Shutthiphong Chandaeng

Introduction

Internet privacy is a raging concern at the moment for many web users around the world, and one risk point is the use of third-party cookies for tracking and data collection. While claimed to be harmless and personalized for your own tastes, many feel that it is wrong for large corporations to profit from our personal information, tastes, and preferences. Then combined with personal identifying information and other cybersecurity risks, a new trend has been established where we may enter a cookie-free world. Unfortunately, nothing comes for free, and digital businesses want their fair share of advertising revenues, and advertisers want to know their ad spend is actually leading to sales.

As of early 2024, the primary proponent of a no-cookie world is Apple (AAPL) and they provide a complex Intelligent Tracing Prevention feature for users. Most other ad platforms have been hesitant, especially Google (GOOG), as they have attempted to stall citing “testing” or “experimentation” with more secure cookie technology. However, the backlash continues and a recent announcement verifies that even Google Chrome will now be limiting tracking, and may even fully phase out third-party cookies. So what can advertisers do now that their high-value customer tracking and consumption data source is drying up? Well, one prime opportunity lies in a small, select group of advertisement authenticators. I believe that DoubleVerify (NYSE:DV) is the primary candidate for investors looking to leverage a higher-quality advertisement landscape.

Advertisers indicated that ‘multiple browsers phasing out third-party cookies’ was their primary worry. This issue held the top spot in 2022, and increased from 38.5% to 45.1% in 2023, showing the high relevance of browser decisions as the industry prepares for cookie deprecation.

– DoubleVerify Post-Cookie Survey Report

DoubleVerify is a newcomer to the growing online advertising industry but is finding a niche in providing authentication services for advertisers. Namely, the company provides third-party verification of where ads are seen, by whom, and the impact of the ads. The main benefit of DV is the ability to be platform agnostic, and the company will succeed no matter which advertising platform wins out, such as Google, Meta (META), Amazon (AMZN), The Trade Desk (TTD), or more.

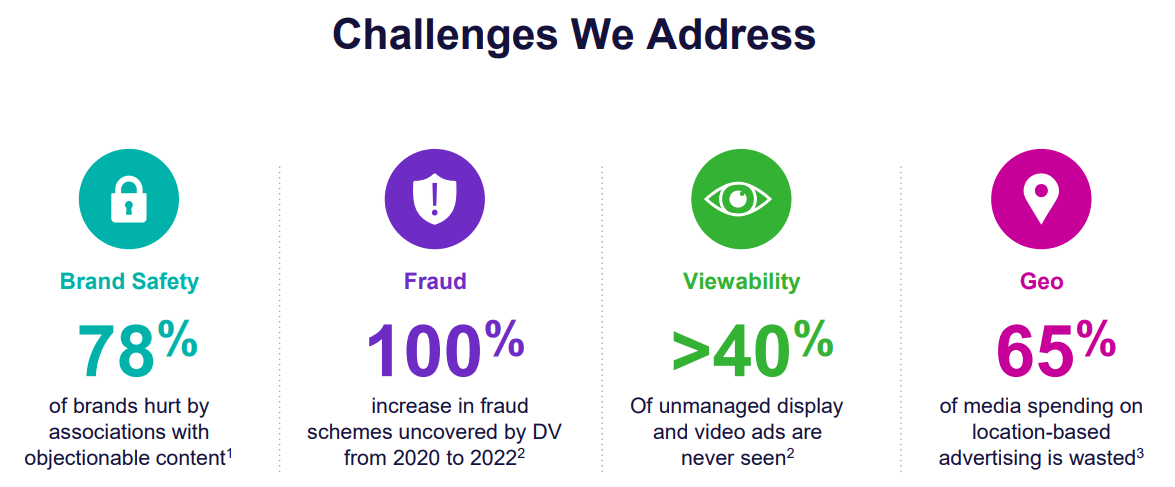

Then, as the information highway shuts down due to a lack of third-party cookies, DV will be one of the only trusted partners between advertisers and publishers for which insights and authentication can be confirmed. Also, in an age where advertisers face risk from associations with objectionable content, fraud, poor viewership, and unoptimized geolocation, DV has multiple profitable paths for long-term growth. As such, I believe this small, but financially sound, company is one of the premier investments in the advertising industry.

