maybefalse

Thesis

The years-long selloff in Alibaba (NYSE:BABA) stock could come to an end in 2024 given the company’s stable revenue and earnings, and the stock’s current low valuation.

Background

I last covered Alibaba in 2021, when I issued a buy rating at nearly twice today’s $72.88 price. I’ll be the first to admit that at the time, I was overly bullish on Alibaba’s growth potential and I did not expect the relatively flat growth that Alibaba has experienced since my last article.

While many investors have given up on Alibaba since 2021, I continue to hold shares. From its current valuation of 10 P/E, Alibaba is no longer priced like a growth stock, and is in fact cheaper than many USA-based value stocks in today’s market. At the same time, revenue has stabilized and EPS is trending back up. As a result, I believe that now is a good time to take another look at Alibaba.

Stock Price vs Business Fundamentals

BABA Stock 5 Year Chart (Seeking Alpha)

Alibaba stock peaked in Q4 of 2020 and has a return of -75% since then. It’s sold off on a nonstop stream of negative sentiment including the disappearance of Jack Ma, the cancellation of the Ant Group IPO, a regulatory crackdown that charged Alibaba hefty fines, concerns about a China real estate bubble, concerns about China’s demographics and a potential recession, and the cancellation of a cloud business spin-off (in favor of an internal restructuring).

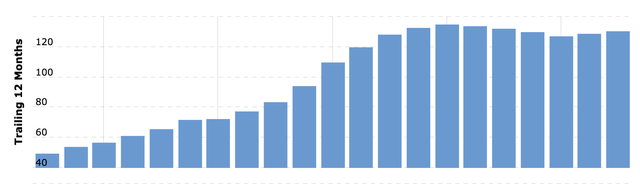

Alibaba ttm revenue (quarterly) (Macrotrends)

Despite all these issues, Alibaba’s financial performance has been decent. Revenue is up 38% since the stock peaked, although four of the past six quarters had slightly negative growth.

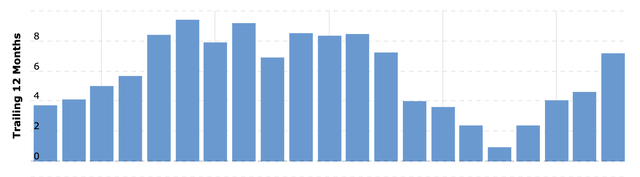

Alibaba ttm EPS (quarterly) (Macrotrends)

On the other hand, earnings per share (EPS) is down 16% since the stock’s peak, but EPS has been rebounding quickly over the past year. It should be noted that the EPS decline is largely artificial due to fines and other temporary issues; shares outstanding have declined in every quarter since 3Q2021 and operating income is at an all-time high.

Valuation & Growth

Based on the above charts, it’s clear that despite some EPS volatility in 2022, Alibaba’s business fundamentals are stable. In other words, the primary cause of BABA stock’s underperformance has been multiple compression rather than a huge decline in earnings.

Some of this multiple compression is certainly justified considering that Alibaba was valued as a growth stock in 2020 but has not exhibited meaningful growth over the past three years. However, the multiple compression has gone too far in my view.

Alibaba currently has a P/E of 10, which means that investors would make their money back in 10 years if Alibaba simply kept its financials stable without growing at all. After the stock market as a whole did very well in 2023, it’s very difficult to find stocks valued below 10 P/E, especially in industries that are projected for future growth like e-commerce and cloud. Given its industry positioning, there are many possible catalysts that could put Alibaba back on a better growth trajectory and lead to multiple expansion.

In an age where every stock associated with AI has soared to a high valuation, it’s seemingly forgotten that Alibaba has a large language model similar to ChatGPT. While I can’t personally attest to the quality of this model, investors who want exposure to AI at a reasonable valuation may soon look to Alibaba. In their recent earnings call, Alibaba mentioned integrating AI as a key focus in both their cloud business and their e-commerce business.

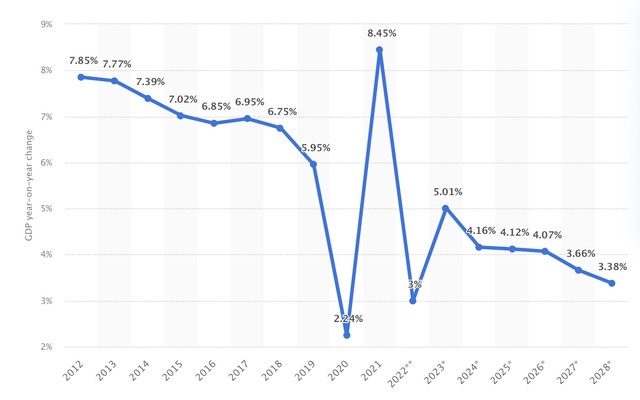

China GDP growth forecast (Statistica)

Another possible catalyst for faster growth is a recovery in China’s economy. Analysts are currently very bearish on China and expect its annual GDP growth to decline from about 5% last year to 3% in 2028.

If China’s economy can rebound to the high single digit growth rates that investors came to expect over the past couple decades – or even stabilize at current levels – it would mean that investors are likely too gloomy about Alibaba’s growth prospects. After all, Alibaba is a cyclical company and its growth prospects are largely tied to China’s economy. One possible catalyst for GDP growth is China’s increasingly advanced technology; a 2023 Guardian report found that China leads in 37 of 44 emerging high tech industries.

International expansion is another way that Alibaba could kickstart revenue growth. Alibaba is already integral to the global dropshipping industry, which has grown more popular in recent years. It also has a strong e-commerce presence in Southeast Asia, including in many countries with better demographics than China.

Limited Downside Risk

Emerging markets are always volatile, so it’s not possible to completely rule out further multiple compression. If Alibaba’s multiple simply compressed from 10 to 8, that would represent 20% downside in the stock price. However, a starting P/E of 10 is about as safe as you can get in the stock market today, and it makes another 75% decline driven only by multiple compression very unlikely. In other words, a major decline in BABA stock from the current valuation would require a further deterioration in the business fundamentals.

There are some reasons to be worried about Alibaba’s business fundamentals. For one, there have been concerns about China’s economy and property sector, which could mean that the GDP growth estimates shared in the previous section are actually too optimistic. Ultimately, GDP growth is difficult to predict, and if China unexpectedly experienced negative GDP growth in the coming years it could be disastrous for a cyclical stock like Alibaba.

Another potential concern is competition. Fortunately, Alibaba’s largest competitor, JD.com (JD), has had similar struggles growing revenue in recent years as well. However, a smaller competitor called PDD Holdings (PDD) posted an impressive 83% revenue growth rate in the most recent quarter and has been growing faster than Alibaba for years. If PDD continues to grow larger, it could eventually start to take significant revenue from Alibaba.

Lastly, while China’s government is likely to focus more on kickstarting growth as long as its economy struggles, the possibility of further regulation, fines, or trade wars that harm Alibaba can’t be ruled out.

While these risks should not be ignored, investors have a reasonable margin of safety from Alibaba’s current P/E of 10. Even in a worse economic climate, Chinese people will continue to purchase products online, and Alibaba will continue to be one of the main places they make those purchases. As a result, it would take a true black swan event – or extremely poor management – to cause a large and prolonged decline in Alibaba’s revenue.

Conclusion

It’s been a difficult few years for Alibaba investors, and it’s impossible to predict with certainty when that trend will change. However, Alibaba’s current P/E multiple of 10 and stabilizing revenue and earnings are reasons for optimism. In a time with most investors are pessimistic about China, 2024 might be a good year for opportunistic investors to look to Alibaba for both value and growth.