DKosig

Introduction

Despite wars in Europe and the Middle East, escalating tensions in Taiwan, recent attacks in the Red Sea, and eleven successive US Fed rate rises since March 2022, equity markets have reached new highs. It is as if nothing happened. The recent reversal of longer-term interest rates (the US 10-year Treasury (US10Y) yield fell below 4.0%1) seems to be the driving force.

At a simplistic level, lower rates lead to a willingness to pay higher prices for expected earnings (higher P/Es). But we do wonder about the lagged effects of rate hikes. How much pain is still yet to be felt in the real economy? Have investors adequately priced the risks of lower earnings? If earnings decline, higher P/E’s can still eventuate with falling prices.

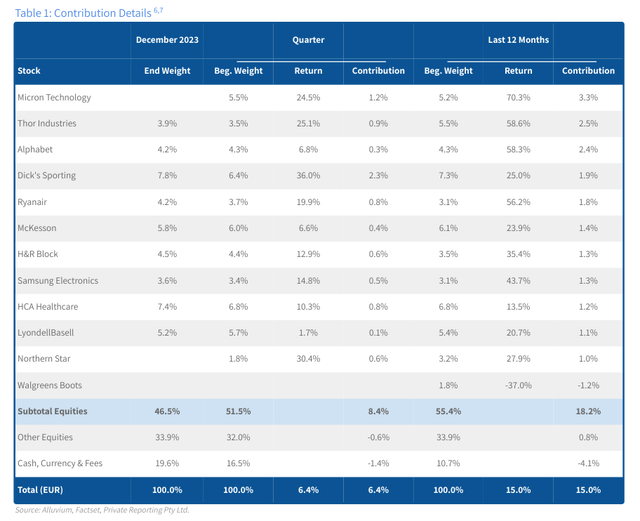

Returns for the quarter were 6.4%, 11.0% and 5.0% in EUR, USD and AUD terms respectively2. For the year they were 15.0%, 19.0% and 18.3%. Longer-term performance is provided in Table 4. Given the buoyant market conditions, and our conservative outlook (for example, by holding a fair chunk of cash in anticipation of better buying opportunities) we are not unhappy.

For what it’s worth, the Index return was dominated by the “Magnificent 7” mega-caps. On a simple average, they more than doubled and our guesstimate is they accounted for around 15% of the Index’s 23.8% return (in USD)3. By comparison, the contribution of that bucket of stocks to the Fund’s annual return (which comes solely via its Alphabet (GOOG, GOOGL) investment), was 2.4%4.

Finally, it would be remiss of us not to mention that we, like many others, have benefited from Mr Munger’s worldly wisdom and his generosity to share it. So, thank you and goodbye Charlie.

“I’m going to party”

– Charlie Munger when asked about his plans for his 100th birthday, 30 October 20235

Snapshot

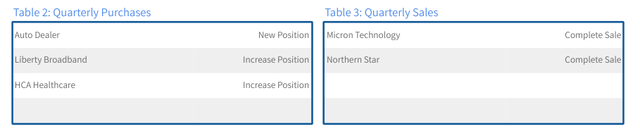

- Our gold miners rebounded – particularly Regis Resources (OTCPK:RGRNF, up 46.3%) and Northern Star (OTCPK:NESRF, up 32.0%). Agnico Eagle (AEM, up18.6%) also performed well. We completed our divestment of Northern Star.

- We also sold Micron (MU, up 24.8%), the semiconductor producer, as we tailor the portfolio away from such cyclical industries. Micron had reported positive results and a strong outlook, which no doubt boosted the share price.

- DICK’s Sporting (DKS) reported good results and its shares bounced back (up 36.3%). With this strong return and our recent buying, it regained the mantle of the Fund’s largest position, at 7.8%.

- Thor (THO, up 25.5%), the maker of recreational vehicles, reported credible first quarter results.

- Ryanair (RYAAY), the budget airline, returned 19.9%, probably the result of exciting news, like announcing solid results, declaring its maiden dividend and an ongoing dividend policy, and reiterating its fleet expansion plans.

- On the other hand, Alibaba (BABA), the ecommerce platform, was down 10.5%. The news flow was overwhelmingly negative. We have our concerns, but the business is priced too cheaply, in our view, to sell.

- Liberty Broadband (LBRDK), the owner of US cable assets also had a poor quarter (down 11.3%). We bought some more.

- Capri Holdings (CPRI) traded at an increased discount to its agreed bid price, and was down 4.5%. We are pretty confident the deal will proceed, and a circa 11.9% return over the next 6-12 months is pretty attractive to us.

- We initiated an investment in an exciting retail business.

- Accounting for that and the aforementioned divestments, we ended the quarter with 19 holdings and 19.6% cash.

