Shares of Lyft (LYFT -0.44%) were climbing again for the second month in a row in December as the ridesharing stock’s recovery continued.

There was relatively little company-specific news out on Lyft last month, but a combination of bullish commentary from management, price hikes from Wall Street analysts, good news from the Federal Reserve, and tailwinds from rival Uber Technologies, which was added to the S&P 500 last month, combined to propel Lyft stock higher.

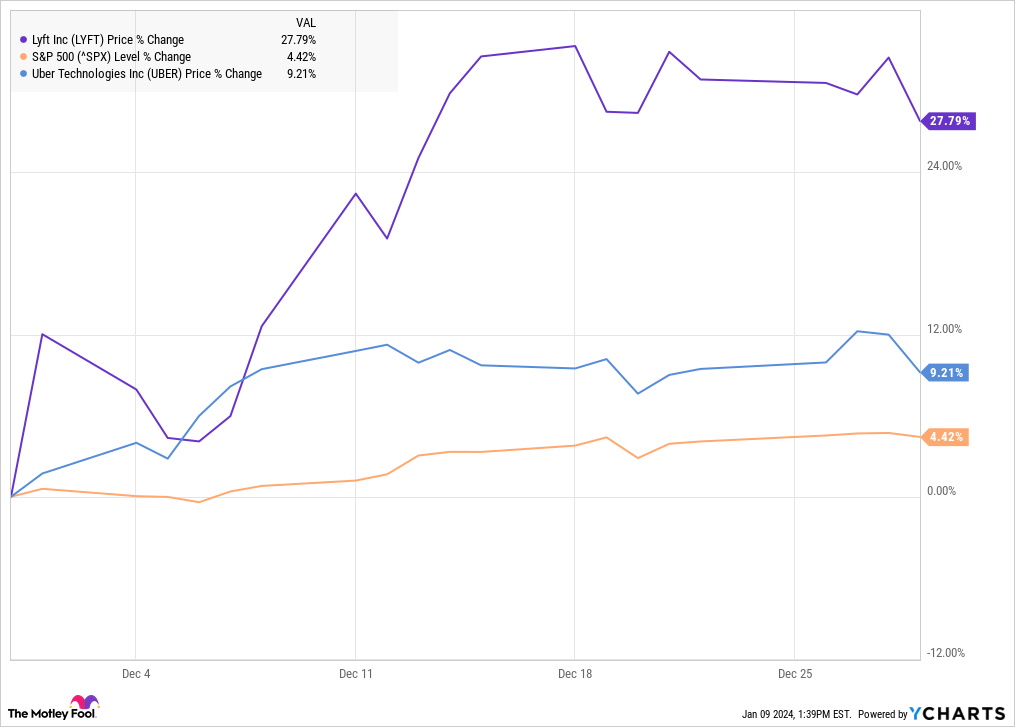

According to data from S&P Global Market Intelligence, the stock was up 28% for the month. As you can see from the chart, those gains came in the first half of December.

Lyft is riding higher

Lyft kicked off December with a big move. The stock jumped 12% in part after new CEO David Risher talked up the company’s improvements on CNBC’s Mad Money, saying it had grown driver hours by 45% over the past year. In addition, new programs like women+connect, which allows women riders and drivers to match with each other, were resonating with customers. Risher also said employee confidence was the highest it’s been in four years, a positive sign for the company’s growth as well.

Lyft also got a boost from dovish commentary from Fed Chair Jerome Powell that day, as the company is likely to benefit if interest rates come down, since it’s dependent on discretionary spending and is still unprofitable on a generally accepted accounting principles (GAAP) basis.

The stock gave up some of those gains the following week, but surged again after the Federal Reserve kept interest rates steady and said it expected three cuts, or 75 basis points worth of cuts, in 2024. The stock jumped 5% on the news on Dec. 13 and gained another 4% the following day.

The stock traded mostly flat in the second half, though it got a pair of price target hikes before falling 4% on the last day of the month as Nomura downgraded the stock.

What to expect from Lyft in 2024

Lyft’s shares have pulled back to start the new year as the broader market declined, and some investors believe the stock may be overbought after gaining more than 50% in the last two months of the year.

However, the business should see continuing improvements in profitability in 2024 due to its cost-cutting efforts and initiatives like women+connect. If the economy moves in the right direction, the stock should have a winning year in 2024.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool has a disclosure policy.