Ljupco/iStock via Getty Images

Performance Assessment

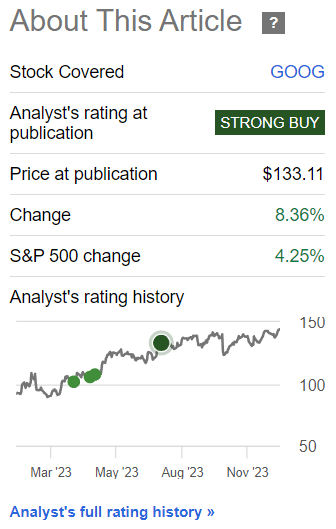

I’ve had a ‘Strong Buy’ stance in Google/Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) since mid last year. Since publication of that last article on the stock, total shareholder return has been +8.36% compared to +4.25% in the S&P 500 (SPY) (SPX), implying an alpha of +4.11%:

Performance Assessment Since Last Coverage of Google (Seeking Alpha)

Thesis

Now, I am changing my stance to a ‘Neutral/Hold’ as I note the following:

- A bull thesis based on search revenue growth is now less compelling

- Revenue backlog visibility is picking up

- Google Cloud margin progress is stalling

- There is no major margin of safety in valuation

A bull thesis based on Search revenues growth is now less compelling

In my last thesis on Google, I had noted that:

Google’s advertising engine remains well-positioned and is only set to pick up with the eventual sectoral rebound.

– Hunting Alpha’s view in the last article on Google

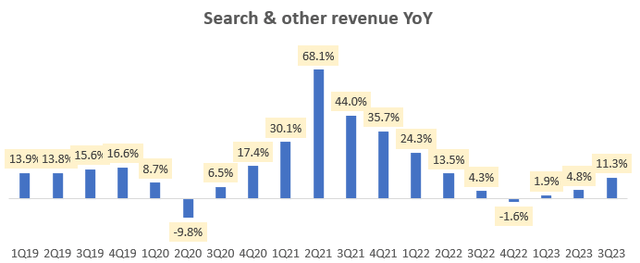

Q3 FY23 results played out in agreement with this view, seeing a YoY growth uptick to 11.3%:

Search and Other Revenue YoY (Company Filings, Author’s Analysis)

Management attributed the source of this growth to be led by strong performance in the retail vertical, particularly on the value side:

We’ve seen 4x deals queries during the holidays versus other periods; 75% of users say they’ll shop with those offering free shipping.

Senior VP & Chief Business Officer Philipp Schindler in the Q3 FY23 earnings call

CIO and CFO Ruth Porat confirmed that they were seeing a “stabilization in spending by advertisers”, confirming what industry research was predicting.

I believe the most effective thesis arguments for a stock are the ones for which the underlying event is anticipated. When these start to play out even before it is fully materialized into reality. That is, when the uncertainty about the anticipated future reduces, the alpha opportunity erodes away. For example, this is why I thought the bullish thesis on Palantir’s (PLTR) inclusion into the S&P 500 was made redundant when the company met all the criteria for inclusion, even though the actual event has not happened yet.

I see a similar thing happening with the bullish Search revenues thesis for Google. There are signs of it playing out and the uncertainty about a more favorable advertising environment is reducing. Hence, I believe the opportunity is less compelling now.

Revenue backlog visibility is picking up

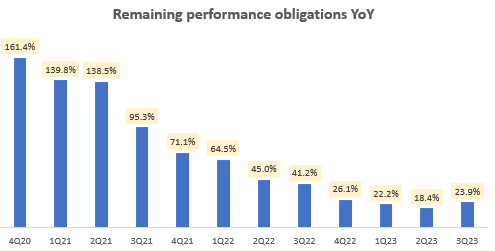

Google’s remaining performance obligations (RPO), which represents the revenue backlog primarily for the Cloud business are starting to see growth acceleration after 10 consecutive quarters of growth moderation, with the latest quarter printing a 23.9% YoY growth:

Remaining Performance Obligations YoY (Company Filings, Author’s Analysis)

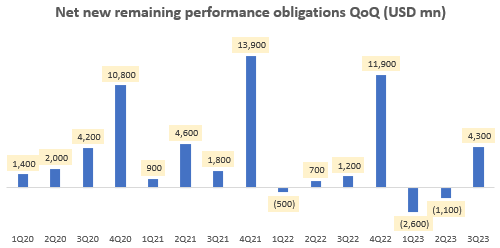

In QoQ net new RPO terms, the company saw a sharp net increase of $4.3 billion, more than offsetting the last 2 quarters’ declines of $3.7 billion in total:

Net New Remaining Performance Obligations QoQ (USD mn) (Company Filings, Author’s Analysis)

This is a bullish sign. However, it remains to be seen if it would lead to a sustainable increase. Clues from management commentary noted that although customers have been optimizing their cloud-related spends, Google Cloud Platform [GCP] within the overall Cloud segment was “above the overall Cloud growth rate“. This could be an early indicator of a rebound in Cloud spends.

