BlackJack3D

Investment Thesis

Check Point’s (NASDAQ:CHKP) steady revenue growth, coupled with a very solid balance sheet and improving margins, the company is a solid contender for a long-term buy and hold. The company’s liquidity allows for a lot of flexibility in how it wants to reward its shareholders in the long run and even with beaten-down estimates, the company is trading at its fair value. However, the market is very saturated, with a lot of formidable competition, and the looming uncertainty of the conflict in Israel may pose some risks shortly.

Briefly on The Company

Check Point is a global provider of cybersecurity solutions. The company develops and sells software and hardware products aimed at organizations to protect them from cyberattacks. The company is a leader in next-generation firewalls, which protect against many attacks such as malware, ransomware, and intrusion attacks.

The company also specializes in threat prevention with the use of AI and machine learning to detect and block any incoming sophisticated attacks. CHKP also specializes in cloud security, with its CloudGuard suite of products that protect public and private clouds alike.

Financials

As of Q3’23, the company had around $1.45B in cash and no debt on the books. That is a great position to be in, as a lot of investors tend to avoid companies that use debt to complement their day-to-day operations. With a decent cash pile, the company can pursue many different avenues of creating shareholder value, through strategic acquisitions, which is one of my preferred ways, or share buybacks, which is my second preferred, and dividends, if there are no better ways of utilizing the available cash. CHKP is not at any risk of insolvency with such a healthy position and should weather any major downturns with ease.

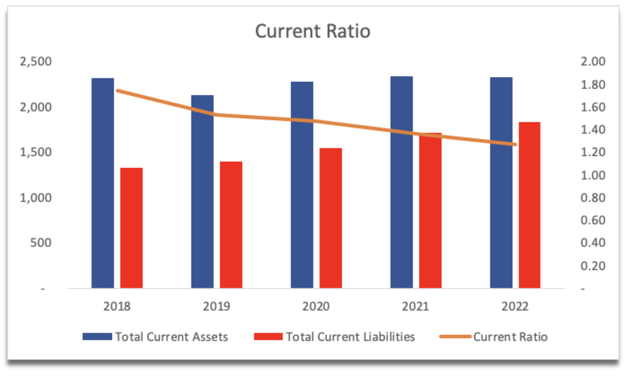

The company’s current ratio has been trending downward over the last few years; however, it is still acceptable in my opinion, and the company shouldn’t have any liquidity issues any time soon. I’d like to see it coming back to at least 1.5, but as long as it’s over 1, the company has no liquidity issues and can pay off its short-term obligations. Deferred revenue is a big part of current liabilities, which is income that was already received but the service not yet delivered. This is usually the case for subscription-based income, so the company’s current liabilities are very little.

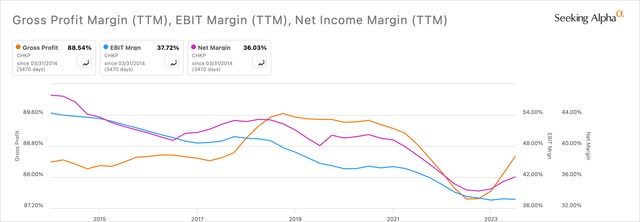

Looking at the company’s efficiency and profitability, margins are beginning to turn back up, which is a very good sign. In FY22, the company saw some deterioration in profitability due to increased numbers in the workforce, the strength of the dollar, and the additional costs of raw materials. Nonetheless, the company’s gross margins are still very high, and the bounce in the other margins is going to bode well for the company in general.

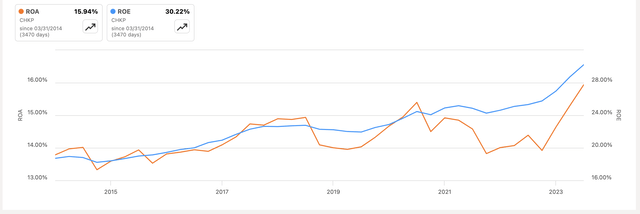

With the bounce in margins, ROE and ROA follow suit. Check Point’s management seems to be doing a very good job at utilizing the company’s assets and shareholder capital, thus creating value. Even when the company experienced a dip in profitability, it was very efficient.

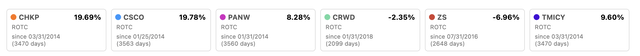

The company’s high ROTC is one of the better ones I have seen in this space. If we look at the competition, we can see that the company is at the top of the list. I took all these competitors from the company’s financial reports. We can see that the company has a decent competitive advantage and a strong moat. I usually look for at least 10% in ROTC, and the company has almost doubled that. This means the management is good at allocating capital efficiently into profitable projects that create value.

