temizyurek

Introduction

Rio Tinto Group (NYSE:RIO) is a major iron ore miner. Besides that, RIO is one of the primary copper and aluminum producers. Most of its assets are in Australia and North America. The most pronounced risk (or opportunity) is exposure to the Chinese economy. 58% of the revenue derives from China. I am bullish on China despite the dominating negative consensus.

The company has a solid balance sheet with excess liquidity and a well-structured debt amortization profile. Compared to its prime competitors, Vale (VALE) and BHP Group (BHP), RIO has lower margins and returns while having better dividends and commanding similar valuations. RIO trades in the middle compared to its 10Y multiples, global materials, and global equity. The company pays dividends with an attractive yield, although with a higher payout (for my taste) ratio. The price is on the verge of a breakout, and if successful, I will take a small speculative position. However, from an investor standpoint, I prefer Vale to bet on surging iron ore demand due to the Chinese economic recovery. My verdict is a hold rating.

RIO Overview

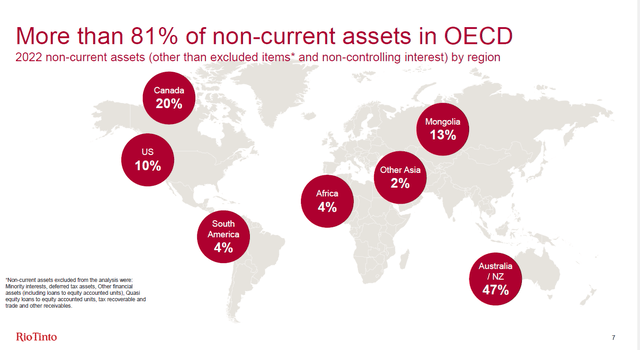

RIO started as a copper mining company in Spain in the 19th century. However, nowadays, it is one of the leading iron ore producers. Its assets are spread across the globe. The map below from the last presentation shows RIO`s operations.

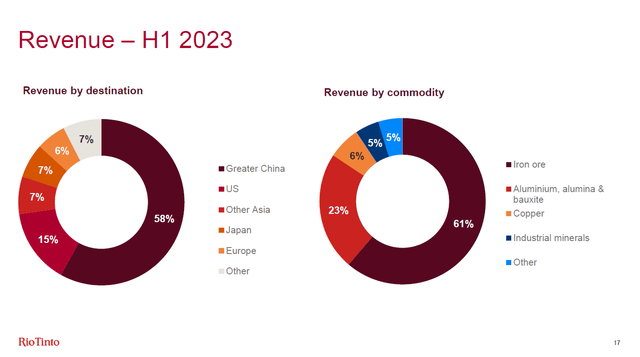

RIO sales globally its production. Its revenue structure is very similar to BHP. China buys 58% of RIO`s output. The second largest customer is Japan, with 15%. Owning RIO shares mean we take a long position in China and Japan.

Copper mining brings 6%, iron ore 61%, and aluminum 23% of total sales. RIO operates mines in the most prominent mining regions in the world. Its copper production comes from Escondida, the largest copper mine in the world. Mine’s annual output is 1.2 Mt copper, making up 5.5% of the world’s total production. The mine is operated by a joint venture between BHP (57.5%), Rio Tinto (30%), JECO Corp (10%), and JECO 2 (2.5%). Escondida falls in RIO`s non-managed operations assets. BHP is responsible for mine operations and management.

Australia is a global leader in iron ore production with 900MT. Around half the Australian iron ore production comes from the Pilbara region in Western Australia. RIO’s Pilbara operations comprise four port terminals, 17 iron ore mines, and independent rail work.

RIO owns You Tolgoi. It is one of the most significant copper and gold deposits globally. It is in Mongolia. In 2022, RIO acquired Turquoise Hill Resources to simplify the ownership structure of You Tolgoi. Currently, RIO owns 66% of mine. The Mongolian government owns the remaining 34%. Open-pit mining started in 2011. In 2013, the copper concentrator, the largest industrial complex ever constructed in Mongolia, started operation. In January 2022, the Oyu Tolgoi Board approved the start of underground activities.

