Yuki KONDO/E+ via Getty Images

Zhengye Is Producing Revenue Decline

Zhengye Biotechnology Holding Limited (ZYBT) has filed to raise $20 million in an IPO of its ordinary shares, according to an SEC F-1 registration statement.

ZYBT researches and develops vaccines for animals in China and exports to Vietnam, Pakistan, and Egypt.

The company’s topline revenue has declined in the most recent reporting period, but profits are still positive.

I’ll provide a final opinion when we learn more about pricing and valuation.

What Does Zhengye Do?

Jilin City, PRC-based Zhengye Biotechnology Holding Limited was founded to develop veterinary vaccines for use primarily in livestock.

Management is headed by Chairman Mr. Zhenfa Han, who has been with the firm since 2004 and was previously a member of various National Committees of the Chinese People’s Political Consultative Conference. He has also been the Vice President of the Agricultural Industry Chamber of Commerce.

The company’s primary offerings include vaccines for the following:

-

Livestock

-

Swine

-

Goats

-

Sheep

-

Poultry

-

Dogs

As of June 30, 2023, Zhengye has booked fair market value investment of $31.8 million from investors, including the founder, Securingium Holding and VVAX Holdings.

The firm sells its vaccines to animal husbandry organizations across 29 provincial regions in China, Vietnam, Pakistan and Egypt.

Zhenye has 13 vaccine production lines, one quality examination center and one animal facility for vaccine development.

It operates primarily through a large distributor network within the PRC and through exporting distributors.

Sales and Marketing expenses as a percentage of total revenue have trended lower as revenues have decreased, as the figures below indicate:

|

Sales & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2023 |

14.2% |

|

2022 |

13.3% |

|

2021 |

16.8% |

(Source – SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing expense, fell to negative (0.5x) in the most recent reporting period, as shown in the table below:

|

Sales & Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2023 |

-0.5 |

|

2022 |

1.5 |

(Source – SEC)

What Is Zhengye’s Market?

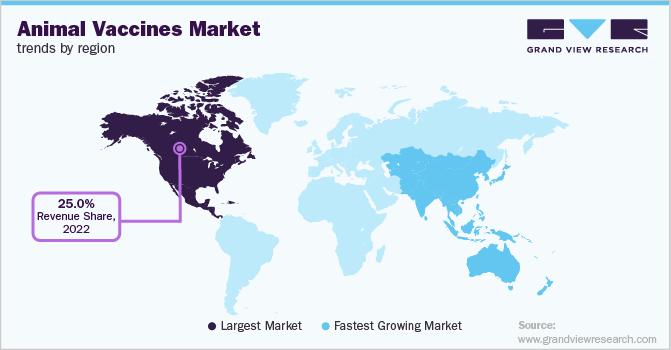

According to a 2023 market research report by Grand View Research, the global animal vaccines market was an estimated $12.8 billion in 2022 and is forecasted to reach $26.3 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 9.4% from 2023 to 2030.

The main drivers for this expected growth are an increasing incidence of cattle disease amid a growing livestock population worldwide.

Also, the chart below indicates that the North American region will account for the largest market share at 25.0% through 2030 but that the Asia-Pacific region is expected to grow at the fastest rate of growth:

Grand View Research

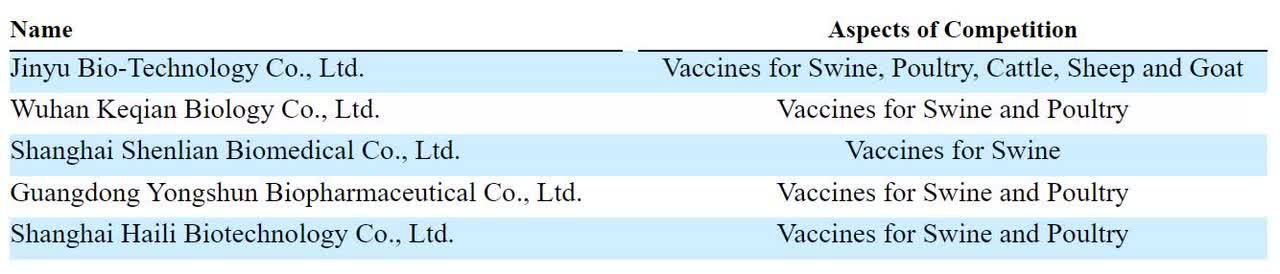

Major competitive or other industry participants include the following:

SEC

On a global basis, the company faces competition from these companies:

-

Zoetis

-

Ceva Santé Animale

-

Merck & Co.

