John M Lund Photography Inc

This article was coproduced with Chuck Walston.

With a market cap of $62 billion, Humana (NYSE:HUM) is the fifth-largest player in the healthcare plans industry.

As November drew to a close, an announcement that Cigna (CI) was seeking to acquire Humana tanked the shares of both companies. Although Humana’s stock has recovered a bit, it still sits near a 52-week low.

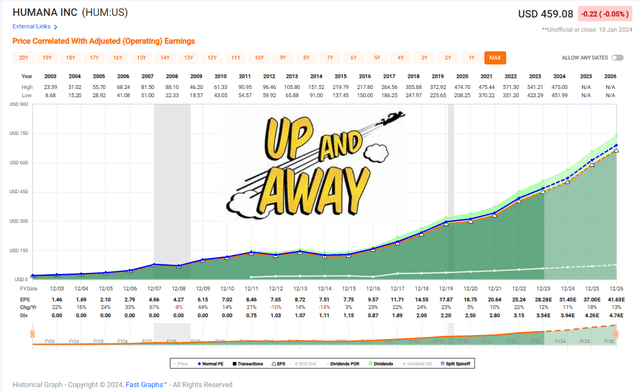

Despite the stock’s poor performance of late, shares of HUM have beaten the S&P 500 by a wide margin over the last ten and fifteen years. And while some may view the low yield as a negative, the dividend is very safe and is growing at a double-digit pace.

Add to that the fact that this fiscal year’s results are marked by double-digit growth in memberships.

Consequently, Humana’s fall from grace may provide a solid investment opportunity, as an aging population should drive long-term growth in the health care sector.

Recent Results Reveal Strong Growth

For the second quarter, HUM posted revenue of $26.8 billion, a 13% increase year over year, along with EPS of $7.66, up $5.48 from the comparable quarter.

That was followed on the first day of November by Q3 2023 results. Humana posted a double beat with adjusted EPS of $7.78 surpassing consensus of $0.61.

Revenue also increased year over year by 15.9%, hitting $26.42 billion. That metric also beat analysts’ estimates by $840 million.

However, increased utilization affected HUM’s insurance segment. The firm’s benefit-expense ratio, which measures the percentage of payouts on claims compared to its premiums, increased to 87.4% from 85.5% in the comparable quarter.

Following management’s revelation that Humana expected higher medical costs in its Medicare Advantage business, the shares fell by 6%. This also led to revised guidance for growth at the lower end of the prior targeted long-term range of 11% to 15% in 2024.

Recognizing the increased utilization we have now seen in 2023 and prudently assuming this level of utilization continues into 2024, we currently anticipate growth at the low end of this range.

CFO Susan Diamond

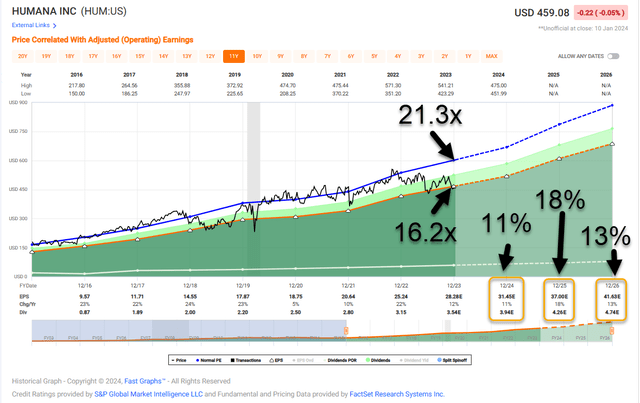

However, for the full year, management reaffirmed adjusted EPS guidance of at least $28.25 which reflects a 12% increase over 2022.

The company also projects annual membership growth of 850,000, a 19% increase that significantly outpaces the industry.

Management targets 2025 adjusted EPS of $37.

Where Humana Shines

From 2017 through 2021, Humana’s Medicare Advantage memberships increased at a CAGR of 11.4% versus 9.1% for competitors.

A study by Forrester ranked HUM #1 among health insurance providers in Customer Satisfaction with Dental Plans, #1 in Communication, #1 in Plan Cost, and #1 in Customer Service Experience.

This marks the third consecutive year that Forrester ranked HUM number one among health insurers for customer quality.

JD Power ranked Humana as #2 among Mail-Order Pharmacies in the US in 2022, and once again, the company has been named the best overall Medicare Advantage insurance company by U.S. News and World Report.

Lest one discount this performance, it is important to note that with Medicare Advantage, the government pays insurers bonus payments for high star ratings. Star ratings, with 1 being the worst and 5 the best, are taken for every insurance plan and focus on outcomes, processes, patient experience, and access.

For 6 consecutive years, Humana recorded the highest percentage of members in 4 star or higher-rated contracts in the nation. In 2024, 94% of the firm’s members will be enrolled in programs rated 4 stars or higher and 61% in plans rated 4.5 stars or higher.

Approximately 98% of Humana’s Medicare Advantage enrollees for the 2024 bonus year are in 4-star plans or above, an industry leading score.

Compare those scores to the national average 4-star ratings for all providers of 72%.

In bonus year 2023, Humana raked in $4.4 billion in star bonus income. While that is an achievement in and of itself, investors should note that to do so, Humana’s programs provided levels of care that drove down costs while improving outcomes.

For example, those enrolled in HUM’s value-based care programs collectively experienced 12% fewer emergency room visits and 245,000 fewer days in hospital beds.

Investors should also understand that Humana benefits from local scale-related cost and network advantages. In most areas in which it operates, Humana is the number-one or number-two Medicare Advantage insurer.

Wherever Humana holds local scale advantages, it provides the company with negotiating power with service providers.

