-Antonio-

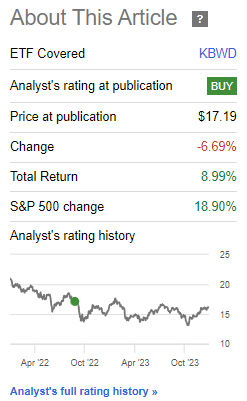

I last covered the Invesco KBW High Dividend Yield Financial ETF (NASDAQ:KBWD) in late 2022. In that article, I argued that KBWD’s strong, growing dividends and cheap valuation made the fund a buy. Since then, KBWD has underperformed the S&P 500, due to losses incurred during the regional banking crisis.

KBWD Previous Article

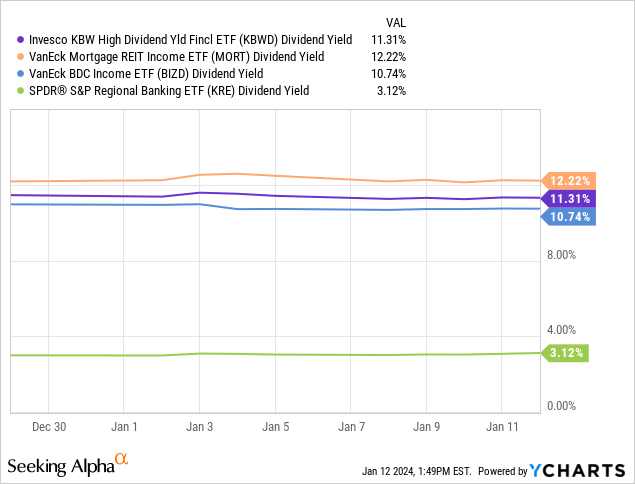

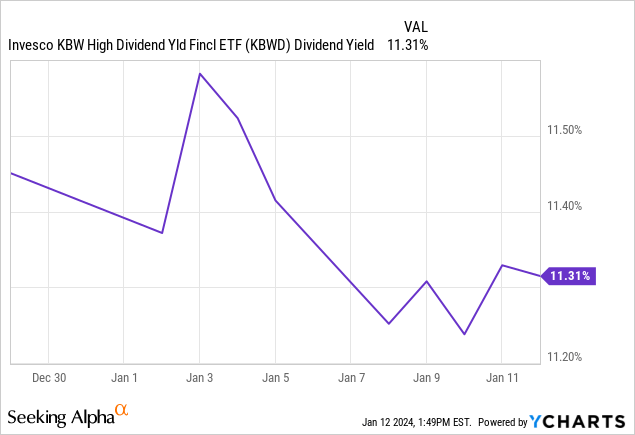

Although KBWD’s recent performance has been below average, fundamentals seem strong, with the fund sporting an 11.3% yield, strong dividend growth, and a cheap valuation. On the other hand, the fund seems to have shifted allocations towards mREITs, incredibly risky, leveraged securities. I find KBWD excessively risky, so I would not be investing in the fund at the present time.

KBWD – Basics

- Investment Manager: Invesco

- Underlying Index: KBW Nasdaq Financial Sector Dividend Yield Index

- Dividend Yield: 11.33%

- Management Fee: 0.35%

- Total Returns CAGR 10Y: 4.74%

KBWD – Index and Portfolio

KBWD is an index ETF, tracking the KBW Nasdaq Financial Sector Dividend Yield Index, an index of high-yield U.S. financials. It is a simple index, investing in the highest-yielding U.S. financials subject to a basic set of inclusion criteria. It is a dividend-weighted index: the higher the yield, the greater the weight. Said weighting scheme directly increases the fund’s yield, but also its risk, volatility, and potential losses during downturns.

