Aleksandra Zhilenkova/iStock via Getty Images

Written by Nick Ackerman.

All it took was the expectations for rate cuts next year, and that sent the risk-free Treasury Rates reeling lower. Subsequently, we also saw the pressure come off of the real estate investment trust (“REIT”) space, and we’ve seen a massive rally from the latest lows. REITs can be impacted in two ways by a higher interest rate environment.

They are often viewed as an income-oriented instrument, which means risk-free rates being higher provides a better risk-reward for income investors. Those investor dollars can then go into Treasuries and avoid going into more volatile equity holdings. Additionally, higher interest rates mean an expectation for slower growth going forward due to a higher cost of debt. Not only a higher cost of debt going forward, but as debt maturities come due, the current cost of borrowings would be expected to rise after years of a zero-rate environment that benefited so many REITs.

Therefore, the massive drop in Treasury Rates due to the expectation for the Fed to cut next year – according to their own projections, they are expecting 3 cuts – bodes well for REITs. That’s sooner than the original projections showed in the September dot plot. This has come amid inflation metrics continuing to show a lower trend, not quite at the Fed’s target but heading that way. As they let inflation run too hot for too long, they appear to be wanting to take a more cautious approach.

By staying tight for too long while inflation is trending lower, they could possibly push the economy into disinflation. Disinflation comes with its own set of negative consequences for the economy. Therefore, the idea of trying to get that “soft landing” would be to ease up prior to the target if we are heading in the right direction. Just like an airplane pilot, they don’t hit the runway and then start slowing down; they start slowing the speed of the plane prior to hitting the ‘target.’

The market itself is expecting the first cut to happen in March 2024. The CME Group Fedwatch Tool shows that there is only a 12% probability that rates will stay where they are. There is a probability of 75.6% suggesting a 25 basis point cut and even a 12.4% chance that rates will be lower by 50 basis points by then.

Lower rates could continue to benefit REITs overall, and there are a number that still appear attractive today. Though they aren’t quite at the dirt cheap deals we were getting just a month or so ago, a long-term investor can still benefit.

Agree Realty Valuation Still Tempting

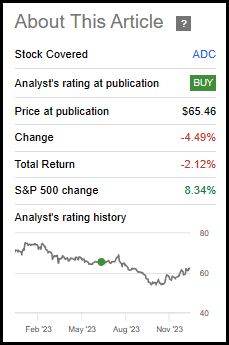

One of those REITs that benefitted significantly was Agree Realty Corporation (NYSE:ADC). Shares of ADC have rocketed higher, blasting up nearly 19% off the 52-week low. Since our last coverage, on a total return basis, ADC has been essentially flat. However, it didn’t take a direct path to get there, and the total return factors in the monthly dividends along the way.

ADC Performance Since Prior Update (Seeking Alpha)

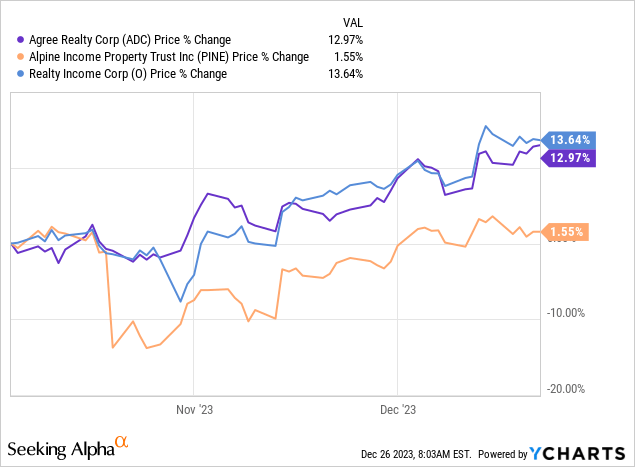

In October’s “5 Dividend Growth Stock” screening article, we also made a suggestion that ADC appeared attractive at that time. That was when we mentioned it relative to Alpine Income Property Trust (PINE) and also made a mention of Realty Income (O).

Despite PINE being the cheapest compared to peers ADC and O, ADC and O are also attractive and have a solid track record with internal management. That likely warrants the premium pricing. As they’ve both also collapsed, PINE, while being quite interesting, doesn’t quite interest me enough.

