guvendemir

Earnings season is here for the stock market, and the fourth quarter is not expected to be as strong as the third quarter, based on analysts’ consensus estimates. This may surprise some, given that the equity market has rallied aggressively since the third-quarter reporting season ended in October.

Fourth-quarter earnings for the S&P 500 are expected to fall to $54.47 per share as of January 12, down from $57.77 per share in the third quarter. That would be a quarter-over-quarter decline in earnings of about 6%. Meanwhile, fourth-quarter earnings are expected to rise by roughly 2% versus last year’s results of $53.36 per share.

Margin Expansion Is The Key

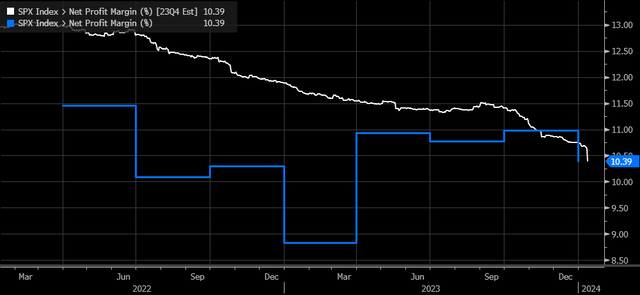

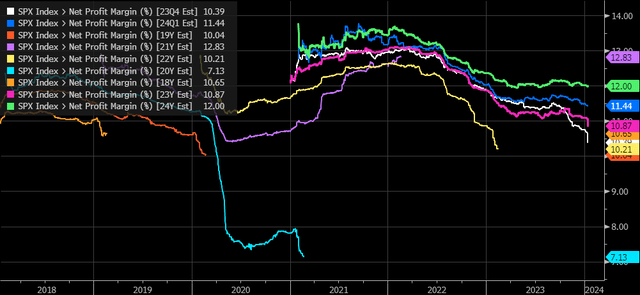

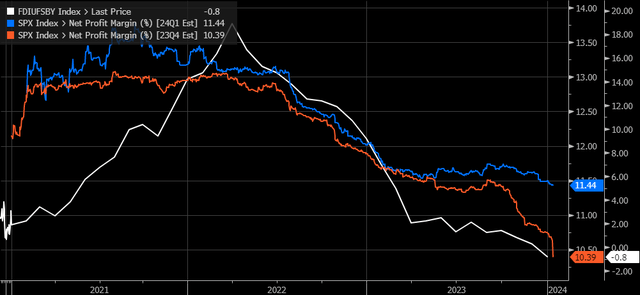

Earnings estimates have been falling in the fourth as margin estimates have declined dramatically to just 10.4%, as noted in October, down from estimates of 11.5% in September and a peak well over 12%. This is similar to what happened in the fourth quarter of 2022, where margin estimates started to come down heading into results and then were sharply revised lower as earnings began to roll in.

Fourth-quarter 2023 margins will also be down from third-quarter margin levels, which expanded to around 11% from 10.7% in the second quarter and were flat with first-quarter margin levels.

Lower Inflation Rates And Rising Costs

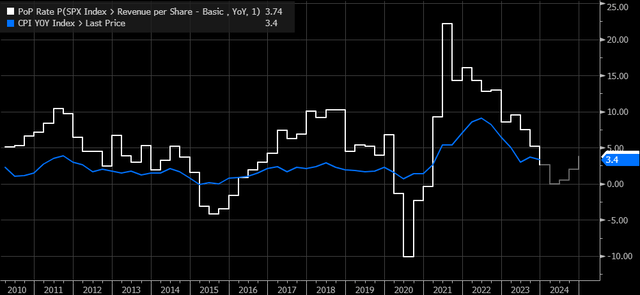

The latest inflation data doesn’t speak too well to the direction of margins in 2024 either, and that could begin to show up in the first quarter and full-year guidance as we move through earnings season. Because of lower inflation, sales growth will likely be lower in 2024, while rising costs push margin expectations lower in 2024.

Sales are expected to grow by 2.6% in the fourth quarter versus a year ago and then fall to just flat in the first quarter versus a year ago. This would reflect the falling inflation rate.

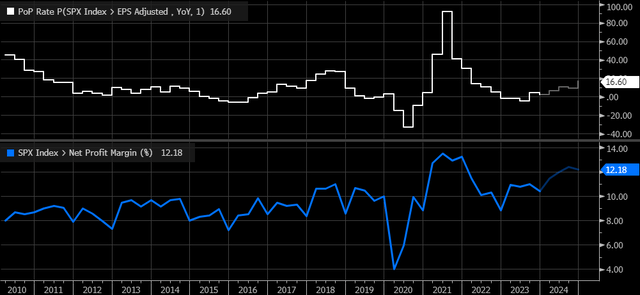

Despite forecasts for no sales growth in the first quarter, earnings growth is expected to accelerate to around 6% y/y, which means that some of that growth can come through stock buybacks and, more importantly, from margin expansion. Margins are forecast to expand in the first quarter to 11.4% from 10.4% in the fourth quarter and from 10.9% in the first quarter of 2023.

However, estimates like margins tend to start high and then come down over time, and that is what we have already started to see for the current fourth-quarter and first-quarter estimates. 2021 was one of the only years since 2018 that has seen margin estimates rise throughout the year, and that was due to the dynamics of the pandemic. Historically, margins range from 10% to 11% over time, with 2021 margins rising to almost 13%. Even 2022 reverted to the historical trend of margins starting high and falling below 11%. While 2023 isn’t over yet, it seems more likely that those margins will be closer to their historical norms between 10 and 11%, with current estimates at 10.9%, but 2024 is expected to rise to 12%.

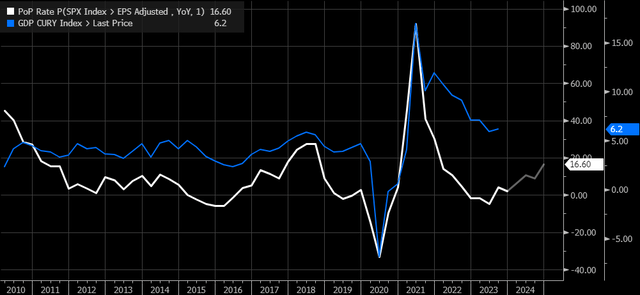

The producer price index trade services y/y, which measures the margins that wholesalers and retailers receive for the services they provide, calls into question the margin expectations from analysts. That index has tended to track margins quite well over history, suggesting that margins aren’t likely to expand. They even suggest that margins will still be under further pressure in the first quarter.

It could be why estimates for the fourth quarter margins plunged following the PPI report and why first-quarter estimates ticked lower.

Slower Nominal Growth

The big jump in earnings growth in the first quarter may not be quite there yet, and that would mean that overall estimates for 2024 are too high and may still need to be adjusted lower. In the end, earning growth rates are just a reflection of nominal GDP growth, and what seems to be clear is that if inflation, which is a big part of nominal growth, is coming down, then nominal growth rates should continue to fall throughout 2024, and return to something more normal, and something closer to 4%, assuming a 2% inflation rate and 2% output growth.

In the end, the stock market trades on earnings expectations, and right now, earnings reflect the idea of expanding margins and buybacks driving earnings growth in 2024. The evidence thus far doesn’t seem to suggest that margins and earnings growth are likely to be as strong as currently being priced in unless sales growth accelerates meaningfully, but we will have to wait until the end of earnings season to find out.