DoubleVerify Investor Presentation

The Ad Market is Huge

Advertising is one of the largest markets in the world, but there is still vast opportunity for improvements now that we have moved to a digital age. Many issues are based on this new digital environment, and DoubleVerify has found a strong niche to grow into. This helps to offset weakness in the face of a higher-than-normal amount of competition. Many of DV’s solutions are best-in-class, but aspects of each can be implemented by ad publishing platforms and marketplaces. This is why advertisers account for 90% of total revenues, and integrations with publishers will be key for long-term success. As management states in the Post-Cookie Survey Report, “DV is proud to equip both sides of the industry with tools and services that foster a more transparent way of doing business.” The key is whether the money flow remains viable.

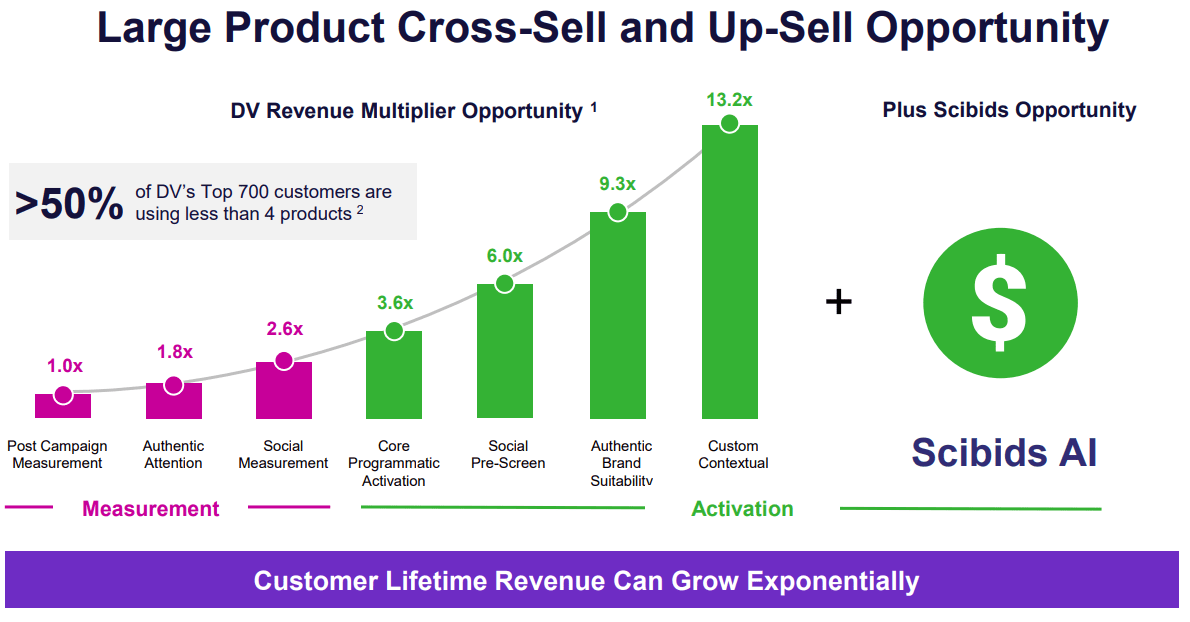

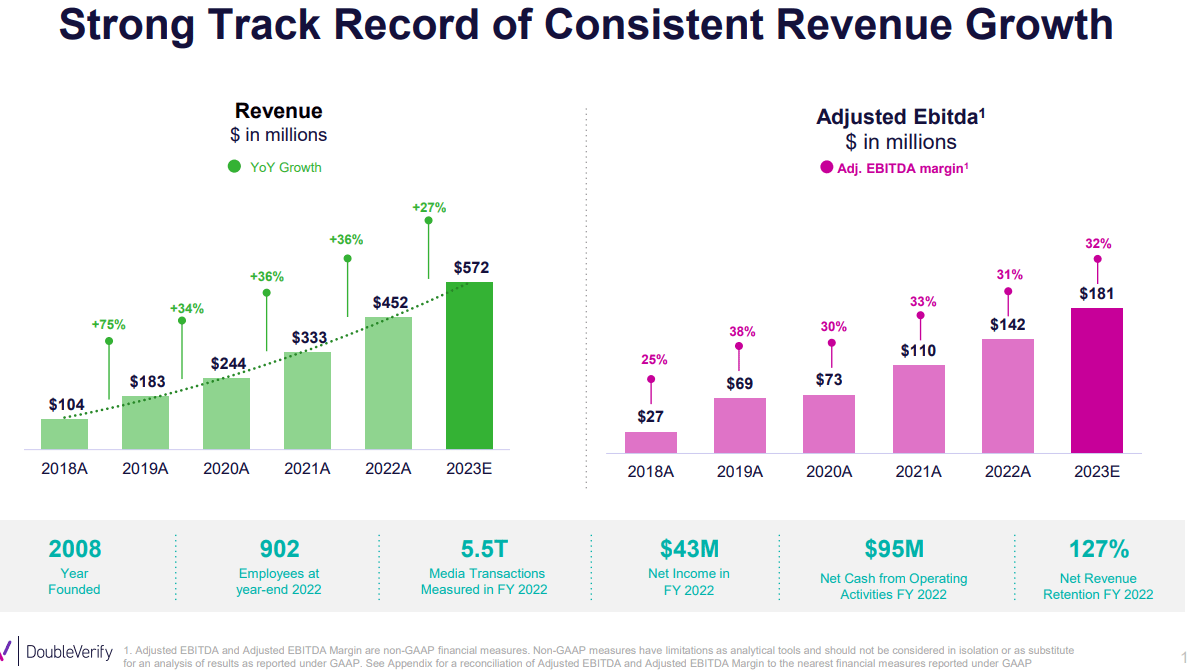

DV key offerings are a suite of solutions that offer a bolt-on strategy for clients based on usage. And, most of DV’s success has been based on retaining customers and moving them towards higher revenue spending opportunities. As an example, management expects that customers who use the whole suite of tools, or 7 solutions across measurement and activation, pay up to 13x more revenues overall. As such, revenues have been able to compound over 30% per year since its founding in 2008. New opportunities continue to be rolled out as well, including AI solutions thanks to the acquisition of Scibids last year. As described by an AdExchanger article:

‘Scibids dynamically adjusts bids for every impression based on an advertiser’s KPIs, such as viewability or desired CPM range. To inform its decisions, Scibids pulls information via APIs from demand-side platforms, including first-party data and media cost, as well as attention data from DV.

‘It just takes our data and moves it to an entirely different level of granularity and applicability for our customers,’ DV CEO Mark Zagorski told AdExchanger.

‘For example, DV can use the Scibids tech to create more refined segments for media activation, identify high-attention inventory and optimize campaigns without relying on third-party cookies by accounting for variables such as domain placement, device and geolocation.’

