After touching bear market territory in 2022, the three major indexes rebounded last year — with the growth-oriented Nasdaq roaring past the S&P 500 for a 43% gain. Of course, no one can predict for sure what the indexes will do this year, but since bear markets have always led to bull markets, there’s reason to be optimistic about the future.

And that means right now is a great time to start scooping up growth stocks. These players generally excel in rising markets, as we saw last year, but the good news doesn’t stop there. If you choose high-quality growth stocks, they’re likely to score a win for you over the long haul too.

Even after last year’s gains, many of these stocks still trade for reasonable prices — offering you the perfect buying opportunity. Could 2024 be the year of growth? Maybe. Here are my top five stocks to buy hand over fist to benefit.

Image source: Getty Images.

1. Amazon

You could think of Amazon (AMZN -0.36%) as the ultimate growth stock. The company dominates in two areas that are growing in the double digits — e-commerce and cloud computing — and also is on track to win in the hot area of artificial intelligence (AI).

AI is helping Amazon’s e-commerce business become more efficient, reducing costs and favoring profit growth. And Amazon Web Services’ (AWS) new AI tools should lift demand for its cloud services. This is key because AWS has generally driven Amazon’s overall profit.

And speaking of profit, Amazon has demonstrated its ability to grow earnings over time, as well as its ability to quickly recover after tough times. After a weak economy drove Amazon to an annual loss in 2022, it improved its cost structure and reported quarterly profit gains last year.

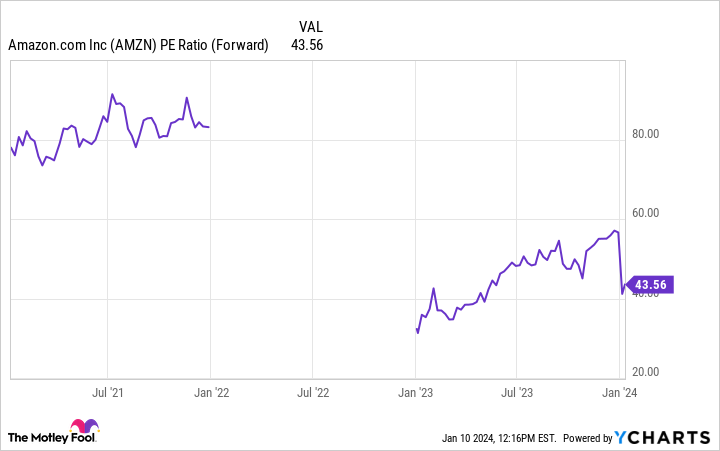

Today, Amazon shares look very reasonably priced compared to their past valuation in relation to forward earnings estimates — especially considering growth prospects ahead.

AMZN PE Ratio (Forward) data by YCharts

2. Etsy

Etsy (ETSY -3.70%) suffered as the economy started to weaken because shoppers weren’t able to buy as many discretionary items as they used to. And most of the goods you’ll find on Etsy — handmade and vintage items — fall into this category.

But here’s why Etsy may be set to take off and also offers you top long-term prospects. First, the company managed to keep the revenue gains it made during earlier stages of the pandemic, it’s maintained profitability in recent quarters, and it has a solid cash position of more than $1 billion. And second, Etsy’s capital-light business model means it doesn’t have to heavily invest in infrastructure to grow — and it can transform 90% of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) into free cash flow.

Finally, Etsy has done a great job of holding on to its customers even during tough times and growing the customer base. Active buyers recently reached a record high of 92 million. And that’s why this stock is an absolute steal at only 15 times forward earnings estimates.

3. Chewy

Chewy (CHWY -4.44%) reached a major milestone in 2022 when it reported its first annual profit. The online seller of pet supplies kept the good times rolling even through a tough economic environment by increasing overall sales, net sales per active customer, gross margin, and other metrics in the most recent quarter.

There’s reason to believe that, over time, Chewy could take a big chunk out of the $144 billion U.S. total addressable pet market. Through services such as Autoship — regular, automatic deliveries of your favorite products to your doorstep — Chewy has proven it can build a loyal customer base. Autoship represents more than 75% of Chewy’s total sales.

Chewy stands out because it offers a variety of services, from supplies to prescription drugs and pet health insurance — and the company recently expanded into veterinary care, announcing the opening of its first Chewy Vet Care practices.

Today, Chewy shares trade for 37 times forward earnings estimates — and that’s cheap, considering analysts forecast double-digit growth annually for the company over the coming five years.

4. Teladoc Health

Teladoc Health (TDOC 0.29%) is a leader in the fast-growing market of telemedicine. The company’s shares have dropped over the past couple of years as investors worried about Teladoc’s ability to turn revenue growth into profit.

But early last year, the company shifted its strategy to balance its quest for revenue growth with its aim to reach profitability. Now, we aren’t seeing the double-digit gains in revenue that we saw in the past, but we have been seeing improvement in EBITDA and free cash flow.

Teladoc said it expects to deliver EBITDA and free cash flow growth that will surpass revenue growth over the next few years — that’s thanks to improvements in efficiency now and moving forward. And all of this shows progress along the path to profitability.

The telemedicine leader also is focusing on a key growth area — chronic care — which has helped drive revenue in recent times.

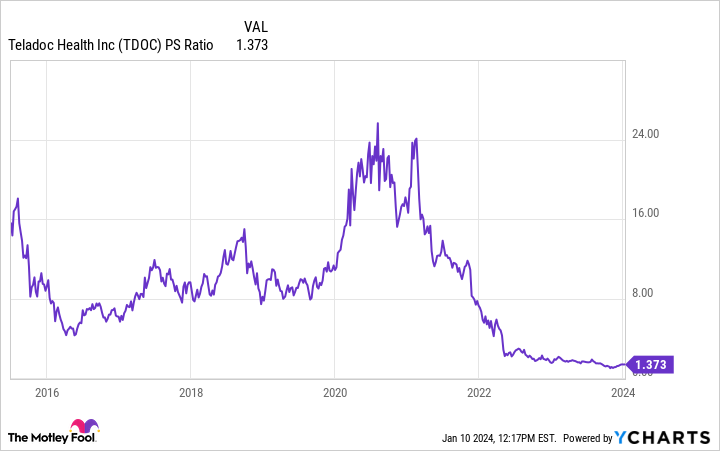

So Teladoc’s growth — and share performance — could be poised to take off. And that makes it a steal today, trading at nearly its lowest level ever in relation to sales.

TDOC PS Ratio data by YCharts

5. CRISPR Therapeutics

CRISPR Therapeutics‘ (CRSP -0.91%) growth story is just getting started. The gene-editing specialist recently won regulatory approval for its first product — one that could become a blockbuster. The U.S. approved Casgevy for sickle cell disease and will issue a decision on the product for beta thalassemia in March. The U.K. already authorized the treatment for both blood disorders.

The biotech company shares revenue with bigger player Vertex Pharmaceuticals, but this new revenue stream still represents a huge milestone. Casgevy sales will help CRISPR Therapeutics fund its other pipeline programs. And the approval is important because it shows regulators are willing to accept treatments based on this new technology — a technology used across the company’s pipeline. So this definitely is positive news for CRISPR Therapeutics moving forward.

Today, CRISPR Therapeutics’ shares are trading much lower than they were a few years ago, when we had a lot less visibility on the company’s future. Considering the company’s recent product approval and growth potential, the shares could explode higher from here — making them a top stock to own in 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon and Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Amazon, CRISPR Therapeutics, Chewy, Etsy, Teladoc Health, and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.