tum3123

By Damien Buchet, CFA, Chief investment officer, Principal Finisterre

Upon entering a New Year, we find ourselves in a somewhat similar market situation as the end of last year, still hoping for better times for global fixed-income assets amid legacy pressures from tight global liquidity, high policy rates, and a strong USD. Yet we have significantly advanced in the global growth/ inflation cycle, with disinflation now well entrenched while, at long last, the U.S. and other developed market economies are showing signs of significant activity slowdown.

The emerging market (EM) fundamental situation, while not overly exciting, has remained satisfactory for emerging market debt (EMD) investors, as growth held up or even improved in many places, while fiscal balances have remained contained and central banks retained a high level of credibility. We will address the situation of smaller frontier countries separately (see Theme #6), where event risks still exist. That said, those seem adequately priced now, and they delivered an attractive performance in 2023, after having been severely punished in 2022. Some fundamental risks do exist, which we develop in this outlook, from a heavy 2024 election cycle, potentially leading to some fiscal pressures, as well as persisting external refinancing needs, or the outlook for commodities when U.S., European, and Chinese growth slow (but those impacts will tend to be country- or issuer-specific rather than systemic, and offsets exist in many countries in terms of domestic sources of growth and policy flexibility).

As is often the case in episodes of rising U.S. yields, stronger USD, and tightening global liquidity conditions, emerging markets were the first to be hit in 2022 in a classic “sell first, ask questions later” instinctive reaction by global investors. This leaves us with an unprecedented combination of extremely clean technicals and doubtful sentiment from investors, even as most risks have been fully uncovered and correctly priced. We particularly like this situation where the whole asset class is now deeply under-owned at the global level, which should skew returns quite positively to the upside when/if any fresh inflows materialize.

In sharp contrast to many global fixed-income asset classes, and developed market (DM) credits in particular, EMD valuations remain attractive, adjusted for the real (if not perceived) level of macro or credit risks. Sovereign external debt (as per the JPMorgan EMBI Global Diversified Index) is still trading near the high end of its 20-year 250-450 basis point (BP) spread range over U.S. Treasurys (USTs). Aside from the well identified China property trouble spot or the 2022 demise of the Russian corporate universe, EM corporate debt remains a beacon of fundamental stability and a source of income, with very few problematic debt structures and generally much lower levels of net leverage than their similarly rated DM peers. Last but not least, local currency debt still trades near its most attractive historical and cyclical levels (especially on an ex-China/South East Asia basis). Across EMs, disinflation is now well entrenched, thanks to EM central banks having done a fine job of acting early and forcefully to preserve their inflation targeting credibility. This leaves the space exhibiting some of the highest levels of real and nominal yields of the past 20 years.

We make the case that this combination of fair fundamentals, well identified risks, ultra-low ownership by still doubtful global investors, and attractive valuations, makes EMD the most asymmetric asset class to embrace better days for global fixed income, which should continue to perform healthily in 2024. We are targeting double digit returns for EMD assets in 2024, slightly higher than 2023, but hopefully with a little less volatility along the way.

Global drivers

U.S. rates and USD outlook: Positive but not a “home run”

The global fixed income disappointment of 2023 owes mainly to the enduring U.S. growth and the much slower-than-expected impact of monetary tightening on the U.S. consumer. The persistently loose U.S. fiscal stance was also a headwind, which came to the fore with the Fitch downgrade of U.S. debt in August of 2023 and led to a significant steepening of the U.S. rates curve in the following September and October.

The end of 2023 was marked by a global relief rally on duration and some weakness in the USD, as U.S. and global disinflation continued, but more significantly, as U.S. and EU data started to show more convincing signs of weakness. The December Federal Open Market Committee (FOMC) meeting, which saw at last the median U.S. Federal Reserve (Fed) funds projection of Fed governors’ endorsement of the prospects of three rate cuts in 2024, was widely considered a confirmation of an upcoming and long-awaited Fed “pivot”.

The power of the late 2023 global yield rally begs the question of what is in store for 2024 and must be put into the perspective of what end inflation and real yields investors should envisage. We have long argued that, although disinflation would continue, reinforced by a slowdown from abnormally elevated U.S. growth levels, we were not believers in a durable return to the sacrosanct 2% inflation target. Indeed, we continue to assume that lingering geopolitical tensions, trade frictions, strategic hoarding of key raw materials, more assertive and competition-distorting industrial public policies, as well as more hurdles against immigration into developed countries, should all combine to keep inflation more elevated than otherwise. Therefore, we assume that U.S. inflation may stall in the 2.5%-3% range into 2025, at which point a debate should happen on the long-term “political-economic” adequacy of the 2% target. We caveat that our view may change if the development of artificial intelligence (AI) and broader robotization proves to be another significant deflationary force. In any case, we do not see U.S. potential growth as exceeding the 2%-2.5% area, which should be consistent with long-term real yields of around 0.7%-1.5% (compared to the early 2000s average of 2%, when nominal U.S. yields were at similar levels as today).