Contribution

Activity

Performance Review

Gold shines! As long term interest rates fall so does the opportunity cost of owning gold. We suspect this led to its rebounding price (up 9.8%). And with this, Regis Resources (up 46.3%) and Northern Star rebounded strongly more than reversing their poor performance of last quarter. Agnico Eagle also performed well (up 18.6%). Having started to sell Northern Star earlier this year, the recovery provided us an opportunity to complete the divestment. It had returned 32.0% over the quarter up to the time of our sale. It panned out okay. Over our average holding period of 2.6 years the position returned 18.5%. This result is consistent with our expectation when we were acquiring the position. What we did not expect, however, was the strong performance of the broader market over the ensuing couple of years. So, whilst not so great in relative terms, at least we did not violate Mr Buffett’s rule number 1. We still own Regis and Agnico, which together account for 7.0% of the Fund.

Likewise, Dick’s Sporting shares, which fell 24.1% over the September quarter, rebounded 36.3%. Management reported encouraging results and a small upgrade to earnings guidance (3.4%). From Dick’s perspective, the consumer is holding up well, and the business is increasing its market share. Like us, management saw an opportunity last quarter and Dick’s bought back stock, some USD388m of it! With our September buying and the strong returns, it is now the Fund’s largest position.

Micron, the semiconductor producer, reported a smaller than expected loss as demand for its memory chips recovered and prices increased. Both are expected to continue to rise progressively throughout 2024 leading to sequential margin expansion. However, management stressed margins are not yet at levels which warrant expanding capacity (in the absence of subsidies). In this cyclical industry our maintainable earnings forecasts are “over the cycle”. We have refined our assumptions. Although they lead to an increase to our long range earnings estimates, they do not materially change our valuation. And notwithstanding the positive outlook, our investment criteria has evolved toward higher quality businesses (which means operating in less cyclical industries). Micron was trading around 33% higher than our valuation so we took advantage of the recent rally and sold our position (which returned 24.8% during the quarter). Our history of investing in Micron (since June 2020) has been pretty reasonable, having achieved a return of 35.0% over an average period of a little over two years.

Thor Industries, up 25.5%, the maker of recreational vehicles, reported credible first quarter results given the challenging market conditions. Like Micron, it also operates in a cyclical industry, but unlike Micron, as far as we can tell it has never lost money over a full year. Thor reduced production levels, thereby assisting dealer destocking. It also amended and considerably lengthened its debt agreements, continued to buy back stock and increased its dividend. Management re-affirmed its FY24 guidance – which still reflects the poor operating environment. Our view of Thor’s maintainable revenue is comparable, but we expect margins will increase over the longer term to a higher sustainable level, hence our view of maintainable earnings is quite a lot higher than management’s FY24 guidance (yet still less than half of peak 2022 earnings). The recent results did not provide cause for us to change our assumptions. We sold some in the September quarter, but Thor still accounts for 3.9% of the Fund. With it now trading at a premium to our valuation this position warrants careful monitoring.

Ryanair had yet another solid quarter (up 19.9%), after reporting strong earnings, and declaring its maiden dividend and an ongoing policy to pay out 25% of its earnings. It also benefited from the misfortune of one of its competitors, with the Pratt and Whitney engine issues groundings. Its cost advantage has widened – and it has further to go as its order book of more efficient airplanes gets delivered. Ryanair intends to fund these aircraft and maintain its dividend out of operating cash flows, and yet still be debt free by 2026. That would be quite an achievement! Aided by the expanded fleet, management envisages growing annual passenger numbers by 5% per year over the next 10 years. We wrote about the attractive investment characteristics of Ryanair in June (here). Despite the strong share price run, we do not view Ryanair as expensive, with it trading at about 10 times earnings and with good growth prospects, and still a reasonable discount to our valuation.

We need to continue to maintain a very strong balance sheet. It’s the airline industry. There’ll be another crisis in three, four, or five years’ time. And the way that Ryanair makes its money over the medium term is we go into crisis with strong balance sheet, and that’s where we do our best work. – Michael O’Leary, 6 November 20238.

Performance Review

Turning to the other side of the ledger.

Alibaba, the massive ecommerce platform, was down 10.5%. Following the news in June that Mr Zhang, the CEO and Chairman would step down from the main role and lead the Cloud business (which was expected to be separately listed), it was then confirmed in September that he would exit completely. Then, in November, Alibaba said it would abandon the spinoff. Understandably, the market was shaken. Alibaba’s reasoning is that the recent expansion of US restrictions has created uncertainties. This is very disappointing, as we had viewed it as a major profit driver going forward. Notwithstanding, the underlying business still appears strong, and it trades at only just a little over 10 times our estimate of maintainable earnings. It seems very little growth is factored into the share price at current levels, and we think there is still upside optionality. So, despite our concerns, we currently intend to maintain our position (2.9% of the Fund).

