Sundry Photography

Investment Thesis

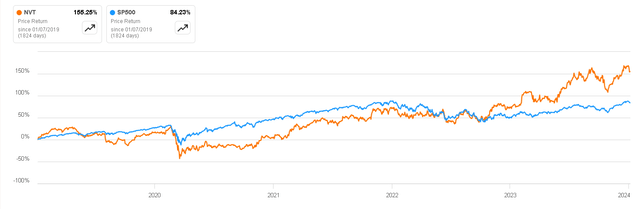

nVent Electric plc (NYSE:NVT) is a company that has performed quite well since going public in 2018, even outperforming the S&P 500 itself.

In this article, I want to delve into the positive aspects of its business model and the sector in which it operates, which has some catalysts that may lead to tailwinds in the coming years. However, I also have my doubts about whether the current margins are sustainable, as they rose mainly due to price increases, and a normalization could occur, affecting the performance of our shares. Hence, for me, it is a ‘hold‘ at the moment.

NVT Return vs S&P500 (Seeking Alpha)

Business Overview

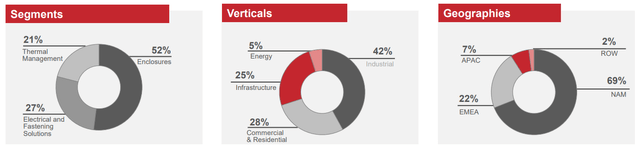

nVent Electric is a company that provides electrical connection and protection solutions. The company serves various industries that expect strong tailwinds in the coming years thanks to trends such as the Electrification of Everything or AI driving demand for liquid cooling in Data Centers. Its revenue is distributed into three main segments, which are the following.

- Enclosures: The Enclosures segment provides solutions to connect, protect, power, and cool critical control systems and electrical equipment. This segment has grown at an annual rate of 4.8% since 2016 and has an average EBIT margin of 20%. Although it is a mission-critical product, its success depends on the capital expenditures of its clients. Due to its very long lifespan, it is difficult to generate recurring income.

- Electrical & Fastening Solutions: The Electrical & Fastening segment provides solutions to connect and protect electrical and mechanical systems, as well as civil structures. It operates under the Caddy and Erico brands and is primarily used by electricians, telecommunications installers, and rooftop contractors. This segment has grown at an annual rate of 2% since 2016 and margins have typically ranged between 28% and 30% in recent years. Similar to the previous segment, these are essential products, but they face challenges in generating a consistent stream of recurring income (which doesn’t mean there aren’t exciting growth opportunities in the segment).

- Thermal Management: The Thermal Management segment provides electric thermal solutions that connect and protect critical buildings, infrastructure, industrial processes, and people. These solutions can be utilized in the industrial sector for temperature monitoring and control in industrial processes. They can also serve residential and commercial purposes, protecting pipes from freezing, defrosting roofs and gutters, maintaining hot water temperature, among other more every day and less industrial uses. This segment has experienced an annual revenue growth of 3% since 2016, with margins averaging 24%.

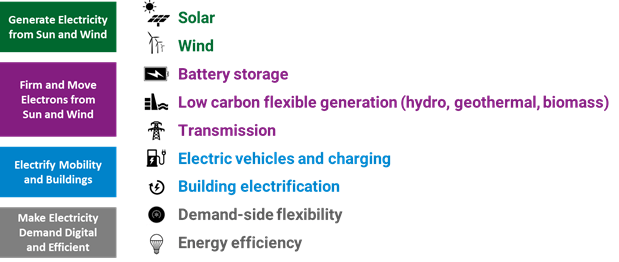

In general, as more industries and sectors electrify their operations, there will be a higher demand for electrical infrastructure, including enclosures, cables, and electrical protection systems. nVent can benefit from increased sales of these products. Also, electrification often leads to increased use of electronic devices and systems, which generate heat, so thermal management solutions, such as cooling systems for electronics are needed.

And we must not forget that the Electrification of Everything is a global trend, and as regions around the world invest in electrifying their infrastructure, nVent may find opportunities to expand its market presence in emerging economies where electrification initiatives are gaining momentum and are much less developed than in Europe or North America.