Since the original posting of the article, shares of ADC and O have both rallied hard, with PINE bringing up the rear.

YCharts

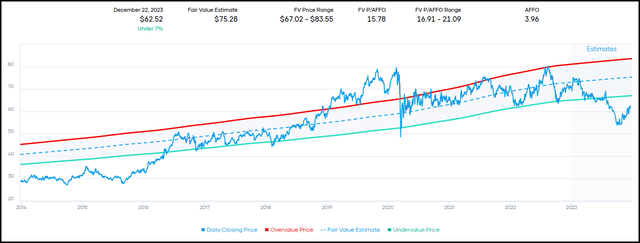

With all that being said, shares of ADC still remain attractive even today after such a run. Interestingly, shares are still off ~21% from the 52-week high. Though, that basis alone isn’t exactly an indication that ADC is still a strong candidate for an investor’s REIT exposure. Shares of companies can be off their highs and still be expensive. This happens all the time when expectations change going forward or a drastic change in the business model takes place.

Where ADC still looks cheap would be the price/AFFO. In this case, the shares are still trading well below the average fair value estimate. Further, it hasn’t even touched the lower range of the fair value estimate range.

ADC Fair Value Range (Portfolio Insight)

At under 16x forward P/AFFO, this has represented a historically attractive level to consider picking up shares with the mid-point multiple at around 19x. Given the higher interest rate environment, it would be easy to argue that a lower multiple is now necessary, and I would agree. However, as rates recede, the valuation range would start to make more and more sense as we get closer to the historical range.

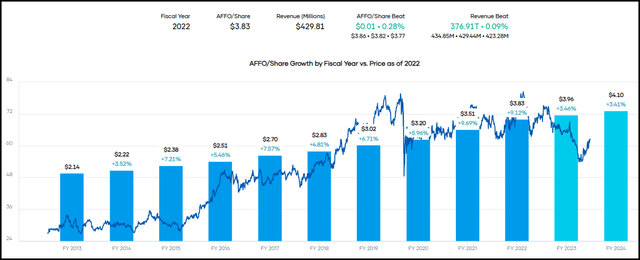

AFFO (adjusted funds from operations) is expected to grow by around 3.4% this year and next year. That isn’t a blistering pace by any means, but it is trending higher.

ADC AFFO History and Projections (Portfolio Insight)

For some comparison, O is looking like estimates are for about 2% growth this year and 3.78% for the following year. O is currently trading at around a 14.2x P/AFFO. I believe that Realty Income is fairly attractive as well. However, the faster growth ADC has been able to experience and Realty Income’s deal to buy Spirit Realty (SRC) are contributing factors to the richer multiple ADC can command.

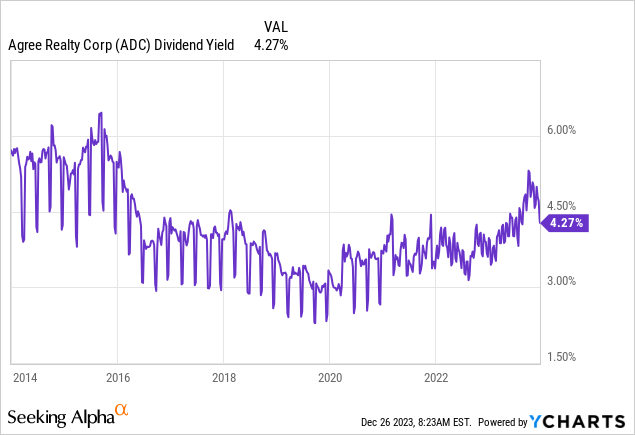

Given the declining share price we’ve seen, that also meant the yield was moving higher for ADC. Again, with the price recovering substantially, we’ve seen that rate come down materially as well.

YCharts

However, with growing earnings and a history of dividend growth under their belt, the dividend here would seem set to grow higher from here inevitably. At a ~4.75% yield based on the last monthly dividend annualized, we are getting an attractive deal here. It’s now rivaling the 10-Year Treasury Rate (US10Y) as it fell below 4%. Further, the coverage here is quite comfortable at less than 73% of next year’s AFFO expectations.