Liberty Broadband, the owner of US cable assets, also had a poor quarter (down 11.3%). Liberty’s main asset is its stake in Charter Communications. In December, Charter’s CFO mentioned that it is likely its “internet net adds” in the December quarter will be negative. That led to its share price falling 8.7% on the day, and Liberty’s share price fell similarly (8.9%). We were not perturbed – our investing reasoning is not affected by such vicissitudes. In fact, we saw this as a buying opportunity. After all, Charter and Liberty trade on earnings multiples of around 14 and 12 times respectively (based on our maintainable numbers) and at or around our valuation. Our increased Liberty holding means it now accounts for 4.7% of the Fund’s assets.

We reported last quarter that the shareholders of Capri Holdings, the fashion house, received a cash offer of $57 per share from Tapestry. Capri’s share price ended the quarter at $50.24. Whilst we understand the Federal Trade Commission will make its enquiries, we do not foresee any competition issues, and with the bid agreed, financing sorted, and subject only to Capri shareholders approval, we believe the acquisition will proceed in 2024. However, it appears other shareholders either think otherwise, or feel there are better options available to them than the 11.9% prospective return over the next 6-12 months. And with the current exuberant market, who could blame them! However, we harbour a more conservative outlook, and we are quite accepting of that return profile. Capri represents 4.1% of the Fund.

It has been a year since we last mentioned Linamar (OTCPK:LIMAF, down 1.8%), when we wrote of our fondness for businesses that actually manufacture real stuff. Linamar will shortly be manufacturing more real stuff, specifically agricultural equipment, with its significant CAD640m acquisition of Bourgault Industries (which makes broad acre seeding equipment). Together with MacDon and Salford, Bourgault will become part of its new “Agricultural Division”. Bourgault generates around CAD500m in annual revenues, at margins comparable to Linamar’s broader industrial division. This suggests a price of around 10 times EBIT. The deal makes sense to us. The expanded distribution network will offer a broader range of equipment, and we would be surprised if there weren’t some procurement synergies as well. Separately, management reported third-quarter results, which were all in line with its prior guidance, and not causing us to change any of our estimates. Linamar trades on a double-digit earnings yield and a circa 20% discount to our valuation. There is scope to increase our 3.8% position and we are currently weighing this up together with other opportunities.

Although posting positive returns, other notable laggards for the Fund were LyondellBasell (LYB), the plastics manufacturer (only up 1.7%), Universal Music (OTCPK:UMGNF), the owner of music content (only 5.4%), McKesson (MCK), the drug distributor (only up 6.6%), and Alphabet, ie Google (only up 6.7%).

We initiated our investment in a new business which we elaborate on in the next section. Accounting for that, and after having completely sold our Northern Star and Micron investments, we ended the quarter with 19 holdings and 19.6% cash.

A Different Kind of Retail

Earlier this year, after our screening started to incorporate 2022 financial data, two US listed Auto Dealership businesses first appeared. When this happens, our first step is to perform some cursory analysis using basic models, which by necessity also includes considering qualitative aspects. We knew the pandemic cash stimulus combined with pronounced supply issues (due to chip shortage and general disruptions) had led to rapid car price growth. It did not take a rocket scientist to conclude that 10% plus margins for these businesses were unsustainable. We are fully aware of the backward-looking nature of the screen. We were also fully aware these supply issues were largely over, and rather than cash stimulus, our thinking was that recent interest rate rises (and the threat of more to come) would surely depress demand. Having little idea as to where prices and margins would ultimately land, we were deliberately ultra conservative in our analysis. And despite the businesses still appearing cheap, we dismissed them – preferring to wait it out and see “where the dust settles” over time. Over the rest of the year these businesses (and the other four US listed auto dealers) reported quarterly results which did show margins retracting, but to nowhere near the extent we envisaged. So we delved deeper into the industry, and progressively became more and more confident of its investment merits. Let us explain why.

First and foremost, auto dealers are not going away anytime soon. The dealer model is entrenched by US regulations. And more importantly, irrespective of that, we believe that dealers are an essential part of the automotive ecosystem and that the model serves the manufacturers and consumers well.

“The dealer system works well for the manufacturer. It works well for the dealer, and it works well for the consumer. It’s been around now for a very long time, and usually when a distribution system becomes that firmly established, there’s a reason for it, and I just don’t see that changing”

– Warren Buffett, March 20159

In addition, the industry remains heavily fragmented. There are around 17,000 dealerships across the US, and estimates are that only 7% are owned by the publicly listed groups10. With many businesses having been built by families over decades, there’s plenty of scope for consolidation. And, for potential acquirers, relationships with the manufacturers matter – given that franchise agreements provide that they approve the transaction. This places incumbent, well capitalised dealer groups that have a track record of cooperatively operating with manufacturers at a competitive advantage. Access to capital is also important, with increasing manufacturer demands for maintaining showroom standards. But, apart from that, there appears to be little scale advantages in this industry. In fact, most dealer groups work on a largely decentralised model.

