Floriana

The world of exchange-traded funds is fascinating. The industry has exploded in popularity such that there are countless funds that track any number of things you can possibly think of. One of those things that’s relatively new in the world of investing is a blockchain-focused fund called Amplify Transformational Data Sharing ETF (NYSEARCA:BLOK). It’s volatile, as you could probably guess, but given its correlation to Bitcoin (BTC-USD), I think this one is worth a speculative look on the long side.

What is BLOK?

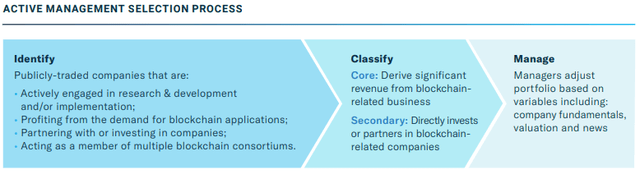

BLOK is an actively-managed fund that seeks to invest in companies that include research, development, utilization, and funding of blockchain-based data sharing technology. Given that goal, the managers of the fund have a lot of latitude when it comes to picking stocks to go in the fund.

Fund website

Basically, so long as a company has some attachment to any sort of blockchain technology, it is eligible for BLOK. In practice, that means holdings are heavily skewed towards Bitcoin-focused companies.

Again, it’s actively managed, so turnover is quite high at 36% annually.

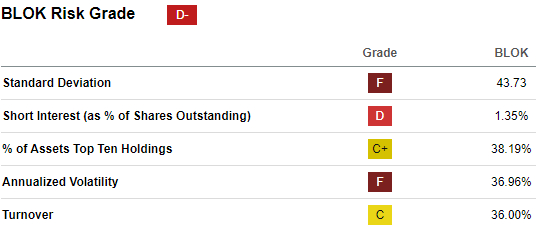

Seeking Alpha

In addition, it’s quite volatile at 37% annualized volatility. For reference, that’s right at 3X that of the S&P 500. However, with that increased volatility comes increased possibility for returns, and that’s why we’re here.

The expense ratio is pretty reasonable at 75 basis points, and I say reasonable because it’s a small fund that is actively managed, so it could be much worse. And as you’d expect, it is far from diversified.

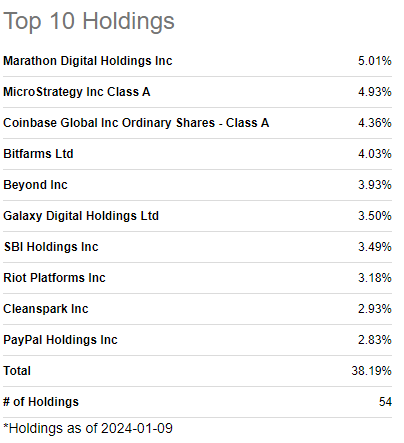

Seeking Alpha

The fund owns 54 equities at the moment, and about 38% of the fund is in the top 10 stocks. If we look at the top 10, we see a very clear theme, and that is Bitcoin. There are other potential applications of blockchain technology but for the foreseeable future, this fund is going to be heavily focused there. If that’s not something you’re into, this fund isn’t for you. However, I happen to like the upside potential of Bitcoin itself (more on that in a bit) and that means I like the upside potential of the stocks in this fund that are tied to Bitcoin.

Now that we’ve level set on what this is, let’s take a look at technicals to get an idea of potential paths forward.

Pulling back into support

BLOK had an incredible run from the October bottom, adding about 70% in the space of a couple of months. The stocks in this fund are high-beta, high-volatility names so one-way action in equities will produce big moves in BLOK in both directions. There was another big down day on Thursday, but the uptrend remains intact so long as support is respected.

StockCharts

The first support level is the former top at $27, which was eclipsed in early December. The fact that the fund is back testing that level is normal, and a good thing so long as it holds. The 20-day exponential moving average failed but that $27 level is just below current price. We have the rising 50-day simple moving average, currently just under $26, that could serve as support as the rally continues, or on a failure of $27.