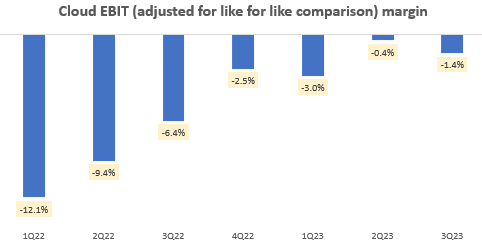

Google Cloud margin progress is stalling

Cloud EBIT (adjusted for like for like comparison) margin (Company Filings, Author’s Analysis)

The chart above shows my estimate of Cloud EBIT margins after adjusting for a like-for-like comparison between the quarters. This adjustment neutralizes the impact of the accounting adjustments related to the increase in server useful life assumptions. I published a more detailed piece on the “The Hidden Truth Behind Accounting Boosts” earlier last year.

Management flagged increase in data center and operational costs as reasons for the worse margin profile in the Cloud business. I am unclear on whether these higher costs have bottomed out.

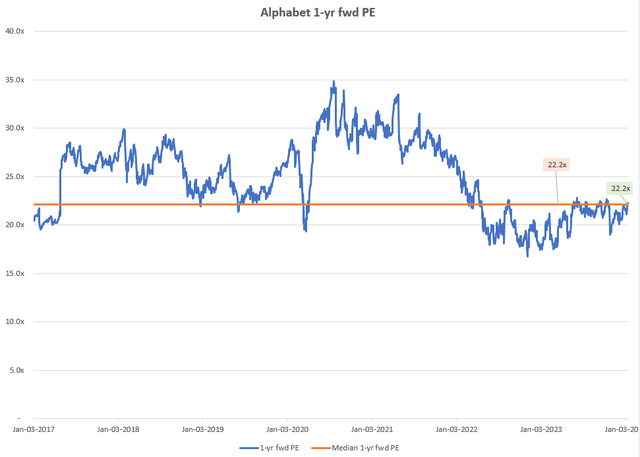

There is no major margin of safety in valuation

Alphabet 1-yr fwd PE (Capital IQ, Author’s Analysis)

Alphabet is trading at a 1-yr fwd PE of 22.2x; right at the median level over the last 6 years. Given the mixed fundamental arguments and the lack of clarity I have on a strong bullish thesis, I interpret the current valuations as a lack of margin of safety to support compelling buys.

Technical Analysis

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do, utilizing principles of Flow, Location and Trap.

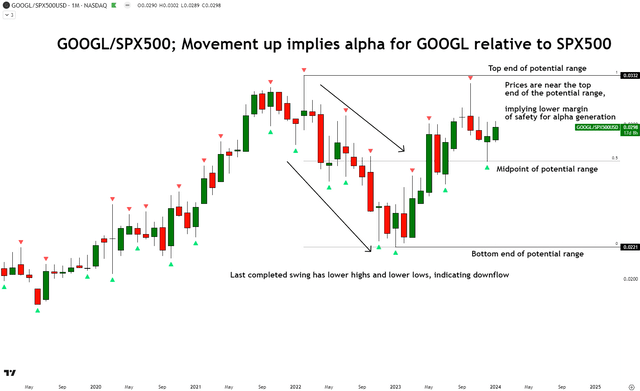

Relative Technical Analysis of GOOGL vs SPX500 (TradingView, Author’s Analysis)

Reading the technicals on the relative monthly chart of GOOGL against the S&P 500, I note that the last major completed swing has been downwards. And now in the current order flow’s rebound up, we may be forming a potential range. The relative ratio prices are currently trading in the upper half of the potential range, which I believe reduces the margin of safety for believing in continued alpha generation.

To have a clearer bullish outlook on the alpha potential of GOOGL vs the S&P 500 from a technical perspective, I would wait for the ratio prices to react from the bottom end of the likely range again, or for an impulse push past the top end of the potential range with strength, and show a successful retest of the highs.