RIO bauxite mines are in Brazil, Guinea, and Australia. In North Queensland, the company runs Weipa operations. They include three bauxite mines, processing plants, ship loaders, an export dock, and a rail system.

RIO has two bauxite operations in Brazil: Aluma refinery and Mineracao Rio do Norte (MRN). Those assets fall under the non-managed operations category. MRN is the largest bauxite mine in Brazil, with a capacity of 18 million tons annually. MRN is JV between RIO (12%), Vale (40%), South32, CBA, and Norsk Hydro (48%).

RIO is involved in the Bauxites de Guinee (CBG) mine in Guinea. The mine has an annual output of 14 million tons of high-grade bauxite. RIO owns a 22.95% stake in the mine, while the government of Guinea has 49% of the shares.

4Q23 production results

RIO’s three major revenue streams are iron ore, bauxite, and copper. Let’s look at how they performed in 4Q23. The tables below are from the last production report.

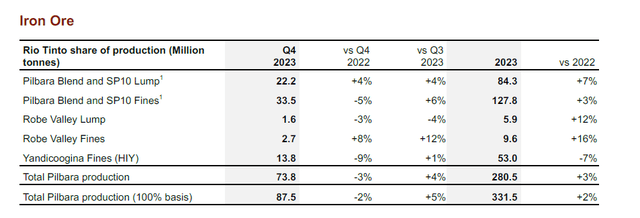

Iron ore

RIO produced 87.5 million tons in 4Q23, 2% lower YoY and 5% higher QoQ. Shipments had increased in the QoQ by 3%, though they declined YoY. On a yearly basis, 2023 shipments were 10 million tons higher than 2022. Gudai Darri ramp-up reaches its nameplate capacity of 43 million tons, offsetting mine depletion. China iron ore sales grew 14.5% YoY from 4.8 million tons in 4Q22 to 5.8 million tons in 4Q23. However, total shipments to China declined annually from 24.3 Mt in 2022 to 23.3 Mt in 2023.

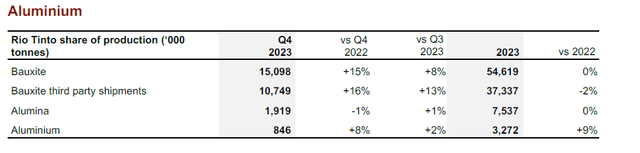

Aluminum and bauxite

Bauxite production had improved significantly, with 15% higher YoY and 8% QoQ. RIO shipped 16% more bauxite in 4Q23 compared to 4Q22. Improved equipment efficiency in Weipa and Gove drives the growing production. Queensland Alumina refineries improved their operations in 4Q23 and reached 100% capacity. The results are higher alumina production by 1% compared to 3Q23. On the other hand, RIO realized a slight decline of 1% of output YoY.

The Kitimat smelter returned to total capacity, and Boyne cell recovery succeeded. As a result, aluminum production grew by 8%, compared to 4Q22, reaching 0.8 Mt. RIO`s aluminum recycling operations delivered 582 kt.

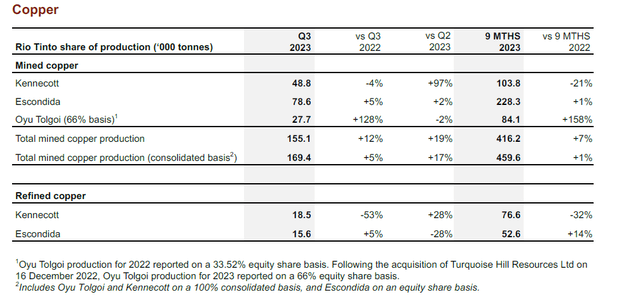

Copper

RIO successfully ramped up Oyu Tolgoi underground operations, delivering 0.53% average head grades (for the whole mine) and improving copper production YoY by 26%. Open pit operations produced 8.7 Mt at 0.42% head grade, higher than the 3Q23 grade at 0.39%. The underground mine delivered 0.9. Mt at 1.59% head grade, lower than 3Q23 at 1.73%.

