Edwin Tan /E+ via Getty Images

We’re initiating Aehr Test Systems (NASDAQ:AEHR) with a buy-rating. AEHR is a leading provider of test systems for burning-in and testing memory and logic integrated circuits with a unique position in the semiconductor industry and exposure to the EV market. The company announced 2Q24 results and outlook earlier this week, reporting a solid quarter but revising FY24 guidance by 15-25% to the range of $75M to $85M and GAAP net income between 20-25% of revenue. Our optimism on the stock is based on our belief that the downside in EV has been realized, now being priced into both the outlook and stock with the post-earnings sell-off. We see an expanding market for Silicon Carbide or SiC demand from EV and industrial markets in the longer-run as the industry penetration rate expands over the next 2-3 years. SiC demand from EVs and industrial is currently soft as the auto and industrial markets undergo a correction. Still, investors shouldn’t be too concerned about this as the customer capacity and production pushouts due to the correction are reflected in AEHR’s FY24 outlook. We see continued Y/Y growth in SiC demand and expect end demand recovery post-correction to also act as a catalyst for AEHR’s top-line growth. Canalys forecasts the global EV market will grow by 27.1% in 2024, hitting 17.5M units; we think the current soft EV demand is temporary as the EV market is still in the early innings of its growth. Reflecting this in a big way is the fact that even after the FY24 outlook cut, the FY24 growth rate remains in the double-digit range of 15-30% Y/Y. We think the bottom is forming now with the pullback across the EV peer group and even semi players with auto and industrial exposure like On Semiconductor (ON). ON management guided for a sales decline of 6-11% QoQ to $1,950-2,050M, trailing consensus. We’re seeing slower growth across the peer group, with industry EV leader Tesla (TSLA) only slightly outpacing its FY unit guidance after it already cut in 2023. We think the market is undergoing a correction, which should be complete in 1H24, as we’re seeing multiple EV players cut back on production.

For the quarter, AEHR reported net revenue of $21.4M, up 45% Y/Y, slower than the 93% Y/Y growth a quarter prior but still in the double-digit range. The company’s shown a robust growth trajectory with its reported net revenue of $42.1M for the first six months of FY24, a 65% increase from 1H23. Additionally, the company’s balance sheet remains strong and has a backlog of $3M, reflecting future revenue flow. We think AEHR is now better positioned to outperform after the macro weakness has been priced into the outlook and stock.

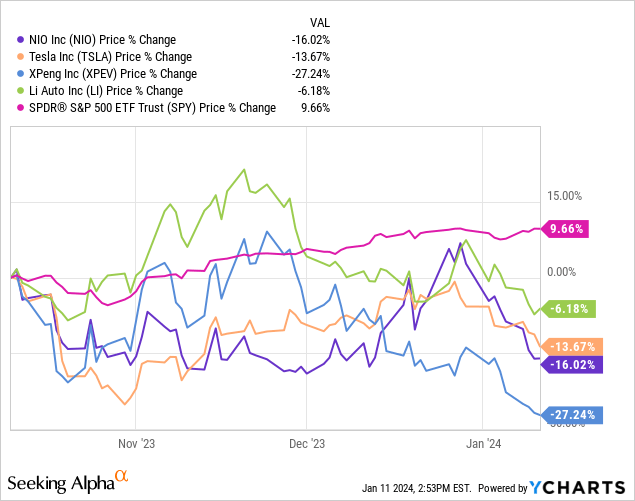

Gayn Erickson, AEHR CEO and President noted on the earnings call, “In the last sixty days, we have seen how the slowing of the growth rate of the electric vehicle market has had a negative impact on the timing of several current and new customer orders and capacity increases for silicon carbide devices used in them.” We expect customers to work through oversupply over the coming quarter and see an end demand rebound beginning in 2H24 for the EV and industrial markets, as the correction should be complete in 1H24 according to our estimates monitoring the peer group. All EV players have been trading lower over the past three months; the following outlines NIO (NIO), Tesla, XPeng (XPEV), Li Auto Inc (LI), and the S&P 500.

