Doran Clark/iStock via Getty Images

Investment Rundown

Since late September when I wrote about Gevo, Inc. (NASDAQ:GEVO) and their exciting and potential future which I still think is the case, the stock has been largely stagnant. It’s slightly down since the time of the last article, and the market still seems to be quite pessimistic against the business seeing as it has over 16% short interest. This will likely remain hovering over the share price keeping it suppressed. I don’t think it’s enough though to justify a low rating here. I had it as a hold last time, but I think with the strong production capacity expansions the company is doing I think there are grounds to support a buy here.

GEVO operates in a very exciting industry I think that will experience a significant amount of demand, as it’s a necessary part of our transition to more green energy generation. Even though the company was started in 2005 it is still in its infancy in terms of establishing a sound asset base that can through time generate strong earnings and reward shareholders. Investments are pouring into projects that relate to what GEVO is doing and I don’t think they will have any issues finding a market to sell to. Since the last report, the company now has 2% of the ethanol market with its Verity tracking system. These are the types of improvements I wanted to see last time around. Because of this, I will be upgrading my rating of the business to a buy now instead.

Company Segments

GEVO focuses on renewable energy generation and will likely see strong momentum following tailwinds like the Inflation Reduction Act, and other measures taken to lower domestic and global emissions. The company’s operations are organized into three pivotal segments: Gevo, Agri-Energy, and Renewable Natural Gas, each fulfilling a crucial role in advancing its mission of promoting sustainable and environmentally friendly fuel solutions.

Company Overview (Investor Presentation)

As GEVO continues to make strides in the renewable energy landscape, its commitment to driving positive environmental impact and contributing to a greener future remains at the forefront of its strategic initiatives. One of these significant initiatives has been the sustainable fuel production facility in South Dakota, aiming to house significant production and provide over 1000 jobs to the area. The company managed to increase its production by a significant amount last quarter and this could very likely result in strong financial results in the next report, potentially leading to a major share price increase.

Markets They Are In

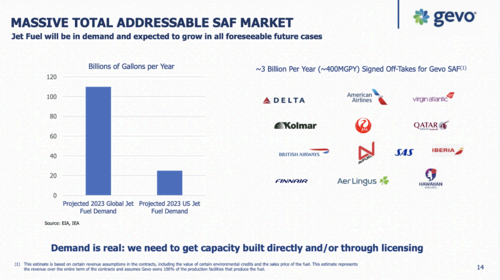

Market Size (Investor Presentation)

There exists a distinct market segment that GEVO could adeptly cater to by further expanding its capabilities and elevating production levels. The TAM for Sustainable Aviation Fuel (SAF) surpasses 100 billion gallons annually. Given GEVO’s technological advancements and ongoing initiatives with aviation fuel, the company is poised to emerge as a substantial player in this expansive market, provided that its pipeline projects are successfully realized within the projected timelines. The potential for GEVO to make a substantial impact in the rapidly growing SAF sector underscores the promising trajectory of the company’s future endeavors.

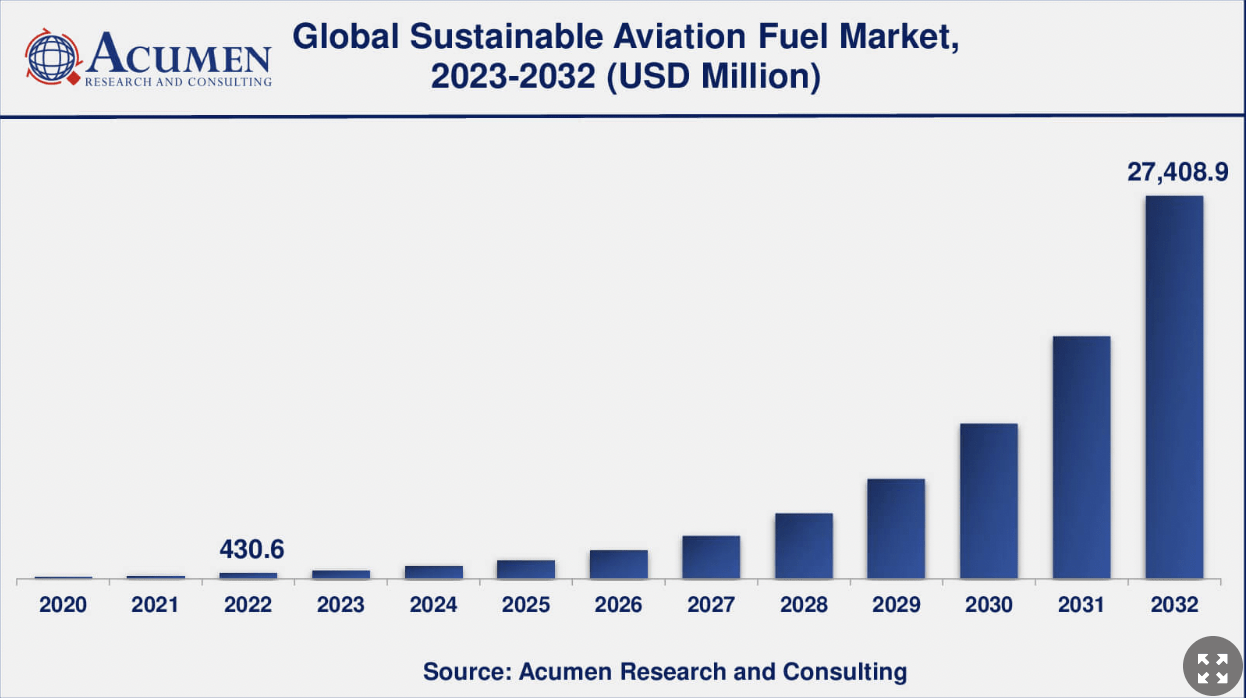

Market Growth (Acumen)

Looking at the market size of sustainable aviation fuel, it’s quite small right now, just around $430 million, but by 2032 it’s expected to reach $27 billion. I think it’s reasonable to assume that GEVO will get a pretty decent piece of this cake and this will be the catalyst a lot of investors are looking for. This appreciation in market value equals a CAGR of around 52%. This is an incredible amount, but I think anything over 20% would be satisfying for sure. With GEVO having several projects in the pipeline for SAF I think it’s a matter of time before the revenues start to snowball. 2026 will be a significant year seeing as that’s when the NZ1 65MGPY project will finish.