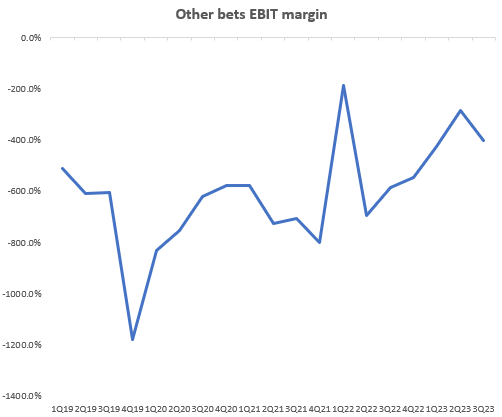

Key Risk

In my last view on Alphabet, I suggested that Ruth Porat may be able to reduce the bleeding in the Other Bets segment. However, in Q3 FY23, the EBIT margins in this segment worsened further:

Other Bets EBIT Margin (Company Filings, Author’s Analysis)

Still, it has only been 1 quarter since Porat became the CIO. So we can’t draw too many early conclusions yet. I recognize margin expansion to be a key risk to my ‘Neutral/Hold’ thesis as it increases the chances of an error of omission.

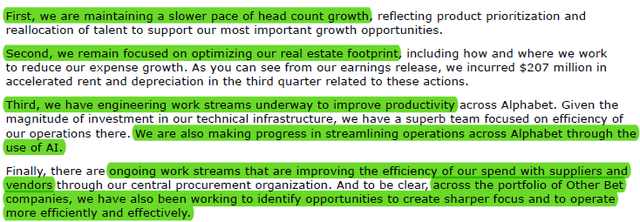

Porat spoke at length on a host of operational margin improvement programs going on at the company; headcount growth control, real estate footprint savings, gross margin improvements, AI-generated productivity improvements, and a sharpening of the focus in the Other Bets portfolio:

Google Margin Improvement Initiatives (Q3 FY23 Earnings Call, Author’s Highlights)

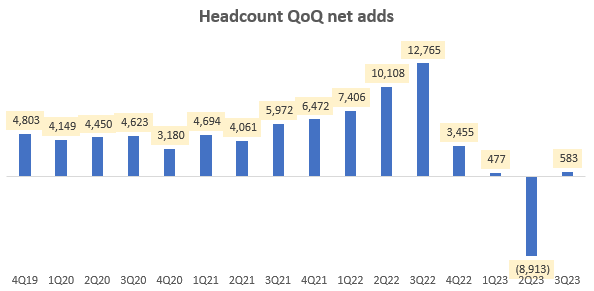

This marks a regime change in the cost control culture at Google, which is visible in the numbers. For example, notice the much more subdued (583) additions to headcount in the latest quarter compared to the usual thousands of additions during 2019 – 2022:

Headcount QoQ Net Adds (Company Filings, Author’s Analysis)

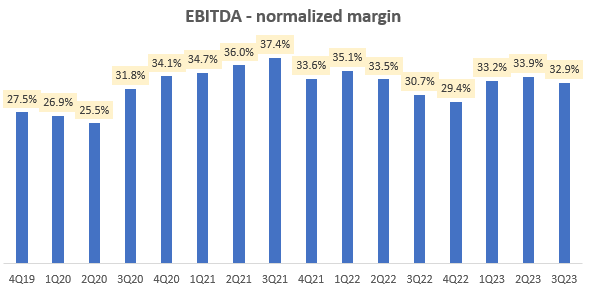

Now management highlighted that some of these operational cost control improvements would be offset by higher traffic acquisition costs going forward. However, I still recognize the risk of a margin surprise toward the mid-35% EBITDA levels on a normalized basis (excluding the temporary margin accretion created by severance and other impacts):

Normalized EBITDA Margin (Company Filings, Author’s Analysis)

Takeaway and Positioning

My earlier bullish view on Alphabet/Google has played out nicely, generating an alpha of +4.11% vs the S&P 500. But now, I am changing my stance to a ‘Neutral/Hold’ as I believe earlier catalysts such as a rebound in Search revenues are already playing out, making it more difficult to make a case of compelling incremental anticipation. I recognize the bullish signs of an increased revenue backlog, particularly in the Cloud business. But this may be offset somewhat by higher data center costs weighing down on Cloud margins.

I also find limited margin of safety in the valuations and whilst the technicals relative to the S&P 500 don’t suggest clear bearishness, I believe the chances of continued alpha generation are lower currently. The company has a lot of opex-focused margin expansion initiatives in play and that is a key upside risk I recognize.

Overall, as I have reduced confidence in the alpha-generation potential for Google, I believe it is time to start scaling out and reinvest the proceeds in either the S&P 500 or in other bullish ideas such as Annaly (NLY), CompX (CIX) or Tenable (TENB).

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.