Escondida production dropped by 2% YoY. The prime reason is the lower concentrator recovery and declining grade on the oxide leach pad. Higher head grade in the concentrator and increased output by 2% partially compensated for the lower concentrator recovery. The lower copper grade affected refined production output, dropping by 5%.

Kennecott concentrator ran at full capacity in 4Q23, resulting in a 1% higher copper production YoY. On the other hand, rebuilding the Kennecott smelter and refinery is still in progress, affecting refined copper production. The latter dropped by 11% YoY. RIO expects to complete the ramp-up process in 1Q24.

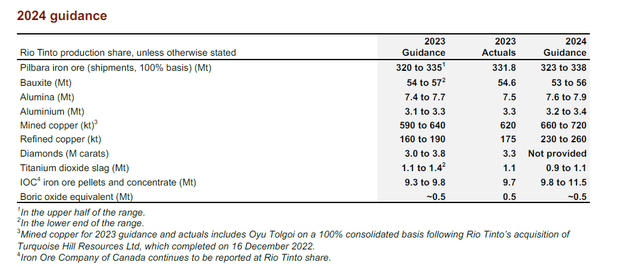

In conclusion, let’s see the production guidelines for 2024.

Pilbara is expected to deliver 323-338 million tons of iron ore. This figure is unchanged since October 2023. RIO plans to increase Gudai Darri production by 7 Mt, to reach 50 Mt annual capacity. Iron ore unit costs are anticipated to be between $21.0-$22.5/ton range. Bauxite production is expected to remain in the same range as 2023. However, alumina and aluminum output are projected to increase. Cooper unit costs are expected to be between $0.18/lb and $0.20/lb.

Balance sheet

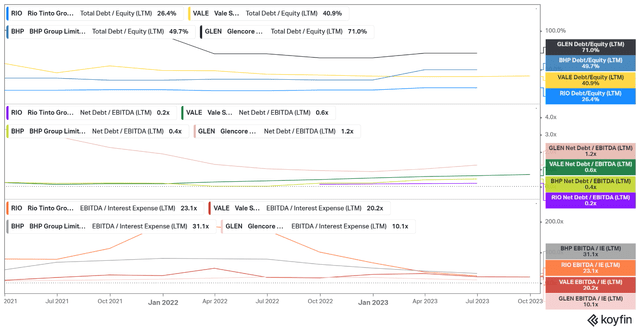

Over the last few years, mining majors have been very profitable. Higher margins and returns resulted in improved balance sheets. RIO is not an expectation. The company scores one of the best metrics: 26.4% total debt to equity, 0.2 Net debt to equity, and 23.1 EBITDA to interest expenses.

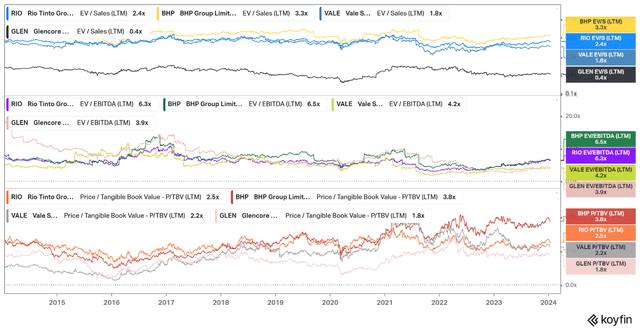

I compare RIO with its prime competitors: VALE and BHP. I added Glencore (OTCPK:GLNCY) for additional context. GLNCY’s revenue primarily derives from copper and coal. However, it is one of the top mining companies in the world, and it is valuable to use it as a reference point.

RIO has $10.5 billion cash,$12.6 billion long-term debt, and $14.07 billion total debt. It is obvious the company is solvent. The following crucial variable, liquidity, is top-notch, too. RIO realized $12.63 billion operating cash flow LTM and $14.3 billion operating profits LTM. In the meantime, the company’s net interest expenses are $596 million.