As such we would expect U.S. 10-year yields to potentially compress further but struggle to durably break the 3.5% area to the downside. As we discuss below, we see more potential for further yield compression in EM local bonds versus USTs in such an environment. We assume that even if the positive returns of being outright long U.S. duration may not be overly impressive (and may see some pullbacks over the year), it may make more strategic sense to retain a broad steepening bias. Indeed, after two years of flattening and a few false starts in 2023, we would expect a broad steepening bias to establish itself – both “bull” via the pricing of the Fed cuts by the short end – and “bear” via some resistance of the long end because of continuing fiscal issuance risks into, and possibly after, the U.S. election. In that vein, one of our key themes for 2024 (see Theme #2), is to reinvest and maintain allocation to a basket of high-carry EM short- to mid-duration corporate credits in USD. Income via shorter maturities should remain an anchor of returns in 2024.

We believe that our scenario of “continuing 2024 disinflation with a pronounced U.S. growth slowdown, yet not morphing into a harsh recession” is consistent with either moderate USD weakness or broad stability. We would likely remain in the middle part of the so-called “USD smile”, i.e., away from the two extreme environments of USD strength, namely exceptional U.S. strength or harsh recession infecting other parts of the world. Such an environment would allow, more than in 2023, non-U.S. regional or domestic factors to play a more dominant role in most currencies’ behaviour and allow the EM foreign exchange (FX) carry trade to express itself again.

Europe: Muddling through at low levels thanks to rate cuts

European growth has clearly disappointed since the summer, but the collapse in core inflation over the same period has also surpassed most expectations. Geopolitical uncertainties, social disturbances in some countries, a more significant direct exposure to the Chinese slowdown through the German export machine, and a tighter fiscal stance than the U.S. (while monetary conditions were still restrictive) all help explain the return to a low-growth environment. Yet, this is now largely expected by investors at a time when EU growth disappointments may stabilize. We expect the European Central Bank (ECB) to be in a position to cut rates possibly ahead of the Fed, given that their sole mandate remains inflation. This leaves us constructive on the EUR in the early part of 2024, but getting more cautious as rate cuts get underway. This also translates into a constructive view on European duration, which in turn makes Central European rates and FX a likely attractive carry trade versus EUR in 2024.

China: Muddling through thanks to fiscal support

We expect Chinese growth to contract moderately from an expected 5% in 2023 to about 4.5% in 2024, largely thanks to additional layers of defensive, but increasingly less effective, fiscal stimulus. China will remain mired in a “3D” conundrum – Debt, Deflation, Demographics – compounded by a longer-lasting depression in property investment, refinancing issues by local governments, and an anaemic private sector stifled by a succession of government clampdowns on key economic sectors. After a brief consumption relief from pandemic restrictions, an aging population lacking enough social safety nets has returned to its traditional saving behaviour. Yet, contrary to the example of Japan in the 1990s, we do not expect any major economic collapse. We believe that the closed nature of the Chinese financial system led by public banks, the fact that the property crisis owes more to a buyers’ strike than the need for prices to adjust significantly, and an absence of extreme leverage among consumers or private corporates, should allow the imbalances to clear up over a longer period of time, at the price of several years of sub-par growth. This implies that the government and large policy banks will remain the key providers of liquidity and refinancing to the system.

Oil and commodities: Can the benign 2023 “Goldilocks” environment last into 2024?

Throughout 2022 and 2023 the Saudis, and to a lower extent the Russians, have been instrumental in making the Organization of the Petroleum Exporting Countries (OPEC+) behave like the “central bank” of oil markets and stick to a tight supply management, thereby keeping oil prices in a $80-90/bbl “goldilocks” range for both importers and exporters. This allowed the sector to adjust to the significant Chinese slowdown in 2023. However, this fragile equilibrium is showing some cracks at the end of 2023, as expectations widened for a synchronized low-growth environment across the U.S., Europe, and China, potentially negatively impacting demand. Meanwhile, supply from non-OPEC countries like U.S. shale producers, Guyana, and Brazil make supply cuts increasingly painful to hold for OPEC members including Saudi Arabia. The latter, despite enjoying one of the lowest extraction costs in the world at a few dollars per barrel, now sees its fiscal deficit explode again, since, at a $95 fiscal breakeven oil price, their revenues are insufficient to finance their multi-year investment program to transform the economy away from oil. As a result, Saudi Arabia will likely be the largest EM USD debt issuer in 2024, at $16.5 billion for the sovereign alone.

2023 saw the rest of the commodity space behave in a similar “goldilocks” fashion, which greatly helped inflation to fall, especially across emerging countries. Iron ore and copper also benefitted from production constraints or tight supply management by the largest suppliers in the face of the Chinese slowdown. We also suspect that some restocking by Chinese traders since the summer of 2023 played a role in expectations of government stimulus measures to support property and infrastructure investments. Going into 2024, we will need Chinese growth to hold in order to maintain this equilibrium. Finally, regarding food commodities, we remain on the hook for a potential El Nino phenomenon at the start of 2024 which would affect grain production through droughts or floods in various parts of the world, although we have scant evidence of it yet. This could temporarily reignite headline inflation across emerging countries, although we would not expect EM central banks to overreact.

Current state and outlook of EMD

Fundamentals: Resilient if not exciting

Global fixed income markets and EMD in particular start 2024 a bit like how we entered 2023-with high hopes for better duration performance, yet still hostages of macro developments out of both the U.S. and China, and dealing with the aftermath of an unprecedented rise in global risk-free rates*, a still-solid USD, and tight global financial conditions.

