The prime aim of investment trust JP Morgan Global Core Real Assets is to deliver a steady stream of income to shareholders from stakes in physical assets such as office blocks and ships that transport liquefied petroleum gas (LPG) across the globe.

It is a role that the fund, valued at £153 million, has carried out satisfactorily since launching in September 2019. Although the quarterly income payments per share are small in absolute terms, running at 1.05p, they are equivalent to an annual dividend income of 5.8 per cent – in line with the trust’s income target of between four and six per cent.

They are also moving in an upward trajectory at a time when interest rates across the globe appear to have peaked.

Later this month, the trust’s board will announce the final dividend payment for the financial year ending February 28. With 3.15p of dividends already declared, it would be a huge surprise if the annual income is not healthily above last year’s 4.05p.

Yet, it is not all good news for the trust’s investors. Over the last year, the trust’s share price has drifted downward – and while it has made a steady recovery since November, it stands at 72p compared with 89p a year previously.

In the fund’s defence, most investment trusts have share prices that do not reflect the value of their underlying assets – a reflection in part of widespread global disaffection with equities.

The JP Morgan fund’s shares are more unloved than most, sitting at a 23 per cent discount to the value of the trust’s assets. The buying back of shares by the trust – a measure designed to drive up their price through restricting their supply – has had little impact on reducing the discount.

Philip Waller, portfolio manager, remains unfazed by the performance of the shares, and believes the trust can play a key role in an investor’s armoury. ‘It’s ideal as a foundation stone, a core holding, in a portfolio,’ he says.

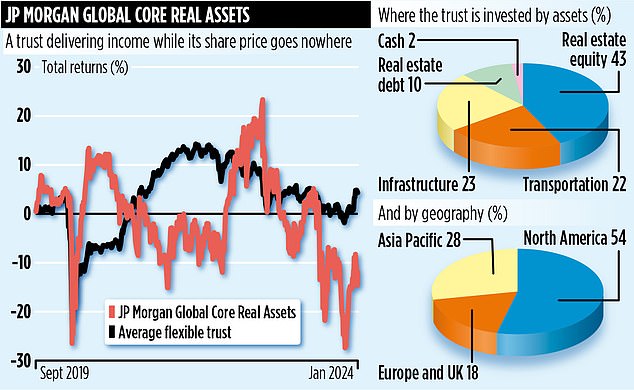

Waller’s argument is that the trust offers investors something different from mainstream income asset classes such as equities and bonds. The fund seeks its income from a variety of sources – in the process providing both asset and geographic diversification. Further layers of diversification are provided by exposure to publicly listed and private assets – and funds holding a number of real assets.

The three main income sources are investments in real estate (industrial, offices, residential and retail), infrastructure (energy) and transportation (planes, trains and ships).

So, for example, the trust owns a fleet of ships that transport LPG from North America and the Middle East to the UK and Europe. The ships are leased out to energy companies with the income from the leases forming part of the dividends that the trust’s shareholders receive. It also owns container ships and wind farm maintenance boats. Some 96 per cent of the assets that it leases are currently being utilised.

JP Morgan is a serious player in the alternative asset sector, managing £167 billion globally. The fund is listed on the London Stock Exchange and has a market ticker of JARA and an ID code of BJVKW8. Ongoing trust charges are 1.29 per cent and its shares can be bought via most investment platforms. Although Waller says the trust is popular with wealth managers, investors should only buy if they are looking to diversify their sources of income.

Capital growth is not the trust’s main priority. Over the past year, shareholders have suffered overall paper losses of 14.3 per cent, with the income part compensating for the slide in the share price.