-

Vetoquinol S.A.

-

Boehringer Ingelheim Gmbh

-

Elanco

-

Virbac

-

Heska

-

Dechra Pharmaceuticals Plc

-

Idexx Laboratories

-

Norbrook

Zhengye Biotechnology Holding Limited Recent Financial Results

The company’s recent financial results can be summarized as follows:

-

Declining topline revenue

-

Reduced gross profit

-

Increasing gross margin

-

Lowered operating profit

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

$ 16,115,000 |

-6.7% |

|

2022 |

$ 37,735,000 |

25.9% |

|

2021 |

$ 29,969,380 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

$ 9,992,000 |

-7.1% |

|

2022 |

$ 22,258,000 |

26.8% |

|

2021 |

$ 17,555,020 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

62.00% |

-0.3% |

|

2022 |

58.99% |

0.7% |

|

2021 |

58.58% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2023 |

$ 4,044,000 |

25.1% |

|

2022 |

$ 9,545,000 |

25.3% |

|

2021 |

$ 7,333,620 |

24.5% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2023 |

$ 2,783,000 |

17.3% |

|

2022 |

$ 6,776,000 |

18.0% |

|

2021 |

$ 5,454,260 |

18.2% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2023 |

$ 1,095,000 |

|

|

2022 |

$ 2,513,000 |

|

|

2021 |

$ 4,452,980 |

|

(Source – SEC)

As of June 30, 2023, Zhengye had $3.2 million in cash and $25.9 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2023, was $1.1 million.

Zhengye Biotechnology Holding Limited’s IPO Information

Zhengye intends to raise $20 million in gross proceeds from an IPO of its ordinary shares, although the final figure may vary.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s market capitalization at IPO would approximate $200 million, excluding the effects of underwriter over-allotment options.

Management says it will use the net proceeds from the IPO as follows:

for acquiring vaccine production companies;

for building a new workshop;

for conducting R&D projects; and

to fund working capital and for other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not currently a party to ‘any material legal or administrative proceedings.’

The sole listed bookrunner of the IPO is US Tiger Securities.

Zhengye’s IPO Is Challenged Due to Declining Revenue

ZYBT is seeking U.S. public capital market investment to fund its acquisition program and for new development capabilities.

The company’s financials have shown declining topline revenue and gross profit, reduced net income and cash flow from operations.

Free cash flow for the twelve months ending June 30, 2023, was $1.1 million.

Sales and Marketing expenses as a percentage of total revenue have trended unevenly lower as revenue has decreased; its Sales and Marketing efficiency multiple fell to negative (0.5x) in the most recent reporting period.

The firm currently plans to pay no dividends and to keep any future earnings to finance its growth and working capital requirements.

ZYBT’s recent capital spending history indicates it has continued to spend on capital expenditures as a percentage of its operating cash flow.

The market opportunity for producing animal vaccines is large and expected to grow at a 9.4% CAGR growth rate through 2030, so the industry has a reasonably solid growth trajectory ahead.

However, the firm faces substantial competition in global markets from entrenched and well-known companies.

Risks to the company’s outlook as a public company include the ongoing uncertainty and unpredictability of China’s regulatory environment, which can change industry dynamics quickly.

Also, the company is an ‘emerging growth company’ and a ‘foreign private issuer’, which means management can choose to provide substantially less information to shareholders.

Such company stocks have frequently performed poorly post-IPO.

Additionally, investors would only own stock in a Cayman Islands-based corporation and would not own stock directly in the operating entities.

There are ongoing risks to such firms’ listing compliance in the U.S., which continues to operate under the HFCA Act regulating auditor inspections and related listings.

Finally, the company is subject to myriad restrictions on transfers of funds and operations with China, and it may be difficult or costly to prosecute the firm or management with legal actions in the case of allegations of misconduct.

When we learn more IPO details from the company, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.