Richard Drury

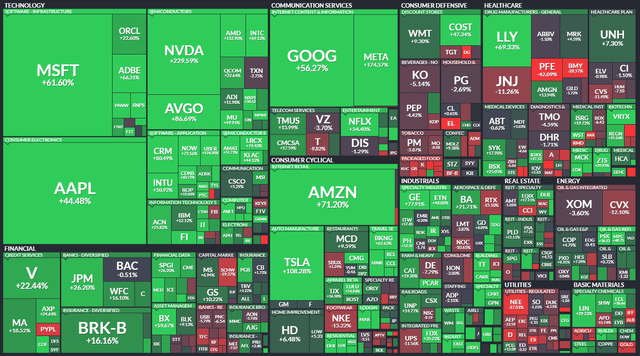

In 2023, the stock market made an impressive recovery from one of its worst years in over a decade, which occurred in 2022. However, the journey for us investors hasn’t been smooth.

Amid worries about inflation, escalating interest rates, an unforeseen crisis in regional banking, and escalating global tensions such as conflicts in Ukraine and Palestine, the US economy displayed resilience. Corporate profits saw an upward trend despite these challenges.

The year 2023 saw impressive returns across indices:

- S&P 500 posted a return of 24.2%.

- Dow Jones gained 13.8%.

- NASDAQ 100 surged by 43.4%.

- My portfolio yielded a return of 22%.

Yes, that’s correct. Following a successful 2022 when my portfolio yielded positive returns compared to the S&P 500’s double-digit slump, my portfolio underperformed the market in 2023.

I was caught off guard in the early months of the year, anticipating underperformance from the tech mega-caps and consequently heavily investing in defensive companies, REITs, telecommunications, and healthcare. Additionally, a significant portion of my investment was in cash, yielding 4% in my domestic market denominated in euros.

Most of my core holdings were of a defensive nature, focused on high quality earnings and dividend growth:

- PepsiCo (PEP) 10-year EPS growth 6.8%, Yield 2.95%

- Realty Income Corporation (O) 10-year FFO growth 5.11%, Yield 5.34%

- UnitedHealth Group (UNH) 10-year EPS growth 17.2%, Yield 1.38%

- Verizon Communications (VZ) 10-year EPS growth 1.7%, Yield 6.76%

- Visa (V) 10-year EPS growth 15.6%, Yield 0.8%

However, it’s the technology, communication services, and consumer discretionary stocks that saw substantial rebounds in 2023, alongside the general rise of growth stocks.

One pivotal factor behind this shift has been investors moving their attention from concerns about rising interest rates to the potential for rate cuts as early as 2024. This shift rescued the performance of REITs, propelling them into positive return territory during the last two months of the year.

Not only did many stocks bounce back, but high-growth, cyclical sectors like technology, communication, and consumer discretionary emerged as the top performers within the S&P 500 for the year.

The Magnificent 7 stocks alone initially comprising 19% of the S&P 500, surged to dominate at 30%. Their impact on the index was unparalleled, accounting for a staggering 70% of its total returns for the year.

On the flip side , defensive sectors where I was heavily invested, including utilities, healthcare and consumer staples, have been the biggest laggards in 2023.

As we step into 2024, the market and economy confront a fresh set of uncertainties:

- Has inflation truly been conquered, or are we heading for another spike?

- When will the Fed cut rates, and by how many basis points?

- Are we poised for a soft or hard landing?

- Which investments will outperform and yield superior returns in 2024?

With that, let me introduce you to my top holdings for 2024 and explain why I believe these companies are poised to deliver exceptional returns.

Google (GOOG) – Strong Buy

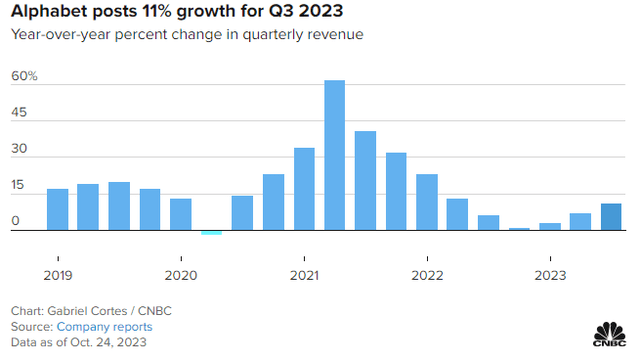

In early November, I wrote bullish piece about Google, detailing a significant drop in stock value by 15% from $142 to $121 following Q3 earnings. This decline, triggered by slower growth in Google’s Cloud unit, led to a staggering $180 billion loss in market capitalization.