In this environment, emerging countries have fared way better than most expectations, with EM growth and fiscal balances remaining resilient to both a weaker China and a still-tight monetary policy by both the Fed and the ECB, which kept the USD well bid until recently. This resiliency certainly owes to a combination of positive factors for EMs, namely the early restoration of risk premia by EM central banks through pro-active rate hikes in the face of rising inflation in 2021, but also broad stability of commodity prices despite the current Chinese slowdown as well as demonstrated growth and fiscal resilience in the face of a slower China and more difficult access to USD financing.

We are not oblivious to a few remaining hurdles for emerging countries in 2024.

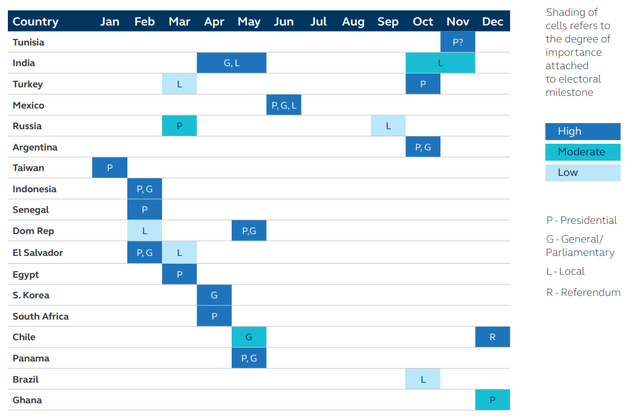

2024 will be the most intense in 20 years for elections globally, with the all-important U.S. presidential contest seizing the headlines. Many EM countries will also go to the poll, from politically paramount Taiwan to major EMs like Mexico, Indonesia, South Africa, and several frontier countries. While not all elections bring uncertainty, especially in several “illiberal” democracies where results tend to be known in advance, this will remain a recurring point of focus for EM investors.

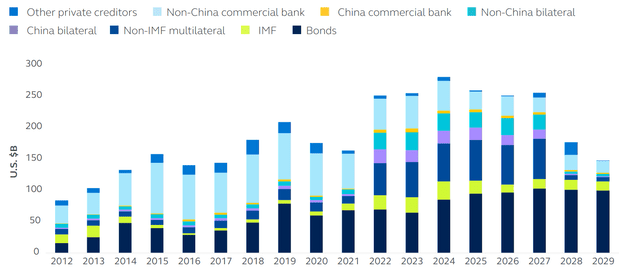

Access to external financing in USD will remain a key focus for many EM sovereigns, at a time when their external repayments schedule will hit a high of almost $300 billion in 2024 owed to the International Monetary Fund (IMF), bondholders, China, and other creditors, and should stay elevated for the next three years. However, we also acknowledge that EM governments and corporates have become more proactive and creative in raising financing over the past few years, through liability management and new financial instruments, and that multilateral have recently proven much more sympathetic, notably to the refinancing needs of frontier countries.

Lastly, we will have to contend with a likely sub-par growth momentum from the three major economic regions of the globe-the U.S., Europe, and China-which will inevitably raise questions on global trade volumes and the sustainability of commodity prices, namely oil and industrial metals. Yet, while the external backdrop may lead to some downside growth pressures for some EMs, we believe in continuing domestic resilience thanks to both a significant monetary policy headroom at a time when rate cuts are becoming a reality, as well as some fiscal flexibility leeway in certain countries. We also note that EM ex-China levels of consumer and corporate indebtedness remain near the lows of the past 20 years, hence the reignition of bank credit potentially providing for future upside in domestic activity.

Valuations: From fair to cheap

Although one could argue that sovereign and corporate spreads have tightened significantly from their recent “crisis” peaks, this also goes hand in hand with a significant clarification of the EMD fundamental outlook. Disinflation is now well entrenched across our space. Commodity prices and EM macro stability have endured and broadly resisted the test of both a slowing China and an unprecedented tightening of global financial conditions. Overall, we find the various EM segments either adequately or attractively valued as we enter 2024.

Sovereign credit

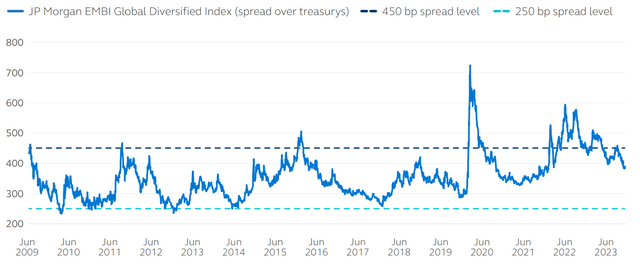

When it comes to sovereign external debt, the overall JPMorgan EMBI Global Diversified Index spread remains near the high end of its 250-450bp long-term range.

JPMorgan EMBI Global Diversified Index spread range since Jun. 30, 2009

As of December 29, 2023 (JPMorgan, Bloomberg)

A lot has been said about how this apparent index spread attractiveness hides a significant bifurcation between tight BBB/BB names and risky B/CCC names. We do sympathize with the idea that true value lies more on the side of the stressed and distressed space, which warrants an uncompromising approach to fundamental analysis, and sometimes implies taking a view on specific event-driven situations. Yet, as long as one can develop a strong fundamental conviction, this space represents an attractive source of “Alpha” to an EMD portfolio.

