Nastassia Samal/iStock via Getty Images

This article series aims at evaluating ETFs (exchange-traded funds) regarding past performance and portfolio metrics. Reviews with updated data are posted when necessary.

RPV strategy

Invesco S&P 500 Pure Value ETF (NYSEARCA:RPV) started investing operations on 03/01/2006 and tracks the S&P 500 Pure Value Index. It has 101 holdings, an expense ratio of 0.35% and a 12-month distribution yield of 2.37%.

As described by S&P Dow Jones Indices, S&P 500 stocks are assigned two scores for value and growth. The value score is based on three ratios: book-value-to-price, earnings-to-price, and sales-to-price. The growth score is based on the three-year sales per share growth, the three-year earnings yield change, and the 12-month share price return. The S&P 500 Pure Value Index selects stocks with a higher value score, excluding those demonstrating both value and growth characteristics. In short, “pure value” means value with little or no growth. Constituents with higher value scores receive greater weights.

This article will use two benchmarks: iShares S&P 500 Value ETF (IVE) and SPDR S&P 500 ETF (SPY).

RPV portfolio

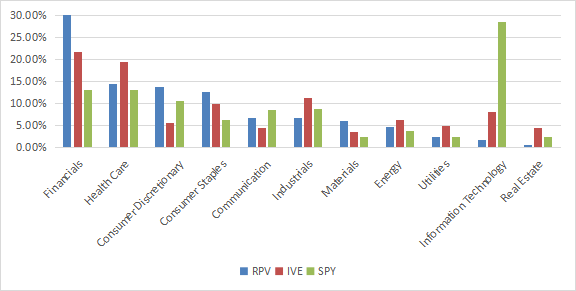

The heaviest sector is by far Financials, with 30.1% of asset value. Healthcare, consumer discretionary and consumer staples are between 12% and 15%. Other sectors are below 7%. Compared to IVE and SPY, RPV overweights mostly financials, consumer discretionary, consumer staples and materials. It massively underweights technology and real estate.

Sector breakdown (chart: author: data: Invesco, iShares, SSGA)

The top 10 holdings, listed in the next table, represent 25% of asset value. The heaviest position weighs 3.38%, so risks related to individual stocks are low to moderate.

|

Ticker |

Name |

Weight (%) |

P/E TTM |

P/E fwd |

P/Sales TTM |

P/Book |

P/Net Free CashFlow |

Yield% |

|

General Motors Co. |

3.38 |

5.14 |

4.86 |

0.29 |

0.68 |

N/A |

0.99 |

|

|

Berkshire Hathaway, Inc. |

3.17 |

10.44 |

18.92 |

2.01 |

1.52 |

29.78 |

0 |

|

|

Ford Motor Co. |

2.63 |

7.76 |

6.34 |

0.28 |

1.08 |

79.26 |

5.07 |

|

|

Walgreens Boots Alliance, Inc. |

2.51 |

38.14 |

7.70 |

0.15 |

1.12 |

N/A |

3.94 |

|

|

Paramount Global |

2.51 |

N/A |

34.08 |

0.31 |

0.42 |

N/A |

1.41 |

|

|

CVS Health Corp. |

2.30 |

12.12 |

9.36 |

0.30 |

1.39 |

12.60 |

3.31 |

|

|

Viatris, Inc. |

2.30 |

7.69 |

3.92 |

0.91 |

0.67 |

9.69 |

4.14 |

|

|

Tyson Foods, Inc. |

2.09 |

N/A |

28.65 |

0.36 |

1.06 |

N/A |

3.54 |

|

|

United Airlines Holdings, Inc. |

2.08 |

5.05 |

4.45 |

0.28 |

1.63 |

10.84 |

0 |

|

|

Invesco Ltd. |

1.99 |

13.63 |

12.36 |

1.37 |

0.72 |

13.31 |

4.50 |

Regarding the usual valuation ratios, RPV is much cheaper than IVE, which itself is significantly cheaper than SPY. The largest gap is measured in price/sales, as reported below.

|

RPV |

IVE |

SPY |

|

|

Price/Earnings TTM |

9.41 |

16.9 |

22.62 |

|

Price/Book |

1.06 |

2.41 |

3.97 |

|

Price/Sales |

0.46 |

1.64 |

2.57 |

|

Price/Cash Flow |

5.05 |

11.61 |

15.72 |

Performance

Since inception, RPV has lagged SPY by 148 bps (basis points) in annualized return, and it has outperformed IVE by 28 bps. It shows a much higher risk than the two other funds regarding maximum drawdown and historical volatility (measured as standard deviation of monthly returns in the next table). As a consequence, it is lagging in risk-adjusted performance (Sharpe ratio).

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

RPV |

308.06% |

8.21% |

-75.32% |

0.4 |

23.24% |

|

IVE |

289.88% |

7.93% |

-61.32% |

0.47 |

16.41% |

|

SPY |

420.01% |

9.69% |

-55.19% |

0.59 |

15.64% |

Data calculated with Portfolio123

In the last 12 months, RPV is far behind the two benchmarks.