Q3 of 2023 saw Google Cloud’s growth rate decrease to 22.4%, a drop from the steady 28% growth seen in the year’s initial two quarters. However, it’s important to put this into perspective. Despite this slowdown, the cloud unit accounted for only 10.9% of Q3 revenue. Moreover, this deceleration in growth has been a trend for the past 10 quarters.

Since publishing the article, the stock has rebounded as anticipated, yielding a close to 9% return. Taking advantage of this, I made significant purchases of Google stock around $125. To me, this seemed like an overreaction, especially considering Google’s growth, which had been picking up since the 2022 ad spending slump and reported an 11.1% growth.

Today, Google is among my largest holdings.

This quarter, there’s been a shift from the usual pattern of single-digit revenue gains, coinciding with the ongoing recovery in the advertising market.

Looking ahead to 2024, a crucial election year in the US, the landscape seems ripe for heavy political contention amidst the country’s prevalent issues. Businesses geared toward advertising stand to benefit significantly from increased online campaigning. Meta (META) is anticipated to be one of the prime beneficiaries as well.

Moreover, Google’s investments in AI are expected to bear fruit in 2024. This growth extends not only to its cloud business but also to the expansion into generative AI, like Bard, beyond its existing offerings.

In October, Google committed up to $2 billion in Anthropic, an AI startup behind Claude 2, a chatbot rivaling OpenAI’s ChatGPT. Claude 2 boasts the ability to summarize up to about 75,000 words, a significant capability compared to ChatGPT’s 3,000-word capacity. This technology allows users to distill large datasets into concise memos, letters, or stories.

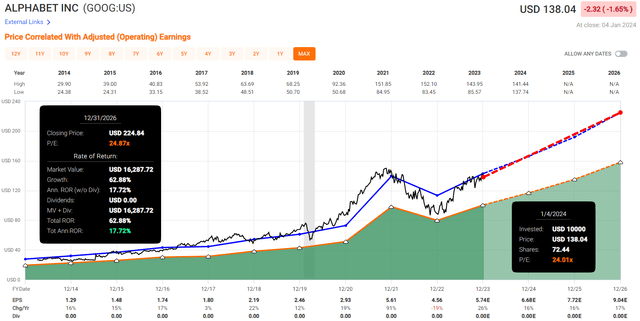

While the future holds promise for Google, its valuation remains a key consideration. Presently, the stock is trading at 24x its blended P/E ratio, making it the “cheapest” among the Magnificent 7.

Since 2014, the company’s average valuation has hovered around 24.9x its earnings. Although today’s price doesn’t immediately offer a discount, the anticipated 16% EPS growth in the next two years aligns closely with the historical 17.5% growth rate.

Consequently, the valuation of 24.8x its earnings appears well-justified. If this growth materializes, Google could potentially deliver an annual performance north of 17% over the next three years, hence the strong buy rating.

Alphabet Valuation (Fast Graphs)

Nvidia (NVDA) – Strong Buy

Nvidia stands out as the most valuable semiconductor company, boasting an impressive $1.19 trillion market cap. It’s a true pioneer in its field, specializing in graphics processing units, or “GPUs.”

Globally acclaimed for its innovations in gaming, artificial intelligence, and deep learning, Nvidia’s cutting-edge GPU solutions not only dominate the gaming console realm but also spearhead advancements in data centers, autonomous vehicles, and various other sectors.