We are also arguing that, even if some segments of EMD debt, like BBB or BBs, have not meaningfully cheapened in spread terms in 2023, they still adequately compensate investors for very clear and resilient fundamentals in most cases. Finally, we make the case to also look at EM credit in overall yield terms, which remain near their 20-year highs, rather than in pure spread terms. We hear the cynics out there thinking that we are trying to tweak the story in favour of EMD, but in fact, the current backdrop of U.S. yields in the low 4%, looks quite comparable to the situation of our universe in 2003 in terms of yield levels and differentials versus (USTs). Such yield levels still allowed for significant EM yield compression versus treasuries in subsequent years, even though UST yields did not drop meaningfully over the 2004-2007 period.

Corporate credit

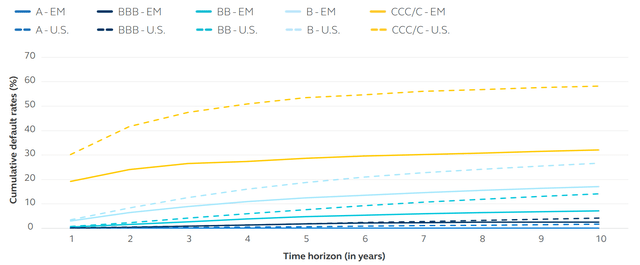

The EM Corporate credit universe has undergone quite a shift in composition in recent years, from the demise of the Chinese property sector to the disappearance of Russian issuers to the long freeze of the Turkish corporate space, which is just now starting to thaw. EM corporate credit no longer looks like an asset class of its own, but rather represents either a diversified field for resilient income opportunities, sectoral thematic baskets to complement a country macro view or certain special credit situations. We continue to appreciate the resilience offered by EM corporate fundamentals which often create a natural arbitrage versus DM credit, in that similarly rated EM corporates tend to exhibit much better credit metrics and access to financing via their domestic banks than their U.S. or EU peers. Investors should always remember that, as per 40 years of default data tracked by S&P, at each rating level the cumulative EM corporate default rate remains a fraction of that of same rating U.S. corporates. This partially owes to the “sovereign rating cap” which prevents most EM corporates, even the best quality ones, from being rated better than their respective sovereign (unless they are considered global champions and can demonstrate a large revenue diversification and an ability to generate FX earnings). JPMorgan’s research highlights how the average EM high yield (HY) net debt/EBITDA ratio has actually been significantly lower than U.S. investment grade (IG) corporates for a couple of years. We also note that EM corporates have generally tended to be proactive in refinancing early, extending maturities, and smoothing their debt profile during the COVID-19 period, where they also took advantage of generous liquidity provisions by their own governments. To the difference of DM HY markets, the EM corporate space also exhibits very few over-leveraged private equity transactions with high short-term refinancing risks.

Cumulative default probability for EM and U.S. corporates by rating (1980-2020)

As of December 31, 2020 (S&P Default, Transition, and Recovery: 2020 Annual Global Corporate Default and Rating Transition Study 1980-2020)

We are struggling with the argument that competing DM credit assets would exhibit more value than EM ones at this point in the cycle, even though they both trade at similar spread levels on a rating-adjusted basis. Beyond the familiarity bias of DM investors for their own credit markets, we do not see many reasons to love U.S. or EU credits if, as we expect, 2024 will finally see the U.S. economy slow meaningfully to a 0-1% GDP range. We note that U.S. HY defaults have already increased to 5% in a few months, at a roughly 0.2% monthly pace, and we expect them to continue to rise. The delayed impact of U.S. rate hikes and liquidity tightening on the cost and availability of refinancing should increasingly bite at a time when margins and cashflows start to compress. Nonetheless, we continue to believe that DM IG and HY credit spreads could reprice in an orderly fashion, as the degree of pain and exposure to those risks remains uneven across the system and will only accrue progressively.

Local interest rates

Local bond yields remain near their 20-year highs (even more so when low-yielding Asia is excluded), although disinflation is now well entrenched across all regions and most central banks have a clear agenda to cut interest rates. Real yields also remain near their historical highs (and often above the already generous 2% real yield offered by USTs) in numerous Latin countries, but also in places like Hungary, South Africa, and Indonesia. While valuations are not themselves a catalyst, we continue to believe that the combination of attractive carry, ongoing disinflation, and the delivery of expected rate cuts leading to a reduction of real yields will serve as a booster to the local duration trade. We would expect EM local curves to steepen in aggregate in 2024, as, although primary deficits should reduce marginally across the largest EMs, continuing substitution of external debt towards local debt issuance to finance deficits in an election year in many key countries, may lead the long end of curves to underperform the rally, while the short end tracks central bank yields lower. Mexico is a case in point as a country presenting a frontloaded expansive budget ahead of its presidential election, with an expected aggressive rate-cutting cycle.

