Many artificial intelligence (AI) stocks had a strong run to close out 2023 and are still moving higher in 2024. In some cases, businesses are trading on hype. In others, the market is just now realizing the full potential of these investments. Super Micro Computer (SMCI -1.09%) and DocuSign (DOCU 3.59%) are two great stocks that fit into the latter category.

While these stocks may have had a strong run in 2023, they’re slated to continue that bull run well into 2024.

1. Super Micro Computer

Some investors may question if Super Micro Computer, often called Supermicro, is ready for a bull run. After all, the stock gained 246% in 2023 — outperforming the AI king itself, Nvidia. Supermicro benefits from the same trends as Nvidia, making servers that house the graphics processing units (GPUs) Nvidia sells.

Whether you want to utilize the server for AI deep learning, engineering simulations, drug discovery, or game development, Supermicro has highly configurable servers suited to your needs. As companies increase their computing capabilities, Supermicro will benefit from this trend.

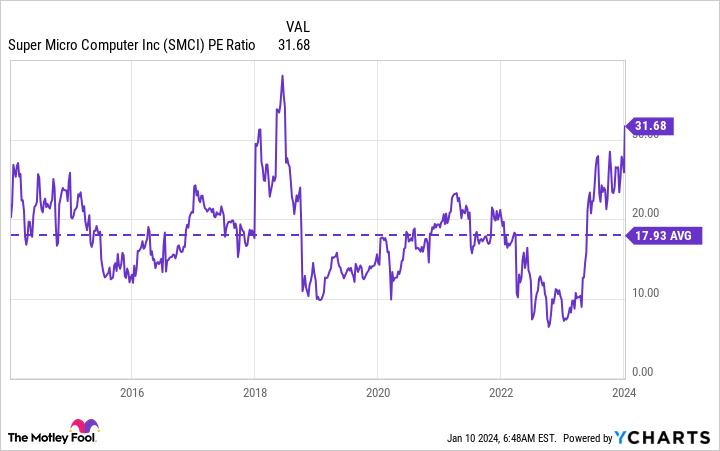

While the stock did well in 2023, that’s because it started from an incredibly low starting valuation of just over 8 times earnings. That’s a substantial discount to where the stock has traded over the past decade.

SMCI PE Ratio data by YCharts

However, the stock has gotten quite expensive (compared to historical averages). But there’s one problem: This analysis looks at the trailing earnings. Supermicro’s business is expected to expand throughout FY 2024 (ending June 30), with management increasing its revenue guidance from $10 billion to $10.5 billion when it reported its Q1 FY 2024 (ending Sept. 30, 2023) results. Compared to the $7.1 billion in revenue it generated in FY 2023 and $5.2 billion in FY 2022, Supermicro is growing quickly.

This fits into management’s vision of having $20 billion in annual revenue each year, which would nearly triple last year’s levels. Because of Supermicro’s expansion, using trailing earnings to value the stock isn’t smart — as it leaves out the best reason to invest in the stock: growth.

From a forward earnings perspective (which uses analysis projections), Supermicro’s stock trades at 20 times earnings. While that’s not historically cheap, Supermicro has undergone a large business transformation, earning the stock a premium compared to historical levels. I expect Super Micro Computer to continue its bull run throughout 2024.

2. DocuSign

DocuSign has been in the dog house for some time. After peaking at $310 per share in 2021, the stock has come crashing down and now sits more than 80% off its all-time high of around $55 per share. But it may be ready for recovery.

Many customers signed on to DocuSign during the pandemic because it was necessary to do business. While this became vital software for many customers, they didn’t increase their usage afterward. This caused DocuSign’s growth to cease, although AI could be a new catalyst.

DocuSign has multiple AI tools, including a generative AI product that creates contractual agreements. This is a massive time and money saver for companies, as they only have to pay lawyers to review contracts, not create them. DocuSign is embracing the AI trend, which could ignite a new growth wave for the company.

DocuSign’s Q3 of FY 2024 (ending Oct. 31, 2023) wasn’t pretty, as revenue rose 9% year over year. However, management was upbeat about what it expects to deliver in FY 2025, causing the stock to pop 5% the next day.

With new management finally getting a full year under its belt, the strategy to stabilize DocuSign’s expenses and kick-start growth is working. While the stock still has a ways to go before truly creating some momentum, it’s priced at dirt-cheap levels right now.

DOCU PS Ratio data by YCharts

DocuSign may not be an AI poster child, but it could be a top-performing AI stock in 2024 if its investments work out.

Keithen Drury has positions in DocuSign. The Motley Fool has positions in and recommends DocuSign. The Motley Fool recommends Super Micro Computer and recommends the following options: long January 2024 $60 calls on DocuSign. The Motley Fool has a disclosure policy.