DoubleVerify Investor Presentation

Quantitative Support Factors

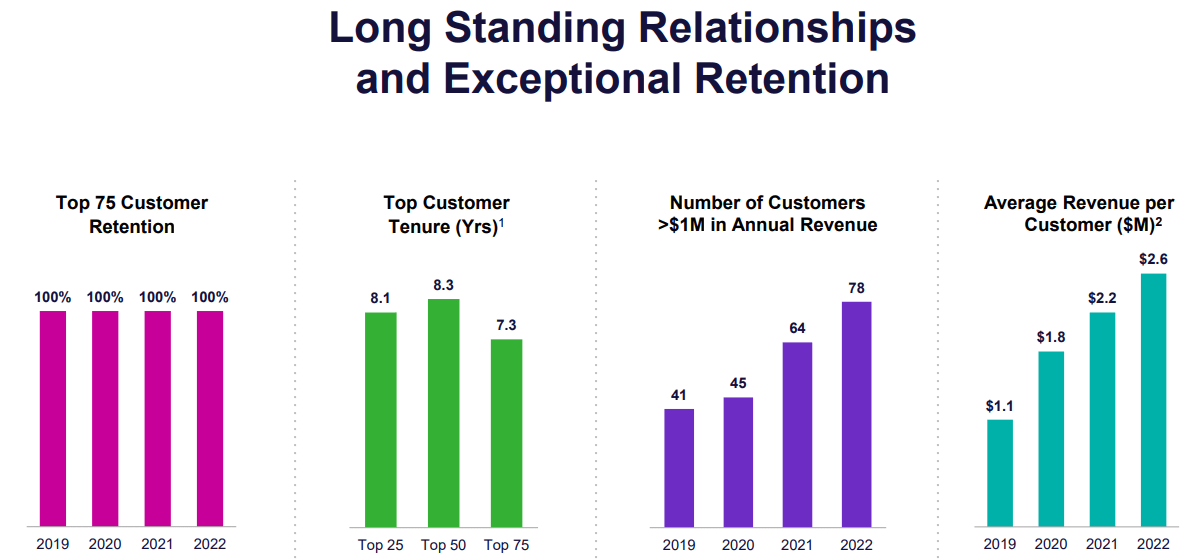

So while DoubleVerify still has time to develop a moat and stave off competition, it will be important to use the financial data as proof of success. Thus far, they offer many data points that suggest success. First, DV is developing strong relationships, and this is evident by the 100% retention rate of top 75 customers. Also, these customers have been partnered for many years, with an average tenure of over 7 years. At the same time, the average revenue per customer has increased from $1.1 million in 2019 to $2.6 million in 2022. As both the number of customers and average spend continue to increase, I am confident that the platform is working. Current net revenue retention is at 127% for 2022, and I expect this rate to continue for some time despite a slowdown in growth over the past year due to a weaker ad market.

