deliormanli

TELA Bio (NASDAQ:TELA) is a small-cap medtech company focused on soft-tissue preservation and restoration. Their portfolio of products consists of OviTex, a reinforced tissue matrix that was designed to address some of the shortcomings of currently available tissue matrices. OviTex is currently on the market for use during hernia surgical procedures, and OviTex PRS is currently on the market for use during plastic and reconstructive surgery.

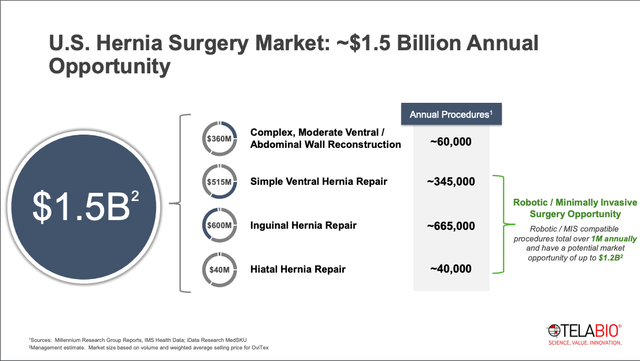

A hernia usually occurs in the abdominal region, when an organ pushes through the muscle or tissue that contains it. Hernia repair is one of the most common surgeries performed in the US, with over 1.1M procedures performed annually. This figure includes moderate ventral/abdominal wall reconstruction, simple ventral hernia repair, inguinal hernia repair, and hiatal hernia repair. Management estimates that these 4 procedures represent a combined market opportunity of $1.5B (this implies an average cost per procedure of $1,351 for OviTex, which is about 20%-40% cheaper than competing meshes).

November 2023 Investor Presentation

Presently, the standard of care for hernia repair has been to implant a synthetic or biologic mesh in order to fortify the tissue rupture. Unfortunately, both types of meshes come with drawbacks.

Synthetic meshes are much stronger and longer lasting, but can lead to long-term complications such as pain, site infection, internal bleeding, bowel obstruction, etc. Case in point, there are currently thousands of pending lawsuits against mesh producer Bard (a subsidiary of Becton, Dickinson and Company (BDX)), providing evidence of the unfavorable tolerability profile.

Biologic meshes, on the other hand, are much better received and tolerated by the host. But long-term, their durability and strength begin to weaken, resulting in diminished efficacy.

OviTex was designed to address these two shortcomings. Its base consists of ovine rumen (sheep intestines), with a small amount of synthetic polymer mixed in. The hypothesis is that with a majority of the material being biologic, the host’s body will better tolerate it. And the small amounts of polymer will give it some extra durability compared to a purely biologic mesh.

Given that OviTex was initially launched in the US in July 2016, the question that investors should immediately ask is why sales have not taken off yet. Normally, a drug takes 5-7 years to hit peak sales, so sales of only $29M in 2022 should be cause for concern.

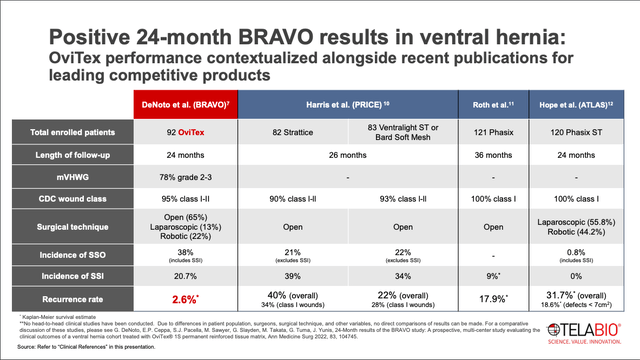

One possible explanation for why sales have not taken off yet is the lack of a head-to-head study comparing OviTex to competitors. The long-term, 24-month BRAVO study looked at usage of OviTex in ventral hernia procedures. As you can see in the slide below, the results were encouraging. Out of the 92 patients that were treated with OviTex, the rate of surgical site infection (SSI) was 20.7%, which compares favorably to other meshes. The rate of surgical site occurrences (SSO) was 38%, which is much higher than some of the other studies showing SSO rates of 21% and 22%. However, the BRAVO study included SSIs in the SSO calculation, whereas the other studies excluded SSIs in their SSO calculation. So the tolerability profile seems acceptable.

The data point to get most excited about is the recurrence rate of 2.6%. This is extremely favorable compared to recurrence rates of 18%-40% for other products.

November 2023 Investor Presentation

However, the data needs to be taken with a grain of salt. The data is not from a head-to-head trial, but rather a comparison of a single OviTex arm against the results of other mesh studies.

While it’s encouraging, we can’t yet say that OviTex is definitively superior to the competition.

Unfortunately, of the four new studies shown on Search of: ovitex – List Results – ClinicalTrials.gov, three will also be single arm studies, where all patients will receive OviTex. The fourth, “Mesh Vs Pledgets for Repair of Paraesophageal Hernia”, will be a randomized study, but the comparison will be between patients receiving OviTex and patients receiving a non-mesh treatment (pledgeted sutures). As it stands right now, this lack of direct comparison data is what keeps TELA from being a more compelling investment.

Results for 3Q23 were announced on November 9. Through the first nine months of 2023, total revenue was $41M, matching total revenues for all of 2022. Management guidance for full year 2023 is for total revenue to be in the range of $57M to $60M, representing growth of 38% to 45% year-over-year (yoy). This would be a continuation of the strong trend seen in recent years, where revenue grew by 41% in 2022 and by 62% in 2021. While OviTex represents upwards of 70% of total revenue, OviTex PRS (for plastic and reconstructive surgery) is also a meaningful contributor to revenue, bringing in $12M in 2022 (+41% yoy), and is also seeing strong growth since launching in May 2019.

This 2016 article from Evaluate discussed the purchase of Acelity’s LifeCell unit by Allergan for $2.9B. Among the portfolio of products that LifeCell had were Strattice, a porcine (pig) tissue-based mesh used for hernia repair, and AlloDerm, a human allograft tissue matrix used for plastic and reconstructive surgery. Annual sales in 2016 were $160M for Strattice and $280M for AlloDerm, with estimated combined peak sales of $467M by 2022. These figures validate the market opportunity for OviTex and OviTex PRS, and show that relative to the current market cap of $164M, there is room for some nice upside potential, assuming sales continue to exhibit strong growth off of the current $60M level.

As of September 30, 2023, cash and cash equivalents stood at $58M. Assuming quarterly cash burn remains steady at around $10M, TELA is probably down to around $47M when the next earnings are announced. They filed a $150M shelf offering on November 13, and it’s highly likely there will be a dilutive stock offering in the near future, given that they are still a bit away from break-even. The increase in the salesforce has caused expenses to rise significantly, so the need for cash certainly presents an additional risk that investors should consider.

But all in all, I think there is enough to like here to justify a small buy. The fact that we don’t have head-to-head data against OviTex competitors is what keeps this from being a compelling buy. But there is clearly a market for hernia mesh products, and the shortcomings of existing synthetic and biologic meshes have been well-documented. OviTex attempts to remedy these shortcomings, and the recent sales growth gives hope that medical practitioners are responding favorably to the data we do have, even if it isn’t fully conclusive yet. I think TELA stock is a Buy.