Nikada

Businesses that create benchmarks and standards that are useful for entire industries are often able to build unique competitive advantages. This is somewhat true for MSCI Inc. (NYSE:MSCI). MSCI’s indexes are well-known throughout the investment management world. But MSCI’s success over the past decade and potential success moving forward has more to do with savvy forward-looking decisions than what is generally thought of to be a moat.

MSCI, S&P Dow Jones (SPGI), FTSE Russell (OTCPK:LDNXF), CRSP, and Nasdaq (NDAQ) capture 95% of the index ETF market. This market share dynamic likely extends to all instances where benchmarks are used. While the CEO of Amundi (OTCPK:AMDUF) went as far as calling index providers an oligopoly, that might be a liberal use of the word.

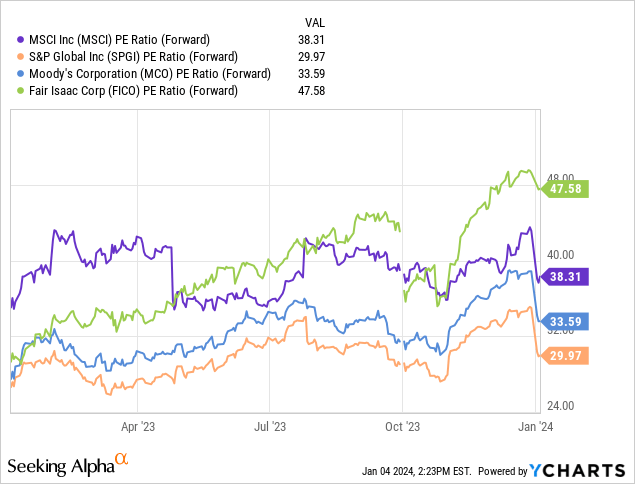

Assessing the ability of management teams is often not clear-cut, but there can be indicators that management is thinking like investors. Across information services, the best businesses are arguably those that have created proprietary rating systems: S&P Global, Moody’s (MCO), and Fair Isaac (FICO). While each business is fundamentally different, and the jockey can’t make the horse run faster, MSCI’s newer initiatives show management has a deep understanding of this dynamic.

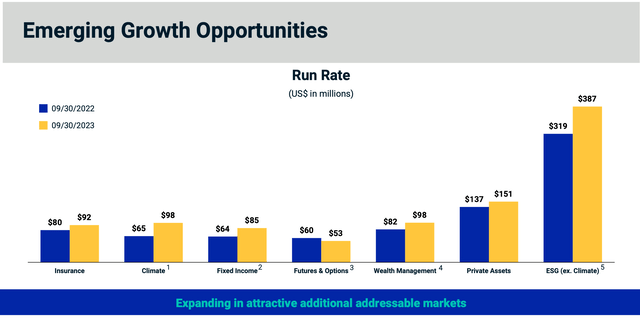

Along with bolstering the prominence of its indices, MSCI is trying to spread its tentacles into new areas, primarily in ESG and private assets. As an example:

Our ESG ratings aim to measure a company’s resilience to long-term ESG risks. Companies are scored on an industry-relative scale across the most relevant key ESG issues based on a company’s business model…Investors use MSCI ESG Ratings for a variety of purposes, including to assist with fundamental or quantitative analysis, portfolio construction and risk management, engagement and thought leadership, benchmarking and custom index design.

While it doesn’t seem like ESG scores are prominent in asset management today, the revenue run rate is closing in on $400M. More importantly, the thought of management trying to build deeply ingrained moats right before our eyes is quite astounding and rare. If MSCI is able to strike gold on ESG ratings or another future system, it could be a heavily moated, decades-long compounding business.

MSCI has also made some interesting M&A moves, most notably the recent acquisitions of Burgiss and Fabric. Burgiss provides indexes for private assets, which can help investment managers to better bogey performance versus true peers, instead of simply public market comps. Burgiss provided this case study for the South Carolina Retirement Investment Commission.

With the Fabric acquisition, MSCI is leaning into the growth of the wealth managers industry. MSCI deeply understands the shifting winds of investment management, as evidenced by this statement in their 10-k:

the construction and management of investment portfolios are becoming increasingly outcome-oriented, rules-based and technology-driven.

MSCI has already been a huge beneficiary of passive indexing, and it is continuing to lean into the trends taking over investment management to find additional avenues for growth.

Competitive Advantage:

Just over a decade ago, MSCI’s indexes were dropped by a number of funds from Vanguard, the world’s second-largest asset management firm, in an effort to lower costs for investors. This caused quite a stir amongst MSCI investors, sending the stock down more than 25% in a day. Not only did MSCI lose $24M of revenue from an important customer, it seemed like the moat had been breached.

Given this piece of information, a twentyfold rally over the next decade would be highly unexpected, but that’s exactly what happened. There’s an interesting discussion to be had around the gray area of competitive advantage. While only 5 companies command a majority of the market share, we see from history that they are relatively interchangeable.

MSCI’s moat isn’t much of a moat at all, it’s brand recognition and relationships. This is where most businesses of all shapes and sizes actually win. It’s very rare to find businesses that have some type of regulatory advantage that indefinitely stifles competition, or have built some asset that is impossible to replicate. But these businesses do exist in the public markets and have much stronger moats than MSCI. MSCI has executed flawlessly over the past decade, a requirement to continue to aggressively compound the stock given the marginal competitive advantages.

Capital Allocation & Valuation:

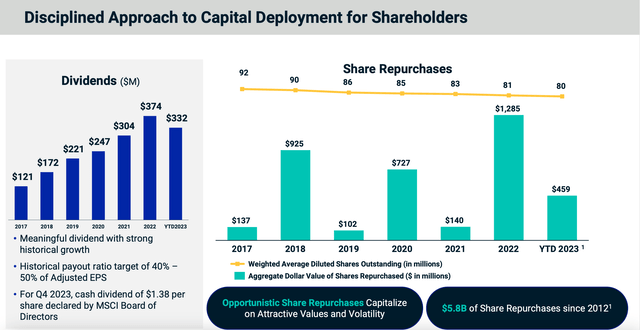

MSCI has shown its prowess when investing in its own business, MSCI has also shown a great deal of shareholder friendliness when returning capital to shareholders:

There’s always a great debate about whether dividends or buybacks are more valuable to shareholders. The answer largely depends on how disciplined management is, as buybacks can be more or less accretive than dividends depending on the prices they are executed. As shown, MSCI has been extremely thoughtful when deploying buybacks. Another feather in the cap of a great management team.

MSCI trades at around 38x next year’s forward earnings estimates, which is well above the market multiple, and reasonably above its closest peers:

MSCI has set a gold standard, not only in benchmarks but in management competency. But unfortunately, this is well understood by the market considering the premium valuation.

Even with the expected double-digit growth rates for the foreseeable future, MSCI’s stock appears quite expensive. Whether or not MSCI is a buy depends solely on what investors think the future multiple will be. In instances like this, it’s likely macro, interest rates, and speculation will be the biggest driver of the share price. It’s difficult for fundamental-based investors to make a stand when multiples get stretched. MSCI might be a fringe buy, but in the current higher-rate environment, it’s likely investors will see better opportunities.