KBWD’s portfolio is comprised of:

- mREITs, which focus on leveraged mortgage investments

- BDCs, which focus on loans to small and medium-sized private equity companies

- Community banks and other small-cap financials, which focus on more traditional financial services

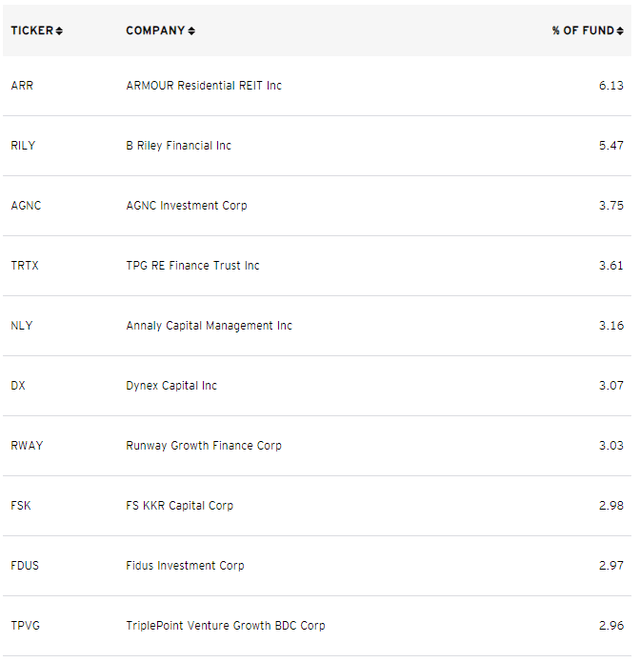

Largest holdings are as follows:

KBWD

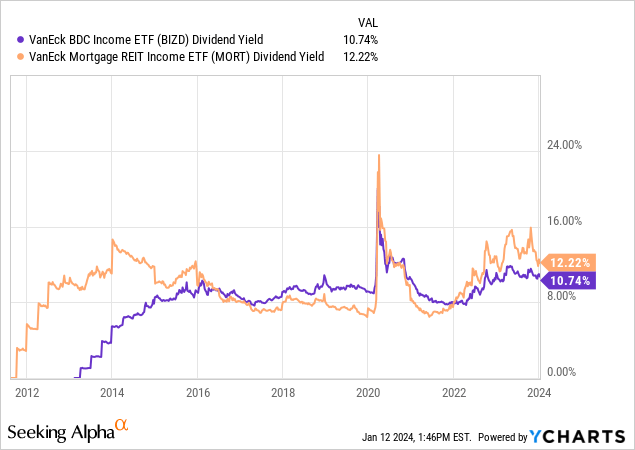

Right now, it seems like the fund is focusing on mREITs, with sizable allocations to BDCs, and smaller allocations to banks. This is noticeable in the list above, and through comparing fund overlaps through Etfrc.com. Focusing on mREITs is consistent with current market conditions, as these securities have seen significant increases to their yields since early 2022. Comparing mREIT yields with those of BDCs makes this quite apparent.

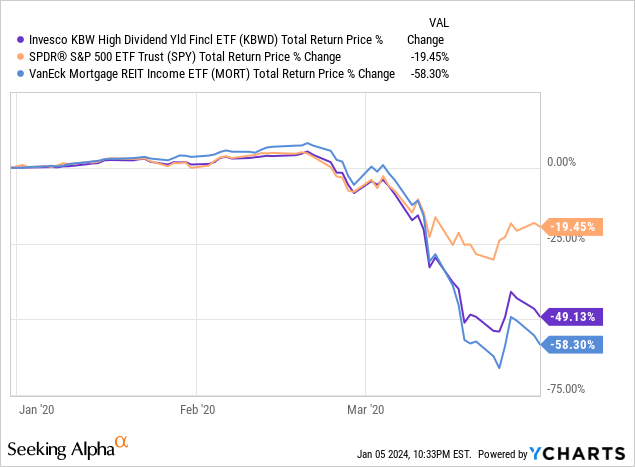

I dislike mREITs as an investment, as these sometimes use excessive leverage, leading to forced asset sales and significant, permanent losses during downturns.