EM currencies

Although the USD outlook has largely determined the fate of EM currencies in 2023, we expect 2024 to see EM-specific fundamentals reassert themselves and differentiation play out again. While carry should remain a major driver of returns, we would expect those currencies exhibiting the best blend of high real yields, central banks’ cautious approach to rate cuts, and preserved growth and fiscal credibility to have room to outperform. We would put Brazil, Peru, Indonesia, and Colombia in that category. This should also be a more auspicious year to reflect differentiation through relative value ideas.

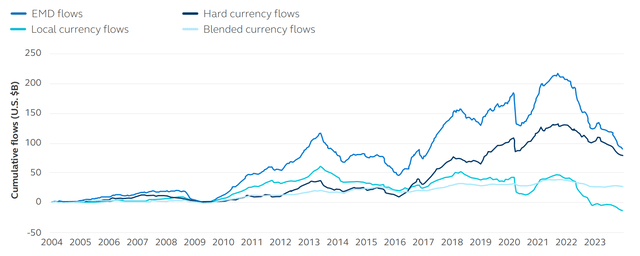

Sentiment and positioning: At secular lows and likely only rising from here

Despite our assessment that, as of the end of 2022, most EM risks were properly priced and identified, the asset class has continued to see unrelenting outflows from global investors in both local and hard currency debt in 2023, which brings the cumulated outflows since the start of 2022 to about six times the amount we had during 2013, the year of the “taper tantrum”. We have reached the point where, in barely two years, 50% of all global inflows into EMD since 2004 have now left the asset class. The situation is even more striking in local currency debt, where foreign investors now own significantly less USD amounts than in 2004, and that is including Chinese local bonds, which were almost the only beneficiaries of any significant inflows over the past five years. We see this level of negativity vastly unjustified vis-à-vis the true situation of EM fundamentals, which remained extremely resilient besides the usual frontier market suspects embroiled in restructuring or those flirting with a credit event but still paying their coupons (although we note that frontier credits did perform finely as a group in 2023). Anecdotal evidence suggests that U.S. investors in particular are running their lowest allocation to EMD in years. We would expect that global crossover investors recognize the diversification merits of a cleaner and properly priced fixed-income asset class, at a time when the delayed impact of U.S. and European rate hikes start to impact DM credit issuers in a broader way.

Cumulative EMD mutual fund flows by fund type

As of December 8, 2023 (EPFR, Morgan Stanley Research)

We expect sovereign USD bond supply in both sovereigns and corporates to remain very manageable around $85 billion net in 2024 and tilted towards better-rated Middle Eastern and Central European countries. We believe non-Asian corporate net supply will also be easily digestible at a similar level. Asian corporates will remain under pressure to refinance, at a net $175 billion.[1]

Outlook and EMD portfolio strategy

At the risk of repeating ourselves, we continue to see this low ownership and total absence of “hot money” in EMD as one of the key attractive features of the asset class going into 2024. As global fixed income comes back in favour, the persistence of a number of risk-adjusted value opportunities across the three EMD asset classes, including in frontier countries, and the fundamental resilience exhibited by most countries and issuers, should mean that any small positive reallocation by global investors could have a magnifying effect in bringing local yields and credit spreads way beyond fair value at times.

In terms of sequencing, we would expect to see EMD inflows early in the year following the recent Fed “pivot”, which could take us quickly into overbought territory. Such inflows will immediately be met by furious issuance by starved issuers, starting with sovereigns in January, and followed by corporates. We will keep a cash stack to acquire cheaper bond primary issues. We would not be surprised to see a significant pullback sometime in the first quarter. The trigger could be weaker U.S. data, taking a toll on DM equity and credit animal spirits, with occasional fears of a U.S. recession resurfacing. That said, we would expect the pullback to be met with fresh EMD inflows, perhaps from more strategic investors (global pension funds and insurance mandates) and crossover credit investors who shunned EMD for so long. That may also be the time when the current craze of retail investors for high-yielding risk-free assets* in the U.S. and Europe may start to fade, as they become used to 4%-5% yields and seek fresh excess returns.

We expect, however, to have to juggle between the relief from looser financial conditions and the unavoidable earnings and cashflow disappointments that DM equities and credit markets will have to digest. We are not even talking of private debt markets, where existing vintages of highly levered smaller corporates will likely need to take regular impairments over the next two years. However, we would expect this adjustment process to be progressive, led by a succession of small disappointments, and do not believe in any “flash crash” from DM equities, which would force a global panic. Although painting a scenario more than a few months ahead is often doomed to fail, an obvious focus until year-end will be the upcoming U.S. election and whether Donald Trump can eventually run despite his judicial issues. If there is one thing the experience of 2016-2020 taught EMD investors, it is that a new Trump presidency would be disruptive, in terms of sentiment, perception, and erratic decision-making, although not necessarily leading to negative macro outcomes in the end.

As was the case in 2022, we would expect EM risk factors (spreads, local yields, FX) to continue to exhibit resilience during episodes of global risk aversion. We would manage those episodes through tactical adjustments to our “Momentum” bucket (reducing liquid long-dated EM bonds and FX) and the addition of proxy hedges (long UST futures versus long credit default swaps (CDS) on U.S. and EU HY indices). Meanwhile, 2024 should see a number of EM special situations improve, with stories like Ukraine, Ghana, and Zambia proceeding to restructure their debts, and other distressed stories like Turkey, Egypt, Argentina, Nigeria, and perhaps Ecuador exhibiting significant policy turnarounds. Some others will remain more protracted like Pakistan, Sri Lanka, Kenya, Angola, and Tunisia. We would also expect some corporate situations to offer opportunities, in places like Brazil, Africa, or China.

