Nucor (NUE 0.42%) is one of the largest and most diversified steel makers in North America. On the same day, it announced some good news and some bad news.

Wall Street tends to think short term, so the bad news attracted a lot more attention. Long-term dividend investors, however, should pay far more attention to the good news.

Nucor’s business is volatile

Steel is a highly cyclical industry, prone to swift ups and downs over short periods of time based on shifts in demand and pricing. Over longer periods, capital investment is a huge driver of the company’s financial results.

That makes recessions particularly difficult for the top and bottom lines. This is just part and parcel of the company’s business, and there’s no way to avoid this fundamental feature of the steel industry.

Image source: Getty Images.

That’s where the bad news comes in. Given the volatile nature of the steel industry, Nucor and its peers make a habit of updating earnings guidance shortly before scheduled earnings releases. This way, the company avoids surprising Wall Street on the day of earnings. Nucor’s updated guidance for the fourth quarter of 2023 wasn’t good.

According to the news release: “Nucor expects fourth-quarter earnings to be in the range of $2.75 to $2.85 per diluted share. Nucor reported net earnings of $4.57 per diluted share in the third quarter of 2023 and $4.89 per diluted share in the fourth quarter of 2022.”

That’s a sizable year-over-year drop and a material sequential decline. The big hit came from the double whammy of lower prices and volumes. And that’s how it goes in the volatile steel industry.

Think longer term with Nucor

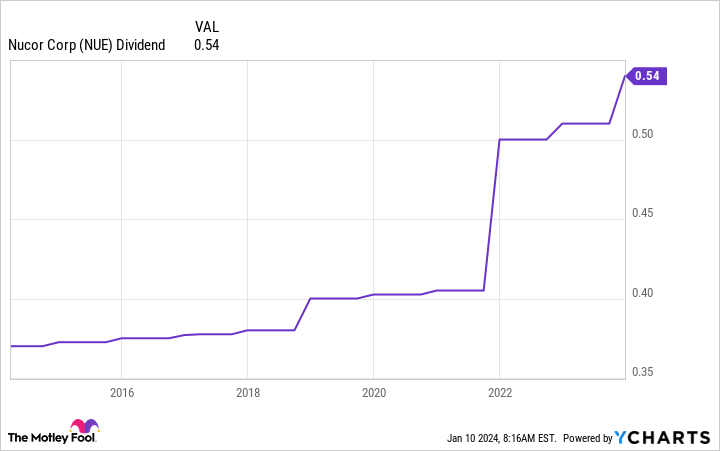

The interesting thing about that news release is that it was one of two releases issued on the same day. The second release highlighted that the dividend was increased to $0.54 per share per quarter.

It’s hard to get a read on how material that is from the release, though Nucor did highlight its status as a Dividend King by explaining that, “Nucor has increased its regular, or base, dividend for 51 consecutive years — every year since it first began paying dividends in 1973.”

That’s good, but it doesn’t do justice to the dividend increase. The previous quarterly dividend was $0.51 per share, so the new rate amounts to a roughly 6% increase. Over the past decade, the average annual increase at Nucor was roughly 3%, so this is a notable uptick in the growth rate.

NUE Dividend data by YCharts.

As the chart above shows, Nucor’s dividend increases regularly, but often the figure is modest. But then, every so often, there’s an outsized increase. Those hikes are generally associated with something important changing in the business, like a new plant coming on line.

The 6% increase suggests that, despite the volatility of the steel industry, Nucor’s business isn’t only fundamentally strong, but also still growing in important ways. Otherwise, management would have provided just a token hike.

Nucor: Thinking long term

Nucor’s shares aren’t exactly cheap today, with the 1.3% dividend yield toward the low end of its yield range over the past decade. Investors looking to buy Nucor might want to keep it on their wish lists, perhaps jumping aboard during a recession, when things look extra ugly for steel stocks.

However, if you own this Dividend King, you’ll want to pay more attention to the recent dividend news than the updated earnings guidance. The dividend story tells you far more about the long-term opportunity.