YCharts

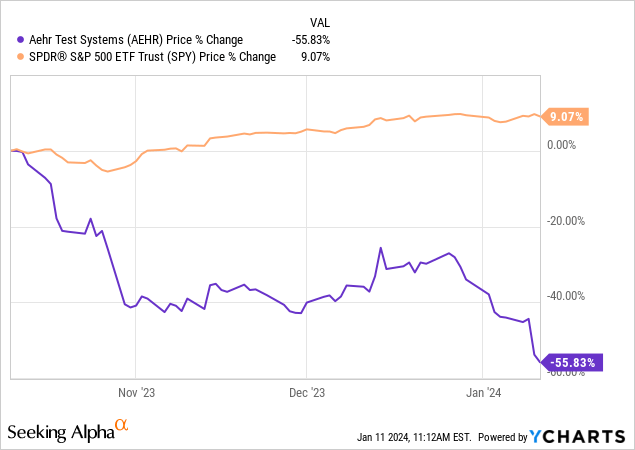

We think AEHR stock now prices in the macro weakness, and we don’t see further guidance cuts in 2HFY24; the reason we don’t see more downside revision in FY24 guidance is that SiC demand needs to continue for auto and industrial markets to sustain growth forecasts. We see an expanding growth opportunity for AEHR in 2024 and 2025 once EV demand rebounds; the EV market is estimated to grow at 20% CAGR through 2030, and a crucial part of ensuring the EV supply needs are met is the supply of SiC. As Erickson puts it, “For clarity, we do not see the silicon carbide market decreasing, only a temporary slowing of the growth rate.” After the pullback this week, we see a more favorable risk-reward profile for AEHR, down 19% over the past five days, versus the S&P 500, up 2%. Over the past three months, the stock has underperformed the S&P 500 by 65%.

The following outlines AEHR stock against the S&P 500 over the past three months.

YCharts

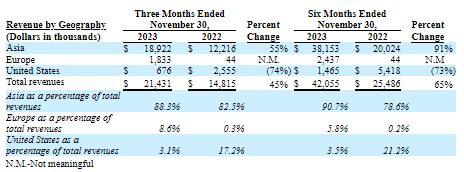

While the rebound may take longer than expected post-inventory correction cycle without momentum to drive it, we think it’s a matter of when not if the demand will rebound and drive top-line growth. In our opinion, the biggest risk factor for the EV rebound is prolonged macro weakness in the Chinese market, as mainland China is by far the largest EV market, with 55% of the global EV sales in 1H23. We think EV demand will continue to be soft in the near-term as customers deal with order pushouts due to weaker-than-expected consumer spending. We see end demand rebounding post-correction as supply-demand dynamics come back into balance. We don’t see China recovering in the near term, but we believe the industry will see an expanding penetration rate regardless. Our belief of a rebound in SiC demand is also based on our expectation that end demand in U.S. and European markets should rebound post-correction as macro uncertainty eases. We recommend investors explore entry points at current levels.

The following chart outlines AEHR’s revenue by geography, highlighting the company’s higher exposure to Asia.

AEHR 10Q

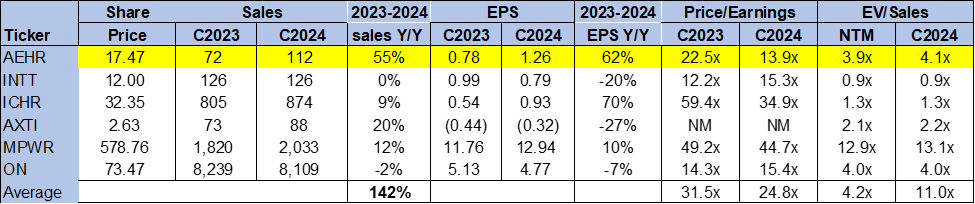

Valuation

The stock is fairly valued, in our opinion, for the growth potential in SiC demand from EV and industrial markets. The sock is trading at 4.1x EV/C2024 Sales versus the peer group average of 11.0x. On a P/E ratio, the stock is trading at 13.9x C2024 EPS $1.26 versus the peer group average of 24.8x. We think AEHR’s valuation is digestible in comparison to the test systems peer group. We value AEHR as a growth stock and see more room for upside potential as the industry penetration rate expands.

The following outlines AEHR’s valuation against the peer group.

TSP

Word on Wall Street

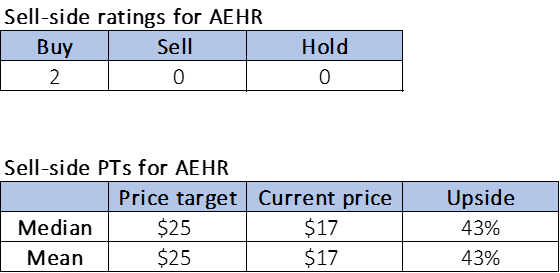

Wall Street shares our bullish sentiment on the stock. AEHR is largely an under-the-radar kind of stock; the two analysts covering the stock share our buy-rating. The stock is currently priced at $22 per share. The median and mean sell-side targets are $25, with a potential upside of 12%. We think AEHR will get more traction after the massive pullback that signaled how bad the EV slump is. Hence, we also believe outperformance will be partially driven by investor confidence in the stock once EV and industrial markets begin to rebound.

The following charts outline AEHR sell-side ratings and price targets.

TSP

What to do with the stock

We initiate AEHR with a buy-rating. 2Q24 results and outlook lead us to believe the downside in EV and correction in auto and industrial markets have been priced into the outlook and stock price. We strongly believe SiC demand is not going anywhere; the market is estimated to grow at a CAGR of 26% between 2022-2030. We recommend investors take advantage of the pullback and jump in at the bottom.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.