ROTC vs Competition (Seeking Alpha)

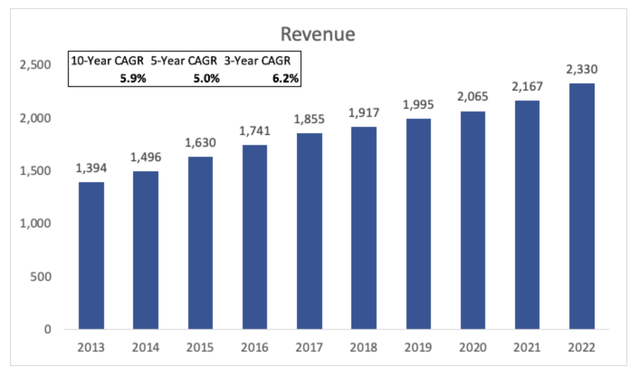

The company’s revenues have seen steady growth, although not very impressive. It’s been a very consistent growth over the last decade and even in the more recent years, which makes it rather easy to model. I’m not saying that past performance is an indication of future performance, however, with such a consistent climb upward, I will be basing my modeling around these numbers, although more on the conservative end, as you’ll see in the next section.

Overall, the company’s financial position is very strong. The fact that the company has no debt, should bode well with many investors, who are more debt-averse. Leverage is not an issue for me, however, if the company doesn’t need it, especially when it has such a strong cash position, then that is okay in my books too. The company’s cash position allows for a lot of flexibility in how the management wants to spend it, and I’m sure they will make the right decision that will award its shareholders in the long run. Furthermore, its efficiency and profitability are starting to improve, and I believe that in the next couple of quarters, the company will get back to its recent highs. Even though the company’s top-line growth is unimpressive, as long as it can improve its profitability and expand margins further, I am okay with subpar revenue growth.

Valuation

As I mentioned earlier, the revenue growth is very consistent, which makes it an easy model for the future. But just to be safe, I will approach the growth with a bit more conservative mindset, as I usually tend to do for all my valuations of companies, just to give myself a little extra margin of safety.

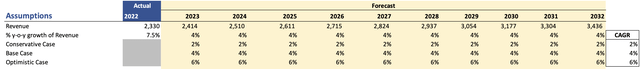

I went with around 4% CAGR for my base case scenario, which seems to agree with what the analysts are estimating for the company. I like to get a range of possible outcomes, so I also added a conservative scenario and an optimistic one. Below are those assumptions and their respective CAGRs.

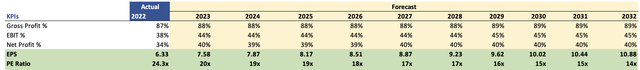

For the margins and EPS, I went with a more conservative outlook also, to give myself some more margin of safety. These estimates are quite a bit more conservative than what the analysts are estimating, however, mine are also closer to GAAP estimates rather than adjusted numbers. Below are those estimates, compared to the company’s GAAP earnings in FY22.

Margins and EPS Assumptions (Author)

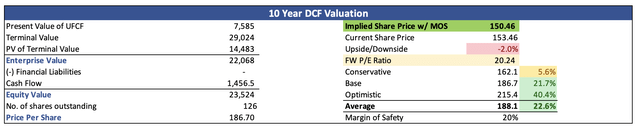

For the DCF analysis, I went with the company’s WACC of 7.2% as my discount rate. I usually add a bit more on top for even more room for error, however, I feel the estimates above are already beaten down, so I’m fine with 7.2%. Furthermore, I went with a 2.5% terminal growth rate. On top of these estimates, I added another 20% margin of safety, just so I could sleep at night, knowing that I didn’t overpay for a company. With that said, Check Point’s intrinsic value, and what I would be willing to pay for it, is around $150 a share, which means the company is trading at its fair value, more or less.

Risks to Consider and Closing Comments

The cybersecurity space is very crowded. There is a lot of competition that may take market share from the company. New companies are entering the market and may offer something more that suits a certain customer more than CHKP. A lot of established players in the market, with a lot of cash to spare, may end up taking more market share as they keep innovating, and if CHKP drops the ball here, I would expect its competitive advantage to be reduced.

The company is headquartered in Israel, which as you know went through some conflict. It is still ongoing, which means I expect to see a lot of share price fluctuation if the conflict escalates further. The company has said that around 5% of the entire headcount is on the reserve military draft, however, the company hasn’t experienced any slowdowns and is operating as planned. I believe many people will see any further escalation of conflict as a reason to potentially automatically sell all Israeli companies just because their HQs are there, but their operations are very far from the conflict zones, and it seems that operations will remain unaffected, at least for now.

So, it seems the company is not a bad buy at these levels, even with the beaten-down estimates above, which provide a lot of margin of safety. The company’s balance sheet is very healthy, and the fact that the margins are coming back up should play into the company’s share price appreciation over time. The company has been experiencing a steady top-line growth and if everything does start to turn back up regarding the margins and profitability, I don’t see why the company’s share price wouldn’t follow suit. Investors could see the strength of the company’s balance sheet along with the other financial metrics and potentially park their money for the long haul in my opinion.