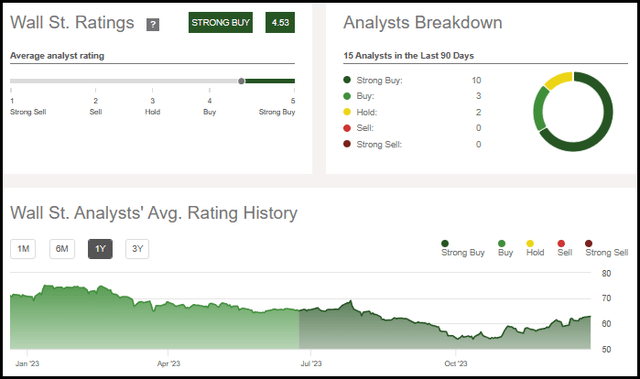

If one considers Wall Street Analyst price targets, it would suggest some further modest upside. I think they are undervaluing the shares, but the consensus here is that the average price target is $66.23. The high price target comes in at $76. I think that’s really closer to where a fair value would be at this time, so that would put me on the much more bullish side.

Interestingly, though, despite the price target upside to hit the average of around 6%, analysts still rate the shares a “Strong Buy.”

ADC Wall St. Ratings (Seeking Alpha)

Risks

Finally, nothing comes without some risks. If the Fed is cutting rates, it’s likely due to the economy being fairly weaker. If they are aggressively cutting, it’s likely because the economy is becoming substantially weaker, and they need to stimulate growth once again.

In that scenario, the whole market is likely to be softer heading through 2024 – which includes ADC’s shares likely taking a hit. So, this is just an overall general risk to most any investment currently. This isn’t anything specific to ADC. However, what is more important is that the tenants within ADC’s portfolio remain strong to weather an economic downturn of any size.

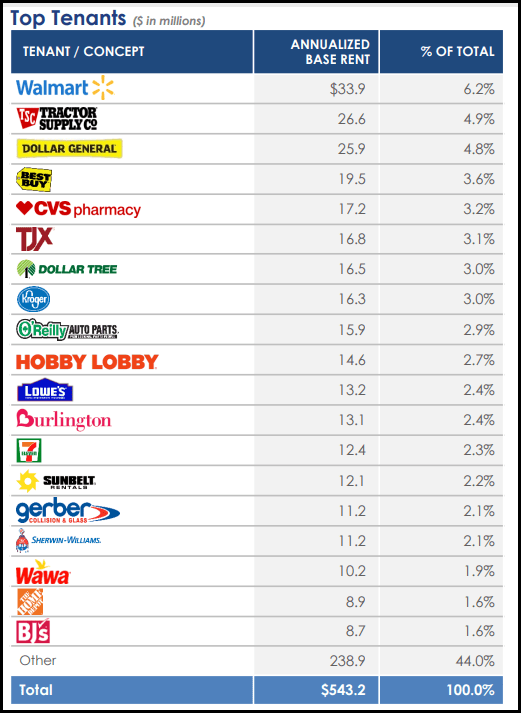

With nearly 70% of their tenants classified as investment grade, they are definitely on the higher quality end. Most of these are essential businesses as well: grocery stores, auto parts and services, convenience stores and even dollar stores. Even home improvement could potentially shine in a weaker economy. Where they might lack in selling materials for larger projects could be in smaller projects such as renovations.

With dollar store exposure and especially Walmart (WMT) as a top tenant for their properties, there really is no trading down in terms of retailers. They are the businesses that consumers have or will trade down to if times get tough.

ADC Top Tenants (Agree Realty)

Therefore, despite a slower economy clearly being a risk to the actual share price, I don’t think their portfolio is overly exposed to long-term damage. I couldn’t see many of these names going bankrupt and being in a position where the rent cash flows would cease. Thus, any downturn would simply be a further opportunity to pick up shares more cheaply than they are today.

Conclusion

ADC shares have rocketed higher from their lows – though they remain substantially down from their 52-week highs as well. After such a strong move higher, it’s natural to be more cautious here. For those investors, it can make sense to hold tight and not make any moves here. However, for the longer-term investor, I believe that ADC is still a worthwhile investment that can provide growing income for years to come.