The one cause for concern in terms of the stock turning higher from here in the near-term is that after becoming incredibly overbought into the end of the year, momentum is nosediving. I’ve put a box around the PPO’s histogram, which shows the difference between the short-term and long-term lines in the PPO itself. It’s used as a sort of early warning signal for trend changes, and right now, there’s no evidence this bearish move in momentum is arresting. It’s something to watch for a potential bottom to start forming.

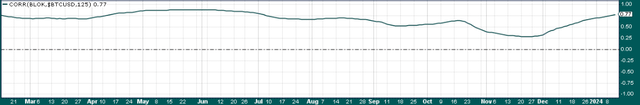

I mentioned most of the top 10 holdings are primarily related to Bitcoin in some fashion, and below, we can see the 125-day correlation of BLOK to the price action of the OG alt-coin itself.

StockCharts

That’s six months of trading (roughly) so this is a longer-term look at correlation, and it’s extremely strong. The most recent reading is 0.77, so Bitcoin and BLOK move largely in tandem with each other. That’s not surprising given the construction of the fund, but it’s always good to confirm a fund is tracking what you think it is. This is a Bitcoin-focused fund with some peripheral exposure to things like financials, in my opinion.

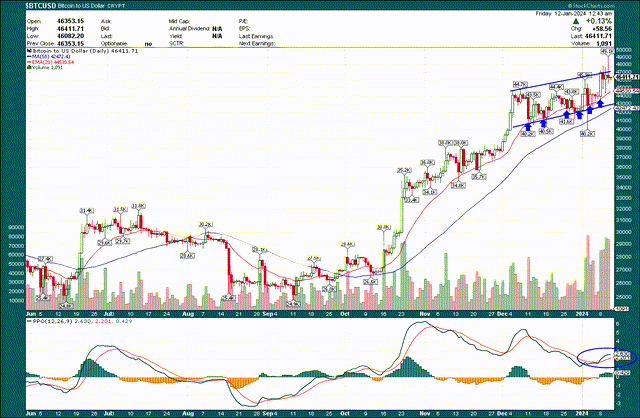

Given the strong correlation, we can take clues from Bitcoin itself, which is pictured below. Of course, the big news this week was the approval of spot Bitcoin ETFs by the SEC, which saw a predictable sell-the-news reaction. However, that can only be good for interest in the space going forward, and I think it adds to the bull case for Bitcoin, and BLOK by extension.

StockCharts

Bitcoin’s bull case is quite straightforward in that it’s in the midst of what looks to me like a bull flag, and when/if it breaks out, we can expect another move to new relative highs. This time, momentum was almost completely reset, and we’ve already seen a turn higher in the PPO. I’m very bullish on Bitcoin and I believe it’s only a matter of time before we see it challenge the all-time highs we saw in 2021. If that turns out to be the case, BLOK stands to do very well with its high positive correlation to the coin itself.

Finally, valuing an ETF is tricky, but in this case, we can value BLOK against Bitcoin itself given they’re so highly correlated. Below we have the ETF’s price over that of Bitcoin, so when the line moves up, that’s BLOK becoming more expensive relative to Bitcoin, and vice versa.

StockCharts

BLOK has undoubtedly underperformed Bitcoin for the past six months or so, and by a wide margin. We saw a boost of 24% in relative valuation in December, so the magnitudes we’re talking about here are sizable. Right now, BLOK is about as cheap as it has been in the past year relative to Bitcoin. In my view, that boosts the attractiveness of the fund today.

If we wrap this up, I like BLOK because it offers pretty targeted exposure to Bitcoin-focused companies that should benefit immensely from what I see as a continued Bitcoin bull market. This one is speculative and moves a lot in both directions, so it’s not for everyone, but I’m hitting it with a buy rating.