RPV vs IVE, SPY, last 12 months (Seeking Alpha)

Comparing RPV with my Dashboard List model

The Dashboard List is a list of 80 stocks in the S&P 1500 index, updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. After this filter, the 10 companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: energy with materials, communication with technology. Real estate is excluded because these valuation metrics don’t work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares RPV performance since inception with the Dashboard List model, with a tweak: the list is reconstituted annually to make it comparable to a passive index.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

RPV |

308.06% |

8.21% |

-75.32% |

0.4 |

23.24% |

|

Dashboard List |

473.14% |

10.29% |

-57.37% |

0.54 |

19.13% |

Past performance is not a guarantee of future returns

The Dashboard List outperforms RPV by about 2% in annualized return, and it looks much safer regarding drawdowns and volatility. A note of caution: ETF performance is real, whereas the list is simulated.

Competitors

The next table compares characteristics of RPV and five of the most popular large cap value ETFs:

- Vanguard Value ETF (VTV)

- iShares MSCI USA Value Factor ETF (VLUE)

- Capital Group Dividend Value ETF (CGDV)

- Avantis U.S. Large Cap Value ETF (AVLV)

- Dimensional US Large Cap Value ETF (DFLV)

|

RPV |

VTV |

VLUE |

CGDV |

AVLV |

DFLV |

|

|

Inception |

3/1/2006 |

1/26/2004 |

4/16/2013 |

2/22/2022 |

9/21/2021 |

12/6/2022 |

|

Expense Ratio |

0.35% |

0.04% |

0.15% |

0.33% |

0.15% |

0.22% |

|

AUM |

$1.69B |

$155.89B |

$6.95B |

$5.55B |

$2.11B |

$1.34B |

|

Avg Daily Volume |

$20.62M |

$401.13M |

$37.51M |

$48.90M |

$13.95M |

$9.57M |

|

Holdings |

101 |

345 |

155 |

55 |

275 |

343 |

|

Top 10 |

24.95% |

22.77% |

34.57% |

41.81% |

20.23% |

20.58% |

|

Turnover |

45.00% |

5.00% |

23.00% |

30.00% |

23.00% |

5.00% |

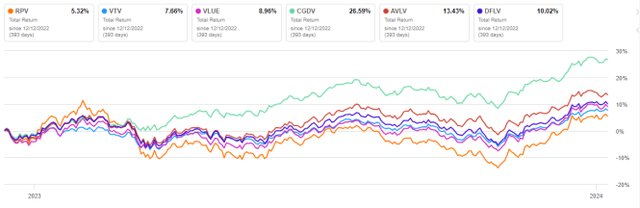

RPV has the highest fee and turnover. The next chart plots total returns since 12/12/2022 to match all inception dates. RPV has been the worst performer of this group.

RPV vs competitors since 12/12/2022 (Seeking Alpha)

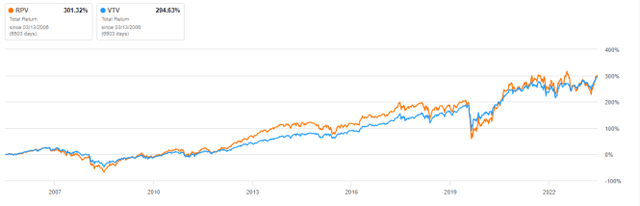

However, since its inception, RPV is slightly ahead of the older fund VTV. Nevertheless, the gap in annualized return is insignificant.

RPV vs VTV since inception (Seeking Alpha)

Methodological shortcomings

I like the idea of mixing various ratios to rank value stocks. Most value indexes have two shortcomings. The first one is to classify all stocks using the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously, they are not: my monthly dashboard here shows how valuation and quality metrics may vary across sectors.

The second weakness is relying too much on the price/book ratio (P/B), which adds some risk in the strategy. Historical data show that a large group of companies with low P/B has a higher volatility and deeper drawdowns than a same-size group with low price/earnings, price/sales or price/free cash flow. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (i.e.125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/2000 and 1/1/2024 with elements in equal weight. The P/B-based set shows the lowest excess return and is behind the benchmark (equal-weight S&P 500) in risk-adjusted performance (Sharpe ratio).

|

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

Cheapest quarter in P/B |

9.86% |

-73.88% |

0.47 |

23.25% |

|

Cheapest quarter in P/E |

10.63% |

-63.06% |

0.55 |

19.88% |

|

Cheapest quarter in P/S |

11.60% |

-68.78% |

0.54 |

22.70% |

|

Cheapest quarter in P/FCF |

12.65% |

-64.24% |

0.62 |

20.63% |

|

Equal Weight Index (RSP) |

9.16% |

-59.92% |

0.5 |

17.55% |

Data calculated with Portfolio123

This explains why I use P/FCF and not P/B in the Dashboard List model.

Takeaway

Invesco S&P 500 Pure Value ETF (RPV) picks large caps based on book-value-to-price, earnings-to-price, and sales-to-price. It is well-diversified across holdings, but overweight in the financial sector. As expected, the fund’s valuation metrics look better than for the S&P 500 and the S&P 500 Value indices. However, it has lagged both benchmarks in risk-adjusted performance since 2006. It shows a significantly higher risk measured in volatility and maximum drawdown. As a volatile ETF, RPV looks a good instrument for swing trading, or in a tactical allocation strategy switching between value and growth styles. However, it has not brought excess return over its parent index on the long term. I see two shortcomings in the strategy: it ranks stocks regardless of their industries, and it relies too much on the price/book ratio.