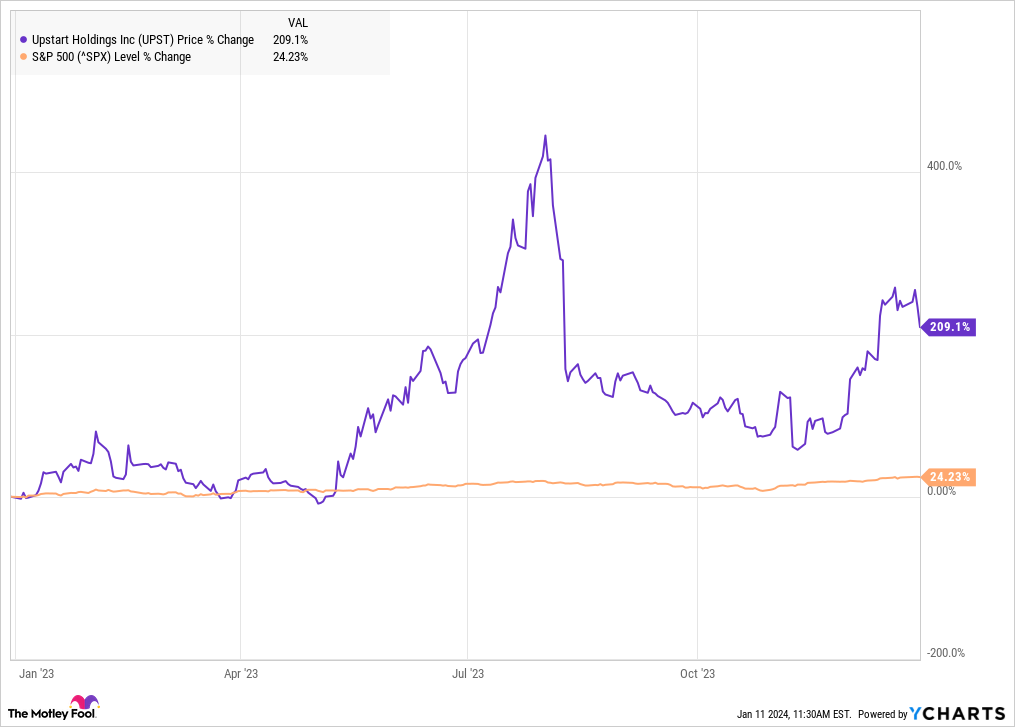

After collapsing in 2022, shares of Upstart (UPST -6.58%) were on the rebound last year, jumping 209%, according to data from S&P Global Market Intelligence.

The artificial intelligence (AI)-based consumer lending company benefited from a more resilient performance from the economy than expected, an increasing premium on AI technology, and expectations that interest rates could start falling this year. A short squeeze also seemed to help drive the stock higher.

As you can see from the chart, Upstart’s gains primarily came between its first-quarter earnings report in May and its second-quarter earnings report in August. After falling sharply on the Q2 report, the stock rebounded at the end of the year on signs that interest rates would fall in 2024.

Upstart finds new life in 2023

Upstart stock plummeted in 2022 as interest rates rose and demand for its loans, from both consumers and its banking partners, dried up.

As a result, the stock entered 2023 with investor sentiment down sharply. Shares traded mostly flat for the first four months of the year and then started to gain after it reported first-quarter earnings.

Though the results were generally weak, the company reported a narrower-than-expected loss, and its guidance was also ahead of the consensus. That, along with the beaten-down stock price and high short interest, helped spark a 35% jump in the stock on May 10, and the stock got another boost after Castlelake, a global alternative investment manager, agreed to buy $4 billion of consumer installment loans from Upstart, extending an important lifeline to the fintech company, which doesn’t typically keep loans on its books.

The short squeeze picked up steam in advance of the company’s second-quarter earnings report in August. However, the stock plunged on those results, falling by more than a third on Aug. 9 as the company beat estimates but offered weak guidance, showing the economy hadn’t strengthened sufficiently to support a recovery in demand for its loans.

Finally, the stock closed out 2023 on an upswing as the Federal Reserve forecast three interest rate cuts in 2024.

Image source: Getty Images.

What Upstart needs this year

Upstart’s business is still weak, and interest rate cuts and short squeezes will only get it so far. The company needs to return to growth in loan originations and revenue and deliver increasing demand.

In the third quarter, for example, revenue fell 14% to $135 million, and the company forecast Q4 revenue to be flat sequentially at $135 million.

If the economy starts to strengthen and interest rates come down, the business should see real improvement, but the timing of that is still uncertain.

Upstart is down nearly 20% to start the new year as investor hopes for interest rate cuts have cooled off. Keep an eye on the Q4 earnings report out in February for any sign that demand is starting to recover.