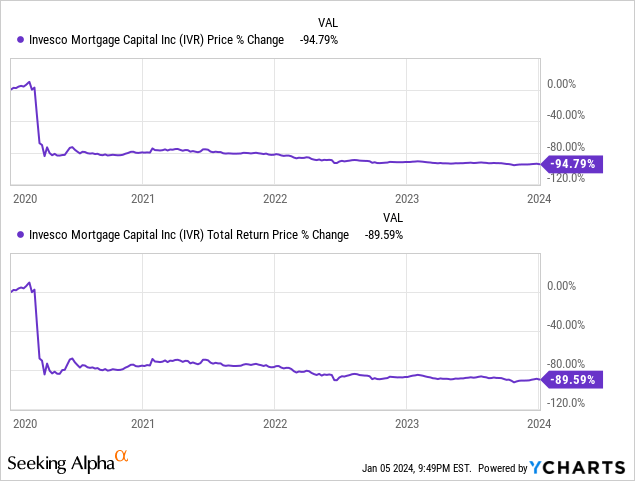

The example I’m most aware of is the Invesco Mortgage Capital (IVR), which suffered losses of almost 80% in early 2020. The onset of the pandemic leads to lower asset class prices across the board, negatively impacting most investors, including IVR. Although these price declines (mostly) proved temporary, IVR was forced into selling most of its portfolio a few months into the pandemic, to comply with debt covenants. Said selling effectively locked in these losses, turning them permanent. IVR has yet to recover from the pandemic and will almost certainly never do so.

Data by YCharts

KBWD focuses on mREITs, an incredibly risky asset class. Due to this, the fund tends to underperform during downturns and recessions, as was the case in early 2020. Losses were particularly severe during the said time period, as mREITs performed disastrously.

Data by YCharts

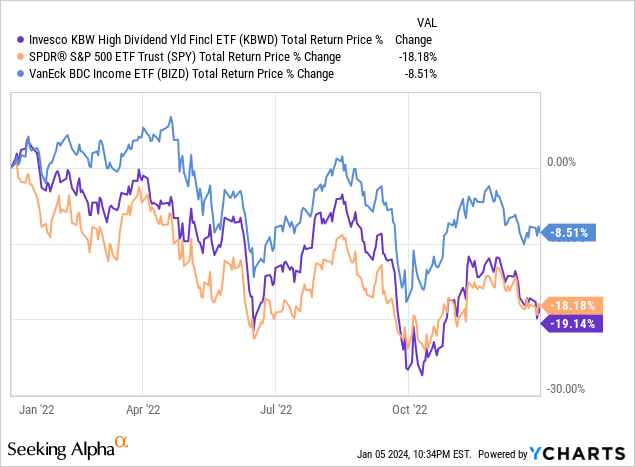

Performance was quite a bit stronger during 2022, the most recent bear market, as BDCs performed quite well during the year.

Data by YCharts

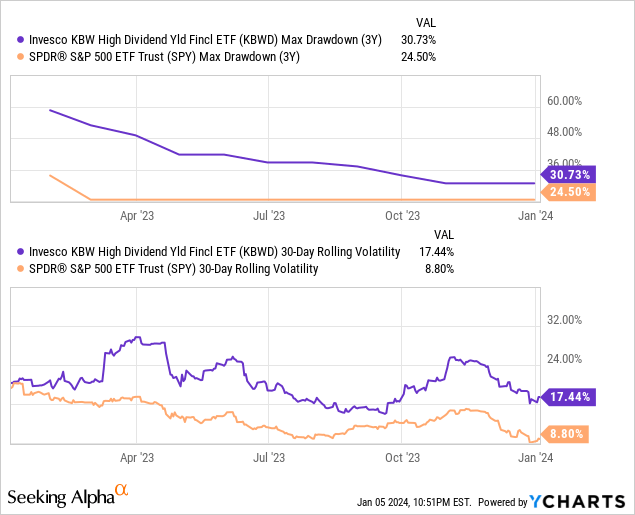

Overall, both drawdowns and volatility are higher than average.

Data by YCharts

In any case, KBWD is an incredibly risky fund, a significant negative for investors.

KBWD – Dividend Analysis

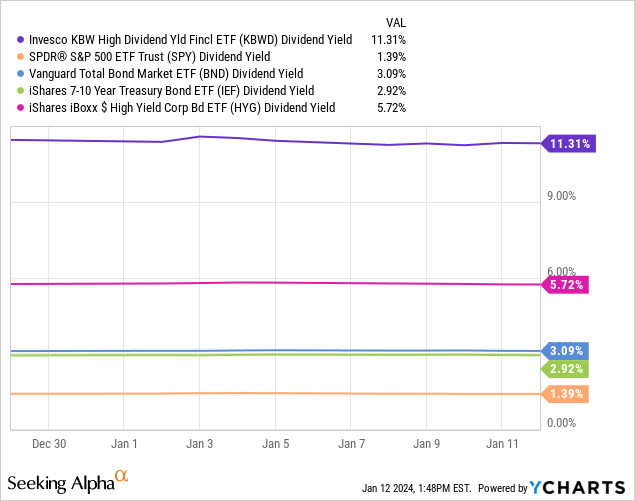

KBWD focuses on high-yield financials which are, by definition and construction, high-yield securities. The fund itself sports an 11.3% dividend yield, an incredibly high figure on an absolute basis, and significantly higher than most other asset classes.