Electrification of Everything Process (Medium)

Key Ratios

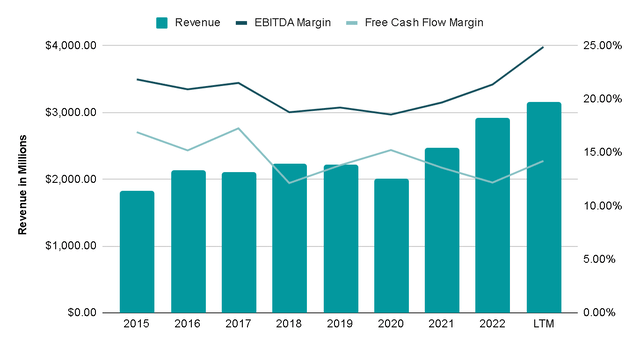

As a whole, the company’s revenue has grown at a compounded annual rate of 7% since 2015. Even in a challenging year like 2020, when the economy was paralyzed due to the COVID-19 virus, revenue only decreased by 9%, and margins did not suffer as much.

Something that strikes me, especially, is that over the last twelve months, profit margins have been well above their average due to the company raising its prices. For example, in the Enclosures segment alone, margins went from 21% to 26%. However, according to the last quarterly report, 4.5% of this improvement was due to prices, and 1.2% was attributed to greater operational efficiency. Therefore, in future years, I believe that these margins should normalize shortly, and I will take that into account for the valuation.

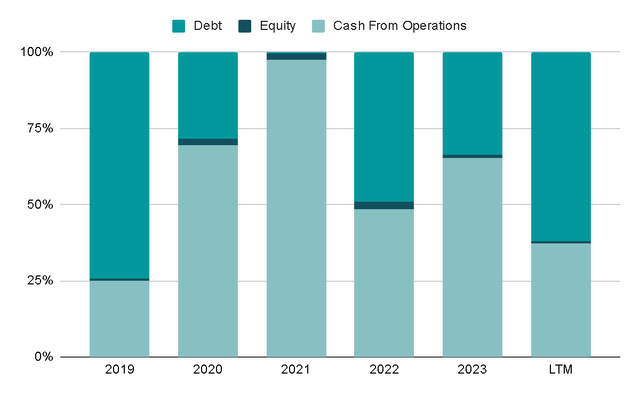

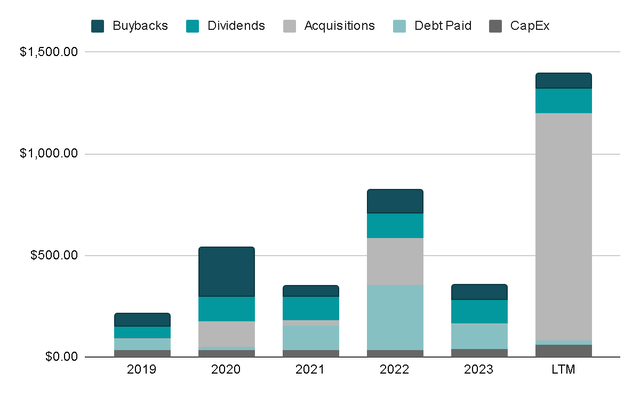

In the last five years, this growth has been financed approximately 50/50 with debt and the cash generated by its operations. The company had not issued that much debt for a while, but over the past twelve months, they issued $800 million, in part to finance the acquisitions of ECM Industries and TEXA Industries.

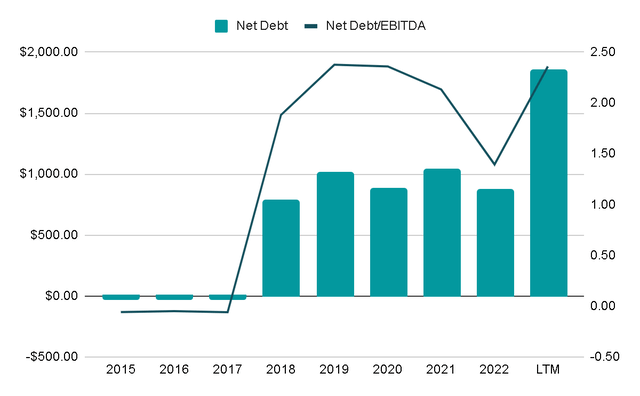

As a result, the company currently has $1.8 billion in net debt, which is calculated by subtracting the cash on the balance sheet from the total debt. This represents 2.4 times the EBITDA generated in the last twelve months. Although this is a high ratio, it is still controllable and could be justified since it was earmarked for growth.

Regarding capital allocation, the truth is that it has been quite diversified between growing through acquisitions. In the last twelve months, the company allocated $1.1 billion in cash payments for acquisitions, reinvesting in the business, and rewarding shareholders through buybacks and dividends. This might be unexpected considering that the company has growth opportunities, but they have allocated $1 billion in the last five years to pay a dividend that currently has a yield of 1.35% and repurchase shares at an average annual rate of 1.4%.

