BlackJack3D

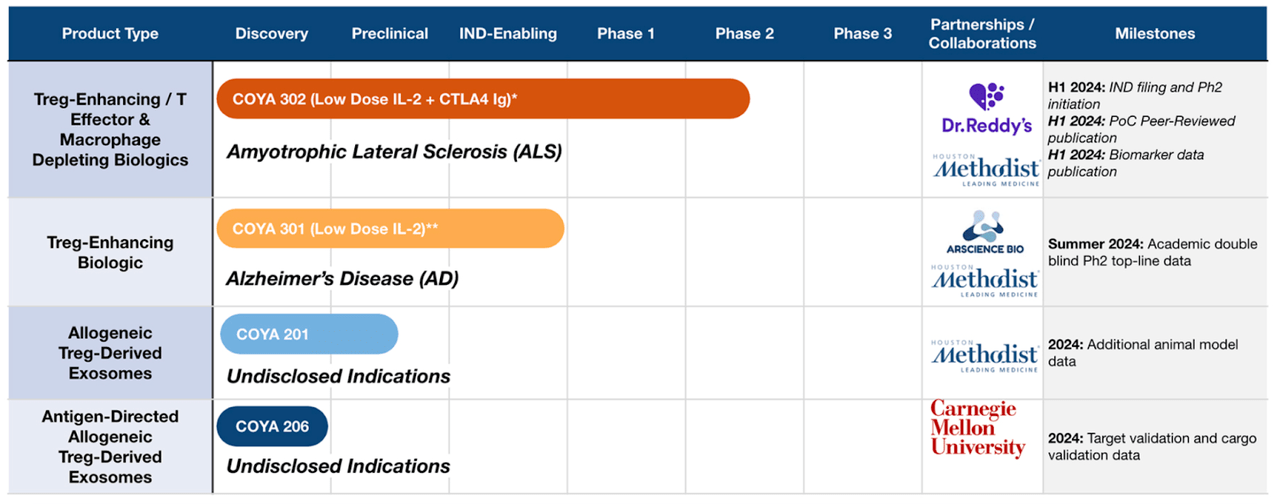

Coya Therapeutics (NASDAQ:COYA) targets inflammation by modulating the function of regulatory T cells (Tregs) in neurological diseases. The “original” lead asset used to be COYA 101, an autologous regulatory T-cell product candidate with a completed Phase 2a trial in Amyotrophic Lateral Sclerosis under its belt. The trial was completed way back in 2022. However, owing to what appears to be a cash problem, the company has decided to hold this program at bay and forward the other assets through early stage studies first. Before we check whether this decision is related to poor data or is otherwise sound, here’s the current pipeline:

The current lead molecule is COYA 302, a low dose IL-2 and CTLA4 Ig also targeting ALS and used as a backbone therapy for other molecules. This molecule will file an IND and initiate phase 2 in 2024. A second candidate is COYA 301, a low dose IL-2 targeting treg-enhancing biologic molecule in early stage trials targeting Alzheimer’s Disease, which will publish academic double-blind phase 2 topline data in mid-2024. Other assets are preclinical.

Now, let me quickly check that COYA 101 data. Data from phase 2a trial was published in a peer-reviewed journal called “Neurology, Neuroimmunology & Neuroinflammation” with the title “Combined Regulatory T-Lymphocyte and IL-2 Treatment is Safe, Tolerable, and Biologically Active for One Year in Persons with Amyotrophic Lateral Sclerosis.” Key details from the study:

COYA 101 was well tolerated and increased Treg suppressive function

The majority (6 out of 8) of patients either slowed or stopped progression (mean change of -2.7 points on ALSFRS-R score) during the open label extension over a 24-week period while 2 out of 8 patients did not benefit from treatment

Assessment of biomarkers of inflammation and oxidative stress over the course of the study correlated with ALS disease severity and may serve to prospectively evaluate and/or monitor treatment response

A few points to note; one, the patient population was small due to covid-19 and adequate statistical analysis was not possible as a result; two, the two patients that did not get a treatment benefit had “markedly higher biomarkers of inflammation (IL-17F and IL-17C) and oxidative stress (OLR1 and ox-LDL).” There were no patient discontinuations. As the company noted, data appeared to show that patients with higher levels of inflammation and oxidative stress at baseline may not benefit from treatment, thus providing a screening mechanism to find those patients with more likelihood of treatment benefit.