Although acquisitions certainly provide growth, there are also opportunities to further capitalise on existing assets – mainly by improving the efficiency of parts and service operations. The glut in new car supply has resulted in an increased age of cars (now reaching 12.5 years in the US), so there is no let up in demand for professional, OEM backed support. We understand labor supply has been the chief constraint, which is being addressed through innovative measures focussed on incentives.

Like all retail, there is an increasing prevalence of purchases being at least partially conducted online. But the car buying experience is a little different – buyers want to see and test drive the vehicle and you can’t just return it on Amazon. So, this does not exclude dealer involvement, and nor has it affected margins. In fact, the evidence thus far seems to be that those savvy dealers that have invested in their systems require fewer front-of-house staff which has led to increased productivity.

With our greater understanding of the industry, comes greater confidence of the “through the cycle” margins we adopt. These form a necessary input into our valuation models. We have considered the margins of the five “pure play” US listed dealers over the last 10 years, in light of the industry’s progression. To sum it up, we are of the view that manufacturers (on the whole) are likely to be prudent with production levels, pricing levels will largely hold and margins, although continuing to revert, will settle at a level higher than the long-term averages (sub 4%) but well below the recent highs. The result, along with our other valuation assumptions, led us to believe that despite the share price gains of those two identified companies (averaging over 55.1% during 2023), they were still reasonably priced, and we acted by buying one of them.

Closing Remarks

This is an opportune time to reflect on the year just gone. In our last December report, we wrote that we were pleased with our conviction to buy Alphabet and Micron, despite those purchases in 2022 being underwater by 20.1% and 16.2% and significantly affecting the Fund’s return. Fast forward to today. We sold Micron for what we think was a good price, Alphabet’s share price is up, and both materially contributed to performance. We also traded Dick’s, Thor and HCA Healthcare sporadically and profitably in 2023, but we do regret selling Dick’s too cheaply in September 2022 when it had reached 8.0% of the Fund, due to regulatory risk constraints. These constraints do impact the Fund’s returns on occasion. As for outright mistakes, well the most obvious was maintaining our investment in Walgreens Boots (WBA) for too long. We had too much faith in management’s transformation plans for this declining business. When management abandoned ship, so did we. And it’s clear we misjudged the risk/reward proposition for Alibaba. We are yet to sell a share. So far it has been a terrible investment for the Fund and although it is unlikely to ever prove to be a good investment, we do expect a more favourable return will eventuate.

The less obvious “mistakes” are those of omission. We regret not buying more Ryanair after it reported those great results in the June quarter (here). We are also disappointed that by the time we invested in the auto dealership business its share price had run. But more pointedly, early in the year Amazon (AMZN) appeared on our screen for the first time (and traded at only a small premium to our valuation), and Apple (AAPL) finally seemed reasonably priced to us. But we still felt they weren’t cheap enough. Truth behold, these businesses are never likely to appear “cheap enough” for us. To have identified but not acted on the opportunity to buy these two high quality companies (to an extent that respects our diversification criteria) is frustrating.

Referring to diversification is an important point. With typically 20 positions, most would consider the Fund to be riskier than the Index, which is comprised of around 1,500 companies3. But we would not be too hasty. On the one hand, the Index weighting leads to a false impression of its diversification properties. Information Technology now accounts for 23% of it (and together with Financials they account for 38%), 70% of its constituents are listed in the US, and no company smaller than 1.3b makes the cut! On the other hand, the Fund invests in a portfolio of around 20 businesses operating in a well-diversified array of industries and geographies, across a broader size spectrum and can hold “opportunistic” cash.

Statistics say that owning two stocks eliminates 46% of the nonmarket risk of owning just one stock. This type of risk is supposed to be reduced by 72% with a four-stock portfolio, by 81% with eight stocks, 93% with 16 stocks, 96% with 32 stocks, and 99% with 500 stocks – Joel Greenblatt11

If not yet convinced, the Fund’s positions trade at less than 14 times earnings (compared to the Index’s at 20 times) and we know these businesses pretty well. No matter what the quant analysis may say, we have confidence that our strategy is intrinsically less risky than the Index. More importantly, given the gradual but significant changes in the investment landscape, we think we are more likely than ever poised to ripe better than average returns over the long term.

With geopolitical tensions increasing we maintain our wariness of investing in risky assets over the short term. Then again over the last three tumultuous years we have been continually surprised by the market’s resiliency. As we write this though, it is retreating a little, so perhaps investors are finally taking heed. We certainly hope so, because we would love to productively deploy our cash. Going forward, we are excited by the continual refinements to our process and the gradual reflection of those in the portfolio. We wish you all the best for 2024 and thank you again for your interest.

Stuart Pearce, Principal

Alexis Delloye , Principal