Finally, current income should remain the key anchor of returns through any periods of valuation overshoots, with generous current yields in the 6-7% range for a hybrid 50/50 asset class between IG and HY, whose duration, at around 5.3 years has shortened by about a year since early 2022, due to the dearth of issuance. We believe in the ability of EMD to deliver low double-digit total returns in 2024, in excess of most other fixed-income asset classes.

Key Finisterre EM themes for 2024

#1 Fundamental focus to shift from inflation and central banks, towards growth and fiscal issues.

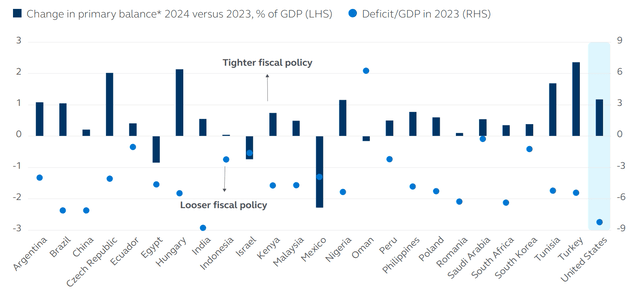

As we have seen in the summer of 2023 for the U.S., the perception of fiscal slippage can lead markets to account for a fiscal term premium (or rather a fiscal issuance risk). As global inflation is now on a receding path, we fully expect an upcoming shift of EM investors’ attention away from the past two years’ focus on inflation and the interest rate cycle, toward a more traditional blend of growth and fiscal dynamics. The latter will matter most to select EM sovereigns in USD, with the risk of further external debt issuance or sporadic fiscal deterioration ahead of key elections potentially weighing on sovereign spreads. Local interest rate curves could also be liable to steepening risks on the back of possible rising issuance, although they should ultimately remain anchored by continuing disinflation and the prospect of interest rate cuts. All in, current expectations as per the IMF World Economic Outlook look relatively benign with some moderate 0-1% of GDP primary deficit reduction between 2023 and 2024, but we remain conscious that higher refinancing costs should also weigh on headline deficit numbers, while elections are often the excuse for extra spending.

Select EMs 2023 fiscal balance versus expected 2024 primary balance change

As of October 2023 (Principal Finisterre, IMF World Economic Outlook)

*Primary balance = Total deficit – Interest payments.

#2 Income generation through EM short/mid duration corporates with visible cashflows.

As highlighted in the chart above, one dominant feature of U.S. fixed income into 2024 should be the pricing of a Fed pivot, i.e. the start of an interest rates cutting cycle. Yet, although we do not feel overly worried about this, market perception of persisting U.S. fiscal issuance risks into the U.S. election may lead the long end of the curve to underperform or at least exhibit less anchored behaviour. This informs our bias to expect a steepening bias for the U.S. curve, hence seeing the short/mid-duration part of EM credits as a resilient placeholder for income generation with some extra yield compression potential.

We like the extra spread and differentiation provided by a range of EM corporate credits in particular. We will summarize the reasons why we think that EM corporates offer incredible value versus similarly rated DM ones at every rating level: a blend of better intrinsic earnings quality and visibility, smoother debt structures, better access to refinancing via local banks, much lower overall levels of leverage at each rating level, and the natural diversification of default risk across so many country situations.

If one thinks that 2024 is a year to be nearly fully invested for an EMD portfolio, a key component of returns should be provided by a substantial allocation to a resilient basket of high-carry EM corporates. We like the quality of AT1 and T2 bank papers in Asia and Mexico, which are callable within a few years, and MREL (EU senior non-preferred) bank papers issued by Eastern European banks. Pan-African and Caribbean telecom or towers operators offer a blend of dollarized revenues and visible cashflows in currencies often linked to the USD (Caribbean Dollar) or the EUR (CFA franc). Oil and commodity exposure should find an expression through select African corporate oil producers or Middle-Eastern oil and gas quasi-sovereign issuers. We think that the Asia credit space remains quite poor in terms of attractive value opportunities although we continue to like the Macau gaming sector as a China normalization trade continuing to benefit from the lack of overseas travel by Chinese nationals. A couple of opportunities may also exist in the Indian renewable space. Finally, Brazil remains a fertile ground for diversified cyclical exposure, from steel to infrastructure or protein sectors, as a play on a growth rebound in both scope and quality, especially if administrative reform is passed in Congress in early 2024.

#3 EM FX: Beware the pace of rate cuts. Potential for relative value.

We believe that a more benign USD environment, either stable or somewhat weaker, is the narrative for 2024. Beyond being the right environment for the return of carry trades, we should also see domestic factors reasserting themselves. 2024 should then provide more opportunities for relative value ideas in the EM FX space, although the selection of the right criteria for differentiation will be key. We will focus on different blends of real yields versus growth potential, monetary policy direction and credibility, quality of the balance of payments, and the extent of external financing needs as a gauge of our FX stance.