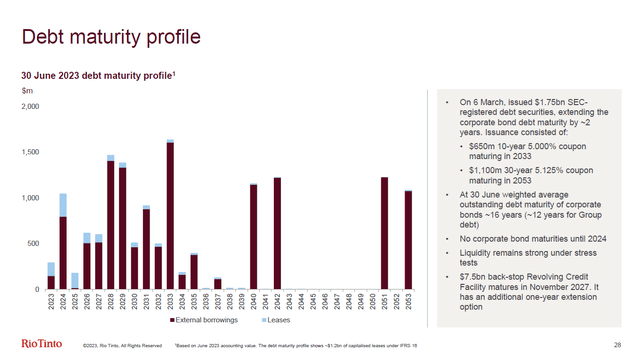

RIO`s maturity profile is well structured.

The company’s average debt maturity is 12 years (for bonds is 16 years). RIO has access to a $7.5 billion revolving credit facility (RCF). The latter has an option for a one-year extension until November 2028. In March 2023, RIO issued a $650 million 10Y debt with a 5.0% coupon and a $1.1 billion 30Y debt with a 5.125% coupon.

Profits and dividends

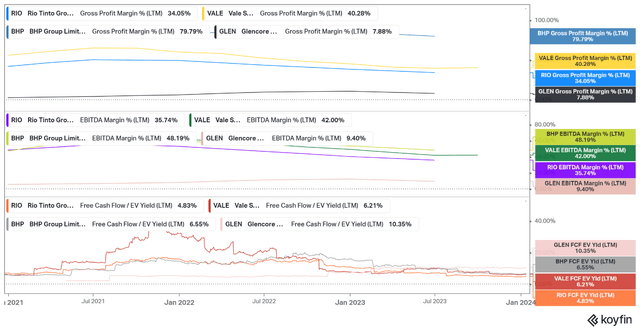

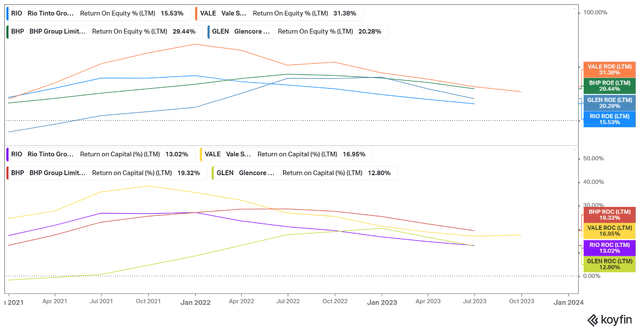

The following two charts compare RIO, BHP, VALE, GLNCY margins, FCF yield, and returns.

RIO is not the most profitable in its peer group. BHP and Vale hold the pole positions. GLNCY holds the bottom except at FCF yields, which score 10.3%. Such differences are undesirable considering the four companies’ distinct operations. VALE has one of the best cash cost profiles in the iron ore and copper mining segments.

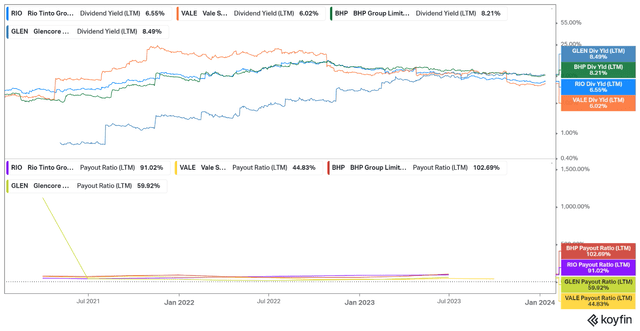

RIO pays dividends with an attractive yield comparable to Vale.

However, Vale has a lower payout ratio (44%), while RIO has 91%. I prefer it below 50%. The reason is simple: maintaining a lower payout ratio, the company can use its free cash flows for share buyback, extra CAPEX, or to top up its coffers. GLNCY and VALE meet my requirements here.