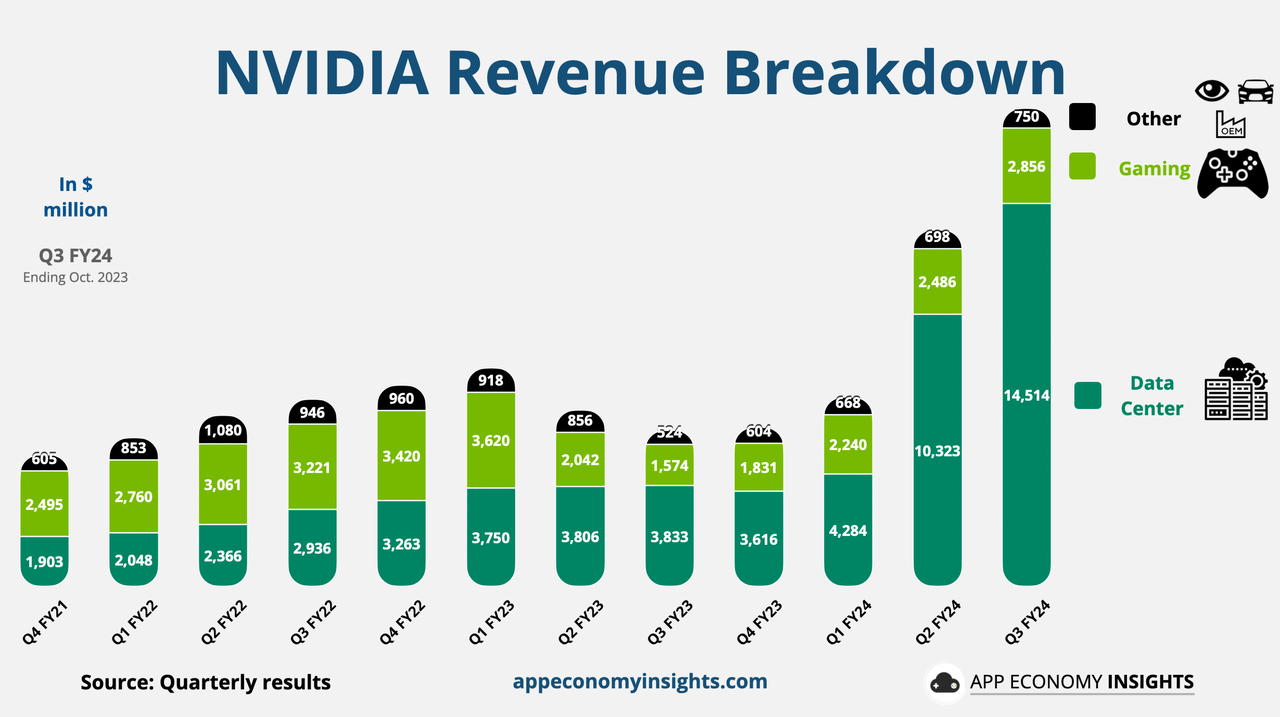

As AI takes center stage, Nvidia skillfully expanded its revenue streams beyond gaming, particularly toward Data Centers, which have emerged as the largest segment in recent years.

This division raked in a whopping $14.5 billion in revenue during the last quarter alone, marking an outstanding 378% year-over-year growth. This contribution now stands at 80% of the total revenue, a significant shift from a time when gaming used to account for over 50% of their earnings.

Nvidia Revenue Breakdown (App Economy Insights)

Nvidia’s surge in stock price throughout 2023, earning it the title of the S&P 500’s top-performing stock with an impressive 220%+ return, can be largely attributed to its pivot toward data centers and the favorable winds propelling AI.

The current price of Nvidia at $493 underscores the market’s volatility, evident in its recent past. In 2022, the stock nosedived to a low of $108 from a previous peak of $346 during the tumultuous trading frenzy spurred by COVID, marking a significant 70% decline.

For Nvidia, the central narrative revolves around growth. If this growth doesn’t materialize in the future, the company could face a stark reality, indicating the presence of risks but also promising high rewards.

Perhaps not an investment which fits every portfolio and appetite for risk.

While many skeptics believe Nvidia might struggle to expand its earnings due to increased competition, potentially impeding its profit margins (presently at a robust 74% Gross margin as of Q3 FY24, significantly higher than its historical margins), the company’s engineering superiority places it well ahead of competitors such as AMD (AMD).

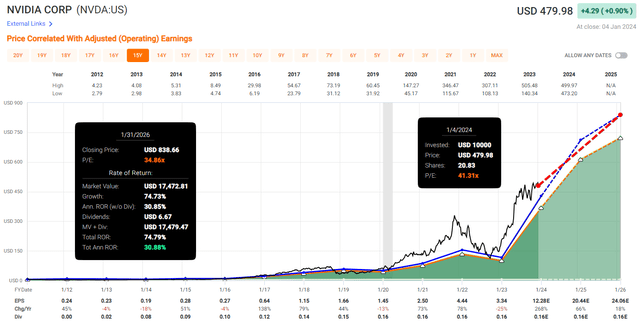

Over the past 15 years, Nvidia has achieved a stellar EPS growth rate of 39.54%, and there seems to be no sign of slowing down; rather, the growth is expected to accelerate in the next years:

- 2024: Projected EPS of $12.28, YoY growth of 268%

- 2025: Projected EPS of $20.44, YoY growth of 66%

- 2026: Projected EPS of $24.06, YoY growth of 18%

If the projected growth comes through, the current blended P/E ratio of 41.3x seems like a bargain.

In the last 15 years, the average valuation hovered around 34.9x its earnings. This means the stock is trading at a premium, but considering the anticipated accelerated growth, this valuation seems justified.

If this valuation remains consistent over the next three years, we might witness Nvidia delivering an annual return exceeding 30%.That’s truly impressive, but Nvidia needs to deliver on these expectations.

In my opinion, with the AI trends dominating the 2020s, this shouldn’t pose an issue as long as the company stays at the forefront of innovation within the industry, hence the strong buy rating.

Nvidia Valuation (Fast Graphs)

Lowe’s (LOW) – Buy

Lowe’s, a prominent home improvement retailer in the US and Canada specializing in building materials, appliances, décor, tools, outdoor living, and more, has demonstrated minimal appreciation in its stock price over the past two years.