A dominant factor of EM FX behaviour in 2024 should be the absolute (and relative versus the Fed) pace and credibility of upcoming interest rate cuts. Some examples of early interest rate cuts in Chile and Poland in 2023 have shown how quickly currencies could sell off if the move was perceived as premature or politically motivated. Hence, although the Fed gave us clearer signals that they are on a more accommodative path, selectivity will still matter and should focus on those currencies exhibiting the best blend of high nominal and real-yield differential, best growth/inflation trade-off, and retaining sufficient fiscal credibility. This does not mean that some countries can’t enact rate cuts in excess and ahead of the Fed. Brazil is a case in point of a country whose external balances have markedly improved, while the Central Bank retained high credibility in keeping very high real yields until inflation collapsed. While the fiscal stance is still looser than it should be (given large social spending pressures), several key tax and administrative reforms have contributed to the maintained confidence in broad fiscal management over the coming years, which now allows the BRL to maintain stability in the face of the rate cut cycle that started in the summer.

From a relative value standpoint, we still express a structural preference for Latin currencies over-developed Asian ones and are interested in high-yielding policy turnaround stories like Turkey and Nigeria which would still have a bias to trade China RMB or the ZAR from a short bias, given policy and growth constraints in those places, and assume that the year will be fertile for tactical relative value within the CE4 bloc.

#4 EM elections in 2024: the most intense cycle in 20 years.

2024 will be the most intense in 20 years for elections globally, with the all-important U.S. presidential contest seizing the headlines, but many other countries will also be going to the polls. The most globally significant should be the Taiwanese election in January, which may or may not help preserve the status quo of the island vis-à-vis China without triggering an escalation of tensions. We believe that none of China nor Taiwan would see any upside in a short-term rise in tensions. February will see Indonesia choose a successor to long-term incumbent Jokowi Widodo. His appointed heir and current minister of defence Prabowo Subianto leads the polls but seems to be a bit more polarizing and less fiscally rigorous, hence the degree to which he retains Jokowi’s legacy will be an important factor. The Mexican election will also see Andres Manuel Lopez Obrador leave his seat in April in what will be a key focus for EM investors, where his appointed successor is a pragmatist but possibly lacks his charisma and is not yet assured of a victory. South Africa’s general and presidential contest in May will likely be the first one since the end of Apartheid where the African National Congress (ANC) party loses its absolute majority and needs to govern with a coalition partner. Whether they end up aligned with the ultra-left Economic Freedom Fighters (EFF) party or the center-right Democratic Alliance (DA) will bear a lot of significance as to the country’s outlook, while they are still mired in an acute energy crisis creating fiscal strains and sub-par growth potential. Other key elections in Senegal, El Salvador, Pakistan, Ghana, Sri Lanka, and Tunisia later in the year will be closely watched and quite defining for those countries with still fragile debt dynamics.

Emerging markets elections in 2024

As of December 12, 2023 (Principal Finisterre, Barclays)

#5 Access to USD funding at a time of high refinancing needs: EMs are being creative

2024 will mark a peak in aggregate external debt repayments for EM sovereigns, at close to $300 billion before dropping modestly but remaining historically high until 2028.

EM sovereign external debt maturities by creditor type

As of December 6, 2023 (BNP Paribas, Bond Radar, IMF, World Bank, Bloomberg)

This has been a challenge in the past two years, where global liquidity was tightening and access to dollar financing was becoming more costly and competitive for many EMs. The large incumbent EMs could substitute external for domestic funding, thanks to their large domestic markets, and supported by expanding balance sheets of local banks, insurers, or pension funds. However, such refinancing issues have proven problematic for EM frontier countries, as market access remained closed to them. This has led many frontier currencies to depreciate sharply, from Egypt to Nigeria to Angola, but also in places like Turkey, as the shortage of dollars in local systems created panic buying at times. However, we expect the global relaxation of financial conditions to allow the better-rated and best-performing frontier countries to access the market again in 2024. Meanwhile, we are positively surprised by the financing creativity displayed by many EM governments. For sure, the shifting attitude of the IMF and World Bank – who both displayed more flexibility and readiness to support several EM frontier names, often for political reasons – has maintained the likes of Pakistan, Egypt, and Kenya afloat.

But 2023 was also the year of financial innovations: Blended bond financing, including multilateral guarantees, has allowed Ivory Coast and Benin to issue. The Dominican Republic and Jamaica have issued dual-currency bonds allowing foreigners a more liquid access to their local currency but in an international format, settling in USD. Countries with large natural resources that they struggle to protect, like Ecuador, Belize, Barbados, and Gabon have been able to buy back some of their existing debt via “Debt-for-Nature” swaps, so-called “blue” bonds, where new loans or bonds were provided or guaranteed by multi-laterals to partially fund nature conservation programs. We would expect such initiatives to continue into 2024, providing some welcome non-traditional financing solutions to more countries. While we expect a deluge of new issues from better-rated countries to start with a bang in January, we do not dismiss the likelihood that improving EMD flows and risk appetite could allow more EM high yielders to successfully return to external debt issuance in 2024 (Ivory Coast, Dominican Republic, Nigeria, Kenya?).

#6 Defaults are priced! Optionality from turnaround/distressed/restructuring stories.