KBWD’s yield is halfway between that of mREITs and BDCs, the fund’s two main asset classes. It is much higher than that of smaller regional banks, but the fund only invests in a few of the highest-yielding of these.

KBWD’s yield is currently quite a bit higher than its 7.0% – 8.0% average, as Federal Reserve hikes have caused yields to spike across fixed-income securities. BDCs focus on corporate loans while mREITs hold mortgages, both of which have seen their yields increase due to said hikes.

Corollary of the above is that the fund should see declining dividends when / if the Federal Reserve cuts rates. Yields should remain quite high regardless, due to starting from a very high base.

KBWD currently offers investors a strong, growing 11.3% dividend yield. Dividends are incredibly strong, almost enough for a bullish rating. Still concerned about the excessive mREIT allocation, however.

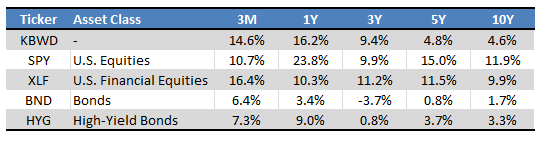

KBWD – Performance Analysis

KBWD’s performance track record is somewhat below average. Long-term returns are somewhat low, but yields were much lower in the past. Returns since after the pandemic have been much stronger. Prospective returns look strong, as interest rates and yields are much higher now than in the past. Drawdowns and volatility are both higher than average, however.

Seeking Alpha – Table By Author

In my opinion, KBWD’s performance track record is reasonable enough. Long-term underperformance is obviously a negative, but conditions have significantly improved for the fund in the recent past, as have returns.

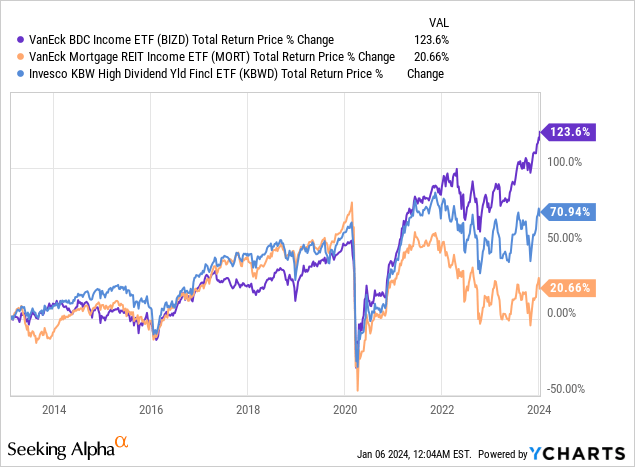

KBWD and BIZD – Quick Comparison

KBWD’s value proposition is very similar to that of the VanEck BDC Income ETF (BIZD). As such, thought a quick comparison was in order.

KBWD invests in high-yield financials, including mREITs, BDCs, and smaller banks. BIZD only invests in BDCs.

Both funds offer investors strong, growing yields. KBWD yields 11.3%, BIZD 10.7%.

Both funds have above-average risk, especially KBWD.

Both funds have benefitted from Federal Reserve hikes and will almost certainly see lower dividends as rates are cut.

Importantly, BDCs are somewhat less risky than mREITs, and better performing too. Due to this, BIZD tends to outperform mREIT indexes and KBWD.

Data by YCharts

BIZD has similar benefits to KBWD, but a much stronger performance track record, and lower risks. At the same time, a lot of the gains incurred by KBWD come from BDCs and also impact BIZD. A lot of the risks and losses incurred by KBWD come from mREITs and do not impact BIZD. Under these conditions, investing in KBWD seems unwise, and unnecessary. I last covered BIZD here.

Conclusion

KBWD offers investors a strong, growing 11.3% yield. On the other hand, the fund focuses on mREITs, incredibly risky securities. In my opinion, KBWD is excessively risky, so I would not be investing in the fund at the present time.