Andrii Yalanskyi

Investors often seek diversified portfolios that can withstand market volatility and provide steady returns. We know that higher rates have created dislocations in markets, so why not take advantage of it more directly? That’s where the VanEck IG Floating Rate ETF (FLTR) comes into play. FLTR is an investment vehicle that aims to match the performance of the MVIS US Investment Grade Floating Rate Index. This index comprises U.S. dollar-denominated floating rate notes issued by corporate entities and rated as investment grade. As of today, FLTR manages approximately $1.29 billion in net assets and charges a competitive expense ratio of 0.14%.

Floating rate bonds, often known as floaters, offer a dynamic interest income that is tied to a benchmark interest rate, such as the LIBOR, making them an attractive investment in environments of rising interest rates. Unlike fixed-rate bonds, whose prices can fall when rates increase, floaters adjust their payouts, thereby mitigating the risk of interest rate fluctuations and preserving their market value. This adaptability means that investors receive higher yields as market rates climb, which can provide a cushion against inflationary pressures where traditional fixed-rate bonds might underperform.

Furthermore, floating rate bonds tend to have shorter durations because their interest payments reset periodically, which reduces the sensitivity to changes in interest rates and can lead to lower volatility in an investor’s portfolio. In uncertain economic conditions where interest rates are unpredictable, floaters offer investors a degree of protection, as they do not lock in a rate that could quickly become unattractive. They also tend to do well during periods of monetary policy tightening by central banks, as this typically leads to higher prevailing interest rates. Additionally, since many floating rate bonds are issued by corporations, they often carry higher yields than government securities, which can enhance portfolio returns.

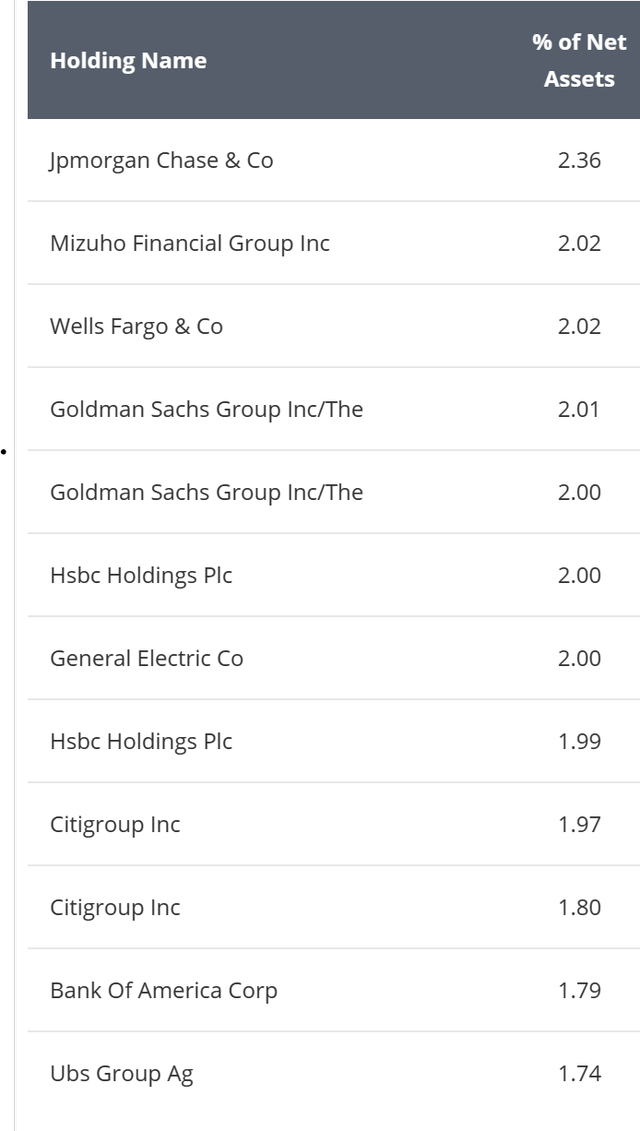

The fund is well-diversified, holding 122 different securities, with no single security constituting more than 2.36% of the fund. FLTR boasts a modified duration of 0.02 and offers a yield to maturity of 6.38%. The fund’s weighted average maturity stands at 3.29 years.

Detailed Analysis of FLTR’s Holdings

FLTR’s holdings are predominantly high-quality bonds. Around 17% of the fund’s portfolio comprises AA-rated bonds, while approximately 49% is invested in A-rated bonds. The remaining consists of BBB-rated securities. These diversified and high-quality holdings contribute to the fund’s stability and reliability, making it a promising investment option for risk-averse investors.

A Look At The Portfolio

No single position in the portfolio makes up more than 2.36% of the portfolio. This is well diversified and high quality from a bond perspective.

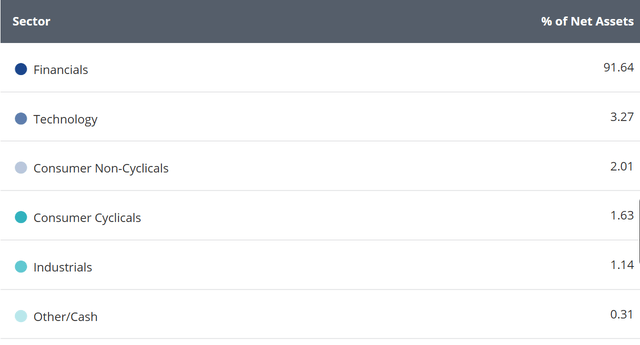

FLTR’s portfolio exhibits a high concentration in the financial sector, with banks making up the majority of the floating rate high-grade corporate bond market. Despite the high concentration, the fund’s diversification across the financial industry and its high-quality holdings provide a balanced investment portfolio for investors.

Comparison Against Peer ETFs

When compared with similar ETFs, FLTR stands out due to its relatively high 30-day SEC yield and broad diversification of 6.35%. The iShares Floating Rate Bond ETF (FLOT), for instance, charges a slightly higher management fee of 0.15% versus 0.14% for FLTR. However, FLOT also has a lower standard deviation, indicating a lower risk profile.

Pros and Cons of Investing in FLTR

Investing in FLTR comes with its own set of advantages and disadvantages. On the plus side, the fund’s high-quality holdings, reasonable management fee, and geographic diversification make it an attractive choice for investors seeking steady returns.

On the downside, the fund’s heavy exposure to the financial sector could be a concern for investors seeking more sectoral diversity. Furthermore, while FLTR provides a relatively high yield, other investment vehicles such as AAA rated CLOs offer even higher yields with similar or lower risk profiles.

Conclusion: To Invest or Not to Invest in FLTR

In summary, the VanEck IG Floating Rate ETF is a solid fund, especially for those seeking a high-yield, low-risk, and well-diversified portfolio. While the fund’s financials concentration and relative yield compared to other investment vehicles may be points of consideration, its robust performance, low fees, and quality holdings make it worth considering.