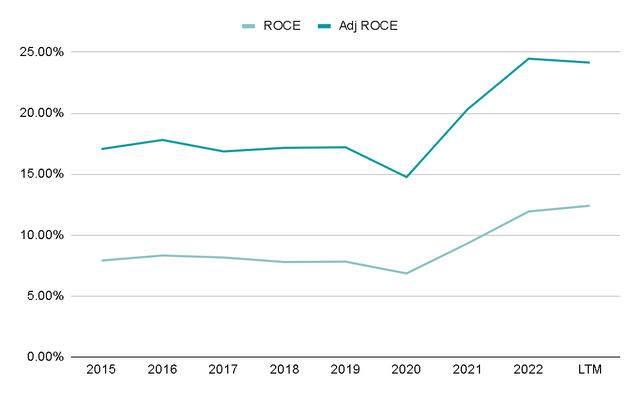

To evaluate how efficiently management has allocated capital, we can look at the return on capital employed. However, considering that the company usually engages in regular M&A activity, it is useful to look at the adjusted ratio by removing the goodwill, which is generated when making acquisitions. While the company will likely continue to be active in M&A in the coming years, this gives us a good idea of the purely operational returns and would be a representation of the ROCE it would have once it makes fewer acquisitions.

In this regard, the ROCE has averaged 9% since 2015, but the Adjusted ROCE has been around 19%, showing a business that is clearly profitable and efficient in its capital deployment.

Valuation

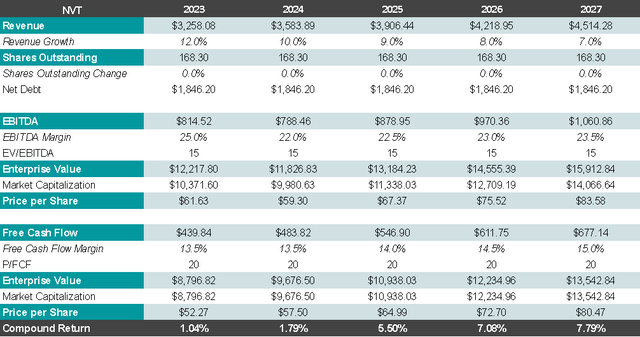

According to the most recent guidance, starting from Q3, the company expects to grow its revenue by 12%, which, considering that there is only one quarter left before the end of the year, is very achievable.

Reported sales growth is now expected to be in the range of 12% to 13% versus our prior guidance of 13% to 15%. This reflects full-year organic growth of 3% to 4% versus our prior guidance of 4% to 6%.

In subsequent years, I estimate a compound annual growth of 8.5%, which is higher than the growth of recent years, but I consider it feasible thanks to the mix of acquisitions and tailwinds from AI and data centers, for example. I will also adjust margins in later years, assuming they adjust slightly above FY2022 margins after the significant price hike they made this year.

With an exit multiple of 20x Free Cash Flow and 15x EV/EBITDA, the expected return would be around 7 or 8%, plus the dividend of 1.35%, which is not entirely attractive. If the company reduced its debt and the share price corrected to around the $45 USD at which it was recently, the return, including dividends, would already be around 15%, which would be very compelling.

Risks

While the company has a fairly good business, the reality is that it is not immune to economic downturns, which could lead to reduced demand for construction and industrial products, directly impacting nVent’s revenue and profitability. Also, as mentioned above, the company’s products are often tied to capital expenditure projects. Any reduction or delay in capital spending by businesses would also hurt the company’s growth.

Ultimately, nVent is an industrial company exposed to disruptions in the supply chain due to events like natural disasters, geopolitical tensions, or global health crises (as seen with COVID-19), which can affect the availability of components and impact production and consequently sales. So, this should also be taken into account when evaluating the company, as I think its biggest defect is having a somewhat high degree of cyclicality.

Final Thoughts

The company’s business solves critical problems for its clients, where the main differentiation is usually in reputation and reliability. Therefore, it is more challenging to initiate a price war to monopolize market share because clients will not want to risk their systems. Additionally, the market for nVent is growing and experiencing tailwinds. It is also a fragmented market with small regional or niche competitors that can be bought and integrated, making the inorganic growth strategy quite profitable.

On the other hand, as mentioned before, the company is much more cyclical than it seems and has not managed to establish sources of recurring income that would increase its predictability and improve the quality of its revenue. Although this would not automatically lead me to rule it out, I think that we are currently buying somewhat inflated profits due to price increases. If these were to normalize, it could become a significant detractor for the performance of our shares. Therefore, I prefer to wait a few more quarters to evaluate if the margins will be sustainable, but until then, I decide on a ‘hold‘ rating for the company.