DoubleVerify Investor Presentation

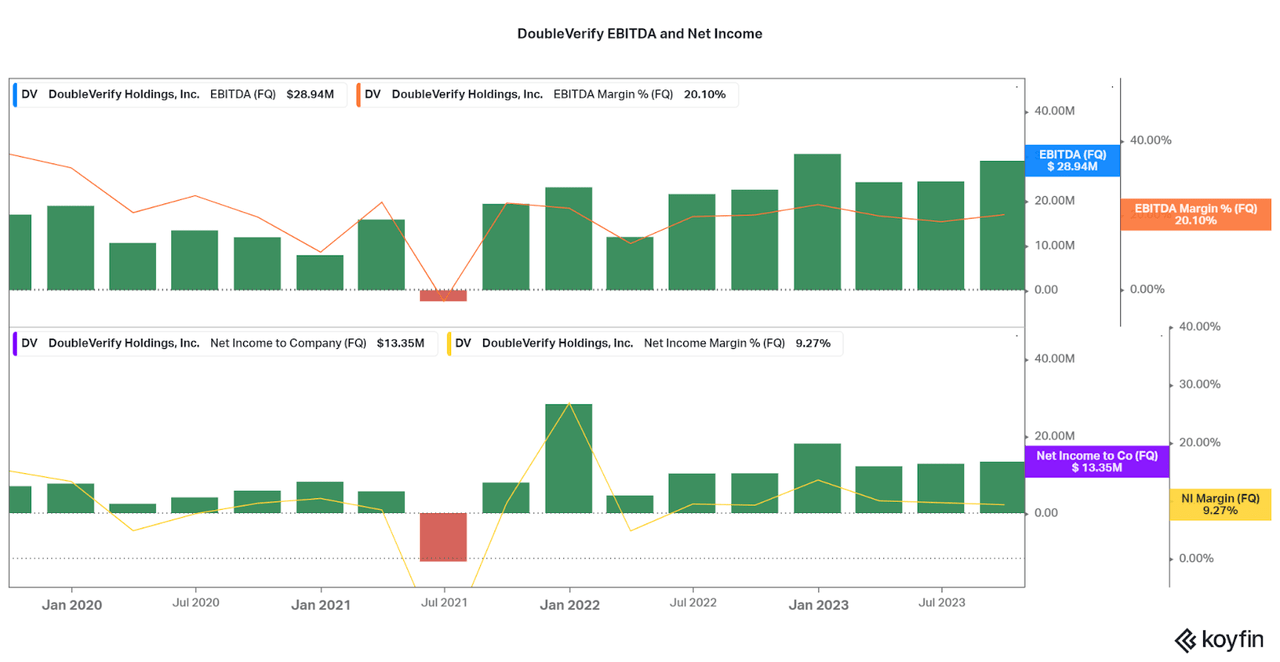

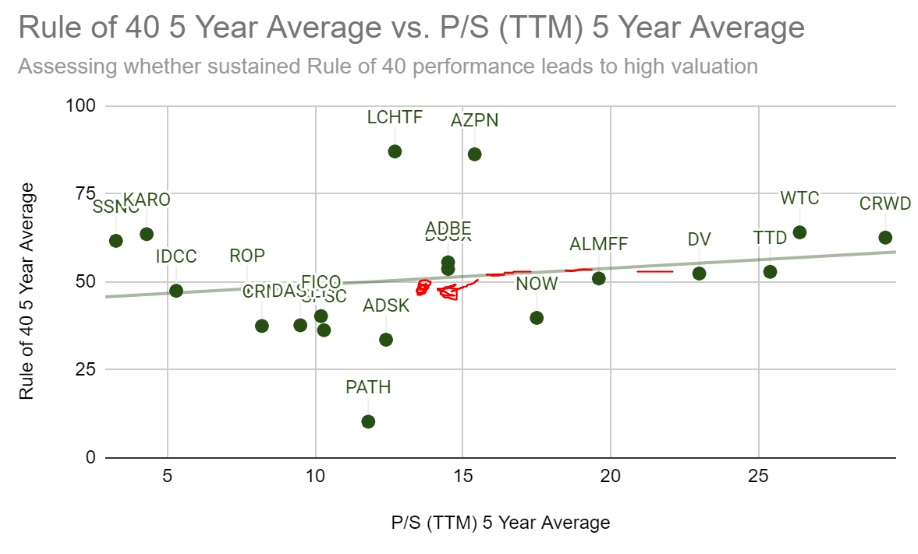

At the same time, most tech investors know that organic growth is not the only important factor. Instead, profitability is what sets out the best from the rest. To that point, DoubleVerify should be noted as extremely profitable for its size and growth rate. In fact, the company is beating the Rule of 40 at 46% (trailing rev growth and EBITDA margin). When taking 5-year averages into consideration, DV is even better at 52%. While revenue growth is not to a tremendous extent, the average 34% rate is no slouch.

At the same time, EBITDA margins are positive around 17-20%, and Net income is also positive, albeit inconsistent. I cannot point to other growth peers that offer such levels of profitability, even industry stalwarts such as WPP (WPP) and TTD. In particular, the main rival Integral Ad Science Holding Corp. (IAS) is growing slower, less profitable, and more leveraged. As such, I believe that the financials reflect the solid opportunity that is available for DoubleVerify.

DoubleVerify Investor Presentation Koyfin

Conclusion

I believe that DoubleVerify is currently in a great position to grow into a leader in ad authentication for the expanding digital ad age. I also believe that DV’s current valuation makes it the better choice when compared to The Trade Desk. Why? Well first DV is growing revenues at about the same rate as TTD but is more profitable on the bottom line (both EBITDA and net income margins). So for more cash generation, one would think that DV is valued higher, but this is also not so. TTD remains one of the more extremely valued companies in the market at a 150x EV/EBITDA and 19x P/S all while DV is currently trading at 55x and 12x, respectively. For me, that is enough of a difference to make DV stand out and be the only viable opportunity at the moment.

Author. Using Seeking Alpha Data.

DoubleVerify may lack the publicity of others in the advertising industry, but this does not mean that the valuation will remain below peers. The issue is that until then, the investment remains risky but tolerable for long-term investors such as myself. With this volatility, I believe that investors accumulating shares anywhere between $30-$35 per share will be happy in the years to come. At the same time, as the ad market stabilizes after a downturn through 2023, valuations may rise again. Therefore, it can be expected that the share price may rise and $35-$40 remain viable accumulation levels. That is what I will be trying to do through 2024.

Thanks for reading. Feel free to share your thoughts below.