This range bound trading follows a significant price appreciation during the low-interest-rate environment triggered by the pandemic between 2020 and 2021, during which the company seemingly borrowed from future demand.

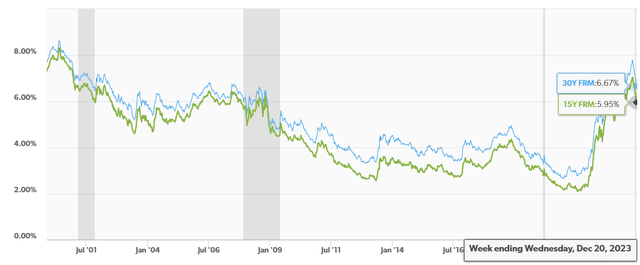

The stagnation in the stock price and earnings is primarily attributed to the elevated mortgage rates in its key markets, which surged from a pandemic low of 2.60% to nearly 8% in October, subsequently retracting to 6.67% for the 30-year fixed rate.

See, Lowe’s business heavily relies on existing home sales, with 75% of its earnings coming from the do-it-yourself “DIY” sector and the remaining 25% from PRO customers.

However, amid the pandemic, many homeowners have locked in their interest rates below 3%, making them hesitant to sell their houses due to the prospect of obtaining a new, higher mortgage for another home.

Consequently, this trend has led to a slowdown in existing home sales, causing nearly one-third of homes in the US to be sold as new constructions—a significant increase from the approximately 17% seen in 2020.

The sluggish existing home sales have resulted in fewer individuals engaging in house renovations or flipping homes, thereby impacting both the top and bottom lines for Lowe’s.

Nevertheless, the FED’s signaled pivot for 2024, indicating potential rate cuts, is expected to directly impact mortgage demand, potentially revitalizing existing home sales. This improvement in the housing market should positively affect Lowe’s and also Home Depot’s (HD) business.

Naturally, the question remains: when will the rates be cut, by how many basis points, and to what extent will these home improvement retailers benefit?

Nevertheless, I anticipate 2024 to mark a year of recovery for the home improvement business.

While I favor both Lowe’s and Home Depot as choices for dividend growth, Lowe’s presents a more favorable risk-reward scenario at present.

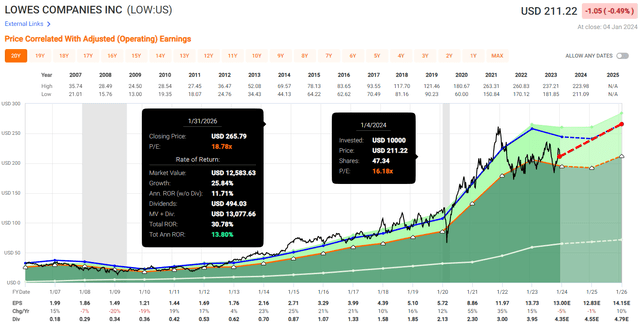

Currently, Lowe’s is trading at 16.2x its blended P/E ratio, significantly lower than its 15-year average of 19.8x.

Considering the adverse market developments and the decline in EPS by -5% in 2023, with an anticipated further decline of -1% in 2024, it’s expected that the stock will trade at a depressed valuation.

However, the company has achieved an EPS growth rate of 16.5% annually over the last 15 years, and growth is projected to resume in 2025 with an expected 10% EPS growth. Yet, I believe this estimate underestimates Lowe’s potential.

Nevertheless, if this growth materializes and the company reverts back to the mean valuation, we could see a total return of more than 13% annually between today and the end of 2025.

Keep in mind that while waiting for the reversal and resumption of bottom line growth, Lowe’s is also paying a dividend with a 2.08% yield, which has grown at a double-digit rate for the past decade.

For Lowe’s, it is not a question of if the stock returns to its original valuation, but when, hence my buy rating.

Lowe’s Valuation (Fast Graphs)

Takeaway

Every year brings fresh challenges for investors, with each carrying its own set of worries. I firmly believe that regardless of the narrative’s negativity, investors should stay invested. However, they could consider rotating their portfolio to align with their risk tolerance and capitalize on better returns in a given period.

Although my portfolio lagged behind the market last year, I don’t see it as cause for concern. Instead, I view it as an opportunity to analyze my choices, learn from any missteps, and strive to outperform the market in the upcoming year.

While beating the market remains a priority for me due to the three decades of growth before my retirement, during which I’ll rely on a high-yielding portfolio, I acknowledge that other investors might prioritize a higher yield over market performance.

Therefore, I’d like to highlight three stocks I heavily invest in heading into 2024. Each of these stocks offers varying risk and reward profiles, catering to portfolios seeking either growth or stable, high-quality earnings.