Antagain

The iShares MSCI Poland ETF (NYSEARCA:EPOL) is a slightly more expensively maintained ETF due to its specific focus on value-weighted exposures in the Polish market. While an entirely developed market and a European success story, there are a couple of issues to keep in mind: idiosyncratic risks in the Polish banking sector over some foreign currency mortgages and related legal risks which we mentioned in our last article, as well as the overall state of the Polish Zloty, which is the resident currency. Our conclusions are that the legal risks are subsiding, and so are the Zloty risks which are coming off recent lows related to partisanship concerns around the central bank.

Zloty

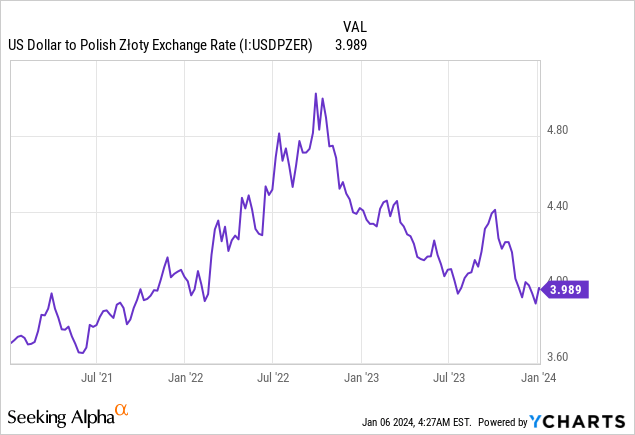

The performance of the Zloty is going to matter a lot for this exposure in dollars. Polish inflation is coming below expectations, but it is still above 6% due to supply chain proximity to Russia and issues on the supply side inflation. Otherwise, underlying inflation rates from benign sources are higher in Poland than other European countries, hence the higher policy band of 2.5% +/- 1%.

The performance of the Zloty hasn’t been great.

One of the reasons why it performed badly towards the end of the year is that as the nationalist party in Poland was on the way out, the central bank pivoted unexpectedly into dovishness, which seemed unsupported by commentators and was inconsistent with the general inflation regime in global developed markets, and created a speculative issue for the Zloty concerning partisanship of the central bank president Glapinski, who may be put in front of some special tribunal by the new ruling party led by Donald Tusk.

However, this is no longer that much of a concern, as there is no incentive anymore for partisanship as elections have passed, and the Zloty is being buoyed by lower than expected inflation rate, also bolstered by the weaker labour market data, which is less than what can be said for the US, as Europe is generally on more shaky ground due to the Ukraine war.

Legal Risks

There are large exposures to the financials in EPOL, including to PKO (OTCPK:PSZKY) at around 13%. The story is that there were some abusive practices, and the ECJ is also ruling in favour of the bank’s clients, meaning large provisions. Thankfully, this is underway and increasingly in the rear-view. There were about 130k loans concerned across the sector, specifically foreign currency loans, and over 50k have been mediated upon between PKO specifically and customers. So that’s quite a lot of progress as PKO is only one part of the sector at risk.

Conclusions

The expense ratio is 0.59% which is a fair bit, but accounts for the frictions associated with the instrument’s FX burdens and the fact that Poland is quite an idiosyncratic market.

We have general concerns around inflation, and remain concerned about inflation trends in a structurally weaker Europe, but volatility associated with the Zloty seems to be subsiding as elections pass which has been a primary factor for the Zloty’s performance lately.

However, both the Zloty and the situation in the large financial exposure, at 46% of the whole fund, is not without complexity. Neither is the overall inflation situation which remains substantially above policy limits and is absolutely at high levels in Poland. The PE is around 8x, which is low, and we see these discounts even around specific Polish issues with respect to European counterparts. While the provisions should account for whatever ways the mediations might go with customers concerning the legal concern, we still think a more targeted approach into specific selections makes more sense for the Polish market than investing in EPOL.