In turn, this allows HUM to offer lower-priced products and services and/or more benefits to current and prospective members versus those of most rivals. This can result in a virtuous cycle which attracts more clients and healthcare providers while also driving down Humana’s costs.

Management has stated that once clients remain on the company’s Medicare Advantage plans for two years, they usually continue with the company for life. Humana’s retention rates average approximately seven years, including involuntary terminations. This is relevant as profitability tends to increase the longer a client sticks with Humana’s plans.

Humana also has the fourth-largest pharmacy benefit manager. Along with the firm’s increasing presence in the provider space, this leads to stronger cost management.

A Strong Industry Outlook

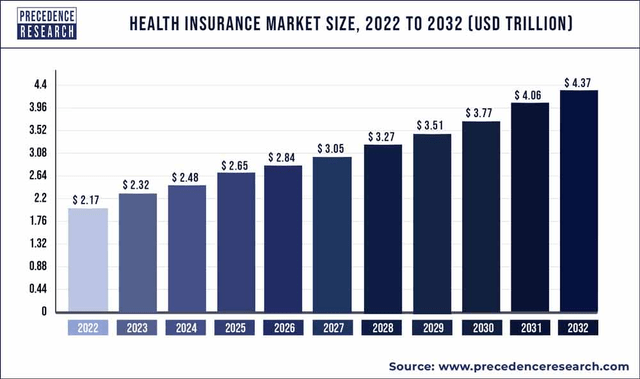

According to Precedence Research, the global health insurance market is projected to record a CAGR of 7.3% from 2023 to 2032.

There are 64.3 million Medicare-eligible individuals in the US today, with one in five US residents facing retirement age by 2030.

Humana forecasts the Medicare Advantage industry will grow in the high single digits through 2025 and expects to garner membership growth at or above that of the overall industry.

Those trends point to robust demand for Humana’s products for the foreseeable future.

An aging population will also result in growth in home health care. Humana estimates that the home health care is recording a sustained CAGR of 6%.

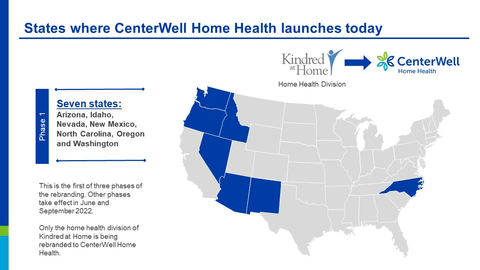

Source: HUM Investor Relations

Home health care is a highly fragmented and growing business. The top five players hold just over a fifth of the market, and with CenterWell Home Health, a home health and hospice provider, HUM sits atop that group with a 6% share.

CenterWell now operates 296 centers, serving nearly 285,000 patients, representing a year-over-year growth of 33% and 17%, respectively.

HUM projects patient annual growth this year for CenterWell in a range of 34,000 to 36,000, far exceeding the original forecast of 20,000 to 25,000 new patients. This more than doubles the patient growth achieved in 2022.

Debt, Dividend, And Valuation

Humana’s debt is investment grade and is rated BBB+ by S&P, Baa2 by Moody’s, and BBB by Fitch.

HUM currently yields .77%. The payout ratio of 12.42% is quite low and the 5-year dividend growth rate is at 12.1%.

Trading at $456.61 per share, HUM’s forward P/E of 17.36x is significantly below the 5-year average P/E for the stock of 19.08x.

The 5-year PEG ratio of 0.99x is well below Humana’s average PEG ratio over the last 5 years of 1.34x.

Humana has a fairly robust share repurchase program. In 2022, the company repurchased $2 billion in shares. As of the end of Q3, HUM bought back approximately $1 billion in shares this fiscal year and anticipates share repurchases of approximately $1.5 billion in 2023.

The current market cap is roughly $56.5 billion.

Is Humana A Buy, Sell, Or Hold?

Humana’s focus on Medicare Advantage plans places it at the forefront of one of the fastest-growing areas in U.S. medical insurance.

U.S. demographic trends should provide strong tailwinds for the company over the foreseeable future.

For 2024, management guides for earnings growth within its long-term target range of 11%-15%.

Although industry wide headwinds affecting Medicare Advantage, coupled with elevated medical utilization, will likely push growth to the lower end of that range, management still expects adjusted EPS of $37 in 2025.

This would represent a 14% CAGR from 2022 to 2025.

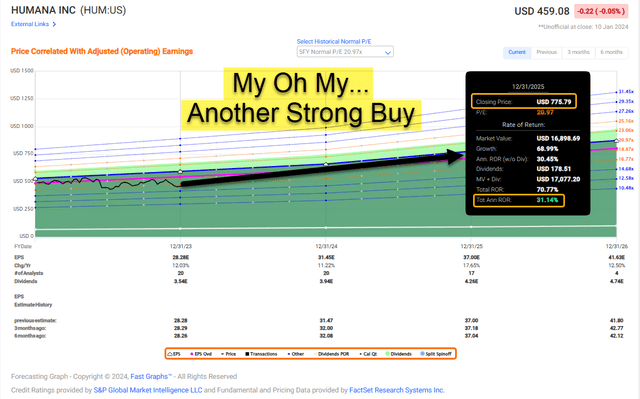

With a strong balance sheet, a hefty share repurchase plan, a safe, a rapidly growing, albeit rather anemic yielding dividend, strong growth prospects, and an enticing valuation, I rate Humana as a Strong Buy.

I will provide a caveat in that my Strong Buy rating is based on holding the stock for an extended period.

I have a small position in the company, and I will readily admit that as a dividend focused investor, I am struggling with myself over whether to increase my position. However, if I was a decade and a half younger, I would definitely be adding aggressively to my investment in HUM.

I’ll add that when I began my due diligence of Humana, I did not expect to rate the stock as a Strong Buy.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.