Artificial intelligence (AI) isn’t just another tech buzzword; it’s a groundbreaking force, reshaping our lives and businesses. In a memorable blog post from the spring of 2023, Microsoft founder Bill Gates compared AI’s game-changing powers to the introduction of the internet and the mobile phone:

It will change the way people work, learn, travel, get healthcare, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.

And Gates is not a lone voice in the wilderness. For instance, futurist and inventor Ray Kurzweil respectfully dissented when asked to sign an open letter calling for a pause in high-powered AI research. “There are tremendous benefits to advancing AI in critical fields such as medicine and health, education, pursuit of renewable energy sources to replace fossil fuels, and scores of other fields,” Kurzweil wrote.

The renowned scientist, serving as Alphabet‘s director of engineering since 2012, saw this revolution coming decades ago. Kurzweil used to believe that affordable household-level computers would eclipse human brain power around the year 2020. That deadline has moved to 2045 or thereabouts, but “humanity 2.0” is still coming. You can’t stop progress — you can only hope to contain it.

The world is changing before our eyes, and the next generation of humans will co-exist with AI-powered computers in a whole new way. These sea changes are rare and extremely powerful. Experts like Gates and Kurzweil argue that AI is the next truly game-changing technology.

So it’s high time to prepare for what’s next. For investors like you and me, that means grabbing a diversified basket of promising AI stocks. Here’s why SoundHound AI (SOUN 2.83%) and IBM (IBM 2.25%) would be helpful components of that basket.

SoundHound: Making the leap from tunes to tech

You may know SoundHound for its music identification app. You know the drill — play a few seconds of any song into your smartphone’s microphone, give SoundHound another couple of seconds to find sonic patterns in that sample, and get data such as the song title, artist, composer, and lyrics.

Rivals like Shazam (now a part of Apple (AAPL 0.18%)) and Deezer work by “fingerprinting” the audio and matching the result to a database of known signatures. SoundHound’s AI-based system digs deeper into the characteristics of the track before matching a more sophisticated range of patterns. For example, SoundHound can isolate the melody line, allowing you to find tunes by singing or humming into your phone — in the wrong key, at an unexpected tempo, or in a noisy environment. Shazam’s simpler approach can’t do that.

But song-ID services are not terribly lucrative, so SoundHound has expanded its focus around the core expertise of AI-powered audio analysis. So SoundHound built a powerful audio recognition engine known as Houndify around its years of song-focused research and oodles of data from those 10-second samples. The company quickly found clients in the automotive industry and consumer electronics. More recently, SoundHound launched voice-driven tools for restaurant management.

Now, SoundHound is a direct bet on AI technology delivering superior results to more traditional consumer-facing systems. You’ll run across automated Houndify interactions at drive-through windows and in call center phone menus. If you’ve gotten used to telling your car what radio station to play or what temperature you want in the air conditioning, you may very well use SoundHound’s Houndify every day without knowing it.

And this little company is going places. SoundHound’s trailing revenues stood at $19.6 million in the summer of 2022, just after its initial public offering (IPO). It has nearly doubled since then to $38.2 million. The company is unprofitable so far but getting closer to the breakeven point in every quarter. Furthermore, the stock isn’t exactly setting the world on fire. SoundHound’s shares have traded sideways since November 2022, despite the AI boom of 2023.

I expect big things from SoundHound AI as it continues to expand into new target markets while refining its pricing and profits. In a worst-case scenario, the company could be a buyout target for some tech giant without a credible audio analysis platform. But ideally, this undervalued growth stock should have room to run higher for many years as a stand-alone business.

IBM: Not your grandpa’s old-school tech giant anymore

Big Blue is a long-standing leader in the tech industry, with a trend-setting presence in the AI segment through its Watson platform. This AI system, famous for winning “Jeopardy!” and beating the world champion of chess in 1999, has evolved into a powerful tool for business analytics and cloud services. IBM is happy to leave consumer-grade AI tools to other companies, focusing on business-grade services instead.

IBM’s shift to hybrid cloud computing and AI-focused strategies under CEOs Ginni Rometty and Arvind Krishna signals a commitment to remaining relevant in the rapidly advancing tech landscape.

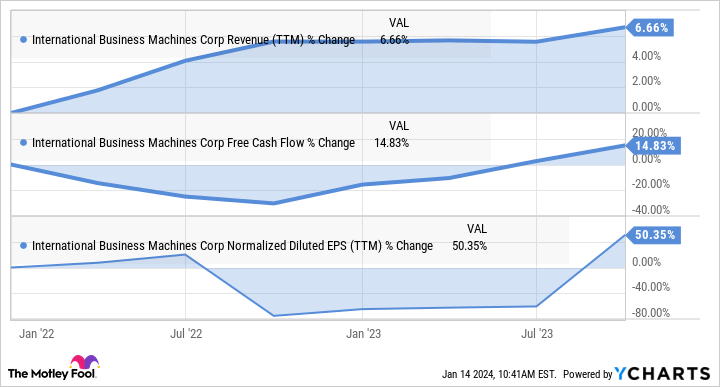

The company’s recent financials show a steady trajectory, with a renewed focus on high-margin cloud and AI services. Sales are up by 7% over the last two years while free cash flows rose 15% and diluted earnings per share jumped 50% higher. These positive trends include an inflation-driven dip in 2022:

IBM Revenue (TTM) data by YCharts

This pivot positions IBM as a stable and promising investment in the AI field, backed by a legacy of innovation and a clear vision for the future. And investors seem to have forgotten about IBM’s robust AI chops amid the recent boom. Big Blue’s stock trades at a bargain-bin valuation of 12.5 times free cash flows and 22 times earnings, having gained a below-par 14% over the last 52 weeks.

If you’re looking for a powerful AI stock without the lofty trillion-dollar price tags of market darlings like Nvidia or Microsoft, IBM strikes me as a top idea today.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet, International Business Machines, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.