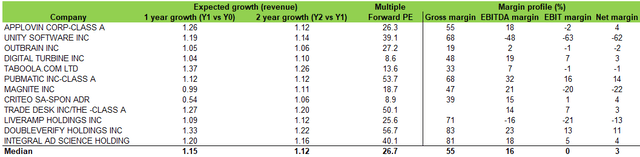

Previously, my model was built to show the downside in case APP missed its guidance. In this round, I inverted and asked myself what the upside could be if things went well. With the strong 3Q23 performance, I believe APP is going to hit its FY23 guidance. The question is: how would FY24 perform? My assumption is that FY24 could be a strong year if the macro environment recovers, leading to a recovery in consumer spending on mobile gaming. Using consensus FY24 assumptions, I assumed FY24 to grow 17% and the net margin to come in at 16%, implying APP will generate $626 million in net income. Unlike previously, where APP was trading at an elevated multiple, at 26x forward PE, it is not ridiculously expensive when compared to other adtech peers (APP is expected to grow faster than peers with margins pretty much in line). Assuming the 26x forward PE multiple holds, I see a potential for 16% upside from the current share price. However, I am not recommending a long position today as I think it is better to wait for management to set FY24 expectations (it also helps to confirm if consensus 17% growth is plausible).

Risk and final thoughts

As I highlighted above, macroeconomic factors are certainly impacting consumer spending on mobile games. If the macroeconomy turns for the worst, we could see further decline in the industry, which could be a major growth headwind as advertisers look to cut advertising budgets.

In conclusion, I recommend a hold rating for APP until management gives more insights into FY24 performance, which I think is going to be crucial in determining the stock’s trajectory. My main worry is that the mobile gaming market’s sluggish recovery poses uncertainties for FY24 performance, especially if consumer spending remains flat. Although management has outlined growth initiatives beyond mobile gaming, I don’t think it is going to be sufficient to move the needle.