Earnings Highlights

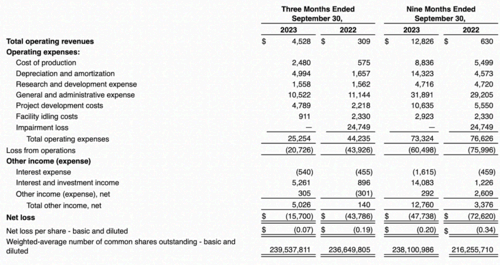

Income Statement (Earnings Report)

Looking closer at the last report and the income statement there are some significant improvements the company has made. The operating revenues have gone a lot higher and are now at $4.5 million, up from $ 300,000 last year during the same quarter. The increased production levels seem to have paid off in a good way and margins have expanded across the board. The EPS remained negative but went from $0.19 to $0.07, which is an impressive improvement. I think a steady margin improvement will be the theme for 2024 and beyond until more facilities come online.

Going into the next few quarters for the company I think investors are best off watching how the progress on their plants and projects are going. This will be the best indication of future sales and earnings for the business. If the projections hold then in 2027 the company would generate a positive EPS of $0.52 putting it at an FWD p/e of 2.2. In comparison to most energy companies trading at 10 – 12 that leaves a lot of upside for the stock price, I think. But this will only come if GEVO and its management are successful in executing its growth plan. I had them as a hold last time I wrote about them, but I think it’s a good time to be investing right now. It’s a small cap, and small caps will be big winners I think when interest rates begin to decrease and more capital is flowing in the economy.

Risks

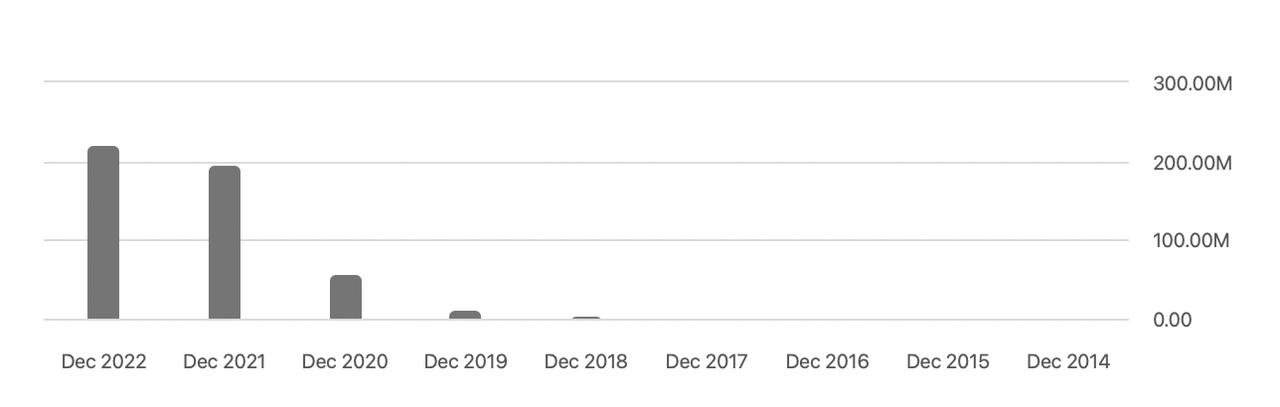

Cash is a big factor for GEVO seeing as the bottom line is negative. The company grapples with the challenge of amassing the requisite funds to underpin its ambitious projects, each bearing a substantial price tag averaging around $850 million. Faced with constrained cash resources, GEVO often resorts to practices like share dilution, a strategy that has become commonplace in recent years. The company’s reliance on such measures raises concerns among investors, as the potential for more dilution looms if GEVO’s projects do not yield favorable outcomes. The risk of additional share dilution has the potential to exert downward pressure on the company’s stock value. The company has over $320 million in cash right now which will cover several years of operating expenses if they remain the same at $60 – $70 million as the last 12 months.

Share Dilution (Seeking Alpha)

With interest rates set to be cut this year, I think GEVO will be able to afford to take on more debt and funding projects that way rather than significant share dilution. The company holds 0 debt so I think this is the right route to go down and it’s a good sign that GEVO hasn’t taken on any unnecessary amounts during this higher interest rate environment, that could have otherwise just harmed their earnings in the short term, driving the stock price down even more. To conclude the risks, I think the most prominent one circles around the company had to finish its projects and establish a consistently positive bottom line. I don’t think that will be until 2026 or 2027 when GEVO finishes more projects and has bigger production capabilities. But how things are going I am quite positive about this outlook right now.

Final Words

It’s not my first time covering GEVO and I think it’s one of the more interesting renewable energy plays right now, much because of all the projects it has in the pipelines currently. The price has come down slightly and I think it will continue trending downward if the short interest remains high. What could be a turnaround is the financial results that GEVO will post once it has more production capabilities, something that I think will occur in 2026 and beyond. I view the company as a long-term bet on increased renewable energy needs and this is why I am upgrading my rating to a buy now.