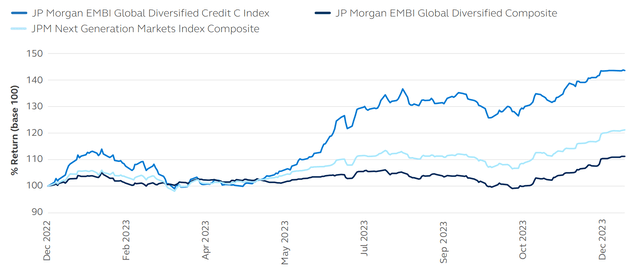

A lot has been said about the increased bifurcation in the sovereign credit space, with value now clearly on the side of the lowest-rated names, where fundamentals are definitely not about plain sailing. Yet we believe that, similar to 2023, where frontier sovereigns handsomely outperformed the more mainstream BB/BBB segment, 2024 should see more of this. In fact, we are able to identify a number of positive turnaround stories that should continue to fuel investors’ interest in this space.

Starting with the non-defaulters, we see Argentina, Turkey, Nigeria, Egypt, possibly Ecuador, Kenya, and, potentially, Tunisia in late 2024, exhibiting significant upside potential on policy improvements and/or additional donor support. Whether linked to leadership changes in Argentina, Ecuador, and Nigeria, a virtuous monetary and fiscal policy U-turn in Turkey (and hopefully Tunisia), or stepped-up multilateral and bilateral donor support for Egypt and Kenya as a result of some delivery on reforms, more so, geopolitical stability concerns; those countries’ prospects suddenly look more constructive into 2024.

When it comes to the ones in default, as we enter 2024, we also acknowledge a significant shift in the approach of EMD’s ongoing restructurings. Back in early 2023, many EM sovereign defaulters (in particular Zambia, Sri Lanka, and Ghana) were left in the cold, stuck between the IMF, China, and bondholders bickering about their respective status and the procedural impasse around the so-called “common restructuring framework” promoted by the IMF. Fast-forward nine months and things seem to have thawed significantly. Under pressure from geopolitical risks, the IMF has turned much more lenient in helping certain strategic countries like Pakistan, Sri Lanka, and Egypt, while remaining fully supportive of Ukraine, and could even discuss a plan with El Salvador after the February (re)election of President Nayib Bukele. The IMF also seems more inclined to consider bondholders as part of the solution, rather than blaming them for their supposed “recklessness” in lending to fragile countries at punishing rates.

The Chinese side has also softened its insistence on refusing debt haircuts and having all its creditor banks treated as senior to bondholders. As a result, a number of the loans provided by their public commercial banks may now be considered private debt. The experience of the Zambian restructuring has likely helped them gauge what those exercises are about, in particular, that one can’t always have their cake and eat it, too. We understand where they are coming from though, as balance sheet investors with no marking-to-market, which creates more incentives to “amend and extend”. In contrast, bondholders have already taken the full mark-to-market hit and thus are less averse to haircuts and keener to draw a line and start afresh with new performing instruments.

What the Ghanaian and Sri Lankan stories have also consecrated, is the fact that local debt should be part of the debt stack to be restructured, thereby no longer leaving local holders immune. Finally, in a lesson from previous restructurings, so-called “value recovery instruments” may become a feature of future ones, in that those instruments allow sovereigns to limit their initial debt service after restructuring, and obtain larger haircuts, lower coupons, or longer extensions, in return for future conditional payments to bondholders, should the country’s economy outperform the IMF macro-economic baseline as per their Debt Sustainability Analysis.

We have long argued that, in liquid EMD markets most defaults/credit risks relating to special sovereign and corporate situations tend to be priced in early, often well before the default occurs. Sovereign defaults, in particular, are typically not “stealth” defaults, but rather tend to happen following a visible deterioration. This typically means that on the eve of a default, bond prices already price the event, and investors are already positioning in reference to the potential future recovery value. Of course, an extra drawdown may occur on the announcement as some late holders become forced sellers, but these tend not to be long-lasting as value players step in and bring them back to a more sensible price. As a result, despite multiple credit events (and some more potentially in store), the distressed/ defaulted EMD space has delivered handsome returns (40%+ performance for EM C-rated sovereigns versus +10% for the main JPMorgan EMBI Global Diversified USD sovereign index) and we would expect more of the same in 2024. We like the fact that the space is most likely devoid of any “tourists” and mostly populated by distressed investors with experience in those restructuring proceedings.

2023 return comparison for frontier sovereigns, C-rated sovereigns, and the main hard currency EM sovereign debt index

As of December 29, 2023 (JPMorgan, Bloomberg, Principal Finisterre)

Risk considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Fixed-income investment options are subject to interest rate risk, and their value will decline as interest rates rise. International and global investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets. Emerging market debt may be subject to heightened default and liquidity risk. Investment in foreign currency can result in losses and values may fluctuate based on foreign exchange rates, exchange restrictions, or other actions of governments or central banks.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast, or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intended for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland.

Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorized and regulated within Europe, and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organization.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under the Corporations Act 2001.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/ Jurisdictions. This material is issued for Institutional Investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Funds Distributed by Principal Funds Distributors, Inc.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Finisterre is an investment team within Principal Global Investors.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

[1] Source: BNP Paribas as of December 6, 2023.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.