Justin Sullivan

I last updated Carvana Co. (NYSE:CVNA) investors in September 2022, as I downgraded the stock following an incredible recovery, picking its initial bottom in late July 2022. That downgrade was timely, as CVNA topped out in late August 2022 and then fell into a downward spiral toward the $3.6 zone in late December 2022 before meeting selling exhaustion. I reminded CVNA holders that the stock remains a highly speculative play, suggesting we shouldn’t hold the bag on CVNA. In addition, I urged investors to “be generous with their margin of safety, given Carvana’s unprofitability and near-term headwinds.”

CVNA’s bottom in late 2022 led to an incredible surge as dip-buyers astutely bet the worst was over. As a result, CVNA bottomed out with peak pessimism, as it was engulfed with significant debt restructuring challenges. As a result, investors have been given another reminder to assess investor psychology appropriately to determine the risk/reward profile of their directional bias. CVNA’s 1Y total return of nearly 940% should have given you a clear view of how much it costs to be bearish when the tide turns against you as CVNA dropped into peak pessimism. By the time investors realized Carvana’s worst decline could be over, short-sellers who went aggressively for the “kill” late last year had likely seen their brokerage accounts implode.

Carvana’s third quarter earnings release demonstrated that bearish investors have failed to anticipate Carvana could turn it around if they managed to secure even a short-term respite. Observant investors should recall that Carvana posted a sharp recovery in total retail gross profit per unit or GPU to $5,952 in Q3, up significantly from last year’s $3,500. As a result, its gross margin has also recovered to 17.4% in Q3, up markedly from last year’s 10.6%. In addition, corporate adjusted EBITDA also inflected back into positive territory, posting a metric of $148M in Q3. In other words, the online used vehicle marketplace leader could have seen the worst in its operating performance in 2022.

However, the market is forward-looking. By the time Carvana posted its solid recovery in its operating results, CVNA had already bottomed out in late 2022. The critical question is whether the market could lift CVNA much higher from here. I indicate much higher because CVNA is a highly speculative play. If you don’t think the risk/reward provides you with a highly significant margin of safety, it’s better to stay out and focus on quality.

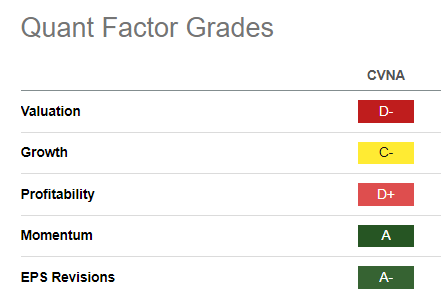

CVNA Quant Grades (Seeking Alpha)

Seeking Alpha Quant assigns CVNA with an unattractive “D-” valuation grade, suggesting investors should remain cautious. Its “C-” growth grade is also relatively unattractive, worsened by its weak “D+” profitability grade. Despite that, Carvana management highlighted that its capacity remains underutilized. As a result, its fixed-cost leverage is relatively low, which could improve further with more robust demand/supply dynamics in 2024. However, it also depends on whether the company could scale its inventory quickly enough to meet potentially improved demand conditions. With the Fed looking to cut rates by three times this year, I gleaned that the market conditions should look more constructive for Carvana.

However, its debt profile is still daunting. With an estimated FY24 adjusted EBITDA leverage ratio of 15.3x, I assessed Carvana as highly leveraged. With relatively weak profitability to go along with it, I’m not confident whether it even makes sense to take a speculative position at the current levels since CVNA’s peak pessimism is long over (meaning the best entry levels are likely no longer available).

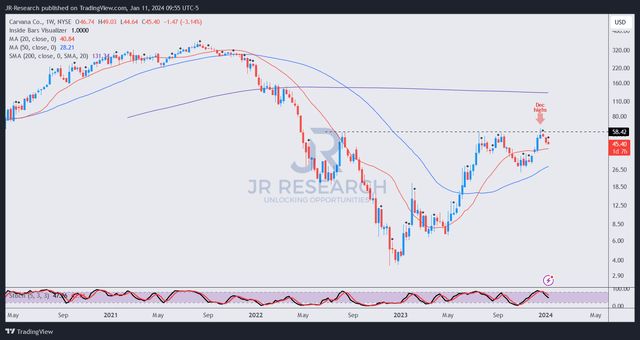

CVNA price chart (weekly) (TradingView)

In addition, CVNA’s buyers failed to break decisively above the $60 critical resistance zone, which proved to be a robust bull trap (false upside breakout). Moreover, selling pressure on the level has already reacted, but I assessed the downside volatility could still carry on, suggesting more pain for holders still holding on.

As a result, I see potentially higher downside risks that could compel a fall toward the critical support zone of $25. It’s still too early to assess whether Carvana Co. could bottom out above that level (which is constructive). However, I urge investors sitting on significant gains from buying the dips in late 2022 to consider taking a sizeable position off.

Rating: Downgraded to Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!