Thus, besides the small patient population due to the pandemic and the ensuing lack of statistical analysis, there is nothing negative in this data and therefore, it does not appear that the decision to progress with the rest of the pipeline before seeing this one through later trials was a strategic decision and not a defensive measure. Personally, I am not yet sure if such a decision will pay off better than if the company were to maintain its focus on COYA 101.

I could find no further updates on COYA 101 in their earnings calls or 10-Ks apart from the fact that they have moved on to 302. COYA 302 is now the new ALS candidate, and it also presented proof of concept data in March 2023. Data showed:

Over the clinical trial’s 48-week period, the drug was tested on four patients for safety, tolerability, the function of Tregs, certain biomarkers, and also for preliminary efficacy. At 24 weeks, there was significant Treg enhancement, and at 48 weeks the serum biomarkers for inflammation and oxidative stress were lowered. Throughout the treatment, the patients did not appear to suffer any serious adverse effects.

COYA 302’s preliminary efficacy was measured using the Revised Amyotrophic Lateral Sclerosis Functional Rating Scale (ALSFRS-R), a validated rating tool that monitors the disability progression in ALS patients. The mean (±SD) ALSFRS-R scores were 33.75 ±3.3 at week 24 and 32 ±7.8 at week 48, not statistically different from the ALSFRS-R score at baseline (33.5 ±5.9) before COYA 302 treatment. In other words, the data suggests a significant improvement in the progression of the disease over the 48-week treatment period, validating Coya’s approach with its new biologic.

Again, this was a small trial with just 4 patients, and the molecule seems to have slowed down disease progression after 24 weeks as well as at 48 weeks, showing no difference in disease metrics from baseline. Later in the year, the company presented about 4-hydroxy-2-nonenal (4-HNE), a key biomarker for oxidative stress, and “a strong correlation between clinical response and levels of 4-HNE and inflammatory biomarkers monocyte chemoattractant protein-1 (CCL2) and interleukin (IL-18).”

In May, the company presented data from an open label study of COYA 301 in Alzheimer’s disease. Data from 8 patients showed the following:

Treatment with COYA 301 resulted in a statistically significant improvement in cognitive function, as measured by the Mini-Mental State Examination test (MMSE). In addition, no cognitive decline was observed when it was measured by the Alzheimer’s Disease Assessment Scale–Cognitive Subscale (ADAS-Cog), and the Clinical Dementia Rating-Sum of Boxes scale (CDR-SB).

Treatment with COYA 301 appeared to be well tolerated in patients with AD.

Over the course of the study, COYA 301 restored peripheral Treg function and numbers, and lowered the levels of systemic pro-inflammatory chemokines and biomarkers in patients with AD.

This trial shows a link between biomarkers of inflammation and Alzheimer’s disease. This was seen in how COYA 301 lowered both pro-inflammatory chemokines and improved cognitive function, proving a link between the two.

As company data showed again in June, COYA 301 “resulted in a statistically significant reduction in the expression of three well characterized proinflammatory cytokines — Tumor Necrosis Factor alpha (TNF-α), Interleukin 6 (IL-6), and Interleukin 1- Beta (IL-1β) — which correlated with lack of cognitive decline of the patients over the course of the study.”

Interestingly, PET imaging in a patient showed significant reduction in inflammatory markers in the hippocampal region, an area of the brain strongly associated with cognitive functions and spatial navigation, two aspects of difficulty observed in AD patients.

Financials

COYA has a market cap of $100mn and a cash balance of $11mn. Research and development (R&D) expenses were $1.6 million for the quarter ended September 30, 2023, while general and administrative expenses were $2.0 million. At that rate, they have a cash runway of 3-4 quarters, however, they really do not have cash for anything more expensive than preclinical trials. All or most of their trials are being funded by outside agencies or actually run in academia.

Recently, Dr Reddy’s signed a deal with COYA to develop COYA 302 for ALS. The company paid an upfront fee of $7.5mn for the deal.

Risks

COYA has produced some interesting data, however, possibly given the preliminary nature of this data, the stock has not taken off, and valuation remains at a poor $100mn.

The company’s cash balance is very low and not at all enough to even begin thinking about later stage trials. Thus, there is a strong dilution risk if a position is opened at this time.

AD is a very difficult area of therapy, and many molecules have failed at finding a treatment for this devastating disease. This is true of the entire neurological diseases space in general.

Bottom line

I happen to like COYA, although, at this level of valuation and stage of development, COYA remains very risky. I like the stock because the data they produced – even with a terrible lack of funds – is impressive. Other than that, though, COYA has many miles to go before it gets attractive.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.