Valuation

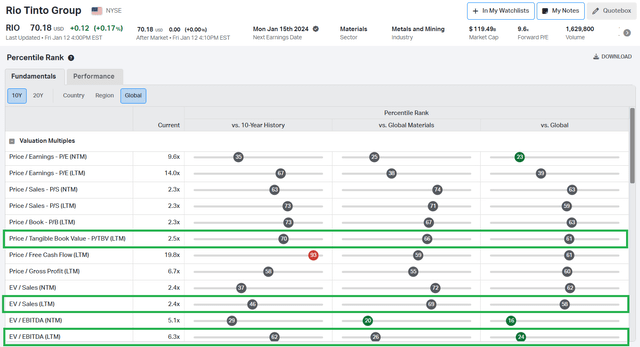

RIO trades in the middle compared to its 10Y multiples, global materials, and global equity.

RIO trades relatively high compared to its peers.

VALE and GLNCY share the bottom, while BHP and RIO trade higher. RIO and BHP command higher multiples because they are more popular and less scary than Vale and Glencore. The former is Brazilian stock, enough to scare most investors, while the latter has been framed negatively in the media. RIO and BHP are part of the commodity investors’ starter pack. However, being an entrepreneurial investor pays out. GLNCY and Vale offer more value at the present stock prices.

Price action

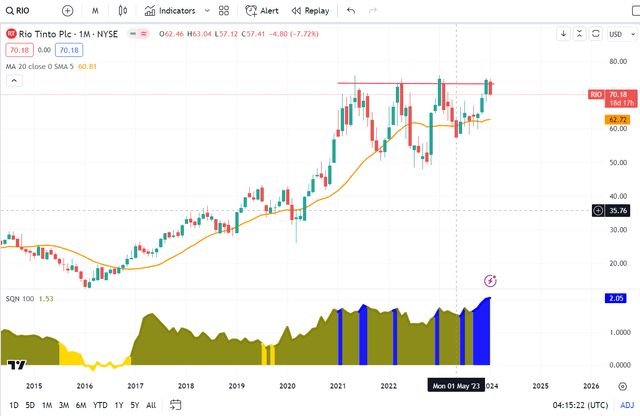

I like RIO price action. The price is close to breaking at the inverted head and shoulders pattern.

Besides that, the price falls within one standard deviation from the 20-month moving average. Simply put, the price is not overstretched. SQN indicators are getting hot, being in a bull volatile regime. I will take it as an entry signal if we have a confirmed break out above the neckline. Till then, I wait patiently.

Risks

Like Vale and BHP, RIO’s profitability depends heavily on the Chinese economy. I am long China, not directly by investing in Chinese equities but by betting on major miners like Vale. 2024 is the year of the Dragon, and the CCP is expected to push hard for economic recovery using all available monetary and fiscal tools. The rising geopolitical risk adds pressure on the supply chains. This can have multiple effects on all miners. Depending on the commodity and where its operations are, the mining company can benefit or suffer from logistic constraints. The political risk almost does not exist for RIO. Its prime assets are in North America and Australia. RIO is involved in operations in Chile, Brazil, and Guinea. The former two are among the safer countries outside North America and Australia for doing business. Financially, RIO has solid liquidity, low debt to equity, and extended debt maturities.

Investors takeaway

RIO is among the first names that come to mind when discussing mining majors. The company is a significant iron ore, copper, and aluminum miner. Financially, the company is sound. Its debt amortization profile is well-structured, and its balance sheet is strong with excess cash. RIO’s margins and returns are lower than those of its top rivals, Vale and BHP. The company pays dividends with an appealing yield but high payout ratio. Regarding valuation, RIO is not expensive, although not the cheapest. RIO, compared to BHP and VALE, trades higher.

If I want to play safer, I would bet on BHP because of the higher margins and returns and better dividend yields. RIO is in the middle. It is neither a conservative bet with solid yields nor risky but cheap. I prefer to stay at one of the sides of the bell curve but not in the center. In my opinion, being in the middle is the most unproductive place to be as an investor. VALE is my top pick to bet on rising iron ore and copper demand due to the Chinese recovery. My verdict is a hold rating